Introduction

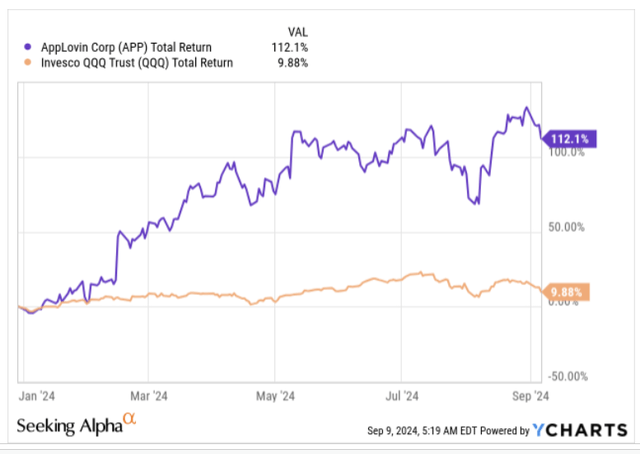

The stock of AppLovin Corporation (NASDAQ:APP), a tech entity with growing clout in the advertising ecosystem has been on fire through much of 2024. On a YTD basis, when its peers from the Nasdaq have only notched double-digit gains, APP has surged ahead, by a whopping 112%! Despite a strong year of alpha by APP’s stock, we feel this story still has legs and choose to go with a BUY rating.

YCharts

Why The AppLovin Story Is Worth Getting Behind

AppLovin’s comprehensive software platform is proving to be a game-changing intermediary in mobile gaming advertising by helping incumbents acquire users more efficiently and monetize their ad inventories more effectively.

The platform’s success is largely driven by its marketing software – AppDiscovery which in turn is powered by an AI-powered ad engine called AXON which does a remarkably efficient job in conducting mass advertising auctions between the demand and supply in a matter of microseconds. AXON plays a key role in not just identifying users that could potentially download clients’ apps, but also that are likely to persist and deepen their engagements with these apps.

What’s key to note is that the AXON tech effect is only just getting started (AXON 2.0 was pushed into the market only over a year ago), and as this model self-improves with even more data acquired over time, it will get more accurate, and add even more value to advertisers, in terms of finding the most lucrative user cohort. To give you a sense of the ongoing uplift, note that eDiscovery installations which were only up by 17% last year, are currently growing at a pace of 82% on average (87% in Q1, and 77% in Q2).

Nonetheless, as APP’s software platform gains traction and takes on a larger share of the revenue pie, one will also see greater flow-through of the group topline to the EBITDA level (more on this in the valuation section of the article).

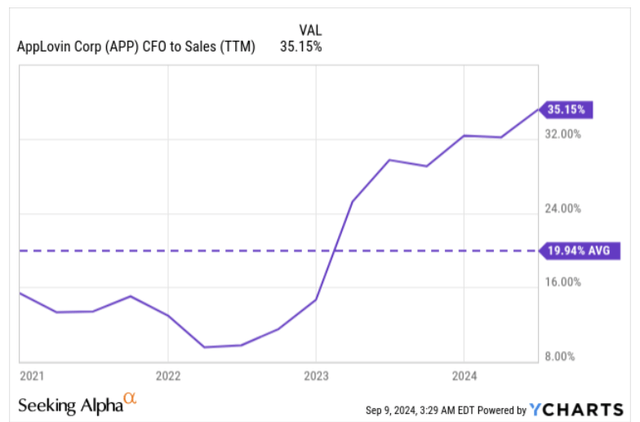

Management has also suggested that growth of the software business (currently growing at a pace of 83% YoY in H1, with long-term growth potential of 20-30%) will also likely result in better cash conversion levels, and one can get a sense of this in the manner in which the CFO margin (Operating cash flow as a function of sales) of the overall business has been trending higher over time.

Three years back in H1, the software platform accounted for just 18% of group sales, and in those days APP was generating CFO margins closer to single digits; as of H1-24, the software business now accounts for almost two-thirds of group sales, we have a scenario where the CFO margin has expanded by 3-4x and is now at the 35%+ levels.

YCharts

In fact, you’d be interested to know that this cash flow generating prowess has seen APP garner the largest weight in the US Large Cap Cash Cows Growth Leaders Index which focuses on around 100 US large cap cash compounders that have the potential of generating higher future and sales earning growth on account of a steep FCF margin. For further context, do consider that the stocks that comprise this index are ranked based on their trailing twelve-month FCF yields (APP’s FCF is currently expanding at a pace of over 100% and is at record highs of $446m), and weighted by a price momentum score.

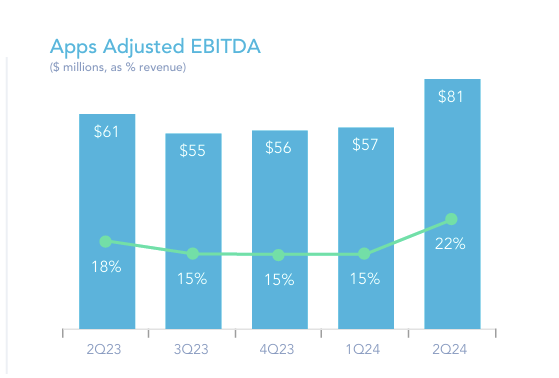

Then, while all the focus is on the software platform side of the business, APP management also deserves credit for managing the cost base of its non-core Apps business (a portfolio of 200 free-to-play mobile games), which it will likely look to divest when market conditions improve. For a while now, they have been pruning their user acquisition costs related to this business and in Q2 this was particularly meaningful, as even though revenue from this segment came off by 2% sequentially, the EBITDA margin saw a meaningful positive progression of 700bps QoQ.

Q2 Presentation

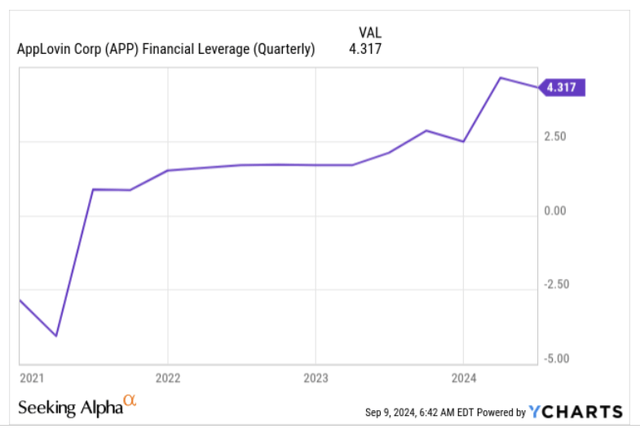

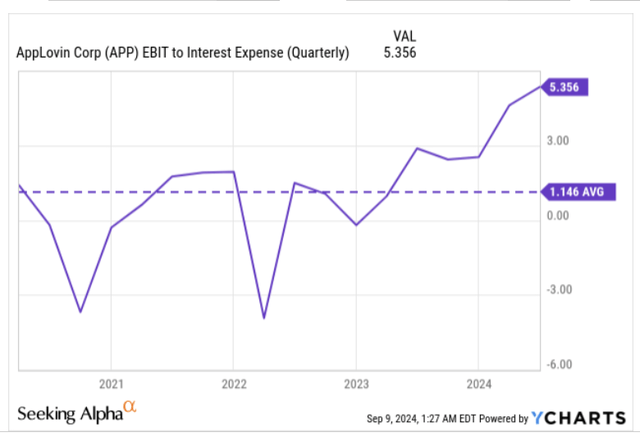

Then, prima facie, if there’s a major concern over the APP story, quite a few investors may point to the degree of heightened financial leverage that has been employed over time. For context, as of H1, the business had around $3.55bn of debt which translates to over 4.3x its common equity.

YCharts

However, we would seek to assuage those concerns, as since the second half of 2023, APP has been increasingly generating a higher threshold of operating profits that are more than covering the degree of interest expense it has been incurring on its debt. Historically APP has faced many periods where it has not generated sufficient EBIT to cover its interest bill (with a 5-year average of just 1.1x), but currently note that the interest coverage stands at a hefty level of over 5x.

YCharts

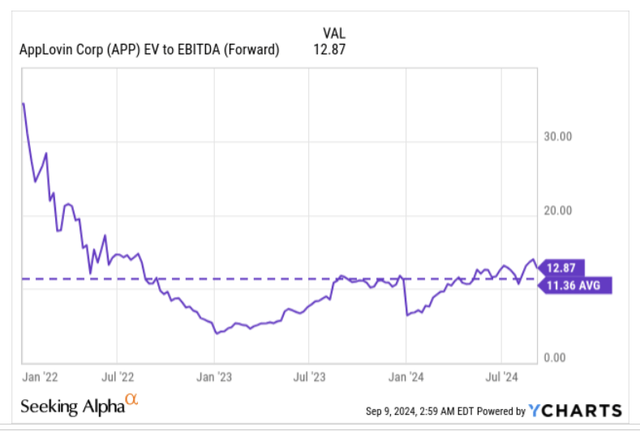

Forward Valuations Are No Longer Cheap, But The Current Premium Is Justifiable

Across its trading history over the last 3+ years, APP’s average forward EV/EBITDA multiple has averaged less than 11.4x, but as things stand, the stock currently trades at a 12% premium over this long-term average. This should not put off prospective investors, as APP’s EBITDA outlook is rosy enough to warrant paying this double-digit premium.

YCharts

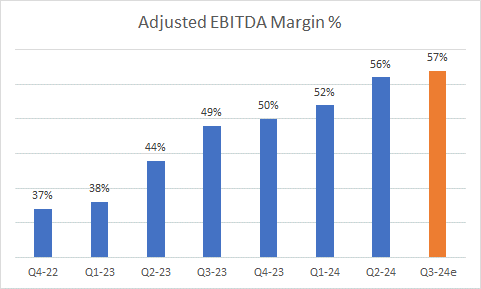

Firstly, note that this is a business that has been facilitating relentless EBITDA margin progress both on a sequential and annual basis for a while now, and this is certainly not expected to abate any time soon. APP management generally refrains from providing FY guidance, but they did imply that EBITDA margin progress would continue yet again in Q3, with a guided figure of 57%.

Quarterly Presentation and Shareholder Letters

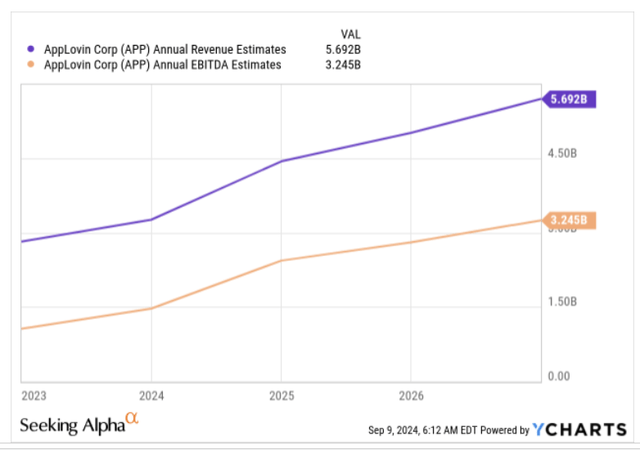

Meanwhile, if we consider sell-side estimates beyond FY24, it looks as though AppLovin’s EBITDA growth will come in at a quicker pace than the topline growth, both in FY25 (15% EBITDA growth on 13% revenue growth) as well as FY26 (16% EBITDA growth on 14% revenue growth). FY25 and FY26 numbers could be underestimated as those years will likely also start seeing greater benefits from APP’s web advertising program, that was only launched on a pilot basis in Q2 and is already performing materially better than expected. Nonetheless, it’s commonplace to spot plenty of businesses that drive strong operating growth over revenue growth in one-off years, but to facilitate the operating leverage of this ilk for 3-4 years on the trot takes some doing.

It’s also worth noting that APP’s EBITDA profile is effectively poised to expand by 29% (3-year CAGR) during FY24-FY27, and that figure is more than twice that of the current EV/EBITDA multiple (almost 13x), which reflects what a good deal you’re getting.

YCharts

Closing Thoughts – Bullish Conditions In-Play

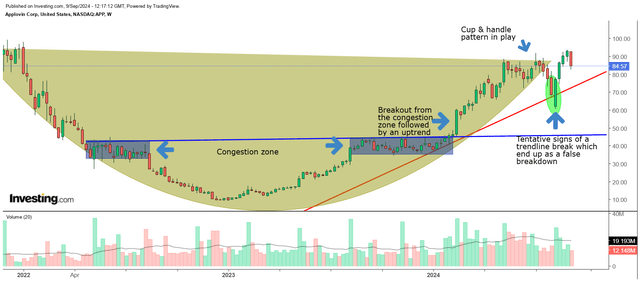

Even when reviewing the APP’s technical conditions, we see quite a few favorable conditions that support the long case.

Firstly bullish momentum conditions are spotted by the stock trading above the psychologically pivotal 200DMA on the daily chart, since mid-May 2023. There were efforts to knock it off its perch in August, but APP managed to defend those levels well.

Nonetheless, to get a bird’s eye view of things, we can shift over to the weekly chart, and our broad takeaway here is that we are dealing with something akin to a cup and handle pattern which is essentially a bullish continuation pattern.

Investing

Note that from August last year, until February this year, the stock spent a long time in a congestion zone (area highlighted in blue last seen in 2022), waiting for a catalyst to break out. We saw that breakout happen in February followed by strong momentum through July. Then, In August there were signs that APP was going to break down from its upper trendline (red line), and whilst that happened for a brief while, the bounce-back qualities of the stock were on display with the bargain hunters sending the stock back above its trendline. This false breakdown bodes well for the stock, as it now prepares to make another leg higher.

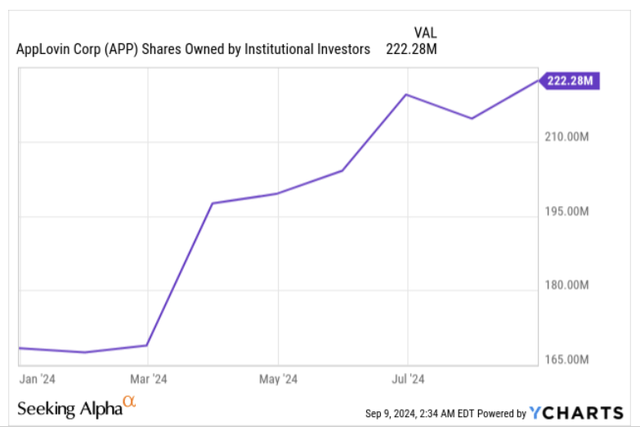

Investors can also be enthused by the quality of the uptrend seen across much of this year, as it has been supported by the strong participation of smart money. Essentially, on a YTD basis, APP shares owned by the institutional segment have increased by a sizeable figure of 32%.

YCharts

The share price could also receive further support from the ferocity of share buybacks; on a YTD basis, the company has already increased its buyback spend by 31% YoY, by deploying $752m, and still has another $500m worth of potential buyback ammunition that is yet to be deployed.

To close, given the pervasive impact of AXON on installations, the favorable EBITDA and cash flow outlook, and ongoing bullish momentum, we feel a BUY rating feels appropriate.

Read the full article here