Yum China Holdings, Inc. (NYSE:YUMC) offers an attractive buying opportunity after good Q2 2024 results, and a significant cluster of insider buying activity in the days following the earning release.

In this article, I will walk you through the different aspects of my investment thesis, and I will try to convey in the most direct way possible the different events that motivated my Strong Buy rating.

Additionally, I will go through some of the headwinds in Q2 2024, especially their strategic move with Pizza Hut WOW, which I believe poses a risk to my Strong Buy rating in the event of an economic downturn.

However, considering that my timeframe is relatively short (three to 24 months) I believe this stock has an asymmetric opportunity in the short to mid-term.

As always, I will begin with a company overview section for those readers new to this stock.

Company Overview

Yum China is a Shanghai based company that operates a large number of restaurants in China, focusing on fast food and casual dining.

They have exclusive rights to operate and sublicense the KFC, Pizza Hut, and Taco Bell brands in China.

Additionally, they own the intellectual property of two brands, Little Sheep and Huang Ji Huang. You might not be familiar with these two names unless you’ve recently spent time in China.

They make most of their revenue through their KFC and Pizza Hut restaurants. To give you an idea about the relative weight of each segment, I have included below a breakdown of their annual revenue in 2023.

| Segment | 2023 Revenue (in millions) |

|---|---|

| KFC | $8,240 |

| Pizza Hut | $2,246 |

| All Other Segments | $779 |

| Corporate and Unallocated | $293 |

Author’s compilation from the latest 10-K.

As a side note, all other segments include revenue from brands like Lavazza, Huang Ji Huang, Little Sheep, Taco Bell, their delivery operating segment, and their e-commerce business.

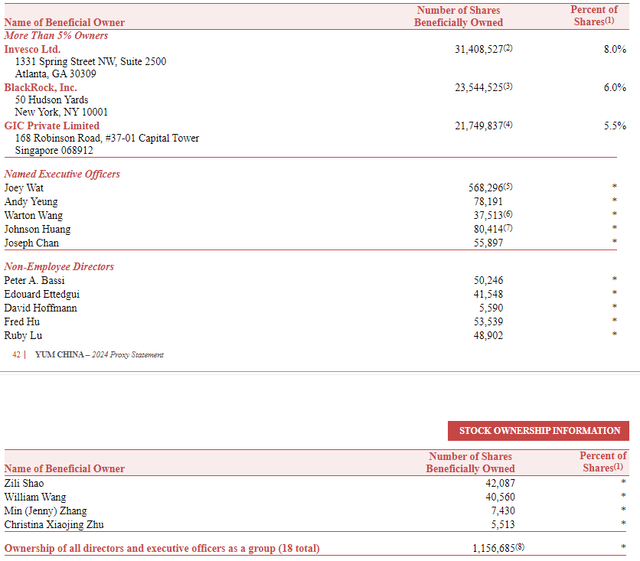

In regards to the beneficial ownership (as of April 11, 2024) of the company, I have to admit that I am disappointed by the fact that the aggregate ownership across all directors and executive officers in the company is less than 1%.

SEC 14A SEC – 14F

However, my investment style leans more on insider buying activity (especially after a recent selloff) rather than total common stock ownership in the company.

If you are wondering why, is because my timeframe is relatively short, between three and 24 months, more often than not, involving highly illiquid call options. Therefore, when I see cluster insider buying activity after a decline in the share price, I have a high conviction that management believes that the current share price is cheap (emphasis on current). Otherwise, if insiders own 40% of the company but don’t buy after a selloff, I cannot infer the same reasoning.

Recent Performance

I like to start my dinner with the cake, so I will cover the headwinds first, despite their decent Q2 2024 results.

My investment style favors companies with high margins and low volumes, mainly during their flexibility during economic downturns. Taken for granted that fast-food restaurants are more focused on volumes than increasing their margins, I considered going through their strategic initiatives, one of which, the Pizza Hut WOW concept, raised my eyebrow.

This concept was designed to cater to a broader audience, particularly solo diners and value conscious customers. The main idea is that by offering smaller portion sizes and cheaper meals, Pizza Hut WOW would meet the needs of a broad audience who prefers dining alone, or are seeking a quick meal at a cheap price.

Look, I’ll be honest with you, nothing bad with this. I was born in a socialist country, so from an ethical point of view, I like it. More people eat more, at more reasonable prices, leading to more employees required to meet the increased demand.

However, from a purely economic standpoint of view, I don’t believe this is good for their net income, in the long run, especially in the event of an economic downturn.

Considering that the operating expenses for their Pizza Hut segment were $460 million, I see the 13.2% margin at risk in the event of a slowdown in the QSR industry.

Just to clarify, I am not saying that there will be a slowdown in QSR, but if there is, the margins for Pizza Hut are at risk, in my view.

Moving on to more positive results, I have to mention that, revenue-wise, this was a record-breaking Q2. Their total revenue was $2.68 billion, up by 1% YoY.

Operating profit was up by 4% YoY, with a total operating margin of 9.9%, also up compared to the same quarter last year, although only by 20 basis points.

I am also encouraged by the 11% YoY delivery sales. As a side note, close to 90% of their total sales came from digital sales, through digital apps to order fast food.

Outlook

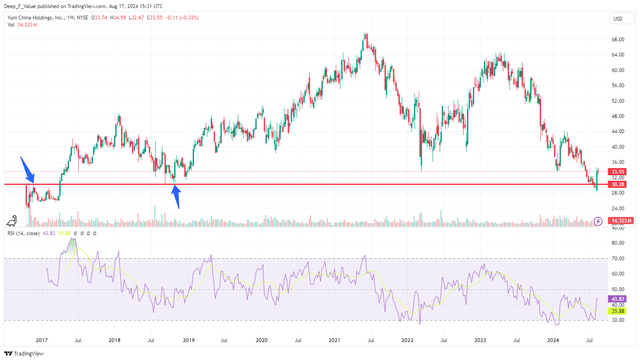

Let’s have a quick look at the share price on a weekly chart.

Trading View

As a contrarian deep value investor, I love this chart for the following reasons:

- YTD decline (prior to Q2 2023 earnings release) of 33%.

- If we look further back, since April 2023 the share price declined by over 50%.

- The price bounced on a validated (in my view) support level from 2019.

Alright, the chart looks good, but this is just the tip of the iceberg.

Let’s proceed to the financials.

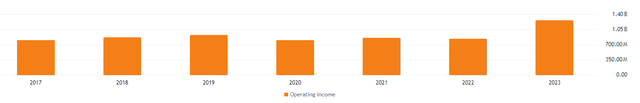

Operating income is up, which is good.

Trading View

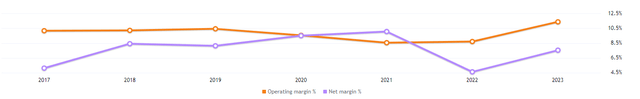

I am also encouraged by the increased operating and net income margins since 2022.

Trading View

Quick and current ratios above 1, and debt to assets below 0.5, which is a good indicator that they can manage both their short and long-term debt, in my view.

Quarterly dividend in place, with a low dividend yield below 2%, TTM. This is a good indication, as they don’t have to give up a significant amount of their free cash flow to pay dividends.

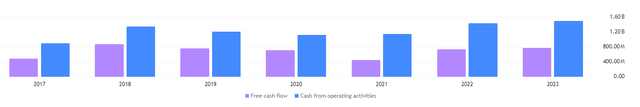

Speaking of cashflows, both operating and free cash flow are up.

Trading View

Valuation-wise I love the fact that most of the valuation metrics are below the company’s five-year average. Given that they operate in the Chinese market, I don’t look too much at the comparison with the broader consumer discretionary sector.

So, the weekly chart shows a selloff, the financial statements look decent, and the valuation ratios are below the five-year average (great!). Now I will focus on insider buying activity.

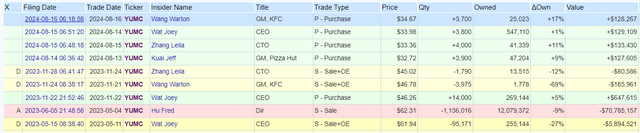

I considered including a screenshot showing the considerable cluster insider buying activity, after the 20% jump in the share price following Q2 earnings results (emphasis on after).

OpenInsider

Earnings were released on August 5, after market close. Insiders started buying between August 13 and 16.

I am highly encouraged by the fact that the five buying transactions were done by five different insiders, including the CEO, CFO, and the GM of their two largest segments.

This is the perfect scenario for my investment style. All the factors that I pay attention to are positive. Therefore, I decided to take a bold step and purchase call options expiring in January 2025.

If my Strong Buy rating doesn’t pan out, my portfolio is going to take a hit.

Conclusion

Wrapping up, I believe Yum China presents a compelling buying opportunity, especially for high-risk, contrarian investors, like myself.

Despite seeing a high risk to Pizza Hut’s margins in case of an economic downturn, the overall financial health of the company is robust with an increase in revenue and operating margins, and strong cash flows.

When compared to their own five-year average, their valuation ratios look quite decent to me, indicating that they could be undervalued.

The insider buying activity, particularly by top executives, and following a 33% decline in the share price YTD, further reinforces my confidence in the current share price.

Therefore, I maintain a Strong Buy rating, holding call options expiring in January 2025.

Read the full article here