Dell Technologies (NYSE:DELL) is a legacy tech company that has re-shifted into an AI play. That transition hasn’t come without stumbles at times this year. Dell’s stock price surged to nearly $180 at the peak of its euphoria in the second quarter before shares were nearly cut in half to an August low of $87.

Ahead of its Q2 2025 earnings report due out at the end of the month, I am upgrading Dell from a hold to a buy. The stock is down about 5% since I initiated coverage of the Information Technology sector stalwart in April. But it has been a roller coaster ride, with an EPS miss tossed into the timeline. But with earnings growth now closer into view and a pullback in the stock, I now see a favorable entry point as we approach the end of 2024.

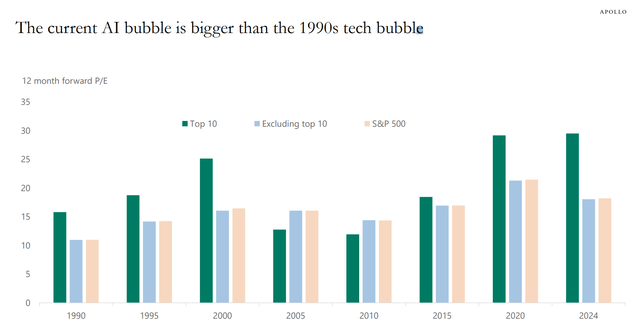

Risks remain around the entire AI theme, however. Torsten Slok at Apollo Global calls the current AI bubble as being larger than that of the 1990s tech boom. As always, investors should be on guard for periods of sharp downward price moves in AI-related stocks.

Risk: AI Bubble?

Apollo Global

Back in May, Dell reported a mixed set of quarterly results. Q1 2025 non-GAAP EPS of $1.27 fell short of analyst expectations of $1.29. But the company’s top line verified much better than Wall Street’s forecast: $22.2 billion, up 6.2% from the same period a year ago, a $550 million beat.

Looking closer at the internals, Dell’s Infrastructure Solutions Group (ISG) revenue of $9.2 billion was a 22% jump from Q1 of its FY 2024, and the Texas-based company posted record servers and networking revenue of $5.5 billion, up a whopping 42% year-on-year. Flat growth in its Client Solutions Group was less impressive and its commercial client revenue was up just 3%.

Dell’s management team clearly feels strongly about its diversified business units – they raised FY 2025 EPS guidance amid strong trends in ISG, driven by solid AI server demand and rising new orders. The backlog for that category was also broadly above street estimates. But a key risk to monitor in the upcoming quarterly report is margins in ISG, as those fell shy of forecasts in the previous period.

As it stands, the current consensus operating EPS forecast is $1.69 on revenue of $24.1 billion. The options market currently prices in a high 10.5% earnings-related stock price swing when analyzing the at-the-money straddle expiring, soonest after the Q2 report on Thursday night. That straddle is more expensive than the 7.2% average of previous quarters, according to data from Option Research & Technology Services (ORATS). Dell has topped EPS estimates in each quarter going back to January 2022, sans the most recent report.

Key risks include softer consumer spending and reduced corporate enterprise investment. Lower IT spending is a particular challenge if we see weaker US real GDP growth in the quarters ahead. Moreover, increasing competition in legacy tech and within emerging AI areas could pose potential challenges for Dell.

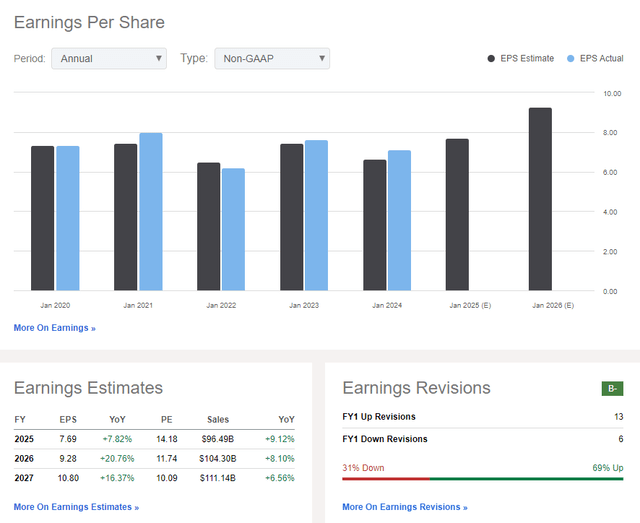

On the earnings outlook, the consensus calls for mid-to-high single-digit bottom-line growth this year with an EPS growth acceleration in the out year. By FY 2027, Dell is expected to earn more than $10 in non-GAAP per-share profits. Revenue, meanwhile, is forecast to climb by more than 9% in the current fiscal year while its dividend yield should remain low, under 2%. Analysts at Goldman Sachs expect $9.19 of operating EPS in FY 2026. What I like is that Dell’s current free cash flow yield is high at 6.8%.

Dell: Earnings & Sales Forecasts

Seeking Alpha

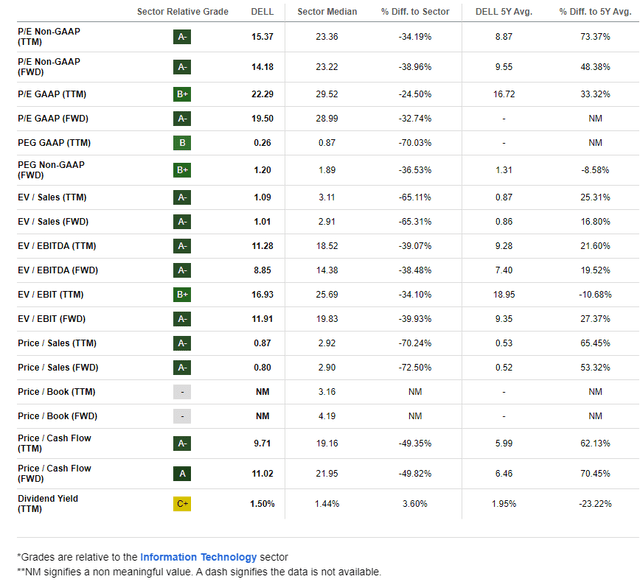

On valuation, Dell has turned cheaper than when I first analyzed the stock. Its forward operating price-to-earnings multiple is now just 14.2. While that is significantly above its 5-year average, high growth in its AI-related segment warrants a valuation reset to the upside. If we assume a mid-to-high teens earnings multiple, below that of the S&P 500, and assume the consensus earnings outlook, we can arrive at a solid valuation target.

With a 16x multiple on $8.50 of non-GAAP EPS over the next 12 months, the intrinsic value target is $136, making the stock undervalued today. That is an increase from my previous analysis amid more clarity on the profitability outlook and the company’s higher earnings guidance.

Dell: Strong Valuation Metrics, High FCF

Seeking Alpha

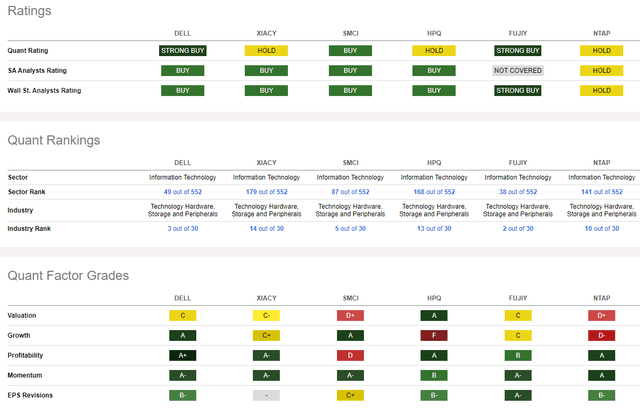

Compared to its peers, Dell features a mixed valuation grade, but its EPS forward trajectory appears sanguine. Along with the strong growth outlook, current profitability trends are robust, while share-price momentum has a strong Factor Grade, but I will highlight some issues seen on the chart later in the article. Finally, sellside revisions have been to the positive sign, evidenced by 13 EPS upgrades to just 6 downgrades.

Competitor Analysis

Seeking Alpha

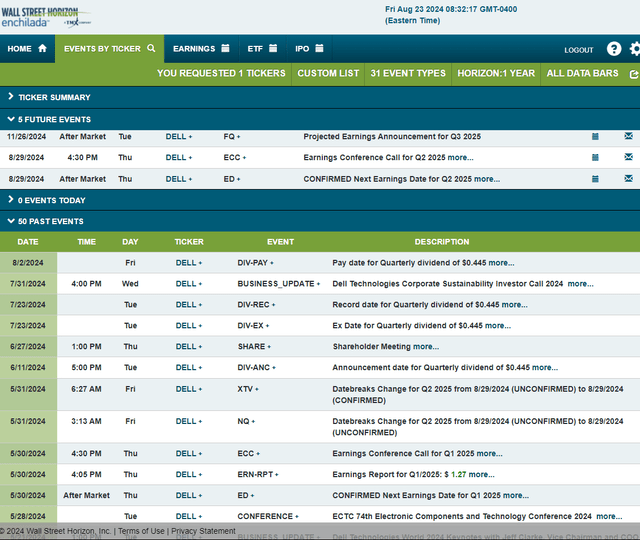

Looking ahead, corporate event data provided by Wall Street Horizon shows a confirmed Q2 2025 earnings date of Thursday, August 29 AMC. The company then holds its conference call immediately after the results are released. You can listen to it live here. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

Wall Street Horizon

The Technical Take

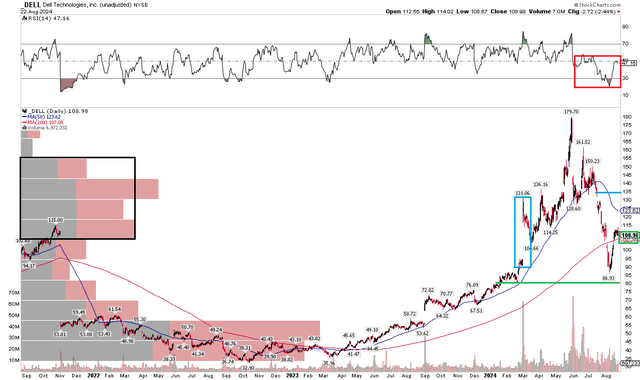

With a favorable valuation and rising EPS estimates, Dell’s technical situation is more nuanced. Notice in the chart below that shares have gone through wild price swings so far this year. I see emerging support, though, in the low to mid-$80s. That’s where the stock dropped to during its summertime plunge. What’s not so encouraging is that Dell’s long-term 200-day moving average is flattening out somewhat in its slope, and the stock has paused at that trend-indicator line in recent sessions.

Furthermore, take a look at the RSI momentum oscillator at the top of the graph. It has been ranging in a bearish zone between 20 and 60, notching technical oversold conditions earlier in the month. Above today’s stock price, there is a lingering, unfilled gap in the mid-$130s that could be a bullish target. Dell also filled the gap from back in March during the recent selloff.

Overall, the uptrend from March 2023 through this past spring is broken, and the onus is on the bulls to regain control of the primary trend.

Dell: Shares Plunge to $80 Support, $135 Upside Gap

Stockcharts.com

The Bottom Line

I have a buy rating on Dell. I am increasing my fundamental price target from $117 to $136, which puts the stock about 20% undervalued despite its technical risks on the chart.

Read the full article here