MongoDB’s (NASDAQ:MDB) Q2 2025 beat and raise was rewarded by a more than 18% jump in the stock during pre-market trading before it pared some of the gains at market open. Recall that the latest Q2 outperformance compares to a downward revision to MDB’s growth outlook coming out of disappointing Q1 results reported in May. The combination of extended macroeconomic headwinds facing the broader software sector, as well as inefficiencies in the implementation of recent operational changes at MDB, were key drivers of the sharp correction.

Yet stronger-than-expected Atlas consumption in Q2 was a bright spot for MDB. Specifically, management cited Q2 Atlas consumption growth was “modestly ahead” of downward-revised expectations exiting Q1. However, performance continues to trail initial expectations set in March, and remains “within a reasonable or typical range of outcomes” set after observations of extended macro softening in Q1.

This reflects that the raised full-year guidance for FY25 is merely a reflection of one-off strength in Q2, which does not translate into improved F2H expectations. Although the new full-year revenue guidance for FY25 essentially restores the original growth outlook provided in March, the forward trajectory that follows remains much flatter than previously expected.

Taken together, the stock’s recent post-earnings upsurge reflects market’s optimism for MDB’s restored FY25 growth guidance, offset by continued skepticism on its medium- to longer-term outlook. Without structural alleviation to industry-wide macroeconomic headwinds in the near-term, and meaningful AI-driven uptake for MDB’s database platforms, the durability to the stock’s recent upsurge remains lacking, in our opinion.

A Deeper Dive into MDB’s Q2 Beat and Raise

Better-than-expected Atlas consumption during Q2 was the showstopper for MDB. Specifically, Atlas-related revenue grew 27% y/y, despite a tough PY comp that had included “large multi-year partnership licensing deals”.

The second quarter’s robust results also reflect structural alleviation of operational inefficiencies observed in previous periods, which had hampered the acquisition of new businesses. Recall that MDB had recently implemented changes to employee incentive and compensation plans to “ensure more balance on size versus volume of workloads acquired”. This was another key headwind that had exacerbated the impact of extended macro softening trends on consumption growth during Q1.

Meanwhile, non-GAAP profit margins also improved sequentially in Q1, despite the increasing mix of less profitable Atlas revenue. Specifically, Atlas-related sales represented 71% of revenue in Q2, up from 70% in Q1 and 63% in PYQ. As a result, the sequential margin expansion reflects continued improvements to operating leverage, as Atlas consumption continues to scale, effectively diminishing the delta between the platform’s cost structure and MDB’s broader corporate cost structure.

Yes, so we didn’t specifically break out Atlas gross margin in the quarter, but they continue to be lower, but obviously we’ve pretty significantly shrunk the delta.

Source: MongoDB F2Q25 Earnings Call Transcript

Yet management reaffirmed expectations for extended macroeconomic headwinds on Atlas consumption patterns. This suggests that the raised FY25 revenue guidance was merely a reflection of a higher Atlas ARR base set in Q2, rather than an emerging recovery to expectations in H2 and beyond.

In addition to outperformance in Atlas consumption, management also highlighted better-than-expected uptake of MDB’s Enterprise Advanced (“EA”) platform. The EA platform represents a database management one-stop-shop curated for enterprise deployments. It combines automation, monitoring, optimization and backup capabilities, while also addressing strict “security and compliance requirements” critical for enterprise database.

In addition to on-prem deployment, EA is also compatible with all three major hyperscalers – namely, Amazon Web Services (AMZN), Azure (MSFT) and Google Cloud Platform (GOOG/GOOGL) – with availability in more than 110 global cloud regions. This accordingly offers a unique “run anywhere” value proposition for MDB’s EA customers, enabling flexibility and scalability to address diverse data management needs in enterprise end-markets. This is further corroborated by management’s expectations for EA momentum in H2 to be driven primarily by existing customer expansions, thus providing further validation to the product’s value proposition and capability in driving incremental market share gains over the longer-term.

Looking ahead, structural long-term growth drivers for MDB include further penetration into no-SQL database opportunities, as well as AI-driven TAM expansion. Specifically, MDB’s Atlas database has only captured a “low single-digit share in one of the largest and fastest-growing markets in all of software”, highlighting significant growth headroom in the long-run.

This would be further complemented by rising prospects of AI-driven TAM expansion. Specifically, the advent of industry-wide generative AI developments and deployments are expected to expand future demand prospects for no-SQL databases like MDB’s Atlas platform. Although no-SQL databases are unlikely to fully displace traditional relational databases, it remains a high-growth complement due to its inherent flexibility.

Specifically, MDB’s Atlas platform endorses a document-based architecture, which provides flexibility and scalability by supporting a broad range of data types and workloads. Atlas’s compatibility with major hyperscalers also offers “seamless integration with leading app development frameworks and AI platforms”. This effectively addresses increasingly structural optimization requirements in enterprise use cases by improving TCO and time-to-deployment considerations.

MDB’s proprietary Atlas platform is off to a strong start in capturing growth opportunities, buoyed by database modernization trends and emerging AI tailwinds. Despite nominal contributions from secular AI tailwinds in the application layer as focus remains on relevant infrastructure build-out, Atlas is already exhibiting more than 30% annualized growth, normalized for unused credits. This growth trajectory is three-fold of the industry average, highlighting robust Atlas penetration and substantial market share gains for MDB in no-SQL database opportunities.

Fundamental Considerations

However, visibility remains limited on when this long-term growth catalyst would materialize for MDB. Macro softness remains a key immediate overhang on MDB’s near-term prospects. Meanwhile, secular tailwinds remain concentrated in the infrastructure and foundation model layers of the AI value chain for now, undercutting MDB from relevant growth opportunities over the near- to medium-term.

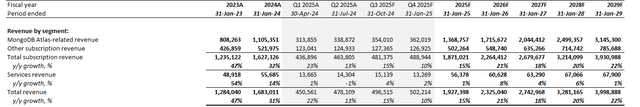

Considering MDB’s raised outlook and limited visibility on material upside changes to its growth outlook in the near-term, we expect FY25 revenue to expand 15% y/y to $1.927 billion. This will be primarily driven by subscription revenue – particularly Atlas-related sales – which our forecast predicts to expand at a 16% five-year CAGR through FY29. Our medium-term growth forecast for MDB considers a modest ramp in FY26, given limited visibility on AI software monetization and use cases. This is in line with management’s confirmation that beneficiaries of secular AI tailwinds remain concentrated in the infrastructure layer, while most investments in software remain experimental.

Companies are currently focusing their spending on the infrastructure layer of AI and are still largely experimenting with AI applications. Inference workloads will come and should benefit MongoDB greatly in the long run, but we are still very early and the monetization of AI apps will take time.

Source: MongoDB Q2 2025 Earnings Call Transcript

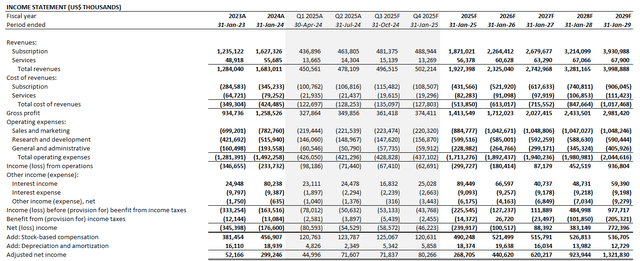

Author Author

Valuation Considerations

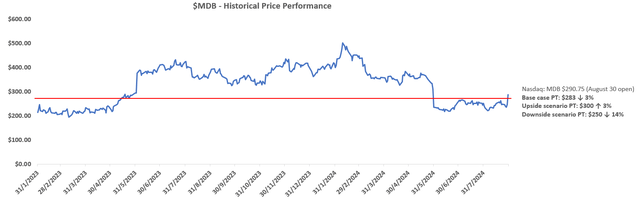

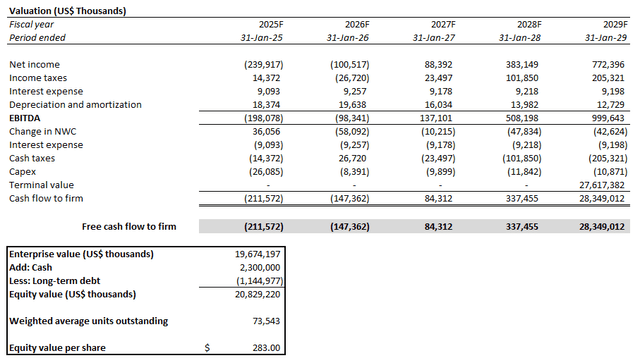

As a result of the material industry-wide step-down in software growth prospects due to the extended macro overhang observed in the past year, with additional consideration of MDB’s outlook discussed in the foregoing analysis, we are revising our base case price target for the stock to $283 (previously $363).

Author

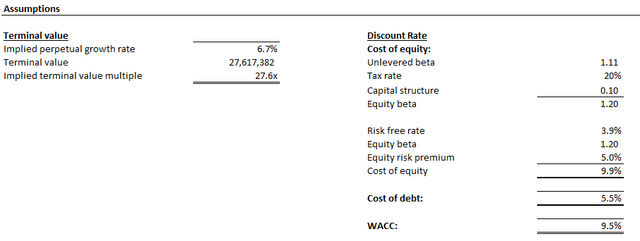

The price is derived under the discounted cash flow valuation approach, which considers projections taken in conjunction with the fundamental forecast analyzed in the earlier section. A 9.5% WACC computed based on MDB’s capital structure and risk profile is applied to the analysis. An implied perpetual growth rate of 6.7% is also applied to FY29E EBITDA in determining MDB’s terminal value. The 6.7% implied perpetual growth rate applied on FY29E EBITDA generates a terminal value equivalent to the application of a 1.5% implied perpetual growth rate on FY34E EBITDA when MDB is expected to reach steady-state.

Author Author

Conclusion

Our base case price target for MDB at $283 adequately reflects our expectations that the restored FY25 revenue guidance does not equate to a fully recovered long-term growth trajectory. As a result, the price target meets halfway from the $300-level that the stock was trading at prior to the downward guidance revision in May.

But MDB’s Q2 beat and raise was commendable, nonetheless, especially considering extended macro headwinds facing the broader software sector. As discussed in previous coverage, consumption-based models are often most prone to macroeconomic weakness, due to customers’ capability in rapidly scaling back usage. This is consistent with management’s continued conservatism over H2 expectations, despite the stronger-than-expected Q2 showing.

Limited visibility to the software sector’s cyclical recovery timeline also elevates MDB’s exposure to a tough comp set-up heading into FY26. We believe this tempered outlook represents the predominant barrier that is keeping MDB’s latest rally from returning to the $300-range observed earlier this year. Until there is structural evidence that broad-base macro headwinds facing software have subsided, and AI tailwinds are transitioning to the application layer, there is limited durability to MDB’s latest rally.

Read the full article here