Investment Thesis

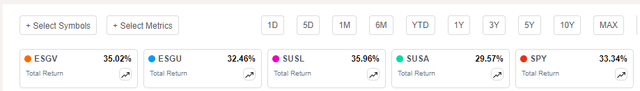

I last reviewed the Vanguard ESG U.S. Stock ETF (BATS:ESGV) on April 3, 2023, when I recommended that ESG investors avoid it and choose the fundamentally stronger iShares ESG MSCI USA Leaders ETF (SUSL). Since that article was published, ESGL has lagged behind SUSL by 0.94%, but it has outperformed other peers like the iShares ESG Aware MSCI USA ETF (ESGU) and the iShares MSCI USA ESG Select ETF (SUSA).

Seeking Alpha

These results were better than I anticipated, and after re-evaluating, I believe ESGV is now the better pick over SUSL because of its better diversification, a feature I expect to be beneficial as the market broadens. Below, I’ll review these screens and highlight the top 25 companies ESGV excludes. I will also evaluate performance and fundamentally analyze the five funds listed above, revealing which ones have the greatest growth potential and which ones provide the best value. I hope you enjoy the read.

ESGV Overview

Strategy and Top Ten Holdings

ESGV tracks the FTSE US All Cap Choice Index and seeks to provide social investors with total market exposure by following an exclusions-based approach based on a company’s products and conduct. Specifically:

- Non-renewable energy (fossil fuel and nuclear power).

- Vice products (adult entertainment, alcohol, gambling, tobacco).

- Weapons (chemical and biological, cluster munitions, anti-personnel landmines, nuclear and conventional military weapons, civilian firearms).

- Controversies (based on the UN Global Compact Principles).

- Diversity principles.

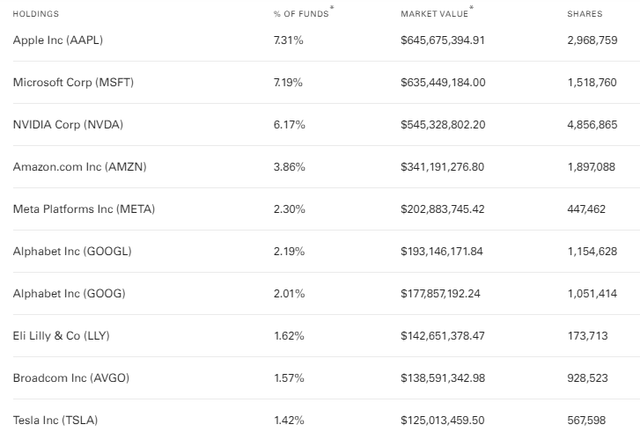

The Index is market-cap-weighted, so many exclusions won’t have a practical impact. To illustrate, ESGV’s top 10 holdings account for 35.64% of the portfolio compared to 35.78% for SPY. It also holds all the Magnificent Seven stocks (Apple Inc. (AAPL), Microsoft Corporation (MSFT), NVIDIA Corporation (NVDA), Amazon.com, Inc. (AMZN), Meta Platforms, Inc. (META), Alphabet Inc. (GOOG) (GOOGL), Tesla, Inc (TSLA)).

Vanguard

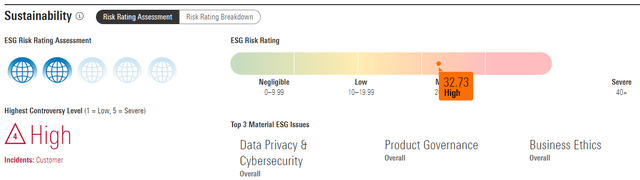

While these stocks don’t fall into the Index’s exclusions categories, that doesn’t mean they’re necessarily ESG-friendly. For example, Morningstar has assigned Meta Platforms, Inc. (META) a high 32.73 ESG risk rating, noting “Product Governance” as a material issue. Amazon’s 29.32 score is not much better.

Morningstar

These inclusions are why investors must research the ETF’s underlying strategy rather than relying on its name. While the “Vanguard ESG U.S. Stock ETF” seeks to appeal to ESG investors, it’s still based on a set of rules that may not be comprehensive enough for you.

ESGV Key Exclusions and Sector Exposures

ESGV excludes 115 S&P 500 Index companies with weights totaling 16.55%, indicating about 83-84% overlap by weight with SPY. I’ve listed the top 25 below, which total 10.22%.

- Berkshire Hathaway Inc. (BRK.B): 1.73% (Financials).

- Exxon Mobil Corporation (XOM): 1.16% (Energy).

- Johnson & Johnson (JNJ): 0.85% (Healthcare).

- Walmart Inc. (WMT): 0.66% (Consumer Staples).

- Chevron Corporation (CVX): 0.60% (Energy).

- Wells Fargo & Company (WFC): 0.46% (Financials).

- General Electric Company (GE): 0.40% (Industrials).

- International Business Machines Corporation (IBM): 0.39% (Technology).

- Philip Morris International Inc. (PM): 0.39% (Consumer Staples).

- NextEra Energy, Inc. (NEE): 0.33% (Utilities).

- RTX Corporation (RTX): 0.33% (Industrials).

- Honeywell International Inc. (HON): 0.29% (Industrials).

- ConocoPhillips (COP): 0.29% (Energy).

- Eaton Corporation plc (ETN): 0.26% (Industrials).

- Lockheed Martin Corporation (LMT): 0.25% (Industrials).

- Analog Devices, Inc. (ADI): 0.24% (Technology).

- The Boeing Company (BA): 0.23% (Industrials).

- The Southern Company (SO): 0.20% (Utilities).

- Altria Group, Inc. (MO): 0.19% (Consumer Staples).

- Duke Energy Corporation (DUK): 0.18% (Utilities).

- KKR & Co. Inc. (KKR): 0.17% (Financials).

- Amphenol Corporation (APH): 0.16% (Technology).

- EOG Resources, Inc. (EOG): 0.16% (Energy).

- Parker-Hannifin Corporation (PH): 0.15% (Industrials).

- Schlumberger Limited (SLB): 0.15% (Energy).

The Index excludes several Energy and Industrials stocks for their exposure to fossil fuels and weapons. However, the most impactful exclusion is Berkshire Hathaway, which has a lower ESG risk rating than Meta Platforms and Amazon, likely because it holds Energy stocks like Chevron Corporation (CVX) and Occidental Petroleum Corporation (OXY). In addition, the Index excludes Healthcare stocks like Johnson & Johnson (JNJ), presumably due to controversies related to its talc-based baby powder products.

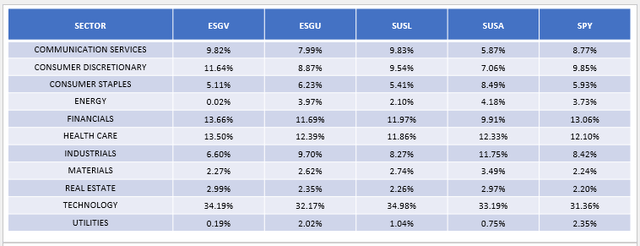

Energy and Industrials are the two sectors most impacted, with allocations of about 2-4% less each compared to SPY. ESGV also underweights Utilities, excluding all S&P 500 Index stocks except Exelon Corporation (EXC) and American Water Works Company, Inc. (AWK). The beneficiaries are primarily stocks in the Technology sector, giving ESGV a slightly higher growth profile.

The Sunday Investor

ESGV Analysis

Performance Summary

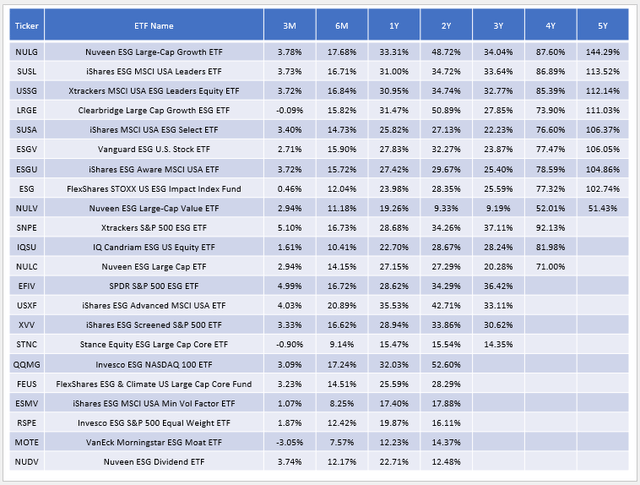

ESGV is one of a handful of large-cap ETFs with at least a five-year track record. The following table highlights its 106.05% total return for the five years between July 2019 and June 2024, which ranks #6 in this sample. SUSL and SUSA are slightly ahead at 113.52% and 106.37%, while the Nuveen ESG Large-Cap Growth ETF (NULG) is way ahead at 144.29%.

The Sunday Investor

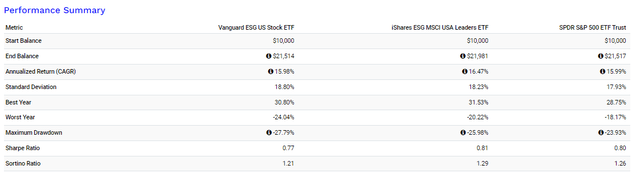

Over the last three years, ESGV’s 23.87% total return ranks #12/16, while its 27.83% one-year return ranks #10/22. These results are solid but not exceptional. Since June 2019, ESGV was also more volatile, resulting in worse risk-adjusted returns (Sharpe and Sortino Ratios) compared to SUSL and SPY.

Portfolio Visualizer

ESGV Fundamental Analysis

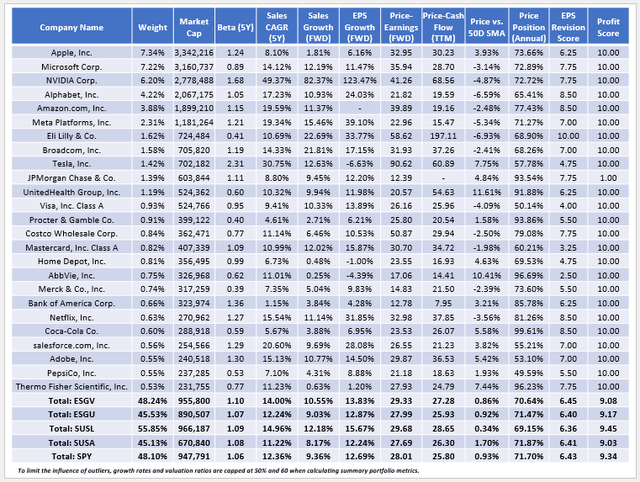

Since past performance is not indicative of future returns, it’s worth evaluating ESGV at the fundamental level, too. The following table highlights selected fundamental metrics for ESGV’s top 25 holdings, totaling 48.24%. At the bottom are summary metrics for ESGU, SUSL, SUSA, and SPY.

The Sunday Investor

ESGV excludes 115 S&P 500 Index stocks, but its 48.24% concentration in its top 25 holdings remains the same as SPY. Effectively, nearly one thousand additional small- and mid-cap stocks (12.24% by weight) serve as an offset, which may prove beneficial compared to SUSL, which has 11.77% and 11.19% allocated to Microsoft Corporation (MSFT) and NVIDIA Corporation (NVDA). It’s tough to say which Magnificent Seven stocks will outperform moving forward, but Apple Inc. (AAPL) is the only one trading above its 50-day moving average price (+3.94%). Nvidia is 4.87% below its 50-day moving average price but still up 128.30% YTD. If you believe the current market broadening will continue, limiting exposure to this stock is prudent, and that’s something ESGV does better than SUSL.

On valuation, ESGV trades at 29.33x forward earnings (23.29x harmonic average), which is about a point more than SPY but reasonable given its higher growth profile. SUSL offers more one-year estimated earnings growth (15.67% vs. 13.83%), primarily due to Nvidia. Neither of these ETFs are clear winners fundamentally, but SUSA has outperformed ESGV when markets declined. So it could be a slightly better defensive pick.

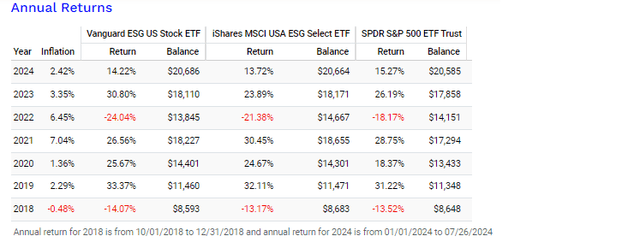

Portfolio Visualizer

As shown, SUSA beat by about 3% in 2022 but also showed its potential to outperform in 2021 (30.45% vs. 26.56%). The unusual dominance of Magnificent Seven stocks has made short-term performance charts difficult to interpret, as it really comes down to how much exposure an ETF had to these stocks and whether that was the result of a superior strategy or just good fortune. All these funds are similar, and barring any substantial returns of a stock like Nvidia, they should deliver similar results moving forward.

Investment Recommendation

ESGV is a reasonably well-diversified fund holding approximately 1,400 U.S. stocks from all size segments. It follows product screens that eliminate companies in the fossil fuels, vice products, and weapons industries. However, its conduct screens related to “controversies” are sometimes inconsistent with other ESG rating systems, so I doubt ESGV will align perfectly with your values. Still, it could be a step in the right direction.

I preferred SUSL last year, but its allocation to Nvidia has increased by 7.40%, and it’s prudent to focus on diversification as the market broadens. Therefore, ESGV is a solid choice, and I expect it to deliver returns similar to those of other total market funds moving forward. Thank you for reading, and I look forward to your comments below.

Read the full article here