Independent power producers are behaving like bubble stocks and Vistra Corp. (NYSE:VST) is the head of the pack.

- Vistra is up 193% year-to-date.

- Constellation Energy Corporation (CEG) is up 122% year-to-date.

- Talen Energy Corporation (TLN) is up 184% year-to-date.

- GE Vernova Inc. (GEV) is up 92% since its recent listing. GEV is not an IPP but is a key supplier.

Weird things like this happen in the market all the time, but what strikes me as even stranger here is that these massive moves might actually be fundamentally warranted (at least partially).

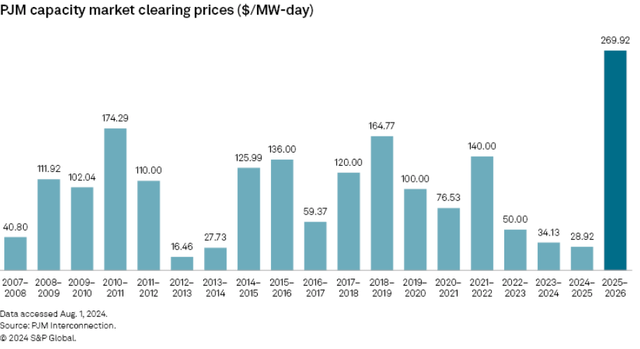

The utilities world is currently witnessing a phenomenon that will likely be used as an example for future economics students: A plentiful commodity selling for astronomical prices. I am referring, of course, to capacity clearing prices which for the 2025-2026 year landed at approximately 10X the previous year.

S&P Global Market Intelligence

It is now anticipated that the prices will remain unusually high the following year and perhaps even beyond that.

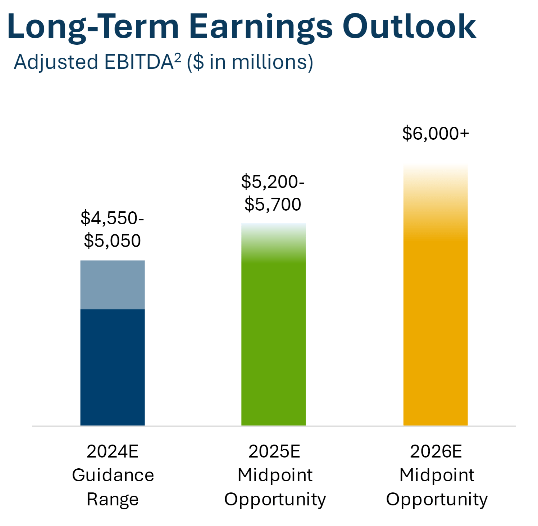

The high auction, along with anticipation of prices remaining high, has resulted in independent power producers or IPPs ratcheting up earnings guidance.

Vistra, for example, has increased its Adjusted EBITDA outlook for 2026 to $6B.

VST

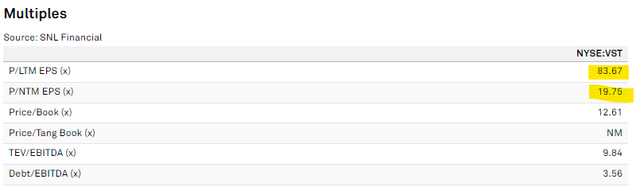

It is not too often one sees growth at that pace in utilities or a utility-adjacent industry. With earnings rising so rapidly, Vistra is trading at an 83X trailing earnings multiple but a 20X forward multiple.

S&P Global Market Intelligence

2026 EV/adjusted EBITDA is just under 6X.

So, despite the meteoric rise in stock price, VST does not look like a bubble. The earnings have risen proportionally such that forward multiples are actually below the market average.

If earnings can remain this strong, the IPPs could be a great place to invest. Thus, it behooves us to try to understand if this is a temporary phenomenon or a sustaining runway of growth.

I believe the atypically high price realizations are the result of a broken market equilibrium, so let us begin by examining how it would work as a well-oiled machine and then discuss some of the shortcomings that have led to the broken equilibrium.

Ideal Power Production

In a free market, commodity prices are kept in check by the standard forces of supply and demand. Higher prices incentivize producers to increase production, which in turn brings prices back down. Ideally, a healthy equilibrium is formed in which the quantity supplied matches the volume demanded at a reasonable price point.

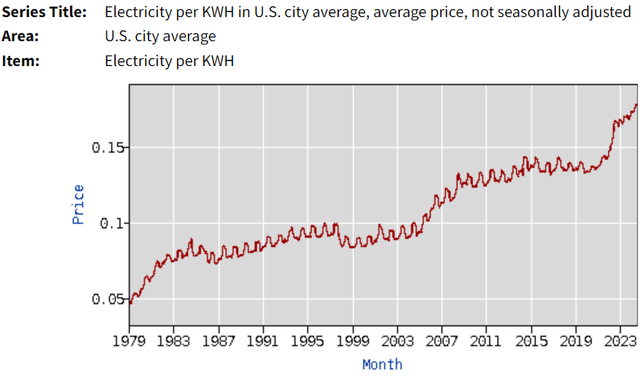

Historically, U.S. power generation and consumption have functioned quite well. Generation has consistently been slightly higher than consumption, which has functioned as a nice buffer to minimize downtime and handle demand surges. Prices to the consumer have tracked up slightly, but largely just in line with inflation. Note that the steep portions of the curve below are during periods of high inflation (the 1980s and the last few years).

Bureau of Labor Statistics

The cost of electricity production has been largely flat over time, with most of the price increases to consumers being related to the high cost of transmission and distribution.

Overall, it has been a healthy environment and has largely been in equilibrium.

Until now.

Equilibrium breaks

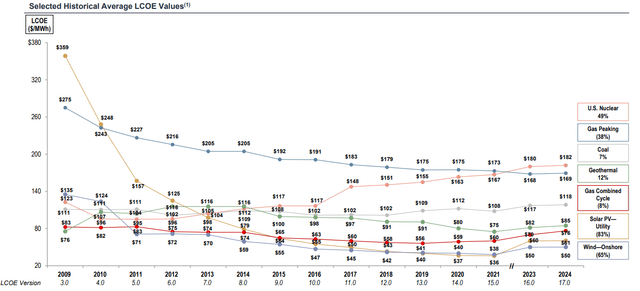

In a functioning system, small price increases would be enough of a signal for producers to build more capacity. Note that the cost of production has been largely flat over the past 20 years.

Lazard

With the cost of production remaining low, even a slight increase in prices should be sufficient to stimulate supply.

However, slight nudges have been ineffective, resulting in the 10X increase in the PJM capacity price – a screaming signal that more supply is needed.

So why is the supply not being delivered?

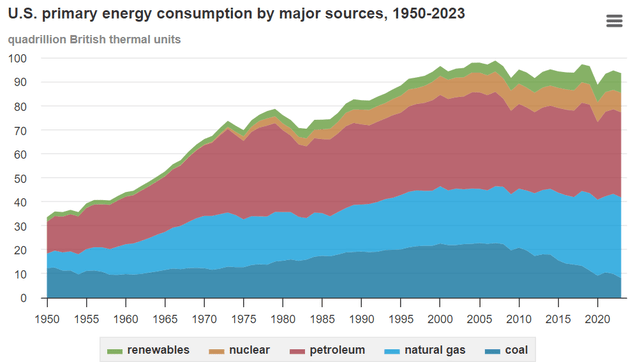

Well, energy consumption has been basically flat for decades.

EIA

Thus, energy producers have only had to build enough to maintain production levels. With minimal new builds, supply chains atrophied.

There are few suppliers of key parts, and each of them has fairly limited production capacity. That was fine for the past decades when demand for new parts was slow and steady.

2 things have changed:

- Decommissioning has ramped up.

- Demand for electricity is surging.

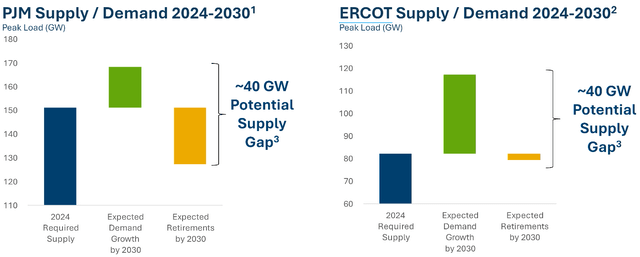

Both data points are captured in this slide from Vistra.

VST

There is huge energy demand growth in Texas (ERCOT), while the PJM grid has moderate demand growth and massive amounts of retirements that need to be replaced.

Plant retirements put producers in a situation where they require more supplies than usual just to maintain production, but then they also must increase capacity to meet incremental demand.

According to the data above, 80 GW of production capacity is needed by 2030 in just PJM and ERCOT.

The supply chain is not ready for that kind of volume.

Equilibrium is broken.

Producers want to increase capacity in response to the price signal, but they can’t. In many cases, it will take until 2028 to get the required parts.

Talen’s investor day presentation shed some light on the issue:

Unknown Analyst from Audience

Maybe just, Mac, just your thoughts on construction timeline of a gas-fired power plant. So your peers talk about multiple years. And I hear you and your peers kind of looking at this PJM price signal but not wanting to jump in. Just how do you marry that 2? How do you make sure that you have the equipment right in time, and you have the permits right in time so you can finally respond to those price signals?

Mark Allen McFarland (Talen CEO)

The honest answer is that we’ve explored some of this. Cole’s worked on this with Dale, our Chief Fossil Officer, and spoken with turbine manufacturers. And there’s not a lot of turbines available before ’28 delivery, okay? And the old model of putting a reservation down at like 10% or 20% and having a spot in line for the next turbine, et cetera, and then being able to sell that in necessary market, that doesn’t exist. I mean GE Vernova or Vernova now is saying, you got to pay for it all to get a spot in line.

That is quite the bottleneck when power producers have to pay 100% upfront to GEV just to reserve a turbine to maybe get delivered in 2028.

Over time, the supply chain will work itself out, but it creates an awkward window in which supply is unresponsive to price.

Essentially, the supply curve has steepened.

There is, of course, some incremental production that can be pushed through even without new plants:

- Plants can run more hours (2nd or even 3rd shifts).

- Previously retired plants can be turned back on.

- CEG is restarting its Three Mile Island nuclear plant.

Impact of broken equilibrium

Based on current supply chain estimates, the supply of new plants will be limited until 2028. I see 2024-2028 as the window in which the equilibrium will be broken. After enough new plants are delivered, equilibrium should be restored. During this period, I think the following will be likely:

- Continued extremely high pricing on capacity auctions.

- Favorable power purchase agreement pricing for producers with data centers and other counterparties having to pay up for power.

- High margins and full sales backlogs for those in the bottleneck of the supply chain such as GE Vernova.

- Significant transmission and distribution build-out, which can reduce power lost in transit.

- Delayed sources of demand. Data centers may have to put off construction until power is more available.

- Geographic shifting of new projects to areas with reduced red tape and better power availability.

Given the above, IPPs such as Vistra and their peers are well-positioned to maintain strong earnings and earnings growth through 2028.

However, once new supply is delivered, prices will come back down, and their earnings may come back down as well.

The current valuation of the IPPs is not expensive on a multiple basis, but it might be slightly expensive on post-2028 earnings when prices have normalized. It will be a matter of just how much profit these companies can rake in during the favorable period.

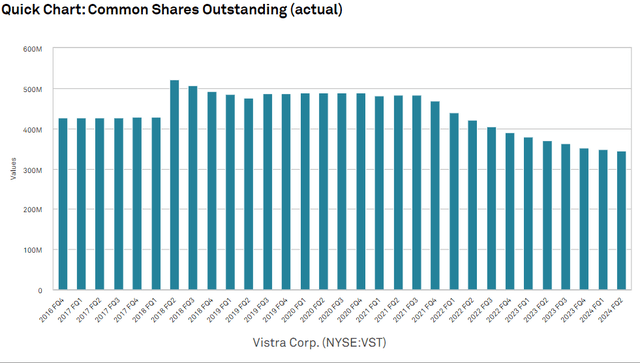

Vistra, for example, is using the abnormally high profits to buy back its stock.

S&P Global Market Intelligence

It is planning billions of dollars more in buybacks.

Reducing the denominator could bolster long-term earnings even after prices normalize.

Vistra or the other IPPs could be a reasonable investment. Whether the current valuation is attractive will depend on how well they can capture the advantageous environment and how long it lasts.

Better way to play the broken equilibrium

GE Vernova is functioning as the gatekeeper of new supply. Their position right in the bottleneck is allowing them to grow earnings rapidly. I think GEV’s growth will be similarly strong to that of the IPPs, but its outlook seems better to me post-2028.

GEV is not bothered by the eventual restoration of equilibrium as it doesn’t directly benefit from high capacity-auction prices. Its benefit comes from the demand for power infrastructure and transmission infrastructure.

Power demand is estimated to increase substantially and continuously over the coming decades. Infrastructure will have to be built out continuously to meet this demand, and I believe this will give GEV a longer runway of growth. For a fuller thesis on GEV check out our feature-length piece.

Read the full article here