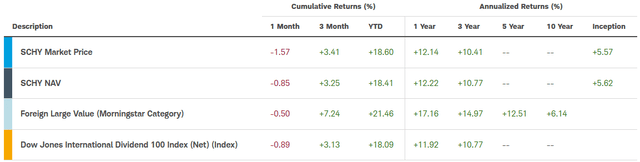

The Schwab International Dividend Equity ETF (NYSEARCA:SCHY) is a passively managed fund designed to track the Dow Jones International Dividend 100 Index. SCHY is a low-cost, income-oriented strategy that provides investors with international exposure. SCHY has a 3.72% dividend yield on a trailing twelve-month basis and has an expense ratio of 8bps.

About Schwab International Dividend Equity ETF

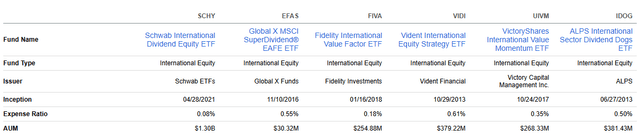

SCHY was launched on April 29, 2021, by Charles Schwab as a passively managed investment vehicle designed to provide investors with exposure to dividend-paying international stocks. The strategy has a low management fee of 8bps. The strategy has roughly $1.3b in assets under management (AUM) with an average of 364k shares changing hands on a daily basis with minimal spread risk, or the cost-in/cost-out, for trading shares. SCHY is benchmarked to the underlying index, the Dow Jones International Dividend 100 Index.

Corporate Filings

Index Structure

SCHY is indexed to the Dow Jones International Dividend 100 Index. The Index includes international ex-US dividend-paying mid- and large-cap companies while excluding real estate investment trusts (REITs). The stock screening process includes:

- Minimum of 10 consecutive years of dividend payments.

- Minimum float-adjusted market capitalization (FCM) of $500mm.

- Minimum 6-month median daily value traded (MDVT) of $2mm.

- Non-constituents must be domiciled in a country whose universe weight is greater than or equal to 0.20%.

- Dividend yield must be equal to or greater than the median-indicated dividend yield of the eligible universe or the 40th percentile of the universe for the existing constituents.

Following these screening steps, equities are then ranked based on fundamental qualities, such as free cash flow as a percentage of total debt, return on equity, the indicated dividend yield, and the 5-year dividend growth rate. From there, the investment universe will be further reduced based on stock volatility.

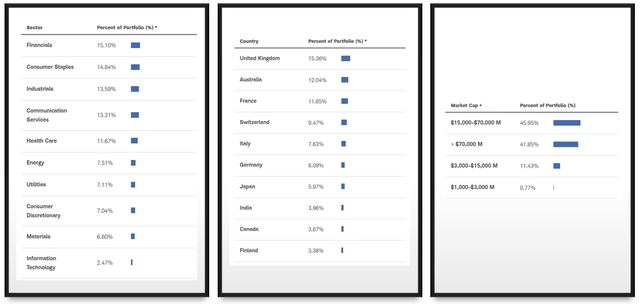

Stocks are weighted quarterly and can make up no more than 4% of the index; sector representation can be no more than 15% of the Index. Emerging market exposure is capped at 15%.

Portfolio Construction

SCHY is fully invested in international equities across 103 holdings, the majority of which are mid- to large-cap stocks. The top-weighted country exposure includes the UK at 15.36%, Australia at 12%, and France at 11.65%. Industry exposure is heavily weighted to financials and consumer staples, making up 15% and 14.84% of the total portfolio weight, respectively.

The top 10 holdings make up 40% of the total portfolio weight, while the bottom 10 make up 0.75% of the portfolio weight. Top companies within the strategy include British American Tobacco (BTI) at 4.76%, Wesfarmers (OTCPK:WFAFF) at 4.21%, and BHP Group (BHP) at 4.17%. British American Tobacco is known for its cigarette brands, including Camel, Newport, and Natural American Spirit. Wesfarmers is an outdoor living and building materials retailer, similar to Fleet Farm in the US Midwest. BHP is an international mining company and is a primary supplier of copper, iron ore, and coal.

Corporate Filings

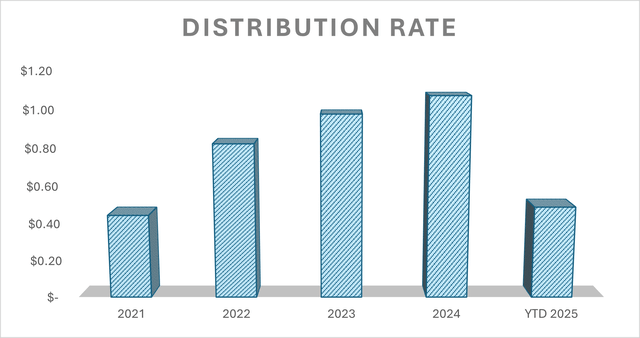

SCHY pays out an appealing quarterly distribution rate of $1.05/share, yielding 3.72% on a trailing twelve-month basis. SCHY transitioned from semiannual distributions to quarterly distributions in 2024. Comparing annualized distributions, SCHY has exhibited annual growth since inception.

Corporate Filings

How to Invest in SCHY

SCHY can be used as a passive income strategy with international exposure. Given that this is an indexed investment vehicle, investors will be responsible for managing this holding as part of a portfolio strategy. This may require some tactical positioning by the investor in order to manage risk. Distributions may come in the form of capital gains and dividend income, making SCHY a good investment candidate for tax-deferred accounts like an IRA or 401(k). For advisors, SCHY can provide international exposure across market sectors.

Seeking Alpha

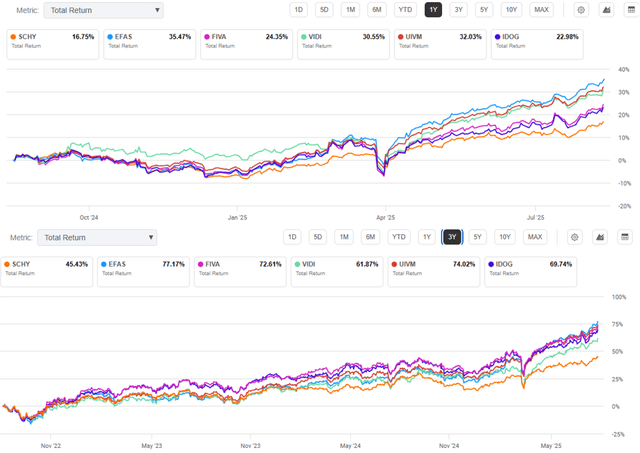

Compared to peer strategies, SCHY is the lowest cost strategy. SCHY is one of the larger portfolio strategies with $1.3b in AUM while providing substantially more depth for active trading. Despite these factors, SCHY has underperformed peer international dividend income strategies across historical periods on a total return basis.

The top-performing peer is the Global X MSCI SuperDividend EAFE ETF (EFAS), outperforming peers across most historical periods. Despite the appealing performance, EFAS has a mere $30mm in AUM and more restrictive liquidity. EFAS may be seen as a relatively more diversified strategy, with the top 10 holdings making up only 22% of the total portfolio weight despite only holding 58 stocks.

Seeking Alpha

Risks Related to SCHY

Index funds are not actively managed, meaning that they are designed to reflect the underlying Index, providing investors with passive performance. As a result, it is left to the investors to actively manage their positions and risk in order to achieve their investment mandate. This compares to an actively managed strategy where professional portfolio managers aim to beat their stated benchmark by actively managing portfolio risk, whether it’s through stock selection or active weights.

SCHY may expose investors to country risk, including geopolitical, economic, and exchange rate and interest rate risk. SCHY may also be exposed to some liquidity risk relating to foreign investments.

Final Thoughts

SCHY can provide investors with low-cost exposure to dividend-paying international stocks. Given that this is an indexed strategy, investors should consider tactical positioning as the strategy is not actively managed and shouldn’t be expected to deliver optimized performance.

This article answers these three main questions about SCHY:

- Is SCHY actively or passively managed?

- Does SCHY provide investors with dividend income from international stocks?

- Are there specific risks associated with SCHY and international investments?

Editor’s note: This article is intended to provide a general overview of the ETF for educational purposes only and, unlike other articles on Seeking Alpha, does not offer an investment opinion about the ETF.

Read the full article here