Introduction

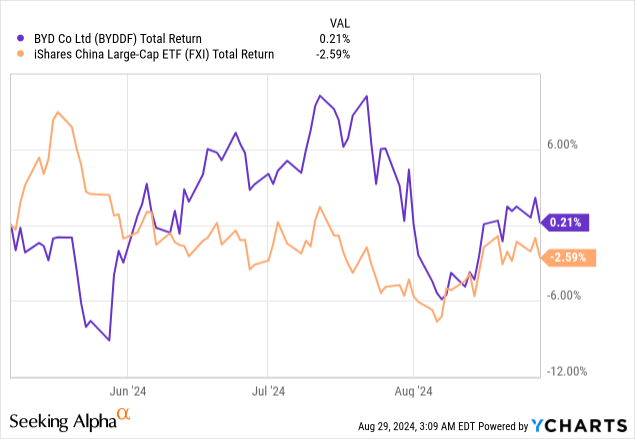

I initiated coverage of BYD Company Limited (OTCPK:BYDDF) (OTCPK:BYDDY) about 3 months ago, in May 2024, issuing a “Hold” rating as I feared the competition in the EV space and generally the slowdown in the end-markets. Since May, the stock is up only 0.21% (total return) compared to the S&P 500 index’s (SP500) (SPY) gain of 7.8% over the same period, which may be mainly explained by weak Chinese equities as a whole.

Yesterday, on August 28, the company released its interim results for 1H 2024, so I think it’s time to reassess my thesis today.

BYD’s Financials Looks Good, To Be Honest

Let’s start with BYD’s income statement – for the sake of simplicity, I’m converting all figures into US dollars using the current exchange rate for the most recent period and the previous year’s rate for June 2023.

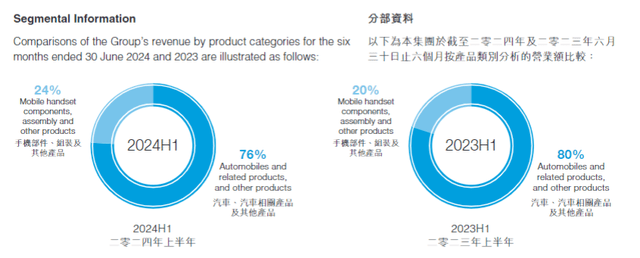

BYD reported operating revenue of ~$42.1 billion, a significant increase from $35.7 billion in the previous year (+17.9% YoY) thanks to still-growing demand: the 1H FY2024 production and sales volume of automobiles in China went up by 4.9% and 6.1% YoY, respectively. At the same time, management is obviously trying to introduce more diversity to the revenue structure, since over the past year, the share of non-auto sales has gone up from 20% to 24%:

BYD’s interim report

The consolidated COGS also rose, as well as OPEX, but the increase in top-line outpaced that headwind, leading to a higher EBIT of $2.4 billion in 1H FY2024 compared to $1.9 billion last year (+26.3%). Tax expenses went up by 61.5% YoY. However, thanks to almost doubled investment gains, other income, the lack of negative finance expenses as last year, and also a rise in non-operating income, BYD’s net profit reached $1.98 billion, which turned out to be 26.1% higher than last year. That is, almost all the operating leverage translated to the bottom line.

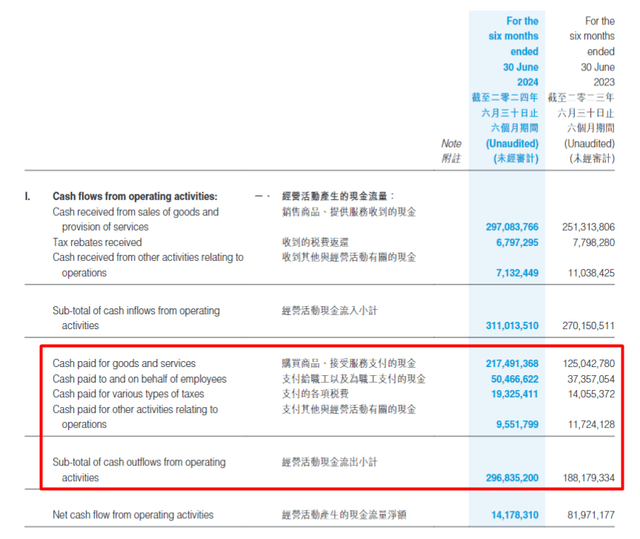

Despite this great performance on the income statement, the cash flows took a massive hit with operating cash flows decreasing to ~$1.985 billion from $11.3 billion in the same period of the previous year. BYD had to pay in cash for goods and services way more than a year ago:

BYD’s interim report, notes added

On the other hand, we may also take a look at the firm’s liquidity side, which looks better now: they managed to reduce the total borrowings to $3.874 billion by mid-2024, down from $5.116 billion at the end of 2023, according to the MD&A section of the interim report. Now a substantial portion of the remaining part of the debt is due within a year. Still, from what I see today, I think BYD maintains adequate liquidity to support its daily operations and capital expenditures. However, the slight increase in receivables and inventory turnover days suggests some operational challenges – FCF may not return as quickly as many investors would like to see.

Based on all this, I can draw an interim conclusion that BYD remains perhaps one of the most financially stable companies in its industry and perhaps also in its region. BYD’s desire to a) maintain its market share in China at all costs by expanding its range of low-cost models and b) constantly enter new, not yet sufficiently penetrated markets plays a largely positive role for investors. Also, since the largest addressable market remains China, BYD is doing a great job dealing with the weak economy’s challenges. But what if the challenge is easing now, at least for the medium term?

China Assets Look Tempting Now?

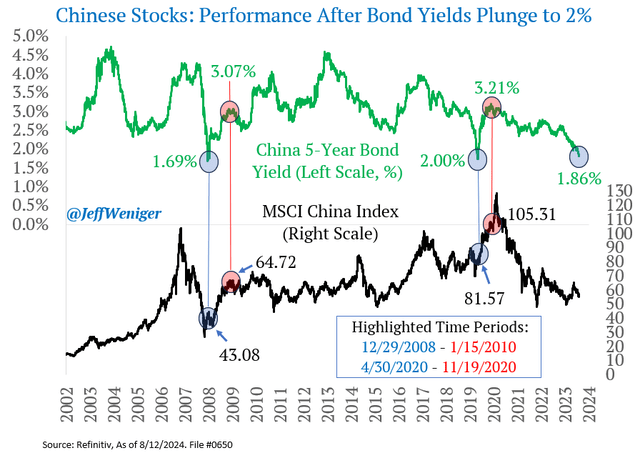

Chinese assets have been falling for the past few months underperforming the developed markets by a significant margin. As Jeff Weniger from WisdomTree recently suggested, the Chinese bond market is currently behaving as if a severe economic downturn, or depression, is expected. The yields are now similar to those seen during 2 previous major crises: the financial crisis of December 2008 and the early days of the COVID-19 pandemic in spring 2020. However, as the old saying goes: buy when everyone else is afraid.

@JeffWeniger on X

As you can see, during those two times (the sample is quite narrow), people who invested in Chinese stocks ended up making significant profits – who knows, maybe this time is not different?

China is indeed taking steps to invigorate its economy. From the basic economic theory we know that when individuals save a larger portion of their income, they have less money available for consumption, so this reduction in consumer spending can lead to decreased demand for goods and services. China has recently lowered the down payment requirement from 20% to 15% for first-time homebuyers and removed the minimum mortgage rate. Although this policy is specifically aimed at new homebuyers, I think it should have a noticeable (though limited) impact on the country’s overall savings rate, boosting consumer demand for goods and real estate.

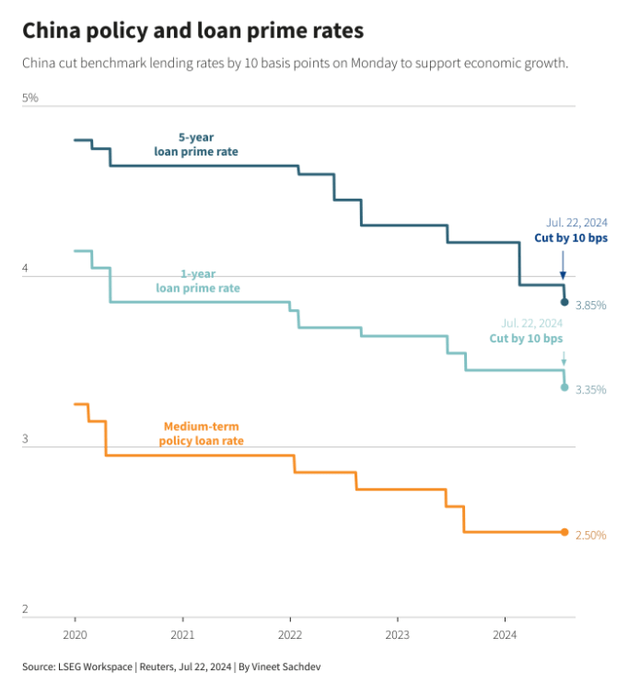

Alongside these changes, China is persisting with its policy of reducing interest rates.

weforum.org

However, more significant rate cuts may follow once the U.S. Fed lowers its rates as well.

I think the positive outcomes of all these measures should become evident by early-mid 2025 as some additional time is required for such policies to take effect (the effect is lagging in nature). I believe this expected growth is likely to benefit not only retail consumption and the real estate sector but also secondary markets like metals and e-commerce. When we talk about BYD, the growth rates we have seen in the first half of 2024 may be only a “low base” compared to what can happen when consumer demand increases because BYD has a market share of over 30% in China and continues to actively grow outside China.

BYD Remains Quite Cheap

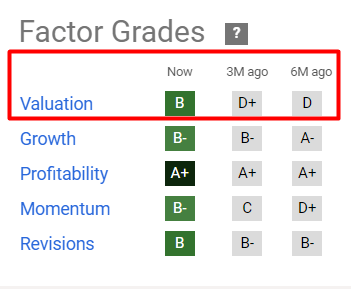

At the same time, I see that Seeking Alpha’s Quant Rating has started to “scream” about the improvement of the situation with BYD: in addition to the Momentum factor, this primarily affected the stock’s Valuation grade.

Seeking Alpha’s Quant Rating, notes added

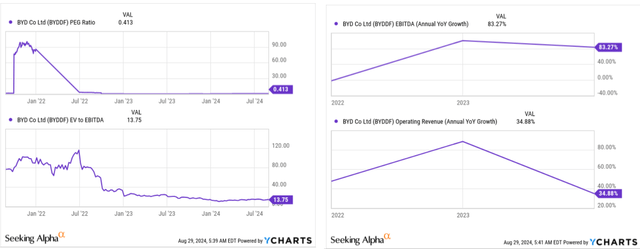

BYDDF stock trades at an EV/EBITDA of just 11x and a PEG (TTM) of 0.44, making them quite undervalued compared to the historical perspective. Yes, growth rates are steadily declining, but that is the logical outcome for any company in a cyclical industry; moreover, we can see from the first half results that BYD is still growing quite fast for a company of its size, so I think the discount we see today is unwarranted (at least if growth is the only explanation for the discount existence).

YCharts, notes added

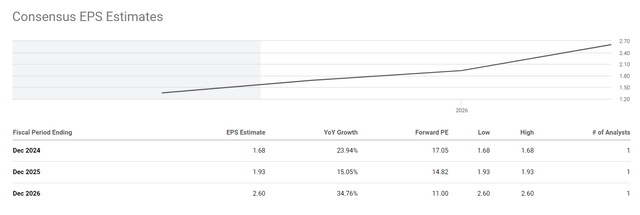

It is also worth noting that the analysts (there is only 1 estimate on Seeking Alpha) predict sustained EPS growth for at least the next 3 years. The estimated CAGR is over 15.6%, which is actually quite good and can even keep up with some tech giants out there. At the same time, however, if these forecasts come true, the valuation of BYD stock will have to fall to a catastrophically low level – to a P/E ratio of around 15x next year:

Seeking Alpha, BYDDF

Why No Upgrade?

Despite my bullish reasoning above, I have to make a number of important digressions and remind all investors of the risks that exist if they buy BYD stock today. First, I have taken a rather one-sided view of the Chinese economy above. By expecting that Chinese household domestic demand will really grow in the next 1-2 years after all the government’s measures and so recommending buying Chinese stock because of that, I’d be violating my own portfolio restriction – no China investments. I don’t like authoritarianism in general because I think it tends to have a negative impact on people and their economic activity in the long run. This can be argued, but it’s my personal belief, which is why I try not to recommend Chinese stocks, even after their sharp decline in recent months (my short-term NIO recommendation and its performance became a valuable lesson for me). Secondly, as I wrote in my previous article, it is also worth noting that the EU is trying to restrict Chinese electric vehicles on its territory – a very bad sign for BYD’s international expansion plans going forward. According to a report by consultancy Rhodium Group, tariffs of 40-50% may be necessary to deter Chinese electric vehicle exporters. Also, given the current geopolitical situation between China and the US, there is nothing to say about a possible takeover of the American car market by BYD.

So BYD’s impressive financial performance in 1H 2024, coupled with China’s economic stimulus measures and the company’s undervalued stock, may indeed present a compelling investment opportunity, but not for me. If you’re ready to take the risks, then you should consider BYD, as its strong market position and potential for growth as China’s economy recovers make it an attractive prospect. But I’m leaving my “Hold” rating unchanged.

Thanks for reading!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here