Very little in this world gives me the kind of joy that being able to upgrade a company does. It’s exciting because I love to see businesses win, and I love to see investors have a bargain at their disposal. My latest upgrade involves a firm by the name of Tennant Company (NYSE:TNC). You see, back in April of this year, I ended up downgrading the firm from a ‘buy’ to a ‘hold’. This came after the company experienced remarkable upside. Since the article that I had previously written about it and rated it a ‘buy’ in, shares had skyrocketed 52.4% while the S&P 500 was up only 19%. But after such a surge, I felt as though further upside would be unlikely. This led me to downgrade it to a ‘hold’.

Unfortunately, even that was too optimistic. Instead of performing more or less along the lines of the broader market, shares underperformed tremendously. The stock is down 21.6% since then. By comparison, the S&P 500 is up 6.2%. As disappointing as this is, I do now believe that the picture is once again favorable for investors. With this year likely to be slightly better than last year was and how shares are priced, I believe that it is finally time to upgrade the company once again to a soft ‘buy’.

A niche business with potential

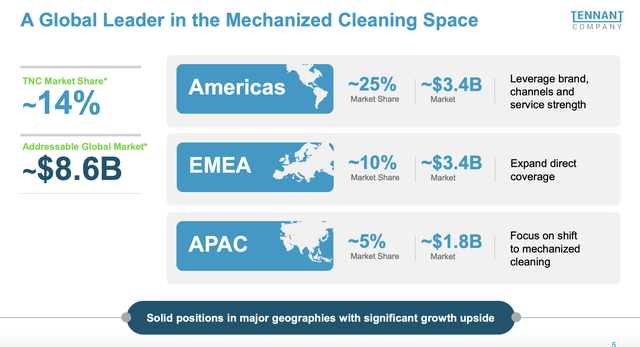

Tennant Company

For those not familiar with Tennant Company, the company operates as a producer and seller of manual and mechanized cleaning equipment. It also sells aftermarket parts, related consumables, and other similar products. And over its lifetime, the company has grown to be a major player in this niche space. According to management, the total addressable market for the regions of the world in which it operates is worth about $8.6 billion. It boasts a 14% market share of all of these in the aggregate. Most impressive is its stake in the Americas. This is a $3.4 billion market that the company controls 25% of. It also has a roughly 10% share of the $3.4 billion market in the EMEA (Europe, Middle East, and Africa) regions. And in the Asia Pacific region that’s worth an estimated $1.8 billion, the company has a roughly 5% market share.

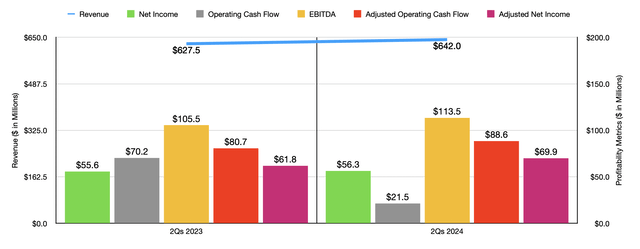

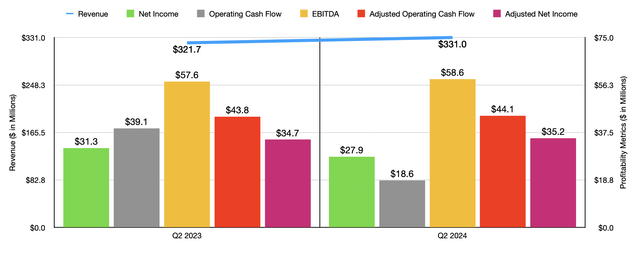

Author – SEC EDGAR Data

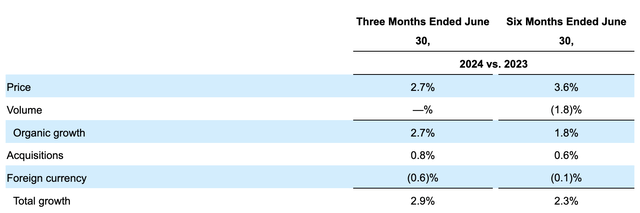

When I last wrote about the company earlier this year, we only had data covering through the final quarter of the 2023 fiscal year. But now, results extend through the first half of 2024. During this time, revenue for the company came in at $642 million. That’s an increase of 2.3% over the $627.5 million the company reported one year earlier. The picture would have been better had it not been for a 1.8% hit associated with volume. In particular, the company saw lower organic sales in both the EMEA and Asia Pacific regions. However, the company did benefit from price increases that added 3.6% to its top line, bringing organic revenue up 1.8% year over year. Acquisitions added another 0.6% to its top line.

Tennant Company

On the bottom line, the company saw a slight improvement, with net income inching up from $55.6 million to $56.3 million. In addition to benefiting from the rise in revenue, the company also saw an expansion in its gross profit margin from 42.2% to 43.6%. Higher prices, combined with cost-saving initiatives more than offset inflationary pressures and the decline in volume. A favorable change in product mix also helped, as did a shift to more direct channel sales. Unfortunately, the firm did see some weakness. Selling and administrative costs, for instance, grew by $14.1 million year over year. This was mostly because of higher costs involving certain strategic investments, as well as higher compensation expenses for its employees. Research and development costs also grew relative to revenue, but only marginally. In general, investors should view these types of cost increases favorably, since they are highly controllable and investments being made by management into future growth and profitability.

Author – SEC EDGAR Data

Other profitability metrics for the company ended up coming in mixed, but were mostly positive. Adjusted net profits, for instance, grew nicely from $61.8 million to $69.9 million. Operating cash flow did plunge from $70.2 million to $21.5 million. Fortunately, if we adjust for changes in working capital, we get an improvement from $80.7 million to $88.6 million. Meanwhile, EBITDA for the business expanded from $105.5 million to $113.5 million. In the chart above, you can also see financial results covering the second quarter of this year on its own. This shows much of the same with revenue, adjusted profits, and cash flows, all higher year over year. The only difference is that net profits declined compared to what they were in the second quarter of 2023.

Tennant Company

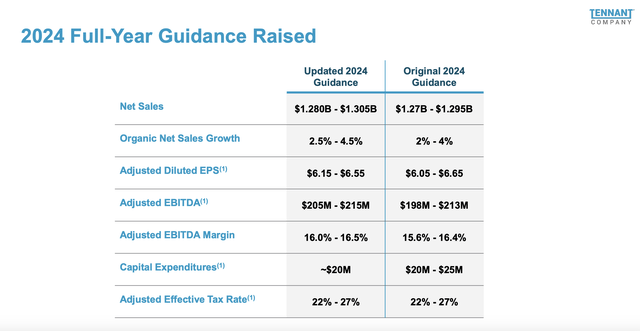

Another great thing about the company is that management recently increased guidance for the year. Previously, they were forecasting revenue of between $1.27 billion and $1.295 billion. They now expect this to come in at between $1.28 billion and $1.305 billion. This is because organic net sales are now expected to be between 2.5% higher and 4.5% higher compared to the 2% to 4% increase management forecasted for prior guidance. The company also expects earnings per share, on an adjusted basis, of between $6.15 and $6.55. At the low end, this is $0.10 per share greater than previously forecasted. But on the high end, it’s $0.10 per share lower. This still has the same midpoint. However, the company did increase guidance for EBITDA from between $198 million and $213 million to between $205 million and $215 million. We don’t have any estimates when it comes to other profitability metrics. But if we assume that adjusted operating cash flow will rise at the same rate as EBITDA will, at the midpoint, then we should anticipate a reading for it of $159.4 million.

Author – SEC EDGAR Data

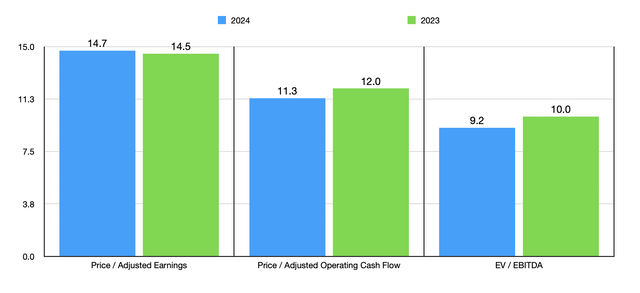

Using these estimates, we can see how shares are priced on a forward basis for 2024. This can be seen in the chart above. The chart also shows pricing based on 2023 figures. This places it on the teetering point between being fairly valued and slightly undervalued. However, on a relative basis, shares are also marginally attractive. In the table below, you can see the company stacked up against five similar firms. On a price to earnings basis, only one of the five companies ended up being cheaper than it is. And when it comes to both the price to operating cash flow approach and the EV to EBITDA approach, two of the five companies ended up being cheaper than our candidate.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Tennant Company | 14.7 | 11.3 | 9.2 |

| Mueller Industries (MLI) | 14.1 | 11.2 | 9.0 |

| SPX Technologies (SPXC) | 67.2 | 33.3 | 25.3 |

| Mayville Engineering Company (MEC) | 37.1 | 5.0 | 8.0 |

| The Timken Company (TKR) | 16.6 | 11.6 | 9.5 |

| Parker-Hannifin (PH) | 26.3 | 22.1 | 17.4 |

Takeaway

Based on the data provided, I must say that Tennant Company is doing quite well. The increase in guidance is nice to see. The rising revenue, profits, and cash flows, are certainly encouraging. On an absolute basis, shares are between slightly undervalued and fairly valued. But relative to similar firms, the company definitely tilts a bit toward the undervalued category. Add on top of this the firm’s robust market share in the regions in which it operates, and I do think that upgrading it after this recent plunge from a ‘hold’ to a ‘buy’ is appropriate.

Read the full article here