I recently posted on how the dividends don’t matter in the accumulation stage. One should simply go for a greater total return. After all, ‘more money is more better’ as I like to write. More money will create greater retirement income. Even if you are under the impression that there is value in the dividend in retirement, you’d still want more money to buy more dividends. That said, there is no value in the dividend when we create retirement income. A share sale and a dividend of the same value are equal.

Here’s why the dividends don’t matter.

Keep in mind that a dividend does not create value. A dividend is the permanent removal of value from your stock holding. In simple math with respect to a $1 dividend payment on a $20 stock.

$20 = $19 + 1

There is no value created. There is value removed.

When a company pays a dividend and removes that cash value from the company, the share price drops by an equal amount on the ex-dividend day.

Watching and counting the dividends is nonsensical in the accumulation stage, in my opinion. You’re looking in the wrong place.

Counting the dividends is like staring at the oil gauge as you try to make the car go faster. – Dale Roberts

Dividends don’t drive the total returns (remember they are a removal of value) it is the earnings and free cash flow that make your portfolio go faster. It is business success that sets you up for portfolio success and retirement success.

The dividends don’t matter in retirement

Keeping the car analogy running, stocks are the growth driver in retirement. Stocks historically have much greater returns over time compared to bonds and cash.

It is the stocks (company ownership) that will enable a higher spend rate. Once again, more money is more better.

Stocks are the creator and keeper of that wonderful value and growth. In retirement, we need to unlock that value so that we can spend the money.

A company can pay you a dividend to unlock $5,000, that is a forced removal of value from your holding. And there’s nothing wrong with that.

You can sell shares to unlock $5,000 of value from your holding.

They are the same, except for tax purposes.

If you have $100,000 of value in a stock, and they pay you a $5,000 dividend, you’re left with $95,000 ownership of that company.

If you sell shares to create $5,000 of income, you’re left with $95,000 ownership of that company.

Of course, the market will then continue to fluctuate at all times.

Sequence risk

Given that you have the same income and the same ending ownership of the company, the dividend does not provide any protection from the sequence of returns risk.

There is a common misconception that selling shares creates additional risk. That is simply not true. Once again, dividends and share sales remove equal value and carry equal risk.

A bedrock of retirement planning and research is the 4% rule. In basic terms, the research shows that with a balanced portfolio, we can spend about 4%-4.5% of the portfolio value each year, adjusted for inflation, and create durable income that could last for 30 to 35 years.

Retirees won’t always use the 4% rule, but it is a good guideline on how hard you can push a balanced portfolio. We can increase our spend rate (up to the 5% range) with a greater allocation to equities, but then we have to pay attention to our risk tolerance and that sequence risk.

Retirement portfolios can fail due to that sequence risk, or because the retiree is investing outside of their comfort level. If they panic during a recession or a major correction, they might sell and create permanent losses.

No additional support from growing dividends

It seems intuitive that we would think a growing and generous dividend would offer protection from sequence risk vs an asset with lumpy or no dividend growth.

Let’s look at a situation where we have equal total returns but one asset has growing dividends vs an asset that has experienced dividend disruption.

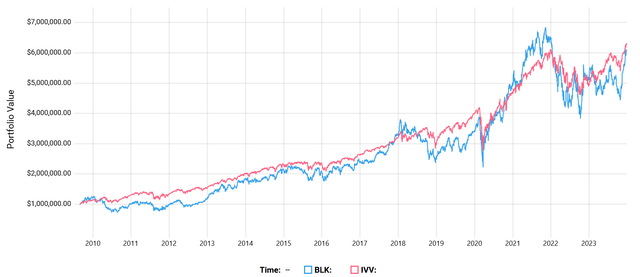

Here’s BlackRock (BLK) vs the S&P 500 (IVV) in a total return comparison. Here’s a timeline where we have near exact total returns.

BlackRock vs S&P 500 (testfolio / author )

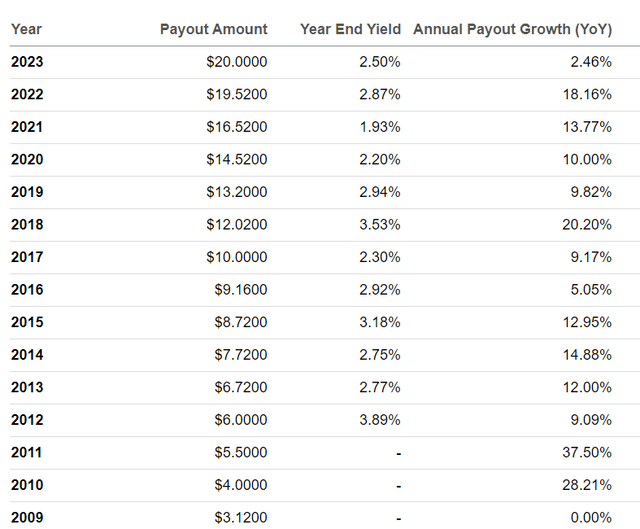

Under the hood, BlackRock pays a more generous dividend. The dividend has a wonderful growth history. The S&P 500 ETF IVV pays a much smaller dividend, and there has been some dividend disruption (cuts) in the period.

BlackRock dividend growth (testfolio / author )

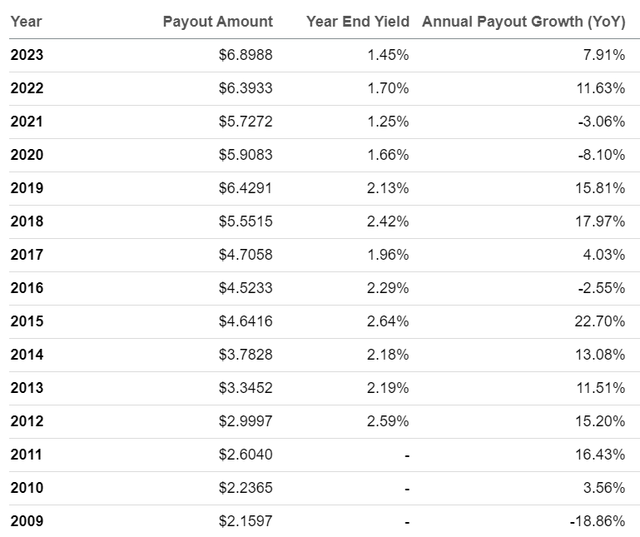

Here’s IVV …

IVV dividend growth (Seeking Alpha )

The dividend payments and dividend growth for BlackRock absolutely dwarf that of the S&P 500 ETF. And yet, that dividend record and superiority was of absolutely no value.

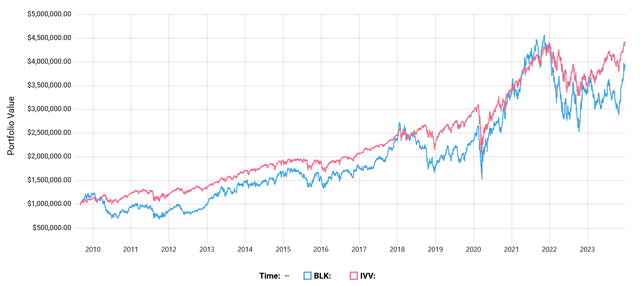

Here’s the comparison in a retirement spending (decumulation) scenario. Each portfolio is spending at a 4.8% spend rate. In fact, we see IVV come out ahead by a decent margin.

Decumulation – BLK vs IVV (testfolio / author )

The dividend was of no benefit because (once again) there is no difference between a dividend payment and a share sale of equal value.

What will matter in retirement is the total return and the risk level. While the assets had the same total return, BlackRock offered greater volatility.

Retirement portfolio success comes down to total return and risk level. That’s it. Of course it’s crucial to also have a financial plan that includes an optimized cash flow plan. We have to invest within our risk tolerance level.

The big dividend didn’t matter in retirement

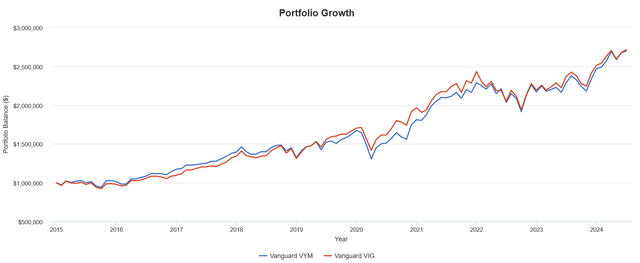

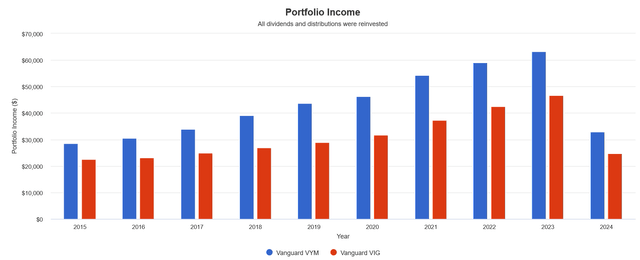

In the next scenario, I will add a small amount of growth by way of the Nasdaq 100 (QQQ) to the Vanguard High Dividend (VYM) to create equal returns to the Vanguard Dividend Growth ETF (VIG). The VYM/QQQ combination will have a much bigger dividend compared to VIG.

But you’ll see that the dividend does not matter in retirement.

Here’s the total return comparison.

VYM / QQQ vs VIG (Portfolio Visualizer / Author )

Here’s the much greater dividend of VYM/QQQ vs VIG

Dividend Comparison (Portfolio Visualizer / Author )

Here’s the bigger VYM dividend approach vs the smaller VIG dividend approach in a retirement funding scenario – a 4.8% spend rate adjusted for inflation.

Big dividend vs small dividends in retirement (Portfolio Visualizer / Author )

Even though the VIG approach required more share sales to meet the funding requirements, VIG came out slightly ahead.

Why? Because the dividends don’t matter in retirement.

Being that a dividend and a share sale of equal value are equal, there is no added value in a dividend. There is no additional reduction of sequence of returns risk from a dividend.

The same holds true for the very risky specialty income products that are popular with retirees. From my observations (especially during the financial crisis) the extreme income ‘stuff’ can lead to retirement impairment. Stick to high quality over high income.

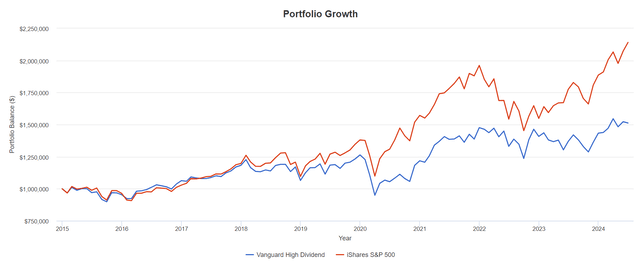

Vanguard High Dividend vs the S&P 500

And of course straight up with no growth kicker, consider the high dividend VYM vs the S&P 500 ETF IVV. The greater total returns of IVV and less volatility leads to the possibility of greater income and greater portfolio value compared to VYM.

VYM vs IVV (Portfolio Visualizer / Author )

In a 4.8% spend rate retirement funding scenario the S&P 500 leaves the retiree with a 40% greater portfolio value. The big dividends created no additional value. The additional shares sales for IVV created no additional risk, quite the opposite.

What matters in retirement?

Given that the dividends don’t matter, we’re back to total return and risk level. That’s it!

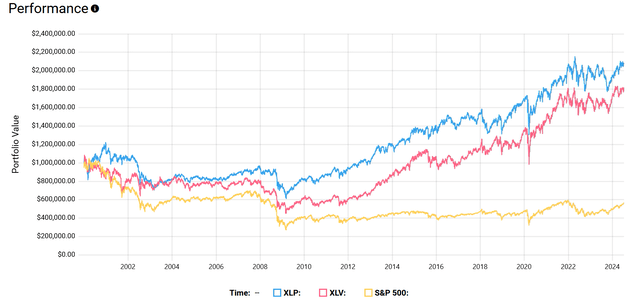

We want solid returns with lesser draw-downs in severe market corrections. It’s not high dividends that matter, it’s low volatility.

In this post, we saw that the defensive sectors were twice as good as a traditional balanced portfolio through the financial crisis. OK, the defensive sectors left the retiree with ‘only’ 50% greater portfolio value, but to my eye that is ‘twice as good’.

Look to consumer staples (XLP), healthcare (XLV) and utilities (XLU) to find that lower volatility. Here’s consumer staples and healthcare vs the S&P 500 in a retirement funding scenario (4.8% spend rate) from 2000, through the dot com crash, the financial crisis and COVID correction.

The dividends didn’t matter, the superior risk adjusted returns mattered. The lower drawdown mattered.

Consumer Staples and Healthcare (Portfolio Visualizer / Author )

You could also certainly overweight a low volatility ETF (SPLV) as an option.

Living off of the dividends

A dividend counter can compound the accumulation mistake (counting the dividends) by then living off of the dividends.

If you live off of the dividends, you are simply letting the dividends decide your spend rate, your tax efficiency and it becomes your financial and cash flow plan. It becomes part of your estate plan.

Obviously, the dividend knows nothing about financial planning, tax efficiency, the appropriate spend rate, estate planning, or appropriate risk level.

It is simply not a good idea in my view.

Don’t sell yourself short; Sell shares

And once you know that sensible share harvesting poses no additional risk, you’ll be free to create more income in retirement.

Living off of the dividends? Why sell yourself short?

Investing success is simple in the accumulation and retirement stages. And it is very important to separate those accumulation and retirement stages.

I will be back soon with an article on how we transition from accumulation to the retirement stage.

Valuation is very important

We want good growth, lower volatility and stocks purchased at a sensible valuation. While our personal and public U.S. portfolio has beat the market from 2015, given the valuation issues of the day, I was asked to put together a stock portfolio for 2023. With no Magnificent 7 it beat the market by 9% over the last year. I have updated the suggestions for mid 2024.

A retiree might overweight to the defensive sector stocks.

Thanks for reading and sharing this post. We’ll see you in the comment section. I do reply to most comments or suggestions.

Read the full article here