Thanks to Jerome Powell and his crew at the Federal Reserve, interest rates are about five percentage points higher than they were a year ago. For stock pickers, that means that debt once again matters.

This should be a good environment for folks who prefer low-debt companies. Beginning in 1998, I’ve written 20 columns recommending low-debt stocks. My low-debt picks have beaten the market 13 times out of 20—but only once in the past five years, when interest rates were freakishly low.

Here are my new low-debt picks.

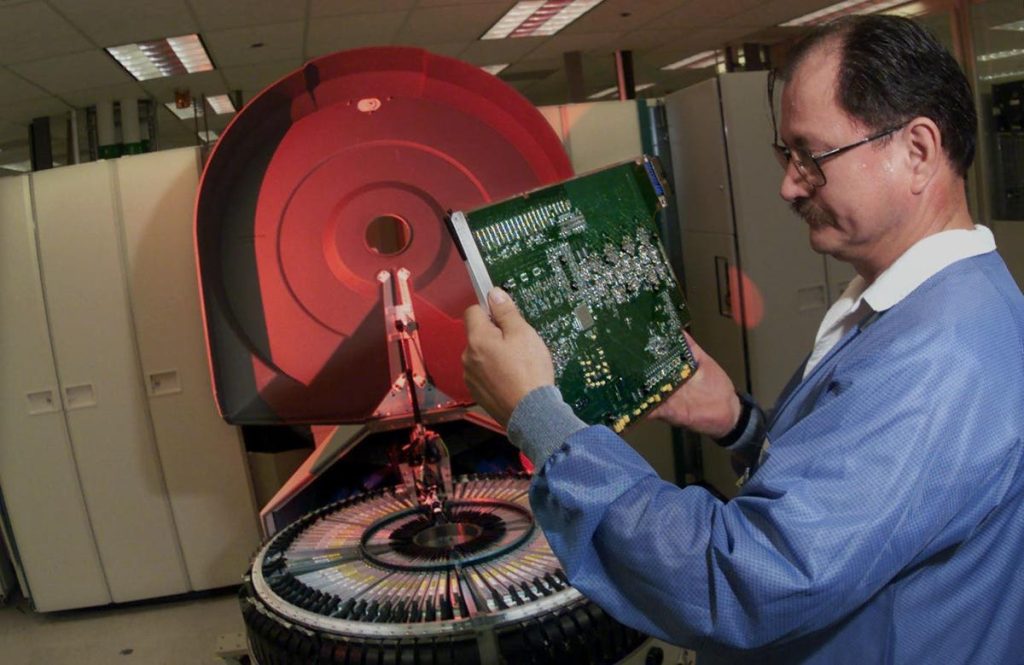

Teradyne

Makers of semiconductor chips need to test them, and testing is a mini-industry of its own. One of the leaders in Teradyne

TER

All the stocks in this industry are volatile, and Teradyne is no exception. In the past year it’s been as high as $112, and as low as $68. As I write this, it trades for about $93, which is 24 times recent earnings. That’s a higher multiple than I usually pay, but Teradyne’s five-year earnings growth rate is 29%, and the company’s debt is only 5% of stockholders’ equity (corporate net worth).

Moderna

I’ve recommended Moderna a few times in this column, and most readers have no reason to thank me. The stock is about 35% off its high, reached last December.

Is Moderna a one-trick pony? It vaulted to prominence on the strength of its Covid-19 vaccine, and its revenue and profits swelled in 2021 and 2022. Now, as the pandemic fades, both revenue and earnings are dropping fast.

My liking for the stock is based on the belief that its messenger RNA technology will prove useful in combatting other diseases, possibly including cancer. Also, I like the fact that debt is only 5% of equity.

Cullen/Frost

Investors have pummeled regional bank stocks this year after several banks failed. Higher interest rates rendered their loan portfolio less valuable, since many loans were issued at lower rates. That probably tees up some bargains and I think Cullen/Frost Bankers (CFR) is one.

The stock is 36% off its high, and sells for only 10 times earnings. Debt is 6% of equity. Based in San Antonio, Texas, the bank serves commercial customers and consumers in its home state. It has shown a profit at least 30 years in a row, and a few insiders have nibbled at the stock this spring.

Cal-Maine Foods

CALM

CALM

Altogether debt-free Cal-Maine is the nation’s largest egg producer. You might think eggs would be a steady business. Not so. Feed prices can fluctuate wildly, chicken flocks can suddenly get smaller because of avian flu, and even the selling price for eggs is surprisingly volatile.

The price of eggs soared in 2022 and now seems to be coming back to earth, so investors afford Cal-Maine stock a miserly multiple of three time recent earnings.

Unlike many companies that smooth out their dividends, Cal-Maine pays big dividends in good years and small dividends in poor ones. For the moment, the dividend yield is 10%.

Insteel

Increased federal spending on bridges, tunnels and highways could be good for Insteel Industries (IIIN), which makes rebar, steel bars used to strengthen concrete structures. Insteel’s debt is only 1% of equity, and it has more than $65 in cash for each dollar of debt.

You might think that this would be a cyclical company with up-and-down earnings, but actually earnings have been fairly consistent, with a profit in 13 of the past 15 years.

The Record

Over the years, my low-debt picks have achieved an average 12-month return of 25.2%. That compares extremely well with the 10.4% return on the Standard & Poor’s Total Return Index over the same periods.

Yes, I know that a 25% average return is hard to believe. That average was helped by returns of 72% on my 1998 picks, 139% on my 2000 picks, 56% on my 2004 picks, and 103% on my 2020 picks. Frankly, I would expect the average to come down some as the years roll on, but I still hope for high returns.

Bear in mind that my column results are hypothetical and shouldn’t be confused with results I obtain for clients. Also, past performance doesn’t predict the future.

Last year was one of five years in which my picks were unprofitable. They fell 10.1% while the S&P’s total return was 5.4%. Intrepid Potash

IPI

GILD

Disclosure: I own Moderna personally and for some of my clients. Some clients own Cal-Maine.

Read the full article here