Overview

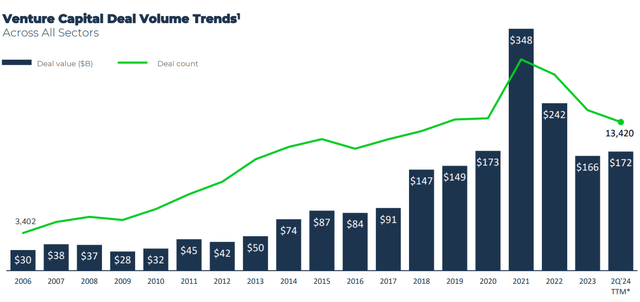

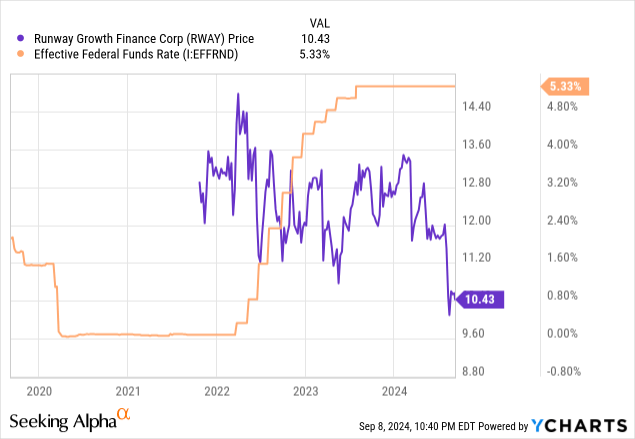

The rapidly changing interest rate environment really exposed the true quality of many business development companies. While interest rates sit at their decade high, it is expected that business development companies are capable of generating elevated levels of earnings through net investment income. However, there are some BDCs that have failed to capitalize during this higher interest rate environment and have fallen short against peers. Runway Growth Finance (NASDAQ:RWAY) operates as a business development company that aims to generate income throughout its late-stage debt investments in middle market companies. When I previously covered RWAY back in May, I issued a hold rating due to the decrease in venture deals.

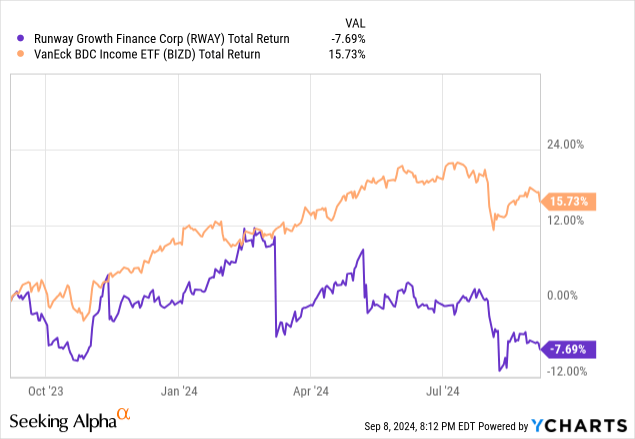

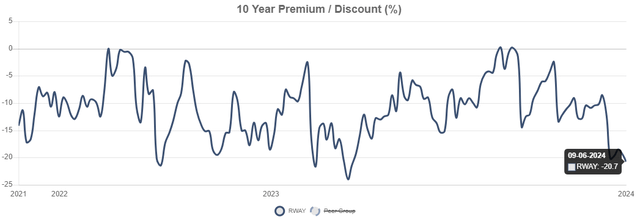

I wanted to provide an update analysis following the most recent Q2 earnings report, which seems to indicate that RWAY is starting to experience the weight of a lower volume of deals. This underperformance has led to RWAY trading near the largest discount to NAV through its entire history. This is likely attributed to the higher interest rate environment, but the outlook here may start to improve with anticipation of interest rate cuts upcoming. When comparing the performance of RWAY against VanEck’s BDC Income ETF (BIZD), we can see that RWAY has significantly underperformed with the total return falling by 7.7%. In comparison, BIZD has provided a total return over 15.7% over the last year.

One of the main appeals of maintaining exposure to business development companies are the large dividend yields that can provide. RWAY’s dividend yield currently sits at 16.5% and is large enough to create a sizeable income stream without the need for an extremely large upfront investment amount. The largest driver for my downgrade here is that earnings no longer fully supports the current distribution rate. After all, aren’t the consistent distributions why we consider BDCs in the first place? Therefore, I anticipate a distribution cut over the next two quarters. First, I wanted to discuss their portfolio strategy and identify some strengths and weaknesses.

Portfolio Strategy

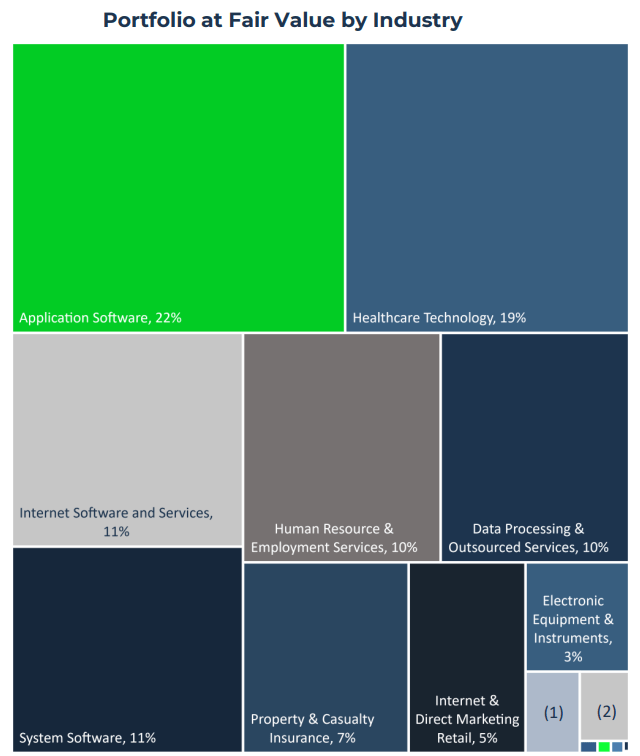

While RWAY maintains a high level of diversity in their portfolio of investments, the leading industry exposure is to Application Software that accounts for 22%. This is followed to exposure to Healthcare Technology and Internet Software & Services, making up for 19% and 11% respectively. Since over 50% of the fund is exposed to the technology sector, it should be understood that RWAY operates as a tech focus BDC and as such, may experience similar vulnerabilities and catalysts to the tech sector.

RWAY Q2 Presentation

The current portfolio value sits at $1.06B and encompasses total loan commitments of $2.7B spread across 31 debt and 83 equity investments to 55 different portfolio companies. Their portfolio of investments generates a yield of 15.1%, representing a slight decrease from the prior quarter’s yield of 17.4%. Something that I like about RWAY’s portfolio is that the structure remains focused on having a majority of investments that are on a senior secured basis. Approximately 94% of their portfolio is comprised of senior secured first lien debt loans, which helps create a better sense of long-term security from a risk perspective.

Senior secured first lien debt sits at the absolute top of the corporate capital structure. This type of debt has the highest priority for repayment in cases where a portfolio company is underperforming and is forced to liquidate assets. It helps increase the probability that RWAY recoups some of their invested capital instead of losing it all in a weak deal. It also helps that 82% of their current investments have an origination channel that is sponsored.

RWAY Q2 Presentation

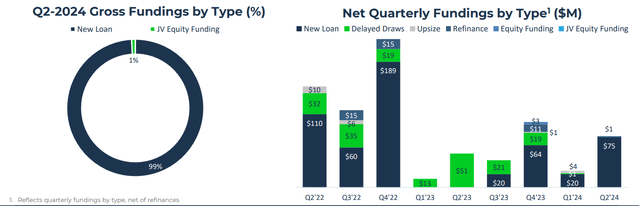

The growth of their portfolio depends on continuous funding of new deals that can result in a larger portfolio value and a higher level of net investment income. Net quarterly fundings have grown during Q2, totaling $76M. While this was an increase over last year’s Q2 amount of $51M, it severely undercuts the normal range above $100M for each quarter throughout 2022 when interest rates were not yet as high as they currently are. This can be attributed to the continued lower volume of venture deals that RWAY relies on for growth.

RWAY Q2 Earnings

Risk Profile

When it comes to measuring the risk profile for business development companies, I like to focus on the non-accrual rate to get a feel for what management’s underwriting ability looks like. Non-accruals measure the rate of portfolio companies that are underperforming and can no longer keep up with the required debt maintenance. So even though higher rates can result in higher income generation, it simultaneously puts more pressure on the underperforming investments that are already working on thin operating margin. Just as a reference point, here are the non-accrual rates for alternative BDCs:

- Barings BDC (BBDC): 0.3% non-accrual rate at fair value.

- WhiteHorse Finance (WHF): non-accrual rate of 5.7% of fair value.

- Ares Capital (ARCC): 0.7% non-accrual rate at fair value.

- CION Investment Corporation (CION): non-accrual rate of 1.36% of fair value.

When I last covered RWAY, the non-accrual rate sat at 3.8% of fair value. As of the latest earnings call, it was confirmed that conditions here have slightly improved and the latest non-accrual rate sits at 3.1% of the total portfolio at fair value. This was primarily driven by two separate portfolio companies that are materially underperforming.

As of June 30th, 2024, we have two loans on non-accrual status. Our loan to Mingle Health Care has a cost basis of $5 million and a fair market value of $3.1 million or 62% of cost. And our loans Snagajob has a cost basis of $42.7 million and fair market value of $30 million or 70% of cost. – Tom Raterman, CFO

RWAY Q2 Earnings

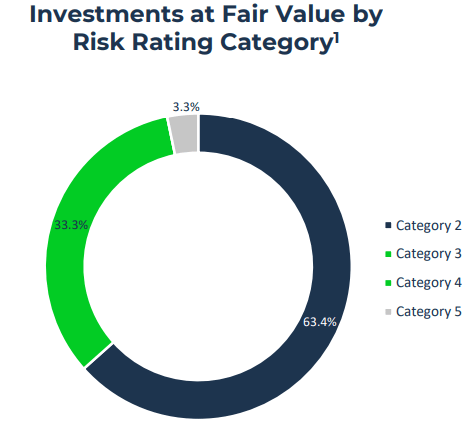

RWAY uses an internal rating scale to grade the credit quality and risk rating of the underlying portfolio companies. The numbered scale operates from 1 through 5, with 1 being the highest rated company and 5 being the worst rated company. When I previously covered RWAY, the percentage of investments at a 5-rating was only 0.3%. This has since grown to 3.3%, representing a decrease in the credit quality rating of portfolio companies.

Financials

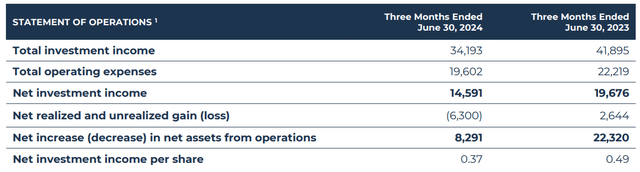

RWAY reported their Q2 earnings at the beginning of August and the results were disappointing with net investment income landing at $0.37 per share, missing expectations by $0.07. This was a huge decrease over the prior quarter’s amount of $0.49 per share. Similarly, total investment income landed at $34.2M, representing a huge year over year decrease of 18.4% from the prior amount of $41.9M.

RWAY Q2 Presentation

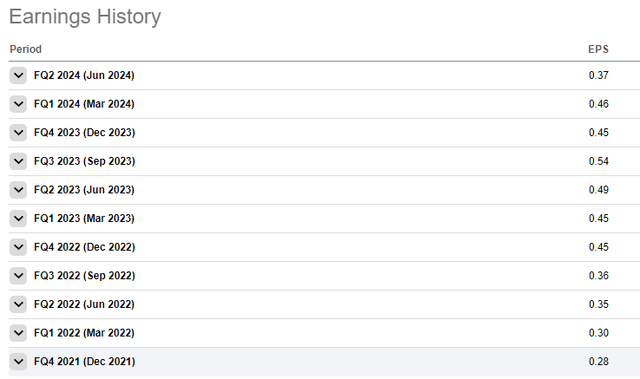

RWAY’s loan portfolio consists of 100% floating rate investments, which has helped the BDC pull in higher amounts of interest income from their investments. We can see this story play out from looking over their earnings history since inception. In Q1 of 2022 before interest rates started to get hiked, net investment income landed at $0.30 per share. The peak earnings were during Q3 of 2023, but has since steadily decreased back below the $0.40 per share mark. Higher interest rates can translate to thinner profit margins for portfolio companies and this can increase the rate of defaults.

Seeking Alpha

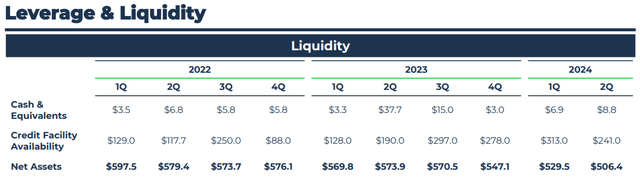

On a more positive note, the liquidity profile of RWAY remains quite solid, with cash and equivalents sitting at $8.8M. The available credit facility has grown to $241M, which is a sizeable increase from the prior year’s total of $190M. This increase in credit can be utilized to grow the underlying portfolio value when the volume of deals starts to increase. When interest rates are cut and the cost of debt on the balance sheet becomes more affordable, there is likely to be an increase in the volume of borrowers that are seeking capital to fund operational growth.

RWAY Q2 Presentation

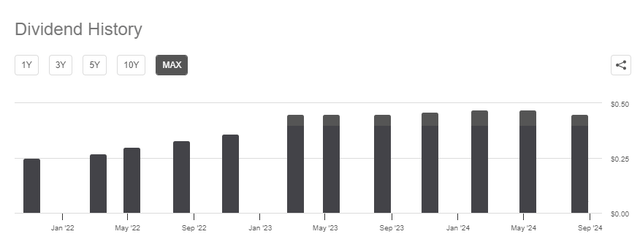

Dividend

As of the latest declared quarterly dividend of $0.40 per share, the dividend yield currently sits at 16.5%. Shortly after going public, RWAY was able to operate during a higher interest rate period that helped it temporarily generate higher levels of income. As a result, the distribution steadily increased and shareholders were rewarded with several supplemental dividends issued over the last year. However, recent performance indicates that this isn’t likely to continue.

Seeking Alpha

As previously mentioned, net investment income for the quarter landed at $0.37 per share. This means that net investment income only covered 92% of the declared distribution of $0.40 per share. This system is not sustainable, and I am expecting a distribution cut next quarter if earnings have not drastically improved. Since rates have remained high since the prior quarter’s earnings, I assume that venture deal volume continues to be lower and a source of vulnerability.

There are stronger alternatives if you are seeking a more reliable distribution. For instance, I recently covered Barings BDC (BBDC) and issued a Buy rating. This rating was supported by a very strong distribution coverage of over 153% by BBDC’s net investment income. This coverage creates a much larger cushion that can offset any short-term negative impacts in net investment income from interest rate cuts.

Valuation

Since RWAY operates as a business development company, the price can vary from the actual value of the underlying net assets. Following the recent Q2 earnings report, the price declined and now trades at a sizeable discount to NAV of 20.7%. Looking over the fund’s short history, we can see that this 20.7% discount to NAV sits near the fund’s all-time highest discount. While the fund has never traded in the premium territory, I believe that future interest rate cuts may have a negative short-term impact but will ultimately be a good thing going forward.

CEF Data

Interest rate cuts will directly reduce the level of net investment income captured from portfolio companies. However, the lower interest rates will increase the number of opportunities that will become available to RWAY. During the last earnings call, management confirmed that the current future environment of interest rate cuts may cater to growth. My thoughts are that the volume of borrowers is rising in anticipation of interest rate cuts. As rates are cut, these borrowers will be able to refinance at more attractive levels.

During the second quarter, we were pleased to execute on attractive opportunities. We’ve been encouraged by the volume of quality companies seeking non-dilutive growth capital and our position as a potential growth partner.

Therefore, future rate cuts can be the positive catalyst for growth. Wall St. seems to agree with this outlook since they have an average price target of $11.88 per share. This would represent a potential price appreciation of 14% from the current price level. The lowest price target of $11 per share still sits above the current while the highest price target sits at $13.25 per share. However, Seeking Alpha’s Quant rates RWAY as a sell and the stock overview as a linked warning that RWAY is at risk of performing badly.

Takeaway

In conclusion, the recent Q2 earnings resulted in net investment income totaling $0.37 per share. This level of earnings is not sufficient enough to cover the current distribution rate and for this reason, I expect there to be a reduction in the dividend before the year-end. This isn’t ideal in an investment that has the primary focus of generating consistent income levels for shareholders. The weakness in earnings has also resulted in a deteriorating price that now trades at a large discount to NAV of 20%. If you believe that interest rate cuts will be a positive catalyst for RWAY, then this would make for a solid entry. However, I’d rather not take any unnecessary bets and would rather invest my capital into BDCs that have more of a safety cushion in distribution coverage.

Read the full article here