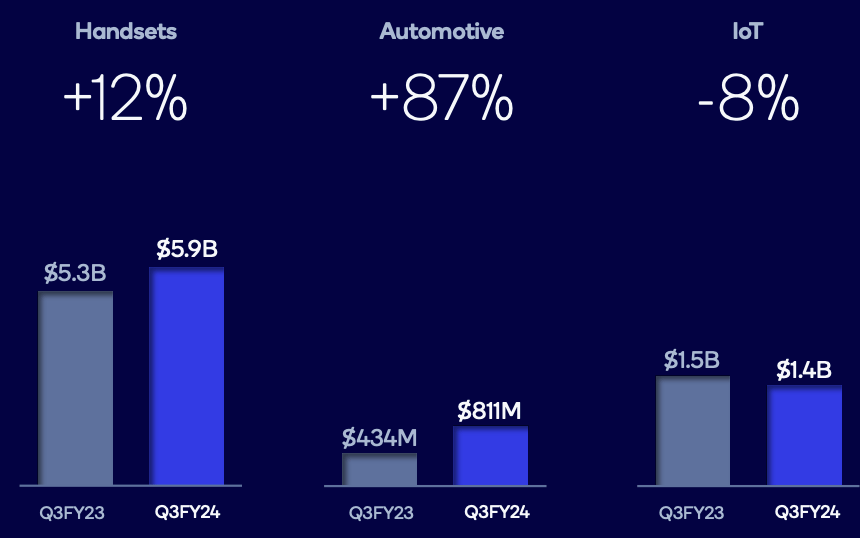

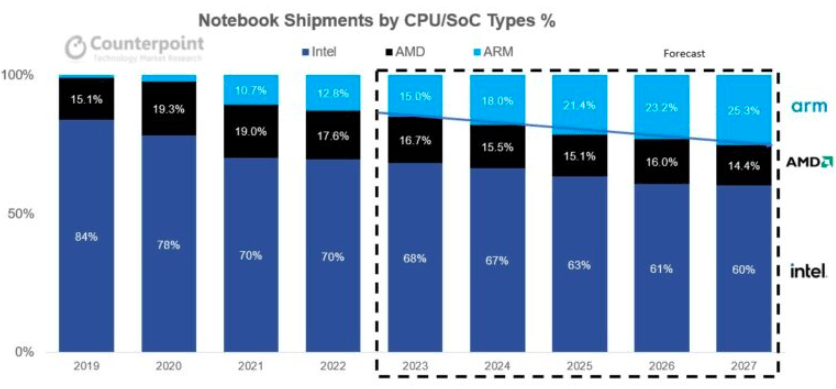

Qualcomm (NASDAQ:QCOM) continues to be in a correction mode after hitting a June peak of over $225. The stock is currently trading at over 20% below the recent peak despite beating revenue and earnings estimates in the recent earnings. However, the stock is quite cheap when we look at some of the key tailwinds in various business segments. The automotive business reported an 87% YoY growth and has seen good growth projections for the future as the auto industry tries to build “smarter cars”. The IoT segment reported an 8% YoY decline in revenue, but new XR categories like Meta’s (META) Ray-Ban smart glasses show huge potential.

The EPS estimate for FY26 is $12.5 which gives the stock a forward PE of only 13.5. This is one of the lowest multiples within the chip industry and the stock could be a good value bet for long-term investors. The dividend yield is over 2% and the company has a good history of giving strong dividend growth. The current dip in the stock price can provide a good entry point for investors looking to make a long-term bet in this industry in a stock that is not expensive.

Good tailwinds will inevitably be rewarded

Qualcomm has a number of tailwinds working in its favor. The automotive segment continues to be a growth driver. The company reported $811 million in automotive revenue in the recent quarter which is 87% higher than the $434 million reported a year ago. Many automakers are working to gain an edge by adding smart features within their new models. This is a long term trend that will help Qualcomm build a good revenue stream in the next few years.

Company Filings

Figure: Recent revenue growth in key segments. Source: Company Filings

The IoT segment reported a YoY decline of 8% but new products are being launched in this space which should help the company in the next few quarters. One of the most interesting is Meta’s Ray-Ban smart glasses. Meta’s management has mentioned the rapid adoption of these glasses and has ordered them to ramp up production significantly. Meta is also looking to have a 5% stake in EssilorLuxottica, the company that makes eyewear brands like Ray-Ban.

Company Filings

Figure: Qualcomm highlighted the potential of smart glasses in recent earnings. Source: Company Filings

Qualcomm recently highlighted the potential of these smart glasses. The current revenue rate is not big enough to move the needle but this category opens the door to a number of new products which can improve Qualcomm’s growth runway.

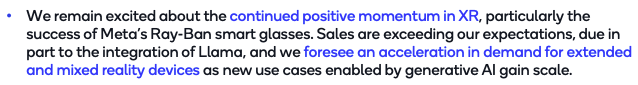

Tom’s Hardware

Figure: Increase in ARM notebook shipments. Source: Tom’s Hardware

There have been various estimates about the growth trajectory of ARM notebook market share. Most have been very positive as new models launched by OEMs can increase the attraction among customers.

A very strong EPS growth trajectory

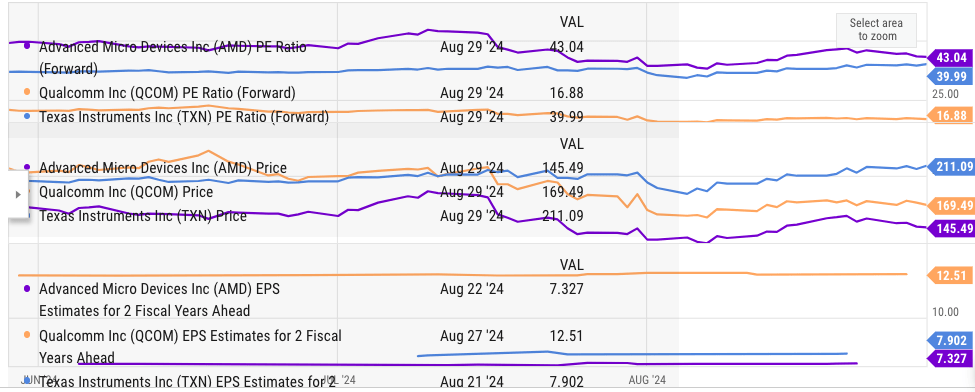

Qualcomm stock is not only cheap at the current price but it also shows good EPS growth. Double-digit EPS growth estimates for the next few years should provide a good tailwind to the stock. The EPS estimate for FY25 is $11.24 giving the forward PE a multiple of 15.08. The EPS estimate for FY26 is $12.5 giving it a low forward PE multiple of 13.5.

Seeking Alpha

Figure: Forward PE multiple for Qualcomm. Source: Seeking Alpha

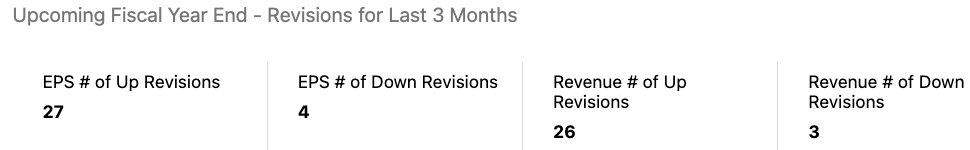

At the same time, there have been a number of Up revisions for earnings and revenue in the last three months. Qualcomm stock saw 27 up revisions for EPS compared to only 4 Down revisions. These Up revisions should improve the sentiment toward the stock and reduce the valuation multiple.

Seeking Alpha

Figure: Recent up and down revisions for earnings and revenue. Source: Seeking Alpha

Risk factors to the Bull thesis

Despite strong tailwinds, Qualcomm stock is also showing some risk factors. One of the key risk is the ability of Apple (AAPL) and Samsung to integrate their own chips into their devices. Both these giants have massive resources and they are investing heavily in building their chips. They also gain an edge in marketing by showing the “uniqueness” of their chips. Apple has done the same with Intel chips replacing them with M1 chips. The marketing of these Apple chips has certainly helped the company in improving Mac sales. Qualcomm still shows a very high concentration of revenue from these companies. Any decline in demand for Qualcomm chips should hurt the company in the near term.

The growth runway for automotive and IoT devices is also uncertain. Both these segments have new products coming to the market, but the long-term revenue generation could be below expectations. This is a big risk for the stock as a lot is at stake due to these growth drivers.

Finally, a big risk is that the stock becomes a value trap in the next few years. Despite growth in EPS, if Wall Street does not increase the valuation multiple, the return potential for the stock will be limited. One of the key factors behind future multiple expansion will be the growth of new revenue streams and new products which can attract a high customer base.

Future growth trajectory

Qualcomm is one of the cheapest chip stocks available on the market. The company gives 2% of dividend yield. Over the last 10 years, the dividend has increased from $0.42 to $0.85. This is equal to CAGR growth of 7%. The payout ratio is 41% which shows that the company has enough room for further dividend growth if the EPS growth continues. The forward PE multiple is 16.8 compared to over 40 for AMD (AMD) and many other hot chip stocks.

Ycharts

Figure: Key metrics for Qualcomm, AMD, and TXN. Source: Ycharts

The company has a double-digit EPS growth estimate which is quite good and it is also showing many Up revisions in earnings and revenue estimates. We could see a strong bullish momentum in the stock in the near term if the current EPS growth continues. When looking at the risk/reward scenarios, the stock appears to be a good bet and has a number of positive factors working in its favor including a cheap valuation.

Investor Takeaway

Qualcomm is showing good tailwinds in key segments. The automotive segment continues to show promise by having a good YoY trend. Even in the IoT segment, new products are launched which can turn into a big revenue stream for Qualcomm over the next few years. The risk factor due to back-integration by Apple and Samsung can hurt the company but the risk/reward balance still favors the stock.

The strong dividend yield and good dividend growth history should help investors increase their returns. The stock is trading at only 13.5X FY26 EPS estimate which is one of the lowest in the chip industry. Any future up revisions should help provide a tailwind to the stock making it a good bet at the current price.

Read the full article here