Introduction

Enphase (NASDAQ:ENPH) — the pioneer of semiconductor-based microinverters and leader in solar-plus-storage home energy systems — reported Q2 earnings a few weeks ago, missing both Revenue and EPS estimates.

Despite the underperformance, the stock rallied more than 12% the following day as investors realized the worst might be over for Enphase amidst an interest-rate-sensitive solar industry.

However, the stock has given up pretty much all its post-earnings rally, accentuated by the broader market selloff.

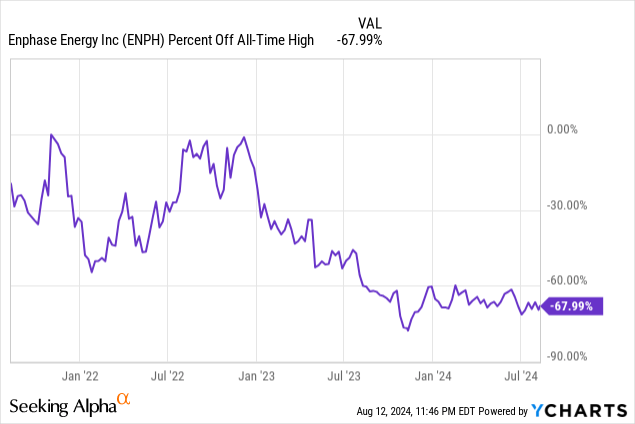

What used to be one of the most popular growth stocks in the market has now turned into a solar fallen angel — the stock is down over 60% from its all-time highs as I write this article.

But with improving business fundamentals and a recovering solar industry, could this be the time to jump into Enphase stock?

Let’s find out.

Growth: The Bottom Is In

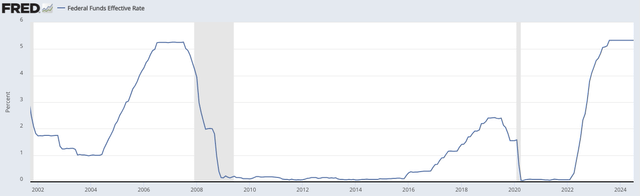

As you know, raging inflation over the last few years prompted the Fed to hike interest rates to levels not seen since before the Great Financial Crisis of 2008. At the same time, it was executed at a record pace, causing macroeconomic shockwaves across multiple industries, including the solar industry.

FRED

As a result, demand for high-ticket items like solar panels and batteries fell sharply, leaving the solar industry at a standstill.

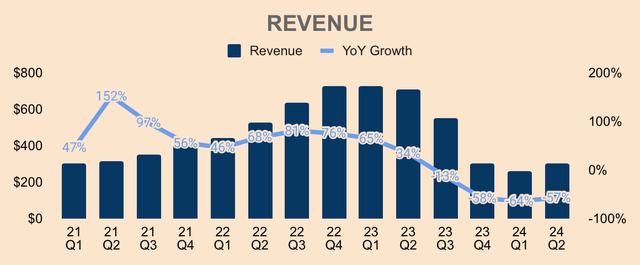

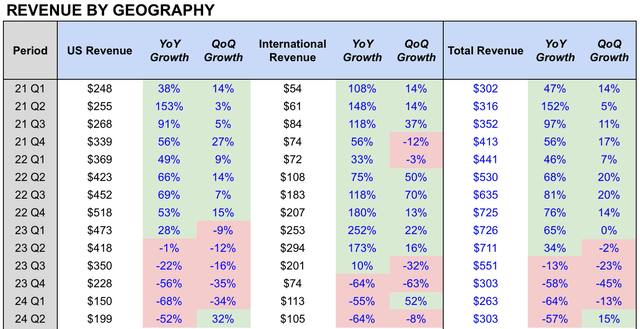

For Enphase, it witnessed a collapse in sales, with Revenue of $303M in Q2, down 57% YoY. After years of explosive growth, Revenue was cut by more than half, illustrating the sheer damage high-interest rates have caused to the industry.

Author’s Analysis

While the demand picture looked extremely gloomy, Revenue did grow by 15% QoQ, implying that the solar drought might just be over. This was due to the normalization of its channel inventory, as Enphase achieved “balance between sell-in and sell-through”. End customer demand for Enphase products also grew 5% QoQ to $396M.

The end market demand for our products was approximately $396 million in Q2, and we reduced our channel inventory by approximately $92 million. Our overall channel inventory returned to normal levels as we exited Q2. (emphasis added)

(CEO Badri Kothandaraman — Enphase FY2024 Q2 Earnings Call)

Breaking it down by geography, the US market drove most of the growth, up 32% QoQ to $199M. Overall, sell-through in the US was up 8% QoQ. Of important note, sell-through in California was up 7% QoQ, “indicating that our California business has stabilized” following recent policy changes, namely NEM 3.0.

On the other hand, the European market is not doing as well, down 8% QoQ, mainly due to regulatory uncertainty in the Netherlands, which saw sell-through rates down 15% QoQ. However, overall sell-through in Europe was up 3% QoQ, and management remains bullish on Europe as the company is still underpenetrated in most European countries.

Author’s Analysis

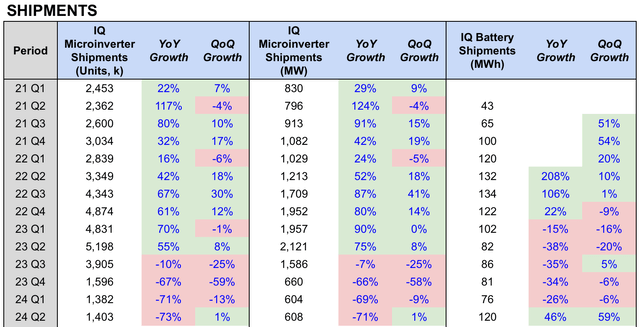

Breaking it further by product type, Microinverter Shipments remained depressed, down more than 70% YoY. While it eked out a small gain QoQ, the microinverter department still has a long way back up. In Q2, microinverter sell-through was flat QoQ in both California and Europe, while non-California states were up 6% QoQ.

Author’s Analysis

Conversely, batteries drove the majority of growth, with Battery Shipments up 46% YoY and 59% QoQ to 120MWh, driven by higher battery attach rates in California and Europe, with battery sell-through rates up 14% QoQ and 18% QoQ, respectively.

That said, expect robust battery sales ahead as the CEO mentioned that the channel is “short of batteries” and that the company is well-positioned to capitalize on this shortage as it now has more than 7,400 installers certified to install its IQ Batteries, up roughly 2,500 installers QoQ.

This is probably why management guided for Battery Shipments of 160MWh to 180MWh in Q3, which is up 97% YoY and 41% QoQ at the midpoint. This also marks the highest level of Battery Shipments in a single quarter… by far.

Of important note, higher battery sales mean that consumers are increasingly opting for solar-plus-storage solutions, which generally have higher average Revenue per system.

As of last week, 60% of our California installations were NEM 3.0. These systems have a high battery attach rate over 90% compared to NEM 2.0 systems, which have an attached rate of 15%. Our data also shows that half of our NEM 3 systems are using Enphase batteries, consistent with what I have reported in the last few earnings calls. Taking this data into account, our average revenue per NEM 3.0 system is approximately 1.5 times the average NEM 2.0 system. (emphasis added)

(CEO Badri Kothandaraman — Enphase FY2024 Q2 Earnings Call)

All things considered, management expects Revenue of $370M to $410M as “bookings in Q3 are the healthiest that they have been in a year”. This represents a 29% QoQ growth at the midpoint.

We are over 85% booked to the midpoint of our overall revenue guidance. This is the healthiest backlog position we have had in the last year. (emphasis added)

(CEO Badri Kothandaraman — Enphase FY2024 Q2 Earnings Call)

More importantly, this is confirmation that Q1 is indeed the bottom in terms of Revenue. As sales continue to recover, the markets should start appreciating Enphase more. And with rate cuts expected later this year, expect Revenue to surge even further.

Profitability: Resilient Margins

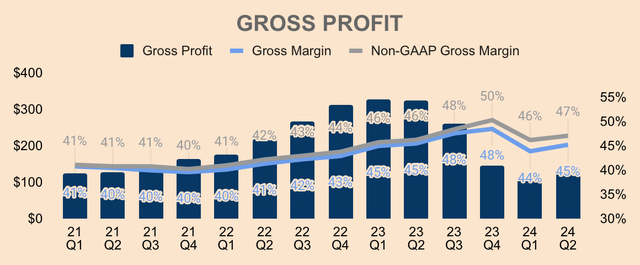

Gross Profit for the quarter was $137M, representing a GAAP Gross Margin of 45%, which was flat YoY but up 1pp QoQ.

Non-GAAP Gross Margin — which adds back Stock-based Compensation and Acquisition-related Amortization — was 47% in Q2, up 1pp YoY and QoQ. The improvement QoQ was due to higher US-made microinverters shipped, which was 574K in Q2, up from 506K in Q1 — higher US-made microinverters meant higher IRA benefit for Enphase. Excluding IRA benefit, Non-GAAP Gross Margin would have been 41% in Q2, which is flat QoQ.

Stable Gross Margins during times of turmoil — which Enphase has demonstrated — reflect strong pricing power and high manufacturing efficiency.

Author’s Analysis

Moving forward, expect Gross Margins to continue to improve as Enphase ramps up microinverter production in the US — projected to nearly double QoQ in Q3, to 1.1M — resulting in higher net IRA benefit. At the same time, battery “cell pack pricing is coming down rapidly” and the company is making architectural changes to its next generation of products, which should drive costs down. All these should lead to higher Gross Margins in the near term.

- Q3 GAAP Gross Margin is expected to be 45% to 48%.

- Q3 Non-GAAP Gross Margin is expected to be 47% to 50%.

- Q3 Non-GAAP Gross Margin excluding IRA benefit is expected to be 39% to 42%.

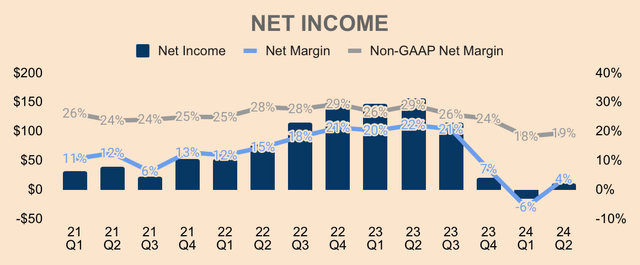

In terms of the bottom line, GAAP Net Income was $11M at a 4% Margin, improving 10pp QoQ. Non-GAAP Net Income was $59M at a 19% Margin, up 1pp QoQ. Improvements in the bottom line were mainly due to higher Revenue as well as lower Operating Expenses.

Author’s Analysis

As you can see, just like its topline numbers, Enphase’s bottom line numbers have bottomed as well (pun intended). And management expects these trends to continue as Enphase rescales further. Granted, it will take a few quarters before margins return to their 2022-2023 levels, but it is definitely encouraging to see the company’s fundamentals finally improving.

Health: Optimized Inventory, Robust Free Cash Flow

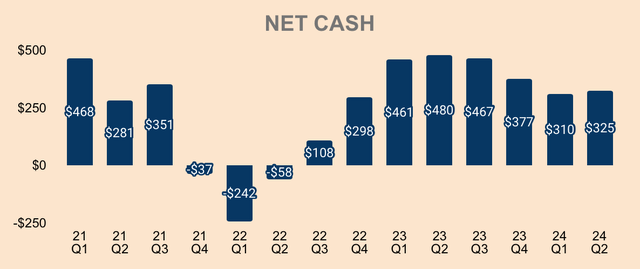

As of Q2, Enphase has a healthy Net Cash position of $325M, up about $15M QoQ.

Author’s Analysis

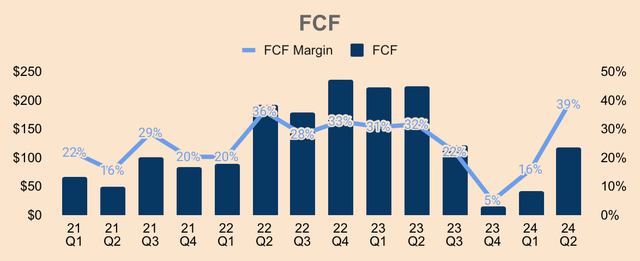

The increase in Net Cash was due to much improved Free Cash Flow, which was $117M in Q2, up from $42M in Q1. This was largely due to Enphase’s ability to offload its inventory in Q2, given that its channel inventory has normalized. This means that orders for Enphase products are picking up once again, which is great to see.

Author’s Analysis

With the excess capital, Enphase bought back 892K shares in Q2, at an average price per share of $112, totaling about $100M. As of the end of the quarter, Enphase has $648M in buyback capacity left — expect more buybacks ahead as shares remain over 60% below their peak.

This should offset dilution from Stock-based Compensation, which was $53M in Q2.

Valuation: Rate Cuts Should be a Catalyst

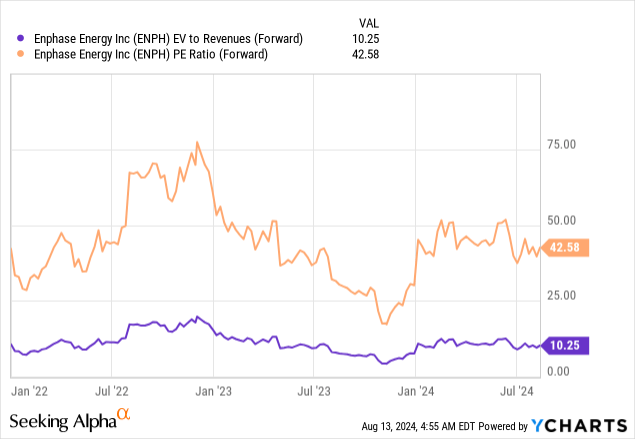

Valuing Enphase based on LTM financials is a redundant exercise. Instead, we can look at forward multiples. As it stands, Enphase trades at a forward EV to Revenue and forward PE Ratio of 10.3x and 42.6x, respectively, which is not cheap by any means.

Then again, Enphase may continue to trade at a premium given its leadership position, industry-high ROIC, and growth potential.

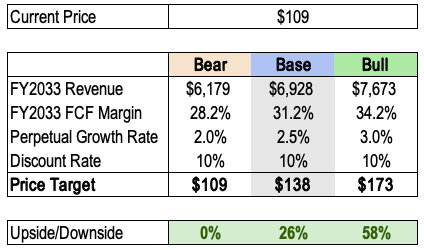

As for me, I’m lowering my base case price target from $160 to $138. I’m still bullish on the company, as seen by its 26% upside potential against my price target. However, I’m worried about the competitive landscape in the long term and what it means for Enphase in the next decade — thus, the lower price target.

Having said that, rate cuts later this year (hopefully) may serve as a major catalyst for the stock, which should also accelerate demand recovery and subsequently, Enphase’s turnaround story.

But in the meantime, Enphase stock is likely to trade sideways, or even down, as long as rates remain high.

Author’s Analysis

Risks

- Competition: my biggest concern with Enphase is competition. More and more solar players are entering the market, most prominently from China, which offers distributors and consumers cheaper alternatives, as compared to Enphase’s more expensive home energy systems. While I believe Enphase will maintain a dominant market position in the US, competition in international markets may pose a threat to Enphase’s growth story outside of the US.

- Higher for Longer: As you may recall at the beginning of the year, many investors were expecting multiple rate cuts throughout 2024 — but what have we got so far this year? Zero cuts. While we are getting close to an actual rate cut, there’s still the possibility of rate cut delays, which, I believe, will continue to put pressure on Enphase stock.

Thesis

Enphase has had a rough few quarters lately, as channel inventory oversupply caused demand for Enphase products to vaporize, leading to four consecutive quarters of Revenue decline.

However, Q2 turned out to be the inflection point for Enphase, as both sales and profits grew sequentially, marking the end of Enphase’s fundamental erosion.

In addition, management guided for further improvements in Q3 as they see demand for their products picking up once again.

The stock is still down over 60% from its all-time highs. Considering improving fundamentals and looming rate cuts, I believe this is just the beginning of Enphase’s turnaround story — perhaps investors will want to jump in before it’s too late.

Read the full article here