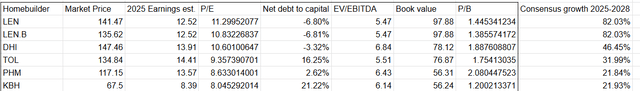

There is a huge disconnect between Wall Street homebuilder estimates and where these stocks trade. If the analysts are anywhere near correct this entire sector is wildly undervalued.

They are trading at 10X earnings and consensus estimates call for 22%-82% earnings growth by 2028. That is functionally rapid growth companies trading at value multiples.

Either the market is wrong, and these stocks are way too cheap, or the analysts are wrong about their earnings forecasts. In this article we will examine the homebuilding industry from a variety of angles to try to make sense of the huge disconnect.

Earnings growth projections

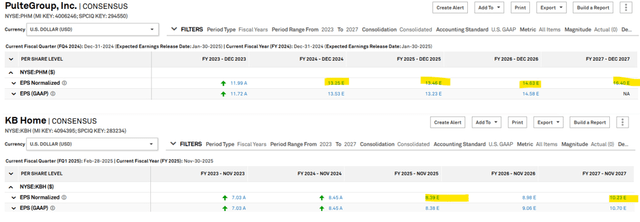

The following earnings estimates are from S&P Global which aggregates and averages the estimates from the Wall Street analysts. These are essentially the consensus growth figures from the community of analysts that closely follow these companies.

The largest homebuilder, D.R. Horton (DHI) is expected to earn $20.24 per share in 2028 as compared to $13.82 in 2025, representing 46% growth over the period.

S&P Global Market Intelligence

For PulteGroup (PHM) and KB Home (KBH) analysts only estimate through 2027. They are each expected to grow earnings 22% by 2027.

S&P Global Market Intelligence

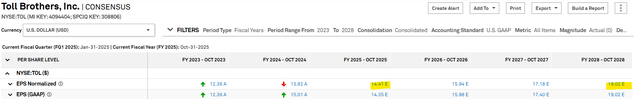

High-end builder Toll Brothers (TOL) is projected to grow 32% by 2028.

S&P Global Market Intelligence

Lennar’s (LEN) (LEN.B) expected growth comes in at a whopping 82%.

S&P Global Market Intelligence

These are the analysts’ numbers. I am slightly less bullish because I think the equilibrant number of home starts is slightly lower than consensus.

With that in mind, let us examine the housing cycle to get a better sense of where the industry is headed.

Long-Term Housing Supply and Demand

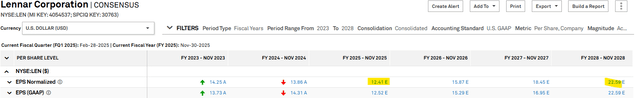

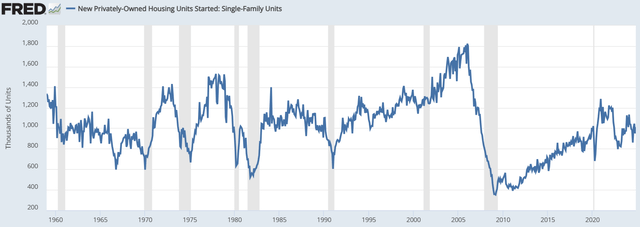

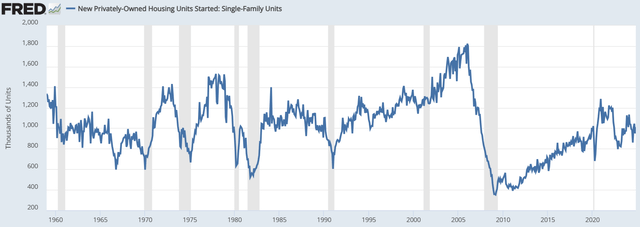

It is broadly believed that the U.S. is materially undersupplied in housing. Historically, housing starts have been somewhere around 1 million to 1.2 million annually. That pattern broke in the early 2000s as the dawn of the housing bubble encouraged above trend building.

FRED

However, the slight supply glut that built up in 2005 was more than made up for by the well below trend building of the last 16 years.

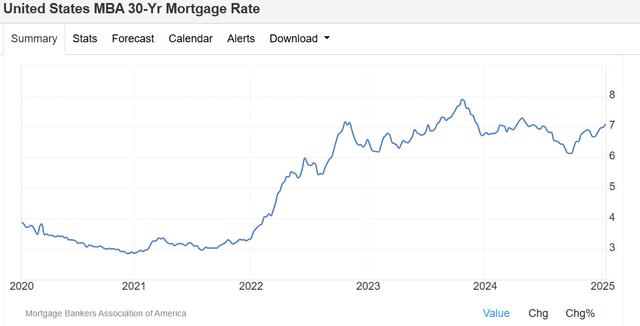

Around 2020-2022 home construction starts started to get back up to a historically normal level, but in 2022 mortgage rates shot up at an unprecedented pace. By the end of 2022, 30-year mortgage rates were approaching 7% where they have remained through today.

TradingEconomics

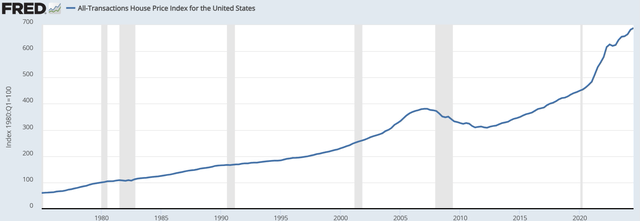

In addition to each dollar borrowed costing homeowners more, this was a period of heavy inflation and houses inflated even faster than broader CPI.

FRED

So home buyers are looking at unprecedentedly high home prices at the same time as each dollar borrowed costs substantially more than people are used to.

It is a bit of an affordability crisis which is causing demand to be much lower than historically normal levels.

As such, the homebuilders are in a bit of a trough right now with 2024 and 2025 expected to be weaker than 2023 and also weaker than 2026.

I agree with consensus estimates that 2024 and 2025 are trough years. However, I think it will be a more moderated growth out of the trough as compared to the explosive growth called for by Wall Street analysts.

The mainstream idea is that the dearth of building from 2007-2020 resulted in housing undersupply of at least 2 million units with some estimates suggesting 7 million units of undersupply. To correct this, the homebuilding industry would essentially have to overbuild by 2 to 7 million units to restore equilibrant supply.

I think some of this above trend building is likely present in the 2027 and 2028 earnings estimates for the homebuilders.

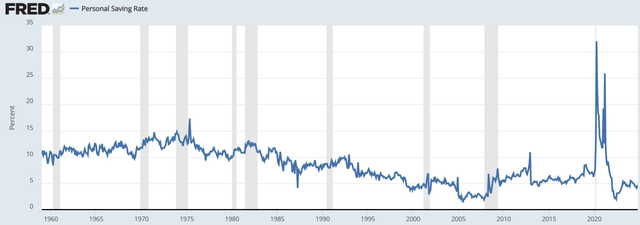

In my opinion, housing starts are going to be a bit more moderate, roughly 1.2 million units. The main difference in my view versus consensus is that I believe there is a semi-permanent shift toward apartments predicated on a very low savings rate.

FRED

Personal savings rate is below 5% and less than half of historical norms.

Frankly, at this rate a large portion of the population is going to have difficulty saving enough money for down payments, meaning they will be stuck renting for longer.

As such, I don’t think the entire 2-7 million unit undersupply is going to have to be made up for in the near term. It is more likely to be just some portion of that.

That said, even with my more moderate demand and earnings growth forecast, the homebuilders look quite opportunistic.

Value and quality

Homebuilders trade very cheaply at price to earnings ratios around 10X compared to the S&P 500 at about 23X forward earnings.

2MC using data from company filings

Homebuilders are even cheaper on an EV/EBIDTA basis at about 6X.

There are a few reasons that companies may trade at cheap multiples, but none of them apply to homebuilders.

- Some stocks trade at low multiples because of low growth. That is clearly not the case here with consensus estimates calling for 22%-82% growth for homebuilders by 2028 as discussed earlier.

- Cyclical stocks should trade at low PE multiples at the peaks of cycles and higher multiples at cycle troughs. Based on housing starts and current mortgage rate headwinds homebuilders seem to be in a trough currently. As such their multiples should be higher than normal. The 10X multiple of the sector seems unusually low for a cyclical trough.

- Low quality stocks should trade at lower multiples. I have been unable to find evidence of low quality among these names. These are excellent businesses.

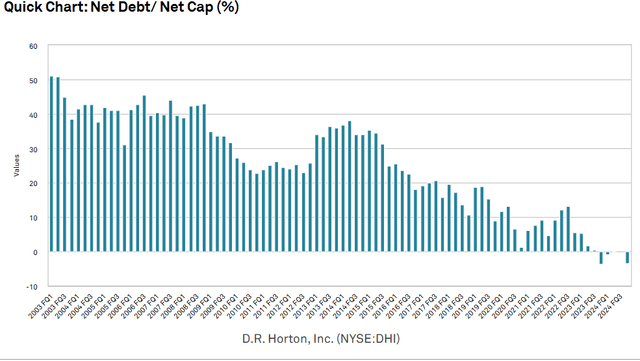

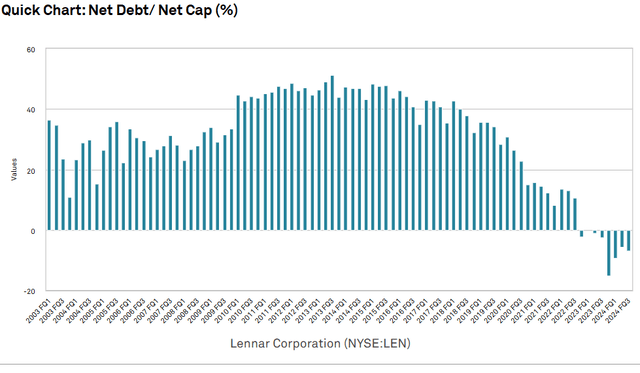

- High debt companies might trade at low multiples due to higher risk. Homebuilders, however, have little to no debt.

Perhaps the reason these companies trade cheaply is that the market is still scarred from the damage sustained in the aftermath of the housing bubble. When demand for new housing went from off the charts high to nearly zero in the depths of the Financial Crisis the homebuilders did indeed get clobbered.

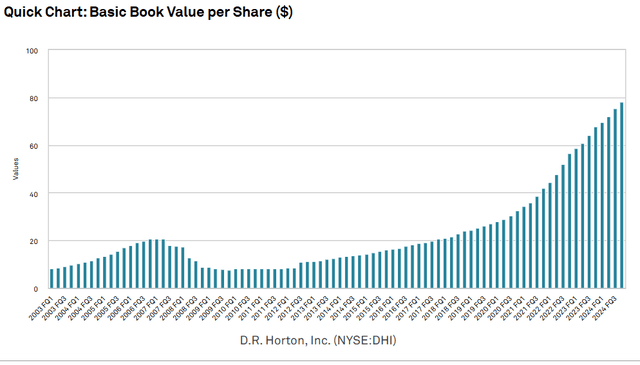

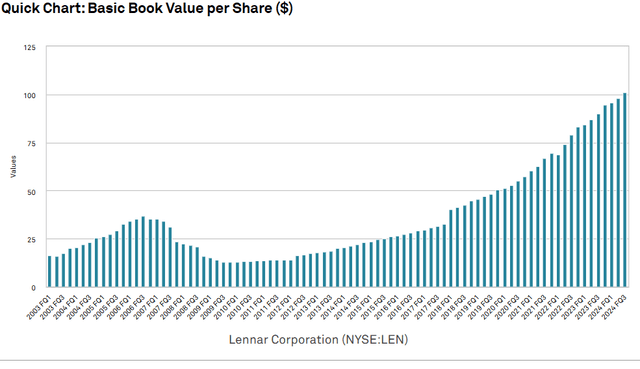

Most of them lost substantial book value. Below are the charts of Lennar and D.R. Horton, but the same pattern holds for the entire sector.

S&P Global Market Intelligence

S&P Global Market Intelligence

Sales stopped and existing inventories sat on the market. Costs largely remained and revenues couldn’t keep up. Book values plummeted.

The crash from the housing bubble was brutal, but I don’t think we should still be pricing that into these stocks. Specifically, there are 2 reasons that homebuilders are unlikely to suffer as much in the future:

- The pop of the housing bubble was a black swan event in which homes were extremely oversupplied. Given the current undersupply, a crash in home prices would play out differently.

- Homebuilders are much stronger now. Business models are improved to be more capital light and they operate with almost no debt.

At the peak of the housing bubble, homebuilders had fairly high leverage with DHI at 40% debt to capital.

S&P Global Market Intelligence

Pulte Group and Lennar were similarly high leverage.

S&P Global Market Intelligence

S&P Global Market Intelligence

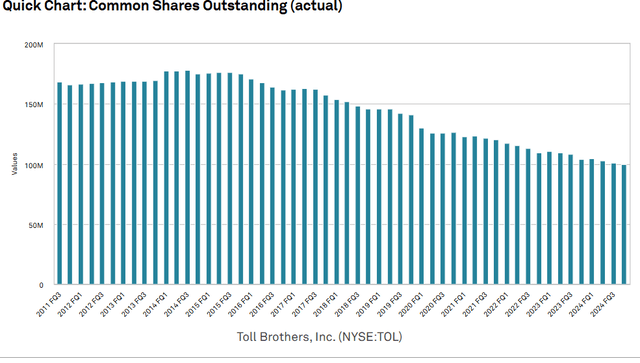

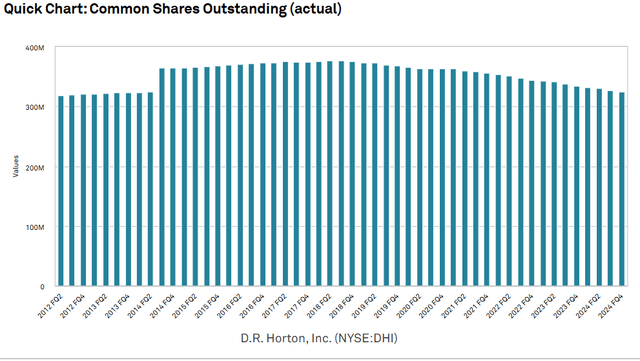

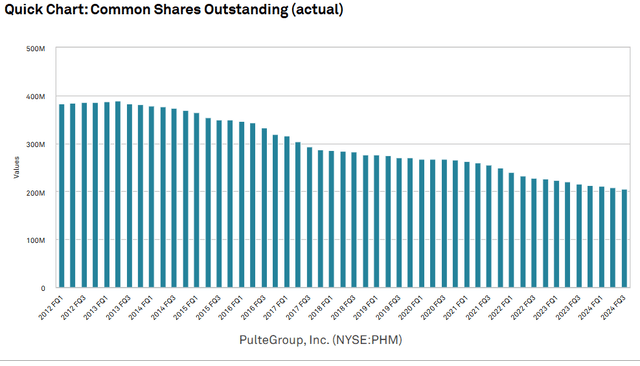

Today, the balance sheets are so much better. The sector has had over a decade of strong free cashflow which the companies almost universally used to pay off debt, expand business lines, and buy back shares.

You can see on the same charts above that Lennar and D.R. Horton operate at negative debt today (more cash than debt) and Pulte has very little debt.

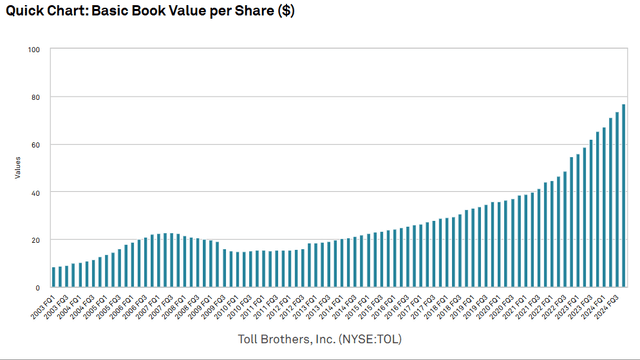

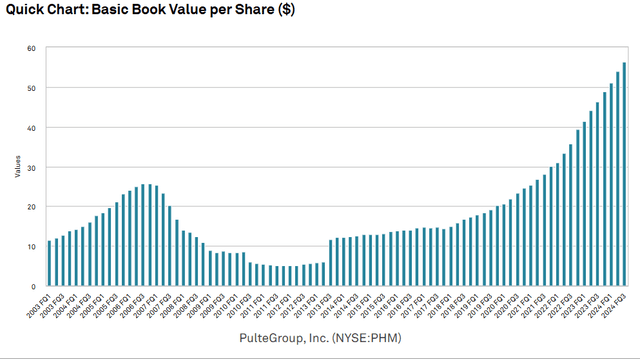

In the 15 years since the Financial Crisis, book values across the sector have soared in steady fashion.

S&P Global Market Intelligence

S&P Global Market Intelligence

The pace of value gains is fast, but also remarkably steady. These book value gains didn’t even pause during the pandemic recession.

Frankly, it is just a great business model. These companies have formed streamlined production lines for a product that is both needed and currently undersupplied. We see two significant pieces of evidence that the publicly traded homebuilders run superior businesses.

- High and improving margins

- Market share capture

Margins

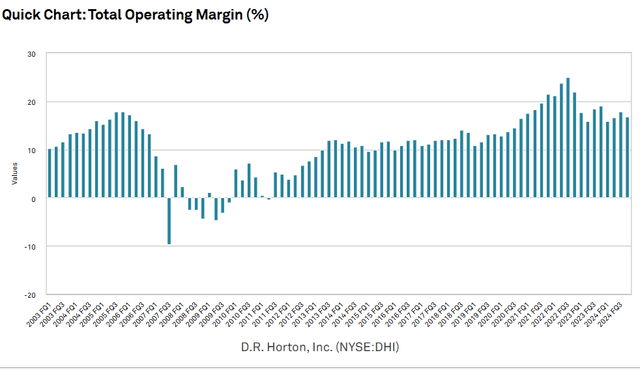

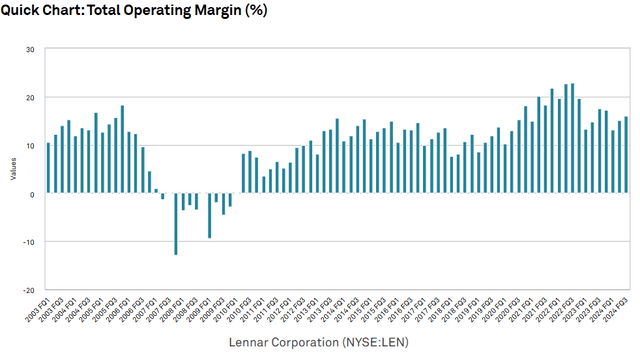

D.R. Horton’s margins are hovering around 18% compared to 11% historically.

S&P Global Market Intelligence

The drop from about 24% in 2022 is related to the delta in mortgage rates. Homebuilders are paying down mortgage rates to address the affordability issues of customers, but even with this sharing of the burden, margins remain above historical norms.

Lennar’s margins are similarly high and follow the same pattern of a slight drop as mortgage rates soared.

S&P Global Market Intelligence

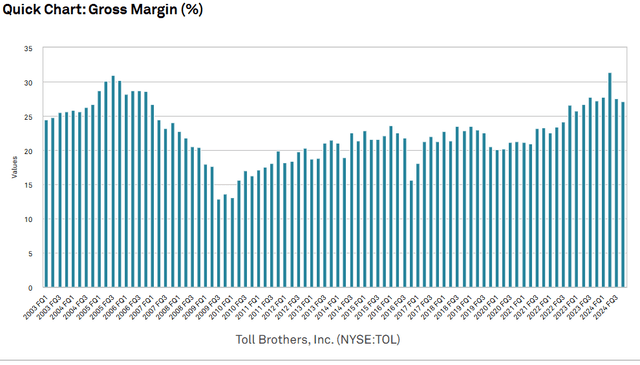

The above charts are the all-in margin inclusive of SG&A and other expenses. We were unable to chart similar data for Toll Brothers, so the chart below is gross margin.

S&P Global Market Intelligence

Note that TOL does not have the same spike in 2022 and drop after because its $900K+ price point caters to a different buyer that often pays in cash such that mortgage rates had much less impact on TOL’s business.

Market share capture

We already posted the housing starts chart earlier, but we are duplicating it below because it is directly relevant to the market share capture discussion.

FRED

The key data piece here is that overall housing starts have been well below historical averages for the last 16 years.

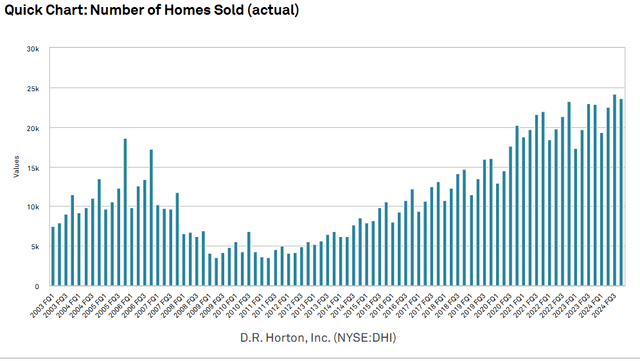

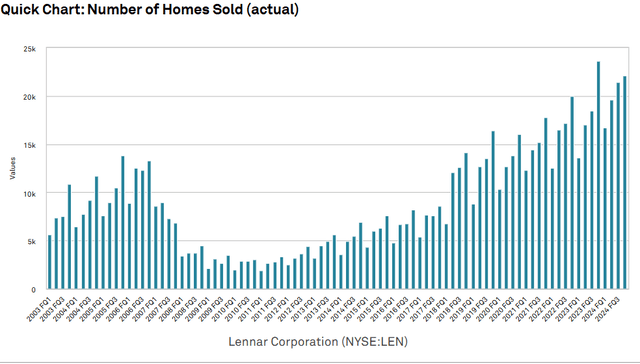

Despite the overall industry output being dampened, the publicly traded homebuilders are building in record numbers.

S&P Global Market Intelligence

S&P Global Market Intelligence

Homes sold by the homebuilders is about double what it was during the housing bubble of 2005 despite the overall industry operating at a volume about half of what it was in 2005.

My read on that is a 4X growth in market share.

The big public homebuilders have some advantages which seem to be making them more efficient than their smaller regional peers.

- Capital light model in which land is held or controlled off balance sheet which allows them to source thousands of lots with minimal upfront capital commitment.

- Volume provides efficiencies of scale.

- Mortgage buydown is a wildly effective sales tool relative to cost of implementation.

Free Cash Flow that is actually free

Many companies have strong cashflow but it is often earmarked for expenses that are necessary to maintain their business.

Tech companies have to spend a significant portion of their cash on R&D to stay on the cutting edge. REITs have to spend some of their cashflow on maintenance to keep properties in leasable shape.

In contrast, homebuilders have a clean round-trip business in which they build a house for a certain cost, sell it for about 30% more and then keep about 17%-22% as profit. Since very little of the cash is needed to maintain the business, it can be allocated however the company sees fit. So far it has gone to paydown of debt and share buybacks.

S&P Global Market Intelligence

S&P Global Market Intelligence

S&P Global Market Intelligence

With debt balances almost eliminated, an even higher percentage can be allocated to share buybacks going forward.

Given the price at which these companies are trading, share buybacks accelerate earnings growth. Buying back stock trading at a 9X multiple is an immediate 11% earnings yield.

A tragic but real catalyst – increased pace of property damage

As the world becomes more populated and property dense, natural disasters do an increasing amount of damage.

The current Los Angeles Fires have already destroyed more than 1200 properties as of January 14th. The total will unfortunately get far larger by the time the fires are fully contained.

Hurricanes have been demolishing countless homes across the entire East Coast.

It never feels good to profit from someone’s hardship, but at least the homebuilders are part of the solution. The homes need to be rebuilt, and the sum of damaged properties just adds to the current undersupply of housing across the U.S.

Risks facing homebuilders

While high mortgage rates are the most pressing current headwind, there is a less known risk factor worth discussing that has been referred to as the Golden Handcuffs.

Golden handcuffs theory: Supply of existing homes is being temporarily restricted by people not wanting to leave their 2% mortgages.

With fewer existing homes on the market the supply of existing homes is restricted, which may be responsible for the meteoric rise in home prices.

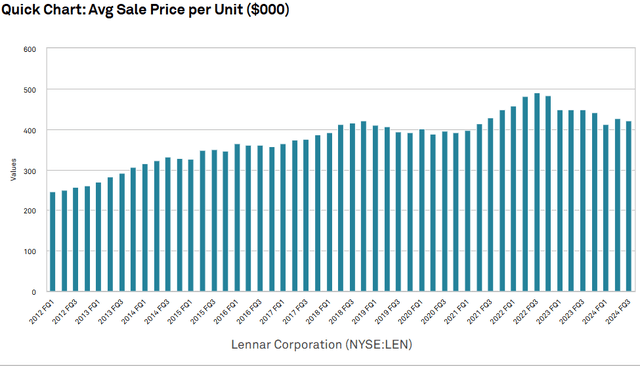

With existing homes costing so much, newly built homes have become increasingly attractive as alternatives. Lennar, for example, sells newly constructed homes for just over $400K on average which is quite a good deal relative to 30-year-old homes selling for about that same price.

S&P Global Market Intelligenc

It is possible that the restricted existing home supply of the golden handcuffs has allowed for higher sales prices from homebuilders.

Over time, mortgage rates will be less of a factor. Even if they stay at 7%, the mere passage of time will mean fewer existing homes are at 2% mortgage such that supply of existing homes will eventually normalize. Some, such as this WSJ article, theorize that home prices will come back down a bit when this happens.

If that is the case, perhaps margins for the homebuilders would drop a bit.

Our overall take

I am slightly less bullish than analyst consensus estimates, but even with a toned down outlook the return prospects of owning homebuilders at current pricing is well above market.

These companies are trading at less than half the multiple of the market with growth rates faster than the market. That is a recipe for above market returns.

We don’t have strong preferences within the sector. All the companies seem to be well managed and have had tremendous fundamental success. As such we are taking a basket approach and nibbling at a variety of homebuilders.

I recently sold my Lennar stock, which we most recently wrote about here. I sold to avoid receiving shares of the spinoff but bought it back after the spin cleared.

The fundamentals of the sector are just so much better than what is implied by valuation that it is an area in which we want significant exposure.

Read the full article here