I have been covering Saratoga Investment Corp (NYSE:SAR) since March this year when I issued an article arguing that the risks are just too high for going long here. After SAR circulated its Q4, 2023 earnings deck, I wrote a follow-up article, where my overall investment stance did not change even though the underlying performance showed some signs of improvement. The reason for this was simple – the combination of one of the highest leverage profiles in the BDC space and a reliance on additional equity financing rendered SAR’s return prospects unattractive relative to other BDCs. Plus, from the yield perspective, the investment case was not attractive either, as one would expect a much higher yield than ~12.5% to compensate for the assumed risks.

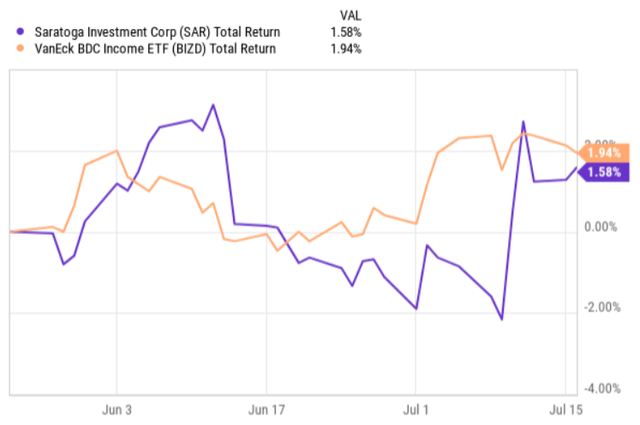

As we can see in the chart below, since the publication of my last article on SAR, it has performed in line with the BDC market. The chart also indicates that after the Q1 2025 earnings release, SAR managed to recover all of the losses that it had recorded during this time period.

Ycharts

Let’s now assess the details of the Q1 2025 earnings report to see whether the investment case has become attractive enough to assign a buy.

Saratoga Investment Q1 Review

The Q1 2025 data points came in relatively strong, continuing to register some improvements both on the adjusted NII and credit quality side.

The adjusted NII was $14.3 million this quarter, up 12% from the prior quarter. Also, on a per share basis, the adjusted NII increased by 12% from the last quarter, reaching $1.05, which translates to an adjusted NII yield of 15.5%. This adjusted net investment income figure of $1.05 per share materially exceeded the quarterly distribution level of $0.74 – i.e., the distribution or dividend coverage is 142%, which could be deemed as one of the highest in the BDC sector.

During this quarter, SAR registered an increase of 2.5% in its NAV figure relative to the previous quarter. However, on a NAV per share basis, the results are slightly lower (by ~ 1%). There are two major drivers behind this. The first one relates to the increased interest expense from the several new notes payable and SBA debentures issued during the past year, as well as an uptick in base and incentive management fees from higher AUM and earnings. All of this imposed a headwind on the overall adjusted NII. The second, however, explained almost the entire delta between positive adjusted NII and declining NAV – which is the combination of distributions and fair value adjustments.

In terms of credit quality, the portfolio kept improving, where as of quarter end, 98.3% of the total exposure was performing well. There were still 1.6% of the portfolio FV placed under the non-accrual status, but these investments were already presented in the previous quarter. Namely, SAR registered no new accruals in this quarter.

What is important to note is the fact that SAR originated no new investments during the Q1 2025 period. Instead, all of the investments that were made stemmed from 16 smaller follow-on investments in existing portfolio companies. Thus, the total origination amount this quarter landed at $39 million, compared to $76 million of repayments and amortization. This means that SAR’s portfolio has become smaller.

Here Michael Grisius – CIO – gave some nice color in the recent earnings call on how he sees the investment activity outlook for SAR:

The overall deal market continues to reflect slower deal volume and M&A activity than in historical periods while liquidity among private equity firms remains abundant; high financing costs and elevated levels of inflation continue to constrain the private equity deal market, which drives much of the demand for new credits. At the same time, some lenders have re-entered the market as they’ve grown more confident in the macroeconomic climate. The combination of historically low M&A volume and an abundant supply of capital is causing spreads to tighten as lenders compete to win deals. As a result, we’re anticipating some pickup in payoffs due to lenders offering extremely aggressive pricing on some of our low-leverage assets.

In other words, the current expectation is that SAR’s portfolio will continue to shrink, where on top of this, it is very likely that we will see a spread compression, introducing additional pressure on adjusted NII generation.

With all of this being said, the key issue – SAR’s leverage profile – has not changed. For example, while the quarter-end cash position has grown to $93.3 million, the net leverage still stands at an extremely elevated level of 171.2%, which is the highest (or most aggressive) in the entire BDC space.

The mitigating factor in this context is SAR’s largely fixed rate and interest-only covenant-free borrowing structure, which has a relatively back-end loaded maturity profile. This enables SAR to enjoy cheap cost of financing and have solid dividend coverage as long as the current borrowings have not reached their maturity dates. The issue is that with each quarter, we get closer to the refinancing dates, with the first one already kicking in this year.

On top of this, we have to factor in the fact that SAR has to borrow incremental capital to fund new investments, especially when the originations will exceed the organic repayments. These kinds of investments will be already subject to a different cost of financing level on SAR’s end, thus leading to a much tighter spread contribution than the current portfolio (investments) offers.

The Bottom Line

All in all, it seems that SAR is increasingly exhibiting patterns that are indicative of improving fundamentals. The growing adjusted NII per share, coupled with sound credit quality, allows SAR to easily cover the dividend while leaving some capital on the books that could be, in turn, directed towards deleveraging activity.

However, the negative net investment activity and a relatively depressed deal outlook (including the spread compression issue) will inherently create a more challenging road for SAR to optimize its balance sheet. Such dynamics put downward pressure on adjusted NII, which in conjunction with gradually increasing financing costs (mostly due to refinancing of existing borrowings) certainly does not bode well for SAR’s return prospects.

As a result of this, I just still do not see any meaningful rationale to go long with Saratoga Investment Corp given the level of underlying financial risk and a dividend yield which is not materially above the sector average of 10.7% – as implied from the VanEck BDC Income ETF (BIZD).

Read the full article here