Luxury fashion major LVMH’s (OTCPK:LVMUY) (OTCPK:LVMHF) interim results (H1 2024) released yesterday were bad. Hardly a surprise. Weakness was already foreshadowed by its first quarter (Q1 2024) sales update, resulting in a Sell rating on the stock. Since then, its price has tumbled by 17%.

But here’s the twist. Even though the company’s fundamentals are weak right now, there are still pockets of positivity. Moreover, its stock metrics are looking somewhat better. But are they enough to warrant a change in rating? Let’s figure out.

Undoubtedly weak results…

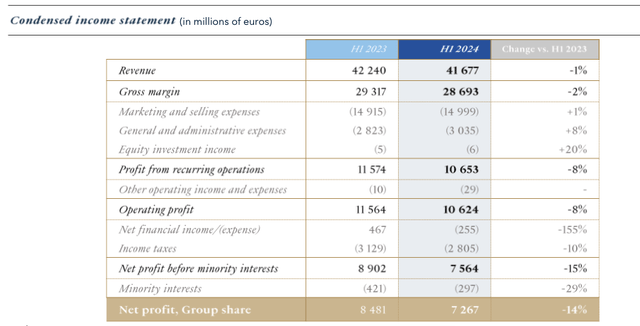

First things first, a look at the company’s latest results. LVMH’s reported revenue contracted by 1% year-on-year (“YoY”) in H1 2024 and operating income fell by 8% YoY. Negative financial income (see Table 1 below) resulted in an even bigger decline in net income, of 14% YoY.

Table 1 (Source: LVMH)

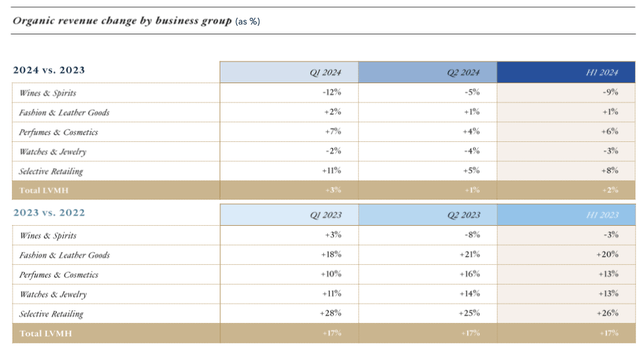

As was already evident in the Q1 2024 quarterly update, the Wines & Spirits segment continued to be the worst offender, with a 12% YoY decline in reported revenues. The big Fashion & Leather Goods segment, which brought in over half of H1 2024’s revenues, was also a drag with 2% YoY contraction, along Watches & Jewelry.

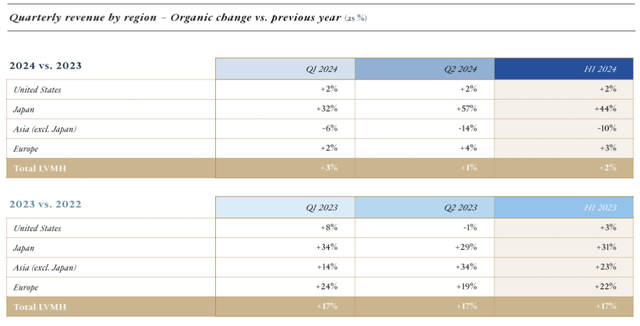

In geographical terms, the luxury market slowdown in China pulled back Asia revenues significantly, even as all the other regions managed to see some growth. That this isn’t even an LVMH specific challenge makes it worse. A recent Bain & Company report notes, slowing luxury demand in China is expected to be a driving factor in the sector seeing the slowest growth this year since 2020.

.. but pockets of positive developments visible

But it’s not all entirely as bad as it looks. For one, LVMH managed to show a 2% YoY organic revenue growth, which excludes the impact of currency fluctuations. The company points out that Fashion & Leather Goods was particularly impacted by exchange rate movements, evident in its 1% YoY organic growth compared to a contraction in reported terms, as noted earlier.

It’s also worth noting that in the second quarter (Q2 2024), the extent of decline in Wines & Spirits softened to 5% YoY in organic terms, after seeing a 12% fall in Q1 2024 and 8% YoY decline in Q2 2023 (see table below). Much of LVMH’s woes can reverse just with a stabilisation in this segment alone, considering that despite its small 6.8% contribution to revenues in H1 2024, it was responsible for over 66% of the decline in total revenues.

Source: LVMH Source: LVMH

Next, in geographical terms, while a part of the slowing down in China is due to sluggish demand, it’s also due to overseas purchases in Japan, as LVMH points out. Japan saw a 44% YoY sales growth in H1 2024 compared to the already strong 31% YoY increase in H1 2023, the only market to see accelerated growth as per the latest report (see table above).

It’s also worth noting that growth in the US has actually seen a marginal increase compared to a contraction in H1 2023. This is pleasantly surprising considering that the US economy is already softening and is expected to slow down further in the remainder of 2024.

Finally, true to form as a luxury fashion biggie, LVMH’s margins remain rather strong even now. The recurring operations profit margin came in at 25.6%, even as it saw a softening from the even higher 27.4% in H1 2023. Similarly, the net profit margin was at a still healthy 18.1%, though softer compared with a stronger 21.1% in H1 2023.

Watch the market multiples

LVMUY’s trailing 12 months (“TTM”) GAAP price-to-earnings (“P/E”) ratio after the latest results is at 24.7x, which is essentially the same as where it was the last I checked. However, if the stock continues to fall, it could actually come off to some of the lowest levels seen in the past five years of around 20x (see chart below). A drop to this level has been followed by a price uptick in recent years.

Historical TTM GAAP P/E (Source: Seeking Alpha)

In fact, the forward GAAP P/E for LVMUY is already close to the level. The figure is estimated assuming that LVMH’s reported revenues will continue to decline by 1% for the full year 2024. The net profit margin is also expected to remain at the H1 2024 level of 18.1%. This brings the forward P/E to 22.3x. In other words, the market multiples indicate that it’s a good time to watch the stock more closely now.

Sustained dividends likely

Also, despite the slack in the latest numbers, the dividends are unlikely to be impacted. For H1 2024, the company’s dividend payout ratio is at a comfortable 38%. In fact, its forward dividend yield at 2.2% is also superior to peers like Hermès (OTCPK:HESAY) at 1.1% and Richemont (OTCPK:CFRUY) at 1.8%.

What next?

With the latest results and sustained TTM P/E for LVMH, there’s little impetus to change the Sell rating on the stock as it can continue to slide. For now. But I do believe it’s getting to a point where it will be a good idea to start accumulating it again, flipping the stock into a Buy instead then.

The forward P/E indicates already that the stock is getting to a level that has historically been followed by a price uptick. Even with the luxury market slowdown, the company’s margins are strong, the US market has seen some resilience, China’s overseas purchases have bumped up Japan’s sales and even the weakest link, the Wines & Spirits segment, is showing possible signs of future stability. In any case, it’s a consistent dividend stock to buy for long-term investors looking for a passive income. With its comfortable payout ratio, there’s unlikely to be any risks to the dividends this year either, despite weakening financials.

I’d be on the lookout for one of two factors to emerge for LVMH now. The first is another ~15% drop in its price, which would make it an attractive stock for the medium term for capital gains again. The second is an upturn in momentum for the stock, which might happen even before the stock drops as much. The key takeaway here is that LVMH can get interesting soon enough, and it’s time to watch it more closely.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here