Introduction

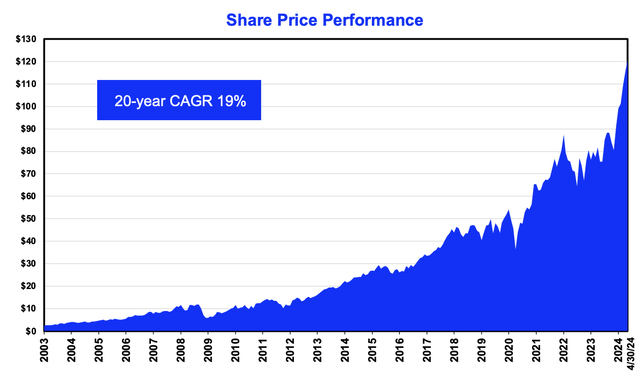

If you had compounded a $10,000 investment at 19% per year for 20 years, you would have ended up with roughly $324,000. That’s the median home price in the state of Wisconsin going into this year.

A $100,000 investment would have turned into $3.2 billion, more than enough to buy a decent home in South Lake Tahoe, California, a place where I would very much like to own a house someday.

Pixabay (Free for Use)

I’m bringing this up because 19% per year is how much the Amphenol Corporation (NYSE:APH) returned between April 30, 2004, and April 30, 2024.

This return has made it one of the best compounders in the industrial space. In fact, it has made it one of the best compounders on the entire stock market.

Amphenol Corporation

On January 16, I initiated coverage of this company in an article titled “Meet Amphenol, The New Super Compounder On My Watchlist.” Since then, shares have returned 32%, more than twice the already impressive 15% return of the Standard & Poor’s 500.

Unfortunately, I wasn’t in it, as I decided to play it safe despite my belief that the company was in a fantastic spot for long-term growth.

While the low dividend yield may raise eyebrows, the company’s stellar stock performance validates the move of prioritizing business growth over immediate yield.

As economic uncertainties loom, I anticipate potential buying opportunities and aim to transition APH from my watchlist to a core portfolio position. – 01/16/24 APH Article

Hence, after roughly half a year and a 32% higher stock price, I’ll update my thesis, using its latest earnings and general economic/market developments to tell you how I’m dealing with what has become one of my favorite watchlist stocks.

So, let’s get to it!

A Quick Look At The Company

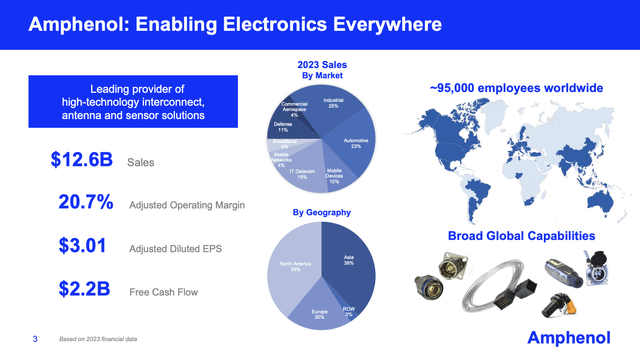

Amphenol is an industrial giant with a current market cap of $47 billion. It is a serial compounder with significant exposure in industrial, automotive, IT, defense, and mobile device markets.

It also has more than 60% sales exposure outside of North America.

Amphenol Corporation

The company, which started as American Phenolic Corp almost 100 years ago, has been a public company since 1991, focusing on aggressive M&A to expand its capabilities in areas with fast-growing demand.

In fact, it has such a good M&A track record that it has become the “acquirer of choice” in many cases, having bought more than 50 companies over the past ten years.

Amphenol Corporation

As we can see in the overview above, it is currently in the process of buying the Carlisle Interconnect Technologies segment from Carlisle (CSL), a company I have owned since 2023 that is becoming a pure-play building materials player.

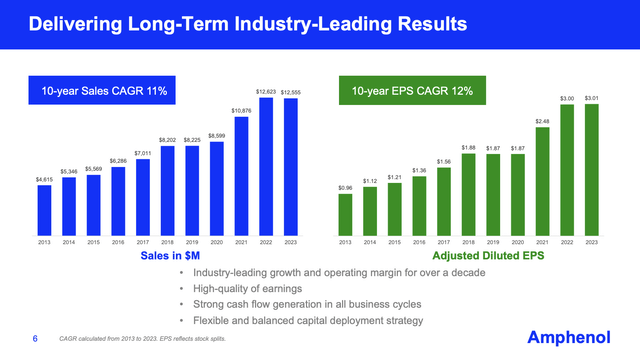

Thanks to being in the right place at the right time, Amphenol has grown its revenues by 11% per year since 2013. Higher margins have allowed earnings per share to grow by 12% during this period.

Amphenol Corporation

Now, to add some color to these numbers, let’s dive into recent developments.

Firing On All Cylinders

As its stock price may have suggested, Amphenol is doing pretty well.

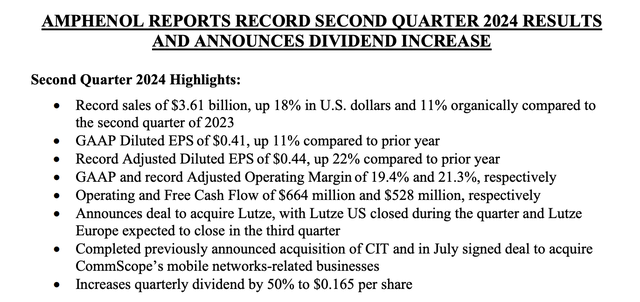

In the second quarter, the company generated record revenues of $3.61 billion. That’s an increase of 18% in U.S. dollars and an 11% organic growth rate – excluding acquisitions.

Meanwhile, the company’s operating income was $769 million on an adjusted basis, with a record operating margin of 21.3%. That’s a 90 basis points increase from the previous year.

According to the company, this improvement reflects effective cost management and strong leverage from increased sales volumes, even as it continues to integrate acquisitions like CIT (from Carlisle), which currently operates below Amphenol’s average profitability levels.

These numbers allowed the company to generate $0.44 in adjusted diluted EPS, 22% higher than its prior-year quarter result.

Amphenol Corporation

Even better, the company’s free cash flow generation was fantastic, as it generated $528 million in free cash flow, 95% of adjusted net income!

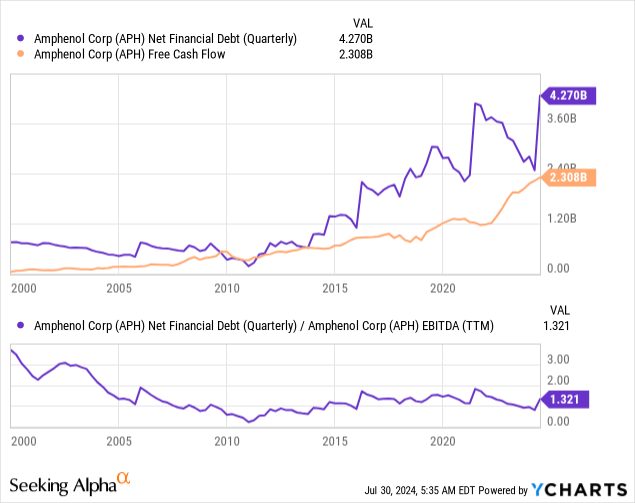

It also maintained a healthy balance sheet, with a net debt load of $4.1 billion and a net leverage ratio of just 1.2x. The company also holds significant liquidity of $4.3 billion, which includes cash and short-term investments.

This is what’s so fascinating about APH. It has found the perfect balance between M&A, free cash flow generation, and balance sheet protection.

Essentially, the company buys a company, integrates it, improves margins, generates substantial free cash flow, and reduces debt, which allows it to buy other companies. Then, the cycle repeats.

As we can see below, the long-term rise in net financial debt has not resulted in a poorer balance sheet, as the company has consistently maintained a very healthy net leverage ratio – while rapidly growing free cash flow.

As long as APH finds good M&A opportunities and executes these deals well, this is a fantastic business model.

It also allows it to reward shareholders.

Shareholder Distributions

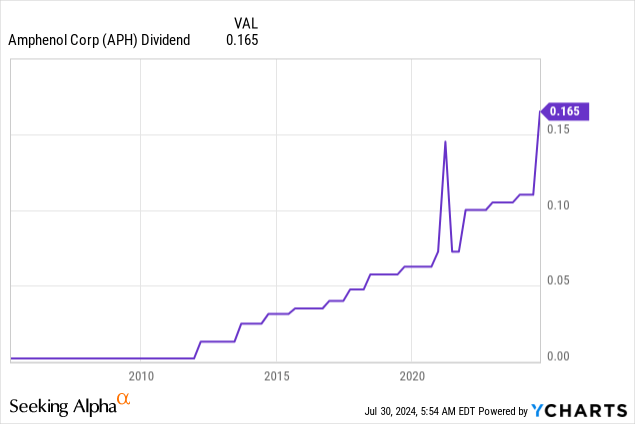

The company currently pays $0.165 per share per quarter. This translates to a yield of 1.0%. Please note that a lot of websites say it pays more. However, that was before its stock split.

While a 1.0% yield is nothing to get excited about, it’s not the company’s fault, as it maintains a healthy 40% payout ratio. The five-year dividend CAGR is 13.6%. This number excludes its latest 50%(!) dividend hike, announced during the 2Q24 earnings call.

In other words, the only reason why APH’s yield is disappointing is the fact that capital gains have offset dividend growth.

That’s bad news for new investors seeking income. It’s good news for anyone who bought APH in recent years. Given its fantastic business model, I expect the company to remain an aggressive dividend grower for many more years to come.

Future Growth & Valuation

With regard to future (dividend) growth, the company booked record orders of $4.1 billion in the second quarter. This indicates a book-to-bill ratio of 1.12x, meaning for every dollar in finished work, it got $1.12 in new orders.

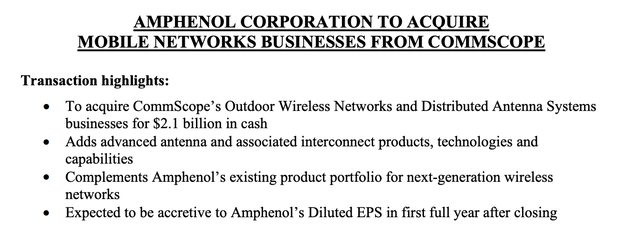

Moreover, CIT isn’t the only acquisition the company is working on.

Amphenol believes that the recent acquisition of Lutze, especially its U.S. and European operations, strengthens its industrial market position with harsh environment cable and cable assembly solutions.

According to the company, Lutze U.S. alone contributes $75 million in annual sales, with Lutze Europe expected to add another $100 million.

Furthermore, the purchase of CommScope’s Outdoor Wireless Networks and Distributed Antenna Systems businesses for $2.1 billion is expected to improve Amphenol’s capabilities in next-generation mobile networks.

Amphenol Corporation

Even better, these businesses are expected to generate $1.2 billion in revenue with EBITDA margins of roughly 25% in 2024, likely providing a significant boost to Amphenol’s overall profitability.

On top of that, it benefits from secular growth in major areas. Defense, which accounts for 11% of its total sales, saw 14% growth in U.S. dollars. The commercial aerospace sector saw 60% growth, supported by the CIT addition and rising demand for next-gen components.

Meanwhile, the IT datacom market benefits from data center demand. According to the company, its products are key in enabling the high-speed and power interconnect needs of these systems. It saw 57% growth in this sector.

For the third quarter, the company expects sales between $3.7 billion and $3.8 billion and diluted EPS between $0.43 and $0.45. This translates to 16% to 19% sales growth and 10% to 15% EPS growth.

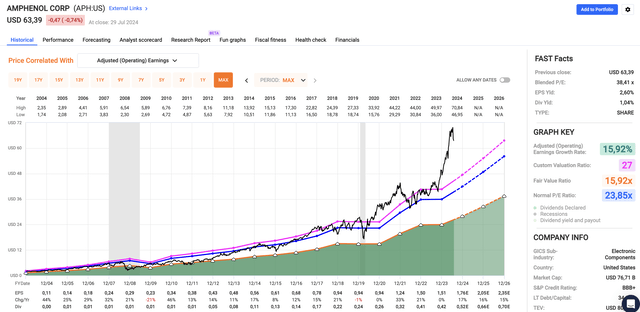

The good news is that analysts expect elevated growth to last.

Using the FactSet data in the chart below, Amphenol is expected to grow its EPS by 17% this year, potentially followed by 16% and 15% growth in 2025 and 2026, respectively.

FAST Graphs

The problem is that a lot has been priced in.

Trading at a blended P/E ratio of 38.4x, the stock trades more than ten points above its 10-year normalized P/E ratio of roughly 27x.

Even by incorporation of elevated growth rates, the company seems to be trading at its fair stock price.

As bullish as I am about the future of this company, after the latest bull run, I believe a Neutral rating is justified.

However, to me, the company remains a case of “buying on weakness,” as I consider it to be one of the best industrial players on the market. It reminds me of my investment in Danaher (DHR), which applies a similar playbook in healthcare.

Going forward, I will continue to monitor APH to potentially add it to my 22-stock dividend growth portfolio.

Takeaway

Amphenol has proven itself as a standout in the industrial sector, delivering stellar returns of 19% annually over 20 years.

Despite missing the recent 32% rally, I’m optimistic about its future, given its fantastic M&A strategy, impressive free cash flow, and solid balance sheet.

While the current valuation suggests a pause, I’m eagerly waiting for a buying opportunity to make Amphenol a core portfolio position.

Its potential for long-term dividend growth and elevated earnings growth in key markets make it a compelling long-term investment, similar to my investments in other sectors.

Pros & Cons

Pros:

- Strong Track Record: Amphenol has delivered an impressive 19% annual return over 20 years, a result of what I consider to be a brilliant business model.

- Healthy Financials: The company maintains a healthy balance sheet with excellent free cash flow generation, a low net leverage ratio, and significant liquidity.

- Effective M&A Strategy: Amphenol’s track record with acquisitions is strong and the pillar of elevated long-term growth.

- Solid Growth Prospects: With a diverse portfolio and strong demand in key sectors like defense, aerospace, and IT, the company’s future growth looks promising.

Cons:

- High Valuation: The stock is currently trading at a P/E ratio of 38.4x, well above its 10-year average of 27x, which suggests that a lot of growth has been priced in.

- Low Dividend Yield: A 1.0% dividend yield isn’t impressive, especially for income-focused investors. However, dividend growth has been strong.

Read the full article here