In the market’s eyes, the Federal Reserve finds itself either poised to head off a recession or doomed to repeat the mistakes of its recent past — when it was too late seeing a coming storm.

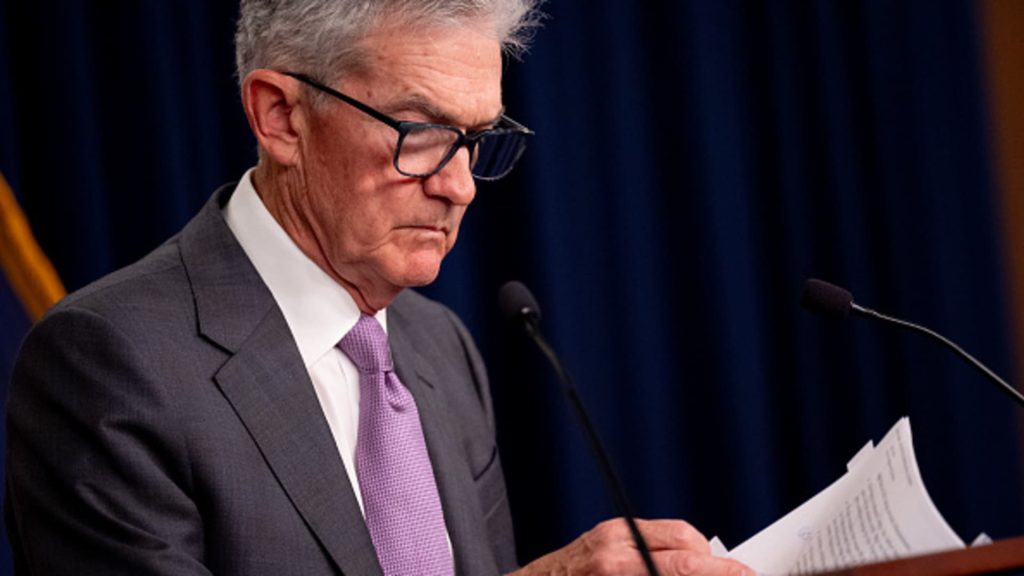

How Chair Jerome Powell and his cohorts at the central bank react likely will go a long way in determining how investors negotiate such a turbulent climate. Wall Street has been on a wild ride the past several days, with a relief rally Tuesday ameliorating some of the damage since recession fears intensified last week.

“In sum, no recession today, but one is increasingly inevitable by year-end if the Fed fails to act,” Steven Blitz, chief U.S. economist at TS Lombard, said in a note to clients. “But they will, beginning with a [half percentage point] cut in September telegraphed in late August.”

Blitz’s comments represent the widespread sentiment on Wall Street — little feeling that a recession is an inevitability unless, of course, the Fed fails to act. Then the probability ramps up.

Disappointing economic data recently generated worries that the Fed missed an opportunity at its meeting last week to, if not cut rates outright, send a clearer signal that easing is on the way. It helped conjure up memories of the not-too-distant past when Fed officials dismissed the 2021 inflation surge as “transitory” and were pressed into what ultimately was a series of harsh rate hikes.

Now, with a weak jobs report from July in hand and worries intensifying over a downturn, the investing community wants the Fed to take strong action before it misses the chance.

Traders are pricing in a strong likelihood of that half-point September cut, followed by aggressive easing that could lop 2.25 percentage points off the Fed’s short-term borrowing rate by the end of next year, as judged by 30-day fed funds futures contracts. The Fed currently targets its key rate between 5.25%-5.5%.

“The unfortunate reality is that a range of data confirm what the rise in the unemployment rate is now prominently signaling — the US economy is at best at risk of falling into a recession and at worst already has,” Citigroup economist Andrew Hollenhorst wrote. “Data over the next month is likely to confirm the continued slowdown, keeping a [half-point] cut in September likely and a potential intermeeting cut on the table.”

Emergency cut unlikely

With the economy still creating jobs and stock market averages near record highs, despite the recent sell-off, an emergency cut between now and the Sept. 17-18 open market committee seems a longshot to say the least.

The fact that it’s even being talked about, though, indicates the depth of recession fears. In the past, the Fed has implemented just nine such cuts, and all have come amid extreme duress, according to Bank of America.

“If the question is, ‘should the Fed consider an intermeeting cut now?’, we think history says, ‘no, not even close,'” said BofA economist Michael Gapen.

Lacking a catalyst for an intermeeting cut, the Fed is nonetheless expected to cut rates almost as swiftly as it hiked from March 2022-July 2023. It could start the process later this month, when Powell delivers his expected keynote policy speech during the Fed’s annual retreat in Jackson Hole, Wyoming. Powell is already being expected to signal how the easing path will unfold.

Joseph LaVorgna, chief U.S. economist at SMBC Nikko Securities, expects the Fed to cut rates 3 full percentage points by the end of 2025, more aggressive than the current market outlook.

“Go big or go home. The Fed has clearly said that rates are too high. Why would they be slow at removing the tightness?” he said. “They’ll be quick in cutting if for no other reason than rates aren’t at the right level. Why wait?”

LaVorgna, though, isn’t convinced the Fed is in a life-or-death battle against recession. However, he noted that “normalizing” the inverted yield curve, or getting longer-dated securities back to yielding more than their shorter-dated counterparts, will be an integral factor in avoiding an economic contraction.

Over the weekend, Goldman Sachs drew some attention to when it raised its recession forecast, but only to 25% from 15%. That said, the bank did note that one reason it does not believe a recession is imminent is that the Fed has plenty of room to cut — 5.25 percentage points if necessary, not to mention the capacity to restart its bond-buying program known as quantitative easing.

Still, any quakes in the data, such as Friday’s downside surprise to the nonfarm payrolls numbers, could ignite recession talk quickly.

“The Fed is as behind the economic curve now as it was behind the inflation curve back in 2021-2022,” economist and strategist David Rosenberg, founder of Rosenberg Research, wrote Tuesday. He added that the heightened expectation for cuts “smacks of a true recession scenario because the Fed has rarely done this absent an official economic downturn — heading into one, already in one, or limping out of one.”

Read the full article here