BRP Inc. (NASDAQ:DOOO) reported the company’s Q2 results on the 6th of September, showing even deeper earnings weakness and lowering its FY2025 guidance again with an indicated margin share loss during the quarter.

In my previous article on the stock, “Be Cautious Ahead Of Q1 As Weakness Persists,” I remained with a Hold rating ahead of the prior Q1 earnings, but suggesting caution as I believed the company’s guidance to be too optimistic. Since the article was published on the 21st of May, BRP’s stock has now lost -6% of its value, compared to the S&P 500’s (SP500) return of 2%.

My Rating History on DOOO (Seeking Alpha)

BRP’s Q2 Report Was Weak

BRP’s fiscal Q2 report was weak as the recreational vehicle industry has remained challenging. The company’s revenues took a -33.7% decline year-on-year into $1.84 billion, being a considerably steeper decline than the -16.4% fall in Q1. With the declining sales, BRP’s adjusted EPS also came in weak at just $0.61, down $2.60 year-on-year.

While sales missed Wall Street’s consensus of $1.90 billion, BRP’s adjusted EPS slightly beat the $0.44 consensus. The gross margin level declined by 4.7 percentage points into just 20.4%, but with BRP’s good operational cost management at a 10% OpEx reduction, earnings still came in at a positive level.

In my opinion, the performance was still quite weak even considering the industry’s ongoing struggles, as BRP seemed to temporarily lose market share in multiple product categories in part due to planned dealer inventory management. Brunswick (BC) also reported a weak Q2 as I have previously written with a -15.2% sales decline, but being considerably better than BRP’s decline. Polaris (PII) showed an -11.5% revenue decline in its Q2, as I have also written on the peer’s earnings. Marine companies such as Malibu Boats (MBUU) and MasterCraft (MCFT) are still reporting deeper revenue weakness than BRP, though. In total, BRP estimates that the company’s retail-level sales in North America declined -18% compared to a high single-digit percentage total industry decline, underlining the quarterly weakness.

I don’t necessarily think that the market share loss in Q2 signals any long-term weakness, as one quarter alone doesn’t give enough data to extrapolate over to the longer term. BRP is also launching its electric Can-Am motorcycles, potentially driving a greater market share in subsequent quarters – while incredibly weak, I don’t see the Q2 financials as a disaster with a weak remaining industry. Jose Boisjoli, BRP’s CEO, also related the market share decline into the company’s dealer inventory management in the Q2 earnings call.

The Guidance Disappoints, Again

With the Q2 report, BRP also again lowered its guidance range, after already pushing the guidance down with the prior Q1 report. BRP now expects FY2025 revenues to come in at $7.8-8.0 billion at a -23.8% year-on-year decline, considerably worse than the already lowered $8.6-8.9 billion range given in the previous Q1 report. Due to the weaker expected revenues, the earnings guidance was also over halved into a $2.75-3.25 normalized EPS range instead of the previous $6.00-7.00 range.

The industry’s remaining struggles have seemed to also surprise other companies and the market. Boat manufacturer MasterCraft guided for a very cautious FY2025, and Brunswick and Polaris have both slashed their current fiscal year guidance in light of a weakening US consumer sentiment. Lower interest rates haven’t yet affected sales positively, and dealers have continued to push down inventories. While a recovery has again been pushed further away, I believe that the lower interest rates and dealers’ already lower inventories should start to aid manufacturers’ demand, potentially soon after BRP’s fiscal 2025.

DOOO Stock – Updated Valuation

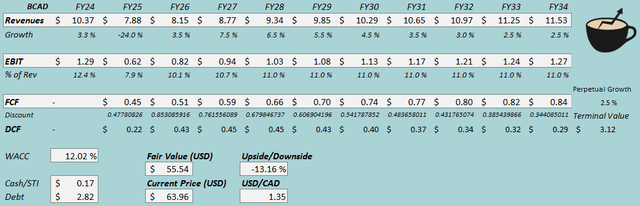

I updated my discounted cash flow [DCF] model to determine a fair value estimate for the stock. I now estimate a -24% sales decline in FY2025 in line with the updated guidance range, and a slow recovery thereafter, with a good 7.5% growth in FY2027. In total, I estimate a 4.3% CAGR from FY2025 to FY2034 and 2.5% perpetual growth afterward.

I again estimate the EBIT margin to reach 11.0% with a demand recovery, but I now estimate the margin recovery to take until FY2028.

BRP’s cash flow conversion should still be fairly good over the long term.

DCF Model (Author’s Calculation)

The estimates put BRP’s fair value estimate at $55.54, 13% below the stock price at the time of writing – I don’t believe that a demand recovery still makes for an attractive investment case at the current stock level. The fair value estimate is down from $70.55 previously, as the significantly lower FY2025 guidance has pushed my revenue estimate level down considerably.

CAPM

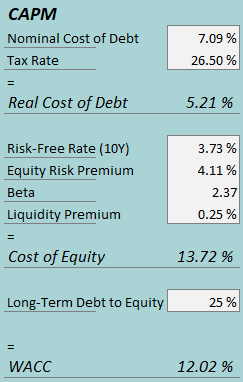

A weighted average cost of capital of 12.02% is used in the DCF model. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q2, BRP had $50.1 million in interest expenses, making the company’s interest rate 7.09% with the current amount of interest-bearing debt. I again estimate a 25% long-term debt-to-equity ratio.

To estimate the cost of equity, I use the 10-year bond yield of 3.73% as the risk-free rate. The equity risk premium of 4.11% is Professor Aswath Damodaran’s estimate for the US, updated in July. I have kept the beta estimate at 2.37. With a liquidity premium of 0.25%, the cost of equity stands at 13.72% and the WACC at 12.02%.

Takeaway

BRP Inc.’s Q2 results were expectedly weak, as the industry has remained challenging and as BRP’s dealer inventory management pushed down the company’s market share during the quarter. With weakness persisting in the industry, BRP again lowered its FY2025 guidance as well, following the footsteps of Polaris and Brunswick that both have also lowered their guidance recently. I believe that a recovery is due in the midterm as interest rates have begun declining, but the short term remains challenging. The stock still isn’t at an attractive level in my opinion, and as such, I remain with a Hold rating for BRP.

Read the full article here