The 1-Minute Market Report August 25, 2024

In this brief market report, we look at the various asset classes, sectors, equity categories, exchange-traded funds (ETFs), and stocks that moved the market higher and the market segments that defied the trend by moving lower.

Identifying the pockets of strength and weakness allows us to see the direction of significant money flows and their origin.

The rebound continues

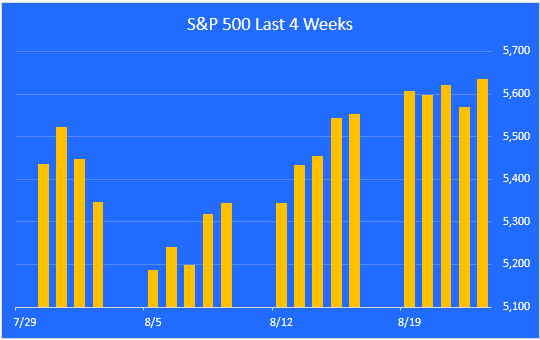

The S&P 500 took a serious hit at the start of August but has since rebounded nicely. The proximate cause for the selloff was the weak jobs report which rekindled fears of recession. The last two weeks have been strong, bringing us back to within 0.6% of the all-time high. Here’s a look at the last 4 weeks.

ZenInvestor.org

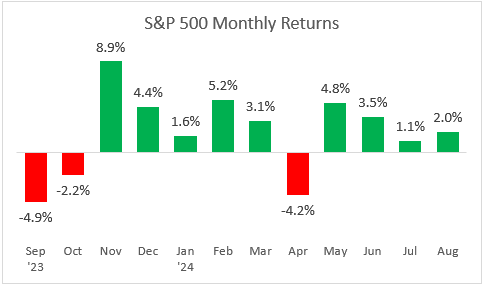

A look at monthly returns.

This chart shows the monthly returns for the past year. August got off to a shaky start but is now solidly in the green. Bear in mind that pullbacks of 5% or so are common during bull markets.

ZenInvestor.org

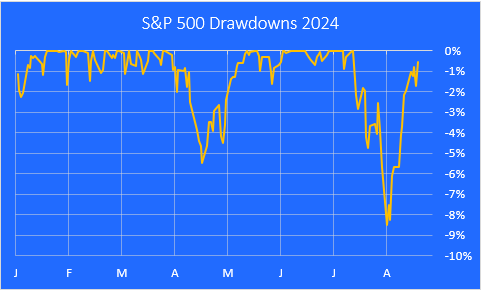

A look at the July-August selloff.

Here is a closer look at the July-August decline, using a drawdown chart. The maximum drawdown so far was 8.5% from the peak on July 16.

ZenInvestor.org

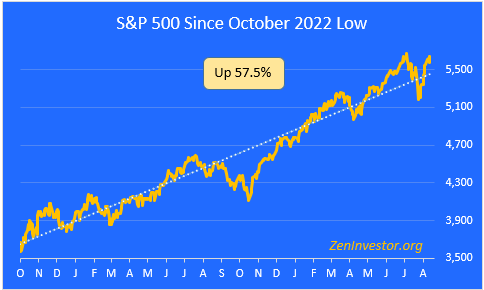

A look at the bull run since it began last October.

This chart highlights the 57.5% gain in the S&P 500 from the October 2022 low through Friday’s close. We dipped below the trendline briefly, and it looks like we may be headed for another record high this week.

ZenInvestor.org

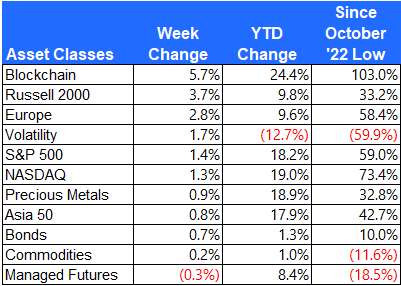

Major asset class performance.

Here is a look at the performance of the major asset classes, sorted by last week’s returns. I also included the returns since the October 12, 2022 low for additional context.

The best performer last week was the Blockchain Index. The worst performer was Managed Futures, which tend to favor the downside. Small caps had another big week.

ZenInvestor.org

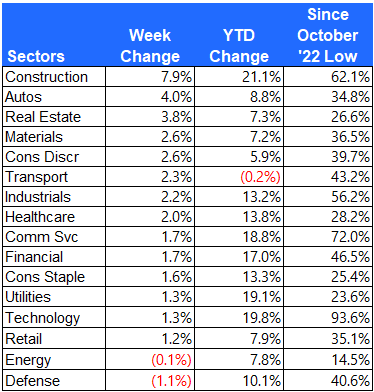

Equity sector performance

For this report, I use the expanded sectors as published by Zacks. They use 16 sectors rather than the standard 11. This gives us added granularity as we survey the winners and losers.

New home construction had a good week. Auto stocks outperformed after an upbeat retail sales report. Real Estate finally caught a bid as investors anticipate falling bond yields.

ZenInvestor.org

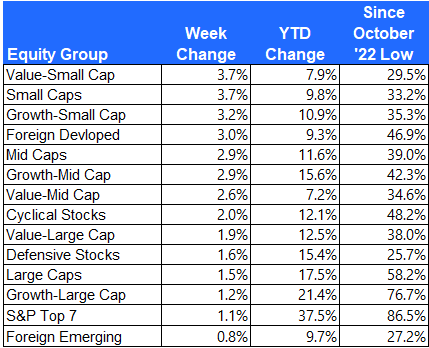

Equity group performance

For the groups, I separate the stocks in the S&P 1500 Composite Index by shared characteristics like growth, value, size, cyclical, defensive, and domestic vs. foreign.

The top three groups last week were the Small Caps as they staged a strong comeback rally. Foreign Developed markets outperformed the U.S. but Emerging Markets were held back by the weakness in Asia.

ZenInvestor.org

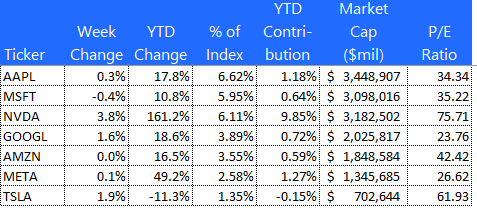

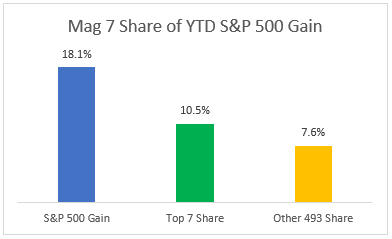

The S&P Mag 7

Here is a look at the seven mega-cap stocks that have been leading the market over the past year. These seven stocks account for 58% of the total YTD gain in the S&P 500. That’s down from 87% at the start of the year, providing evidence that participation in the bull market is broadening. Tesla (TSLA) was the big winner while Microsoft (MSFT) struggled.

ZenInvestor.org

The S&P Top 7 dominance is fading

ZenInvestor.org

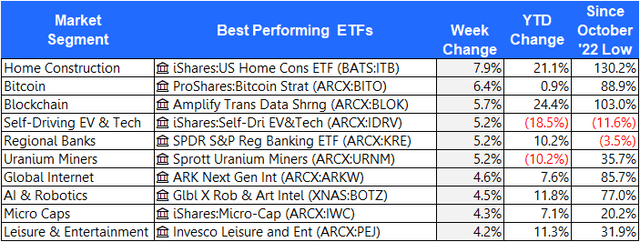

The 10 best-performing ETFs from last week

Home Construction and Bitcoin surged higher last week.

ZenInvestor.org

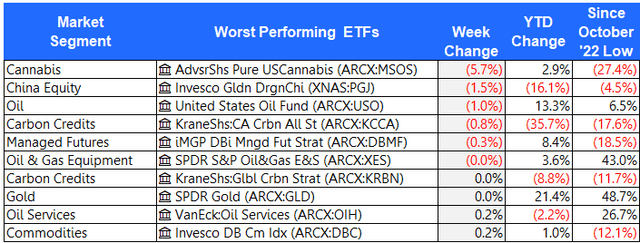

The 10 worst-performing ETFs from last week

Growers and marketers of Cannabis had a rough week, YTD, and full cycle. This surprises and disappoints me. There was so much hype about these stocks as weed became legal in a growing list of states, but somehow these companies can’t seem to figure out how to make a profit.

ZenInvestor.org

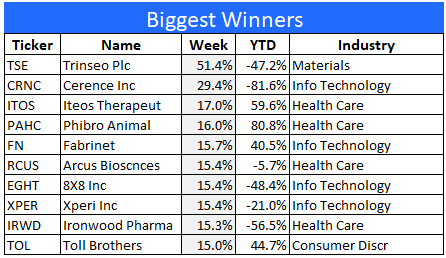

The 10 best-performing stocks from last week

Here are the 10 best-performing stocks in the S&P 1500 last week. Emergent

Trinseo (TSE) bounced from a low base on the news that the insiders were buying big stakes.

ZenInvestor.org

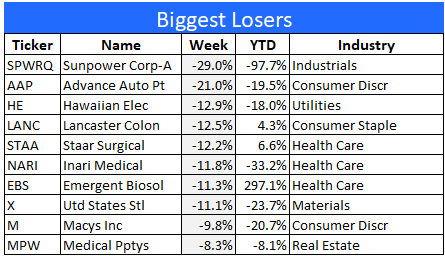

The 10 worst-performing stocks from last week

Here are the 10 worst-performing stocks in the S&P 1500 last week.

Sunpower (OTC:SPWRQ) looks headed for the dust bin.

ZenInvestor.org

Final thoughts

Small Caps were the stars of the show last week, while the Mag 7 struggled to keep up. All eyes will be on Nvidia next week as they announce their earnings on Wednesday. The bar is set high for Nvidia, and if they remain true to form they will blow past their numbers with ease.

But what if they miss their numbers, or present a disappointing forecast for next quarter? I think the market will react with a fierce selloff, since Nvidia is the top stock in the top industry and the market as a whole.

With so much riding on Nvidia’s earnings report, it’s little wonder that investors are a little skittish. Last week the market was up, but most of the gain came on Friday. Monday was an up day, Tuesday was down, Wednesday back up again, Thursday down, and a strong finish on Friday. Investors are nervous.

Not only are they worried about Nvidia’s earnings, but they are also concerned that the Fed may have overplayed its hand by keeping rates too high for too long. A policy mistake like that could spell trouble, especially as we approach the traditionally weak month of September.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here