Introduction

One of the interesting elements of preferred shares in Canada is that some of the issues (and then predominantly preferred equity issued by larger companies) have a conversion component. Within the preferred security spectrum, you generally have two types of preferred shares: Fixed rate and floating rate preferred shares. In Canada, even the floating rate preferred shares generally see preferred dividend rates being locked in for five year stints (i.e. every five years the preferred dividend rate gets reset, usually based on a five-year government bond plus a mark-up). However, in some cases, preferred shareholders get the option to convert the five-year lock-in for a “real” floating rate preferred security with a quarterly dividend that fluctuates along with the short-term interest rates. That’s what happened at Enbridge, which recently issued a new series of preferred stock with a quarterly preferred dividend payment based on the three-month government bond rate.

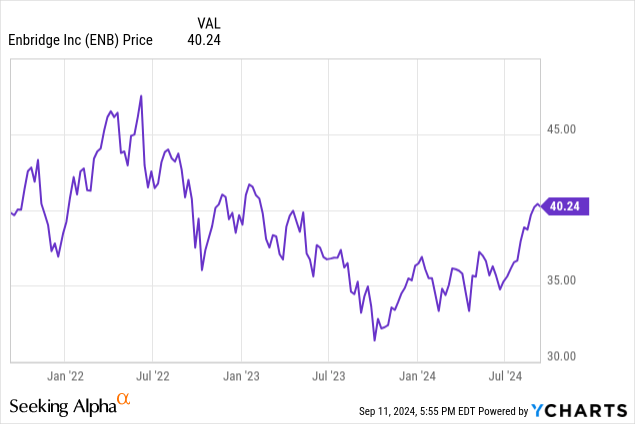

In this article I will focus on the newly issued Series 4 preferred shares of Enbridge (NYSE:ENB) which started trading just a few days ago. From a fundamental perspective, nothing has changed since my previous article was published in August, and I’d like to refer you to that article to read up on the dividend coverage ratio and asset coverage ratio of Enbridge’s preferred stock.

Introducing the new Series 4 preferred shares

At the beginning of August, when Enbridge announced it wasn’t planning on redeeming its Series 3 preferred shares, it opened up the possibility for Series 3 preferred shareholders to convert their preferred securities in a newly created Series 4 preferred security. The threshold to make the conversion happen was 1 million shares: If less than 1 million of the 24 million Series 3 preferred shares wanted to convert into Series 4, no new class would be created.

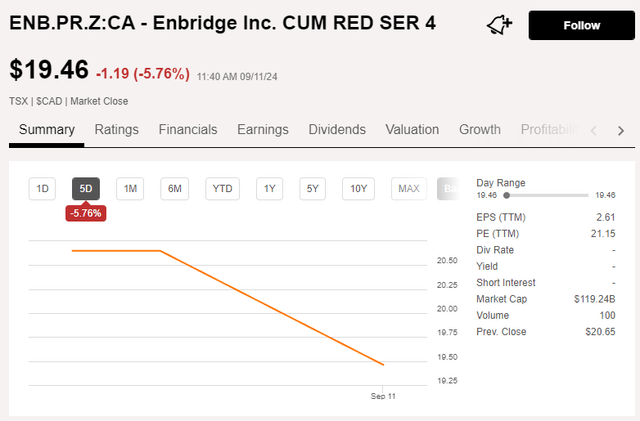

Surprisingly, the company received applications from just over 1.5 million Series 3 preferred shares to convert the stock into Series 4 preferred shares, so as per the terms of the prospectus, Enbridge now has to convert those 1.5 million Series 3 into Series 4 stock. This means there are now approximately 22.5M shares of the Series 3 outstanding and approximately 1.5 million shares of the newly created Series 4. That new series of preferred shares started trading with ( TSX:ENB.PR.Z:CA) as the ticker symbol. Keep in mind trading volumes are currently pretty light but I expect the volume to pick up once all shares have been deposited in the respective accounts (there sometimes are delays). Additionally, as market participants become aware of a new quarterly floating issue, I expect the interest in the new Series 4 to pick up.

Seeking Alpha

The newly issued series of preferred stock is trading at C$19.46, and the company announced the first floating rate dividend will be 42.206 Canadian Dollar cents per share. This represents an annualized dividend yield of approximately 6.75% per share based on the par value of the security.

Readers are cautioned the preferred dividend on the Series 4 preferred shares will be reset every quarter, based on the three-month Canada Government Treasury bill plus a mark-up of 238 bps.

As the share price chart above shows, the share price is now trading at just under C$19.5, which means the current yield on cost is approximately 8.65% based on the preferred dividend for the current quarter (payable on Dec. 1).

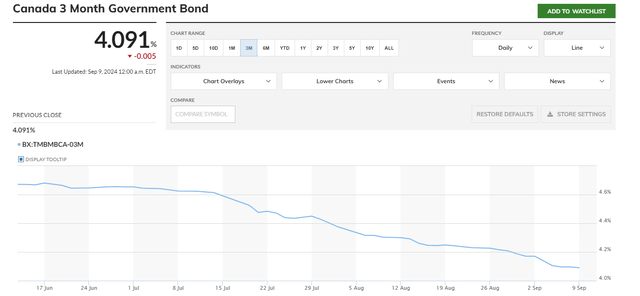

Sounds great, but keep in mind the preferred dividend will fluctuate every quarter. And the three-month government bond yield has been steadily decreasing in the past few months (the Bank of Canada has been walking down its benchmark interest rate, and this obviously had a negative impact on the short-term interest rates on the financial market). As you can see below, the three-month yield has lost about 60 bps in the past three months.

Marketwatch.com

So while the preferred dividend for the current quarter is pretty appealing, odds are the next few quarterly dividends will be lower. If I would use the current three-month government bond rate of 4.09% and add the 238 bps mark-up, the quarterly preferred dividend would be C$0.404/share for a yield of 8.3%.

That’s still good. But between now and the end of this year there are two more policy ratings. An additional two meetings are scheduled to be held in the first quarter of next year. So the odds of seeing at least two more rate cuts announced between now and the end of March next year is pretty realistic.

So let’s assume the three-month government bond yield drops to 3.50%. In that case, the quarterly preferred dividend would drop to C$0.3675 per quarter for a current yield of 7.55%.

I can also look at the Series 4 preferred shares from another perspective. The Series 3 preferred shares reset to a 5.288% yield and considering the share price of the Series 3 is currently C$18.12 (shown below), the current yield is approximately 7.3%.

If that’s what the market likes to see for a five-year lock-in, I can now use this number to figure out what the minimum required three-month government bond yield is to generate a similar return on the Series 4.

7.3% * C$19.46 = C$1.42 is what’s needed to make the Series 4 preferreds yield 7.3%. This represents a yield of 5.68% based on the C$25 principal value, and after deducting the 238 bps mark-up, the three-month Canada government bond yield has to be 3.3% (on average throughout the next five years) for the Series 4 to offer the same yield as the Series 3.

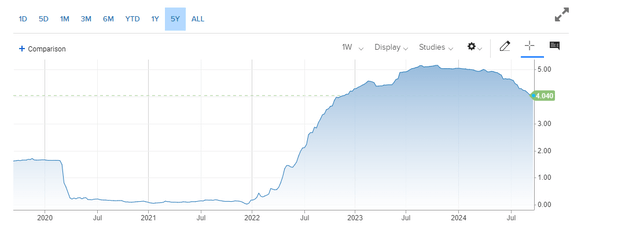

While the 3M yield is currently 79 bps higher than the required 3.3% threshold, I wouldn’t bank on the current advantageous situation to continue. The question now obviously is “by how much will interest rates on the financial markets decrease” and I wish I had an answer.

CNBC.com

I don’t think we’re going back to a zero interest rate policy. But even before the 2020 pandemic related rate cuts happened, the 3M Canada bond yield was trading around 1.75%, in which case the yield on the Series 4 would drop to just 5.3% based on the current share price.

Investment thesis

While the Series 4 preferred shares of Enbridge are a perfect vehicle to speculate on the three-month Canada government bond yield staying “higher for longer,” I’m passing on buying stock at the current levels. I’d rather prefer the visibility and certainty offered by the Series 3 where the new preferred dividend has been locked in for the next five years rather than speculating on the short-term interest rates.

Series 4 could be a “speculative buy” for anyone looking for exposure to these short-term interest rates, but I’m not interested at the current price levels. Perhaps I will have another look when we are nearing the end of the end of the rate cut cycle.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here