Shares of Regeneron Pharmaceuticals (NASDAQ:REGN) reached new all-time highs this month. This was driven by the Eylea franchise returning to growth in the second quarter, and despite minor regulatory setbacks for the oncology side of the pipeline. These involved the company receiving complete response letters for odronextamab in March and for linvoseltamab last week.

The European Commission is, apparently, less demanding as it has approved odronextamab under the brand name Ordspono for the treatment of relapsed/refractory follicular lymphoma and diffuse large b-cell lymphoma, and the review of linvoseltamab is ongoing. The good news is that these approvals are just being postponed, and I expect both odronextamab and linvoseltamab to become significant growth drivers for Regeneron in the second half of the decade.

After the recent run-up, Regeneron’s valuation is demanding more growth, and I believe the company can deliver it.

Eylea franchise returns to growth in Q2 as Eylea HD launch ramps up, Dupixent and Libtayo remain in high-growth mode

Regeneron’s total revenues grew 12% Y/Y to $3.6 billion in the second quarter, beating estimates by $160 million.

We have gotten used to Dupixent delivering strong growth and Q2 was no different — global sales increased 27% Y/Y to $3.56 billion, with Regeneron’s antibody collaboration profits rising nearly 31% to $988 million.

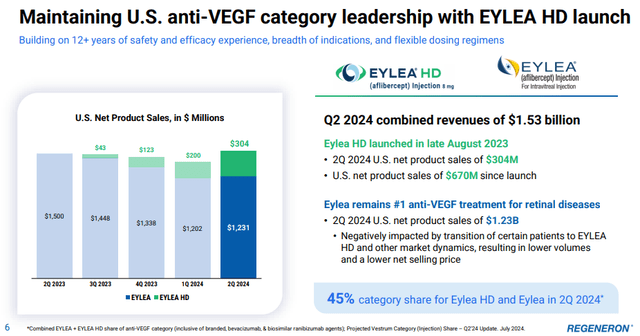

The Eylea franchise was responsible for the revenue beat, as it surprisingly returned to Y/Y growth in the second quarter. The combined net sales of Eylea and Eylea HD rose 2.3% to $1.53 billion, ending a string of six quarters of low- to mid-single digit Y/Y declines.

The approval and launch of Eylea HD (the high dose version) has helped stop the decline driven by the launch of Roche’s (OTCQX:RHHBY) Vabysmo, and Eylea HD sales increased from $200 million in Q1 to $304 million in Q2.

Regeneron investor presentation

The additional importance of Eylea HD is that it offers additional patent protection, which should help Regeneron defend the franchise against biosimilars. Regeneron is so far successfully defending Eylea from market entries of biosimilars through ongoing litigation, but success is not guaranteed. As such, the importance of Eylea HD is not just to protect the franchise from Vabysmo and other potential branded competitors. It is to extend the patent life of the franchise, as biosimilar manufacturers will need to challenge the new high dose formulation patent, which expires in 2039.

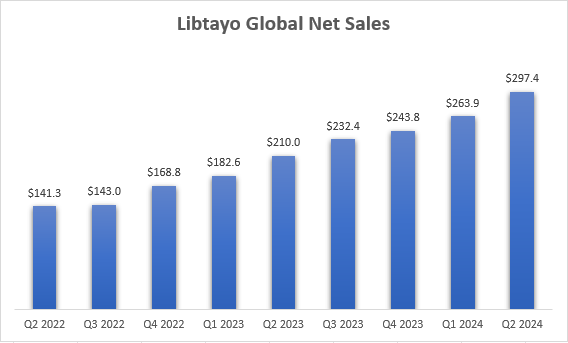

Libtayo also performed well in Q2, with global net sales increasing 42% Y/Y to $297 million. Management said on the Q2 earnings call that Libtayo has maintained its leadership position in non-melanoma skin cancers, and that it is “making impressive inroads in non-small cell lung cancer.” Q2 was also favorably impacted by $15 million in international stocking orders.

Regeneron earnings reports

Regeneron does not provide revenue guidance, but the strong performance of Eylea in the second quarter suggests we should see higher total revenue growth this year compared to previous expectations. The Street consensus has increased from $13.86 billion ahead of the earnings report to $14.14 billion, and this looks reasonable to me based on the performance in the first half of the year. I do not expect significant outperformance in the second half of the year.

European Commission approval for odronextamab represents a small regulatory win for Regeneron after recent FDA rejections and delays

The FDA has not been kind to Regeneron this year. The agency issued a complete response letter for odronextamab for the treatment of relapsed/refractory follicular lymphoma (“FL”) and diffuse large B-cell lymphoma (“DLBCL”) in March. It extended the review of Dupixent for the treatment of chronic obstructive pulmonary disease (“COPD”) by three months in late May. This was due to a request for additional information. Last week, it issued a complete response letter for linvoseltamab for the treatment of relapsed/refractory multiple myeloma due to issues identified at a third-party manufacturer.

These are not really major setbacks, but speak to the difficulties of getting a drug on the market even for large biopharma companies with plenty of regulatory experience. As I covered in my previous article, the CRLs for odronextamab are related to the enrollment status of the confirmatory trials in both populations, and we are waiting for an update on when a resubmission will occur.

The CRL for linvoseltamab was expected as the potential outcome was communicated in the second quarter earnings report. I expect a relatively quick turnaround here, as this does not sound like a major issue. Furthermore, I believe linvoseltamab will become available, at the latest, by the second half of 2025 with a few months for the company to address the issue and resubmit the BLA plus a likely six-month review period.

The European Commission has been more forthcoming and has approved odronextamab under the brand name Ordspono, for the treatment of R/R FL and R/R DLBCL. It has also approved Dupixent for the treatment of COPD without delays. The review of linvoseltamab is ongoing, and it is possible that the manufacturing issues will be ironed out in time to get linvoseltamab to market in Europe before the end of the year.

While Dupixent in COPD represents another important growth market for Regeneron and partner Sanofi (SNY) in the near-term, odronextamab and linvoseltamab will take more time and additional trials to move the needle for Regeneron. We will need to see them moving to earlier lines of therapy in the targeted diseases, where both have the potential to become multi-billion-dollar products.

Regarding the near-term growth prospects of odronextamab, in my article on Genmab (GMAB) last week, I wrote about the improving growth prospects of Genmab’s and AbbVie’s (ABBV) Epkinly due to better-than-expected uptake in third-line+ DLBCL, and the recent approval for third-line+ FL. Epkinly shares the mechanism of action with odronextamab and is now approved for the two indications odronextamab was rejected for by the FDA and approved for by the European Commission. I would expect odronextamab’s uptake to be similar or slightly better than Epkinly’s because it has both labeled indications at launch, while keeping in mind the third-comer status of odronextamab compared to Epkinly and Roche’s Columvi.

REGN’s valuation now demands more growth, and Regeneron can deliver

Regeneron has made the right moves in the last few years to deliver long-term shareholder value. This includes the acquisition of worldwide rights to Libtayo from Sanofi two years ago to the introduction of Eylea HD and the expansion of the pipeline across oncology, inflammation, and immunology. More recently, it expanded to obesity with the combination trial of trevogrumab and garetosmab.

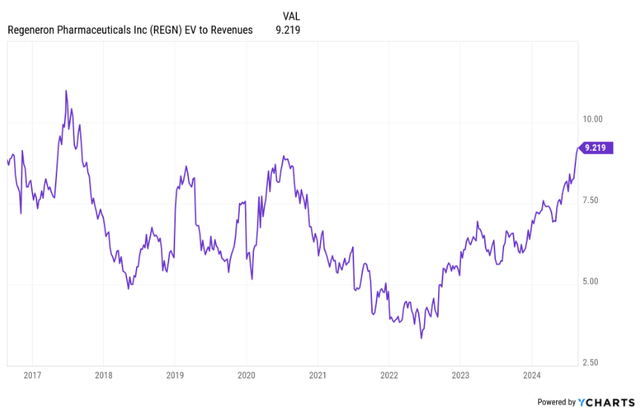

REGN stock is now trading very close to the high end of my valuation range based on which I am comfortable with a bullish rating on Regeneron — an EV/revenue ratio of 10.

Ycharts

I believe the current valuation demands more growth from Regeneron than what we see in the current analyst consensus, but I expect Regeneron to deliver this kind of growth.

Growth estimates have trended higher in the past two years, but I believe many of the upside growth drivers are not included in the consensus. For example:

- I expect the oncology business to become much larger toward the end of the decade, with the ever-increasing contribution of Libtayo, with odronextamab and linvoseltamab hitting growth inflection points by moving into earlier lines of therapy in hematological malignancies. There are other shots on goal with the LAG-3 antibody fianlimab in combination with Libtayo, and other earlier-stage efforts.

- I believe no contribution from trevogrumab and garetosmab to obesity can be seen in the current consensus. I think this is fair currently as we are yet to see the data and the obesity market is evolving at such a rapid pace that there is no way of making reliable long-term contribution estimates anyway. I see obesity as a near-free long-term call option for Regeneron (not entirely free due to the cost of development).

- Itepekimab could be another important product for Regeneron and partner Sanofi, also in COPD, like Dupixent. Top-line results from the phase 3 trial are expected in 2025 with a potential launch in 2026.

- I believe that pozelimab and cemdisiran are underappreciated clinical assets with potential across several complement-mediated diseases, and more recently with another big shot on goal as Regeneron announced plans to test the combination of pozelimab and cemdisiran in geographic atrophy.

- Regeneron wants to disrupt the $20 billion global atrial fibrillation market with its factor XI antibodies REGN9933 and REGN7508 expected to advance to pivotal trials in early 2025, assuming they generate positive phase 2 data later this year.

- We will see many additional pipeline projects emerge in the following years, be it through the company’s internal efforts, and increasingly through business development.

I see these as potential major growth drivers that are really not accounted for in the analyst consensus, and they come on top of those that are accounted for. These are primarily Dupixent, which is expected to remain a key growth driver in the following years, closely followed by Libtayo. The Eylea franchise is expected to continue to decline going forward, but I believe it has room for upward revisions in growth expectations with Eylea HD.

Conclusion

Regeneron’s EV/revenue ratio is approaching levels last seen in 2017. The valuation is now demanding stronger top and bottom-line growth, which I believe the company can still deliver in the following years with Dupixent, Libtayo, expanding oncology product portfolio, through additional pipeline maturation, and finally, through business development.

The main risks in the near- and medium-term are the underperformance of the commercial portfolio (primarily Eylea HD) and litigation setbacks on Eylea. Longer-term, the company risks being unable to produce the top and bottom-line growth required for additional value creation from current levels.

Read the full article here