Investment thesis

My previous bullish thesis about GigaCloud Technology (NASDAQ:GCT) aged extremely poor. The stock has lost 45% of its value since May 5, 2024. To add context, the broader stock market rallied by almost 10% over the same period. Frankly speaking, it is likely I was wrong, as I have overestimated the strength and potential of the company’s business model. Key profitability metrics have been stagnating for the couple of past quarters, despite revenue continuing to soar. This might indicate that the business model’s operating leverage potential is quite limited and once revenue growth decelerates, the EPS expansion can start stagnating. With revised assumptions for the discounted cash flow model, the valuation does not that compelling to take on the risk. All in all, I downgrade GigaCloud Technologies’ stock to ‘Hold’.

Recent developments

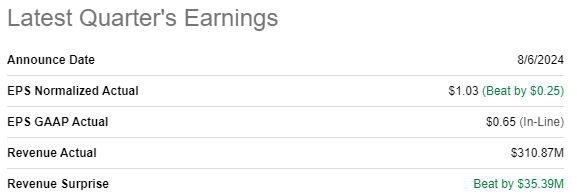

GCT released its latest quarterly earnings on August 6 when the company notably surpassed consensus estimates. Revenue grew by a staggering 103% on a YoY basis. The adjusted EPS expanded to $0.65 in Q2 2024 from $0.45 delivered in the same quarter last year.

Seeking Alpha

While the EPS expansion is generally a positive sign, it is important to mention that the bottom-line growth substantially lagged the revenue growth. This might mean that the management is unable to efficiently deal with rapid revenue growth. If this is the case, the problem is likely temporary. On the other hand, it might mean that the business model is not efficient enough. To understand it, we need to look at how the upcoming few quarters will unfold. If profitability continues moving in opposite directions with revenue growth, this will be a warning trend.

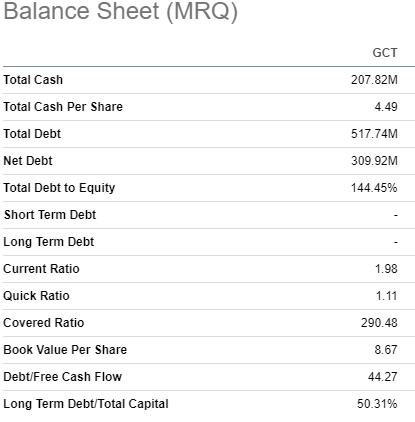

Nevertheless, GCT’s financial position is decent, with more than $200 million in cash and equivalents. The total debt is also notably lower than the current market cap. That said, the balance sheet is sound, and the company is financially flexible enough to invest in further growth.

Seeking Alpha

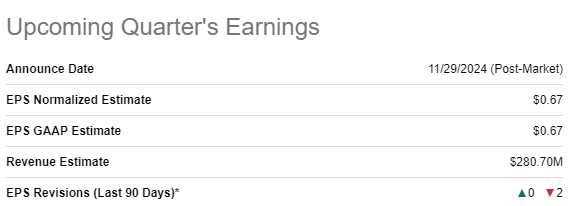

The upcoming earnings release is scheduled for November 29. Consensus estimates forecast FQ3 revenue to be $281 million, which will mean a solid 58% YoY growth. The adjusted EPS is expected to expand YoY from $0.59 to $0.67. This will be a modest 14% growth, and the management’s expectations about further EPS expansion will be a crucial factor to look for during the next earnings call. If the trend of the bottom line’s growth substantially lagging revenue will sustain, it will further increase the market’s doubts in sustainability of the business model.

Seeking Alpha

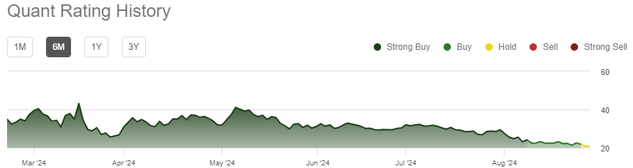

Given uncertainty regarding the company’s ability to deliver operating leverage, I tend to agree with the downgraded overall Seeking Alpha Quant rating for GCT. The ability to demonstrate profitability expansion alongside revenue growth is something that differentiates a great growth company from just temporary winners.

Seeking Alpha

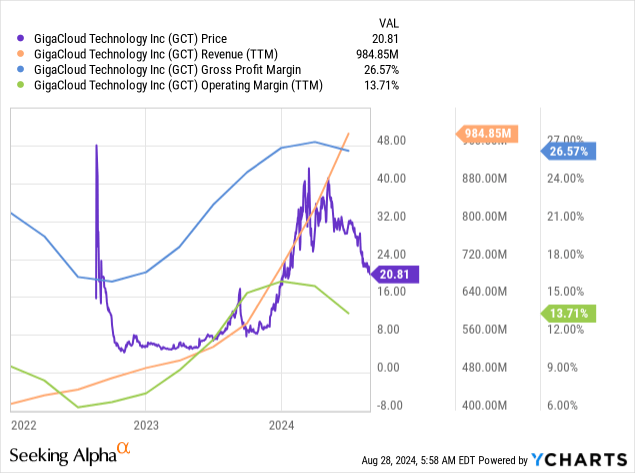

That said, it will be difficult to stay bullish until the company does not start demonstrating strong correlation between revenue growth and expansion of its gross and operating margins. Profitability expansion is crucial for long-term growth investors. The below chart underscores this thesis, since GCT’s stock price started deteriorating immediately after key profitability metrics stopped expanding in line with revenue growth.

Valuation update

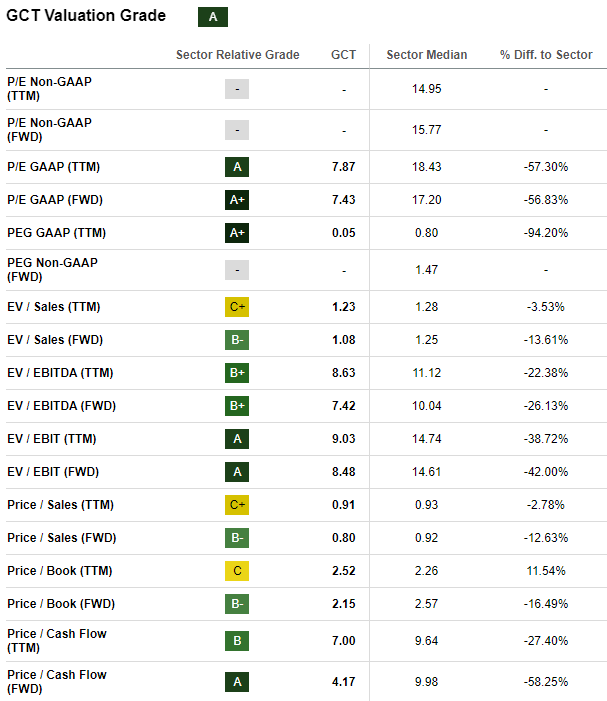

The stock rallied by 79% over the last twelve months, substantially outpacing the broader U.S. stock market. The YTD performance is also quite positive, with a 14% share price appreciation in 2024. GCT boasts a high “A” valuation grade from Seeking Alpha Quant. GCT’s valuation ratios are substantially lower compared to the sector median across the board.

Seeking Alpha

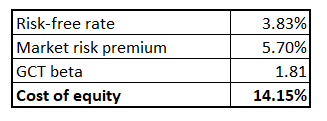

To determine the upside potential, I need to simulate the discounted cash flow [DCF] model. To be more conservative, I will use GCT’s cost of equity as a discount rate. The company’s cost of equity is calculated using the CAPM approach. Calculations and underlying variables are outlined below.

Author’s calculations

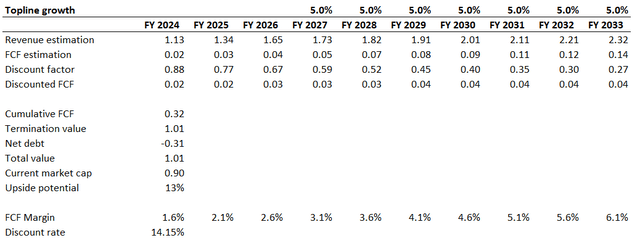

GCT’s revenue consensus estimates are available for the next three years. Since my previous bullish thesis aged poorly, I will be more conservative with my revenue growth assumptions this time. Therefore, I use a modest 5% revenue CAGR for the years beyond FY2026. The TTM levered FCF margin is 1.6%, and I incorporate a 50 basis points FCF expansion. With a 14.15% discount rate, the business’s fair value is $1 billion.

Author’s calculations

The fair value I have calculated above is around 13% higher than the current market cap, meaning there is a decent upside. On the other hand, I consider the discount fair given rising doubts about the efficiency of GCT’s business model.

Risks to my rating downgrade

The stock has been significantly outperforming the S&P 500 index over the last 12 months, and it is still well ahead. Therefore, the stock likely has a solid fan base, and we all know that the stock market is a voting machine within short-term timeframes. Therefore, I think that the stock can demonstrate some temporary spikes in its price. However, I do not believe that these rallies will be sustainable until GCT’s profitability metrics return to their growth trajectories.

Seeking Alpha

Moreover, it is vital to recall that there is a massive 14.3% short interest. This might be a strong short-term catalyst for the stock price if the short squeeze occurs. If positive news or momentum triggers a rush to cover shorts, it could drive the stock price sharply higher in a short period, creating an opportunity for substantial gains.

A solid beat of consensus earnings estimates in Q3 might also be a strong catalyst for the share price growth, even if it will be due to some one-off events instead of strong operating leverage. In this case, my rating downgrade for GCT will also not look good. Investors might perceive the earnings beat as a sign of resilience or potential turnaround, which could lead to renewed confidence in the stock despite the temporary nature of the gains.

Bottom line

To conclude, I think that GCT is a “Hold”. Stagnating profitability metrics over a few last quarters might indicate that the business model’s potential has achieved its peak levels in terms of the operating leverage. Moreover, the upside potential does not look sufficient for a company where there are doubts about the strength of the business model.

Read the full article here