Note: All amounts are in Canadian Dollars.

In our previous coverage of Artis REIT (TSX:AX.UN:CA), we felt the risks were moving lower as the company was in the process of achieving the right level of deleveraging.

Artis is headed in the right direction. We are probably reaching a stage where it will be hard to have negative total returns. But we are still not impressed with the mess the company got itself into with its debt.

We might enter along position for the preferred shares for Artis once more if we get an attractive entry. These still yield about 10% and that dividend looks safe.

Source: Deleveraging Makes High-Yield Preferred Attractive.

So far, the REIT is up about 5% since that article, and we have not dived into the Artis Real Estate Investment Trust PREF SHS I (OTC:ARESF, TSX:AX.PR.I:CA) security either. We look at the Q2-2024 results and tell you how we see this playing out.

Q2 2024

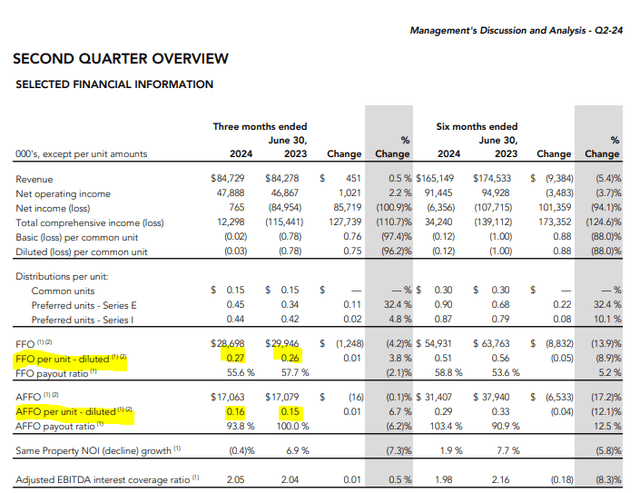

Artis has got a lot wrong over the past few years, but it has got a few things right. The key one has been its relative exposure to US dollars, which it has kept unhedged. That showed up this quarter as a benefit as well, and we saw revenues and net operating income (NOI) increase primarily based on that. Funds from operations (FFO) changed its trend and were actually up. The same could be said for the adjusted FFO (AFFO). Both numbers are down year to date when you benchmark the first half of 2024 vs. 2023, so that goes to show our point.

Artis Q2-2024 Financials

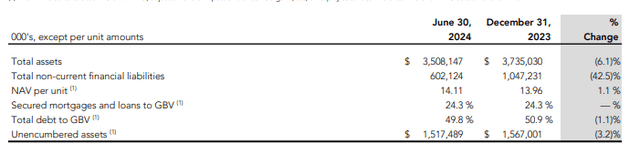

The REIT’s leverage ratio improved marginally from before, and that came via some asset sales.

Artis Q2-2024 Financials

It is a bit funny how little the debt to asset ratio moved despite almost $300 million of sales.

During Q2-24, Artis sold three office properties, six retail properties and one parcel of land in Canada, and two office properties in U.S. for an aggregate sale price of $292,362. The sale proceeds, net of costs of $3,660, related debt of $56,869 were $231,833.

Source: Artis Q2-2024 Financials

But Artis was not done yet.

So far this year we have sold over $650 million of real estate and have unconditional sale agreements in place for an additional approximately $370 million, scheduled to close in the coming months. Proceeds from these sales will be used to further decrease debt in order to bring us closer to our goal of reducing overall leverage below 45%. With leverage and our near-term debt maturities looked after, we will now pursue growth opportunities that allow us to maintain our current distribution and are aligned with our key long-term goal of growing NAV per unit.”

Source: Artis Q2-2024 Financials (emphasis ours)

Outlook

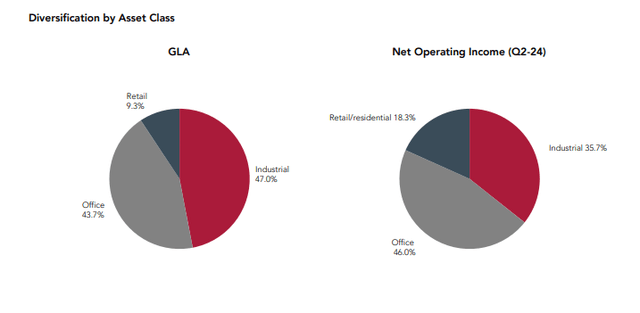

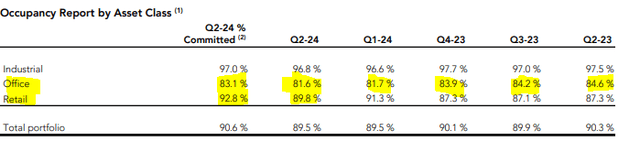

It looked fairly close on the distribution coverage for a while, but Artis might have gotten the metric turned around just enough. But is the stock worth investing in? Well, there are still some issues in place. The office segment makes up almost half of the NOI.

Artis Q2-2024 Financials

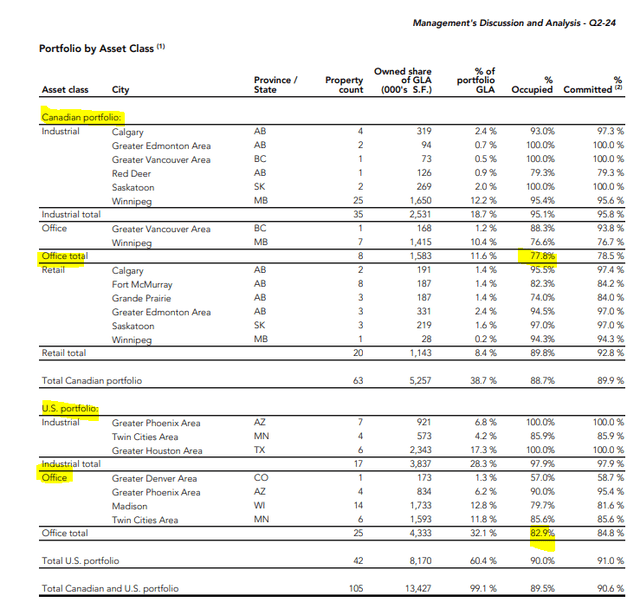

Within the portfolio, office occupancies are not very impressive on either side of the border.

Artis Q2-2024 Financials

Actual occupancies have been on a downtrend for several quarters. Some of this has also happened because Artis has sold its star performers in this segment. On the plus side, retail is actually up year over year and committed occupancy is approaching 93%.

Artis Q2-2024 Financials

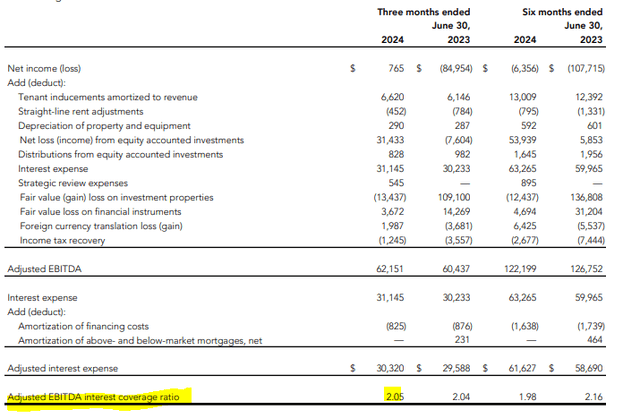

The debt to adjusted EBITDA is just at 2.05X. But here again, we think the ratio has bottomed out.

Artis Q2-2024 Financials

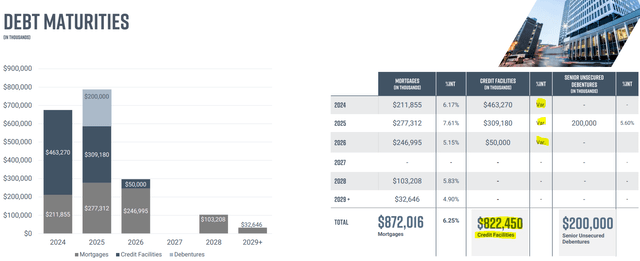

If you look at the Q1-2024 presentation, Artis had $822 million of variable rate debt. It is also painfully obvious that almost all of that was flying straight into the management’s face over the next 1.5 years.

Artis May Presentation

But the announced asset sales have ensured that we are now out of the woods. In some ways, this is funny, as Artis might have paid down the variable debt at potentially the peak of the interest rates. That is what comes via bad planning. But what that also means is that all those asset sales are actually accretive. If they were selling 6% cap rate properties to pay down interest rates of 4%, well, FFO would fall. However, Artis was at CORRA (Canadian Overnight Repo Rate Average) plus 1.7% on some of its variable rate debt. So this is actually marginally positive.

Verdict

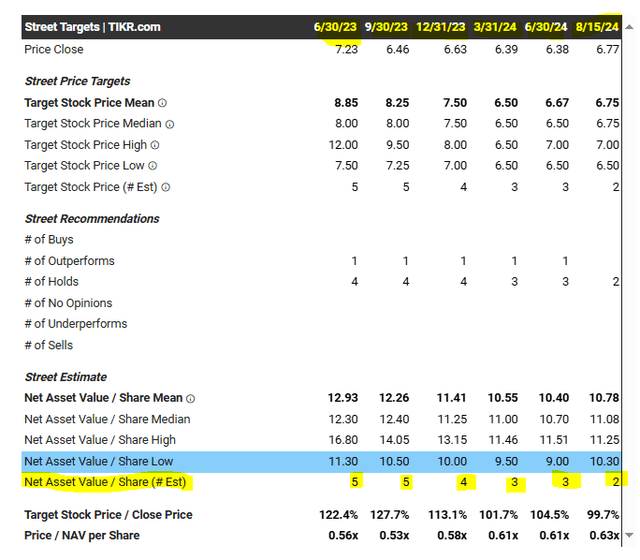

Do you believe the $14.11 IFRS NAV per unit? We think that is definitely inflated and would put realistic numbers today closer to $10.00. This is after interest rate cuts and a compression in credit spreads. Over time, the estimated NAV has declined, but this might simply be due to the optimistic analysts dropping coverage.

TIKR

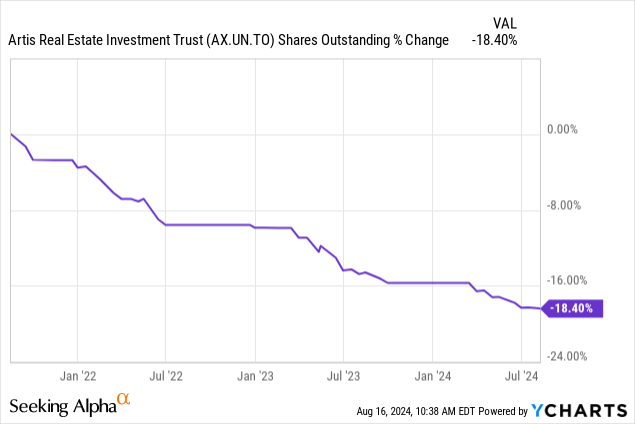

One thing to keep in mind is that if Artis can actually sell the entire portfolio over two years at $10.00 equivalent, you still land up back to $14.00. That is simply because it can continue buying units that are substantially under even that price.

So Artis remains an interesting way to be a property bull. But for our money, we are sticking with H&R REIT (HR.UN:CA). The implied cap rate on that is actually higher than Artis, despite a far higher quality property portfolio. Artis also continues chasing Dream Office REIT (D.UN:CA) and now owns 20% alongside its partners. This is quite befuddling considering it has not finished cleaning up its house and its NAV discount also remains quite compelling. So we continue to take a pass on the common.

Artis Real Estate Investment Trust PFD SER E (TSX:AX.PR.E:CA)

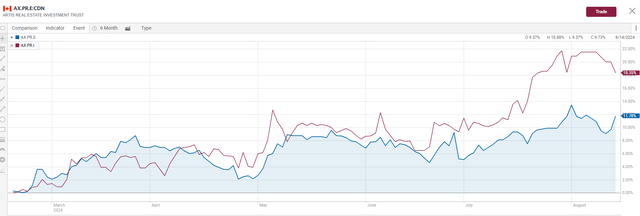

We have mentioned AX.PR.I before and AX.PR.E is very similar. Both are resetting preferred shares. AX.PR.E is Government of Canada 5-year bond (GOC-5) plus 3.30%. AX.PR.I is GOC-5 plus 3.93%. The key difference here is that AX.PR.I has a floor dividend rate on par of 6.0%. Some of the outperformance of AX.PR.I has likely come from that as GOC-5 has fallen.

CIBC

At this point, AX.PR.E is definitely the better bet. Since neither of these reset until 2028, it is highly probable that Artis finishes disposing of everything and wrapping up things before that. In the interim, you get a 1% higher yield with AX.PR.E and potentially $1.75 of extra upside to par.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here