YieldMax Magnificent 7 Fund of Option Income ETFs (NYSEARCA:YMAG) is a portfolio strategy that consists of each of YieldMax’s option income strategies, covering the individual names within the Mag7. The collection of single-name, actively managed options strategies is intended to provide investors an investment vehicle that collectively owns an interest in each of the seven constituents. The goal of the strategy is to provide income to holders of the ETF by investing in the actively managed single-name options strategies and to provide a collective and “diversified” investment vehicle. Given both the income component and exposure to the Mag7 company cohort, I recommend YMAG with a HOLD rating with a 2% allocation target in tax efficient portfolios.

Mechanics Of YMAG

YMAG is the collection of YieldMax’s single-name income strategies that covers the entirety of the MAG7 cohort. Similar to the holdings in YMAG, the ETF does not directly invest in equities and solely invests in the portfolio company’s ETF strategies that comprise the Mag7. This includes Amazon (AMZY), Apple (APLY), Meta (FBY), Google (GOOY), Microsoft (MSFO), Nvidia (NVDY), and Tesla (TSLY). In addition to this, YMAG holds a small position in cash and money market funds.

The portfolio holdings’ primary objective is to provide income through managing short-short and short-long, and occasionally long-long and long-short options strategies in order to generate income for investors. The individual portfolios oftentimes manage straddle options positions around the underlying’s price in order to generate income. From there, excess returns are returned to holders of the ETF through monthly distributions that can oftentimes thwart income realized through fixed income strategies.

One of the biggest risks associated with investing in these strategies is the potential tax burden as a result of the high-income component. This is primarily why I recommend utilizing a tax-efficient retirement account if you elect to invest in such a strategy.

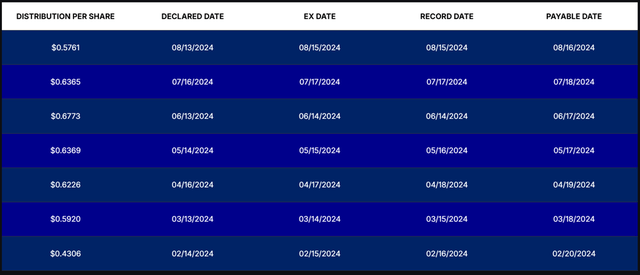

YMAG’s forward distribution rate is 37.25% at $0.5761/share. Given the short lifespan of YMAG, I recommend reviewing the historical rate across the constituents, as they may vary significantly from month-to-month. YMAG’s distribution has been as low as $0.4306/share and as high as $0.6773/share.

Corporate Reports

With the high-income component comes a relatively high fee of 1.28% gross expense. The gross expense ratio is made up of a 29bps management fee and a 99bps acquired fund fee and expense. The acquisition fund fee is the cumulation of fund fees associated with investing in YieldMax’s single-name company ETFs.

When considering the investment strategy, I believe it is prudent to weigh one’s risk tolerance as it relates to the underlying options strategies and concentration risk related to the Mag7 tech names.

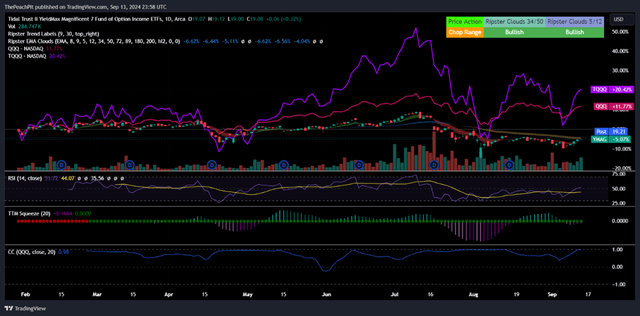

In terms of price performance, YMAG is highly correlated with the Invesco QQQ Trust ETF (QQQ) NASDAQ Index, as depicted below. Given the high correlation between the two ETFs, I believe that YMAG offers a more compelling investment opportunity for those seeking exposure to the index and income. As it relates to the NASDAQ, the top 10 constituents make up 49.79% of the portfolio weight, suggesting significant concentration and directional pull by the top 10 names. Given this factor, I believe that an investor can realize similar price returns by concentrating down their strategy to the Mag7 with the added benefit of income. For reference, I included ProShares UltraPro QQQ ETF (TQQQ) to provide a different perspective for leveraged portfolios.

TradingView

Market Outlook

I recently reported on ProShares UltraPro Short QQQ ETF (SQQQ) with a robust outlook on the market. For the most part, I believe that durability will remain in the hyperscalers and AI-related tech stocks that cater to enterprises for automation and operational efficiency. One factor that is mentioned in my report is that consumers have been tightening their grip on spending, allocating more of their incomes to staples over discretionary, a theme that I have remained consistent with for all of 2024. Given the heightened level of inflation and despite the slowing of the rate of growth, I believe consumers at the low-to-mid-income bands will remain pressured by higher costs as they pertain to the day-to-day cost of living.

This includes a focus on housing, food and beverage, insurance, electricity, and gasoline. Though these factors don’t necessarily directly impact the Mag7 in terms of enterprise spend for data consumption, storage, and other tech-related spending, I do believe the general economic sentiment may play a bigger role in the direction of the index. For this reason, I recommend caution when investing in YMAG as the ETF is heavily correlated with its respective index and may experience a sharper turn given the underlying options strategies.

In addition to this, there are two major events on the horizon that may impact volatility. First, the September 18, 2024 Fed meeting that will set the direction of the Federal Funds Rate. Secondly, the November 5, 2024 Presidential election. As discussed in my report covering SQQQ, economists are leaning towards a rate cut following the September Fed meeting, which, I believe, will drive price appreciation in the NASDAQ Index.

If the Fed decides to keep rates stagnant, I believe the market may experience a heightened level of volatility that may push down the NASDAQ Index, which will in turn impact the price of YMAG.

Though presidential elections aren’t necessarily catalysts for direction in the market, I believe volatility will be heightened as a result of the event. A higher level of volatility may impact the underlying ETF holdings in YMAG given the short-straddle options strategies across the underlying ETFs. This may have the ability to impact the underlying assets, and in turn impact the value of the portfolio.

YMAG has a relatively low level of trading volume in the market, with an average of 284k shares changing hands. This may impact an investor’s ability to buy or sell their positions in the event of a highly volatile market.

Conclusion

YMAG is an income-generating portfolio strategy that focuses on the Mag7 companies, holding YieldMax’s respective income-generating ETFs. Given the high level of correlation with the NASDAQ Index, I believe that YMAG can offer investors similar price returns with an additional income component. Given the short life of the strategy, historical distributions may not provide an accurate reading on performance and may not be reflected in future periods.

For investors seeking exposure to the NASDAQ Index and income, I recommend YMAG with a BUY rating with an allocation of 2%. Given the volatility risk as a result of the September Fed meeting and the November election, I recommend easing into the position as these two events may be catalysts for heightened volatility.

Read the full article here