By Mark Barnes, Ph.D., and Christine Haggerty, Global Investment Research

The global equity rally that began last October made further headway in April, with most indexes adding to their robust first-quarter gains. Beneath the surface, however, big shifts in market and sector leadership reveal far more investor angst than these upbeat results may suggest.

As we cover in our latest Market Maps Performance Insights report, the UK, Japan, and Developed Europe outperformed the FTSE All-World index and their developed peers in April, particularly the US. The Emerging index fell, dragged down by steep selloffs in China and Taiwan. US small caps were the worst performers for both the month and the year so far.

Regional equity returns (TR %) – One month ended April 30, 2023

Data as of April 30, 2023. Past performance is no guarantee to future results. Please see the end for important disclosures (FTSE Russell)

April leadership exposes defensive drift

Arguably, the strongest evidence of investors’ more cautious positioning was the huge U-turn among winners and losers in April from trends earlier in the year. Fueled mostly by the banking sector panic in March, technology, consumer discretionary and industrials outperformed in Q1, while financials plunged, as investors sought refuge in the stocks of financially healthy companies viewed as better equipped to withstand any potential economic and credit-market fallout. These Q1 growth outperformers also benefited from the sharp pullback in discount rates triggered by the crisis.

April turned this hierarchy on its head. Amid lingering worries about the US banking system and slowing global growth, investors abandoned tech and other growth stocks in favor of less cyclically sensitive stocks, such as those in personal care, food producers, household products, and drug makers, whose earnings tend to remain steady regardless of the state of the economy. Growth stocks were also hurt by Q1 earnings disappointments, while financials got a lift from stronger-than-expected quarterly results and waning worries about the global banking system (though those have flared again more recently.)

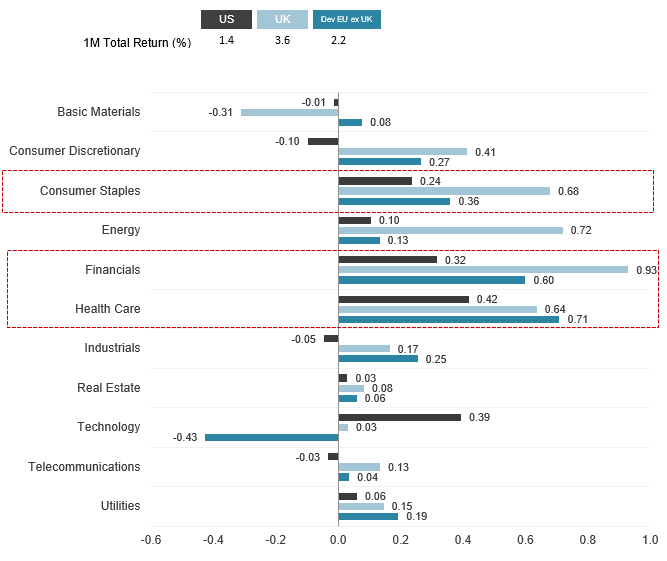

Regional industry returns (TR, LC) – One month ended April 30, 2023

Based on Industry Classification Benchmark data as of April 30, 2023. Past performance is no guarantee of future results. Please see the end for important legal disclosures. (FTSE Russell)

These performance shifts filtered into the industry-weighted contribution to returns in the US, UK, and Developed Europe returns, as shown below.

Industry-weighted contributions to returns (TR, %) – One month ended April 30, 2023

Based on Industry Classification Benchmark data as of April 30, 2023. Past performance is no guarantee of future results. Please see the end for important legal disclosures (FTSE Russell)

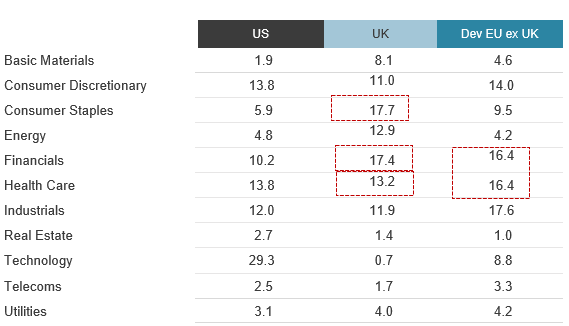

The investor gravitation into defensive stocks also underpinned leadership among the major equity markets. The outperformance of the UK and Developed Europe indexes over their global peers owes much to their more diversified industry exposures and defensive tilts. The UK benefited significantly from its large exposures to outperforming staples, financials, and health care (see chart below), while largely avoiding weakness in tech stocks in April. Likewise for the Developed Europe index, in which financials and health care each make up 16%. By contrast, these winning industries made far smaller contributions to US returns, while the drawdowns in discretionary and industrial stocks were major drags.

Industry index weights (TR %) as of April 30, 2023

Based on Industry Classification Benchmark data as of April 30, 2023. Past performance is no guarantee of future results. Please see the end for important legal disclosures (FTSE Russell)

The underperformance of US small caps is further evidence of the more cautious currents sweeping through markets lately. As illustrated below, the strong investor preference for larger players in the banking, technology (software and hardware), and energy industries contributed most to Russell 1000’s edge over the small-cap index in March and April, overshadowing the impact of the latter’s far bigger weights in financials and health care.

Russell 1000 sectors’ relative returns vs Russell 2000 sectors (TR, rebased, LC)

Based on Industry Classification Benchmark data as of April 30, 2023. Past performance is no guarantee of future results. Please see the end for important legal disclosures (FTSE Russell)

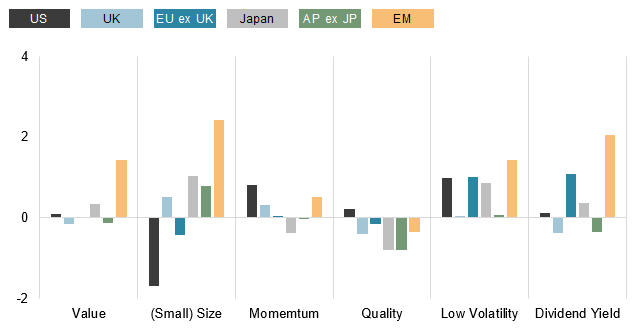

The low Volatility factor also shines

Equity factor performance also displayed a more guarded tone in April: The Low volatility factor outperformed broad-market benchmarks and most other factors in most regions, especially versus post-pandemic champion Value. As we discussed in a recent blog post, in most markets, Quality did a complete 180-degree turn from its winning streak in Q1, hurt mainly by its large exposure to the sharp reversal in tech and other growth-tilted stocks.

Regional factor returns relative to home market (TR, local currency) – One month ended April 30, 2023

Data as of April 30, 2023. Past performance is no guarantee of future results. Please see the end for important legal disclosures (FTSE Russell)

Thanks to its strong rebound in March and April, Low Vol returned to positive territory in most markets (except the UK) for the 12 months.

Regional Low Volatility factor returns relative to home markets (TR, rebased)

Data through April 30, 2023. Past performance is no guarantee of future results. Please see the end for important legal disclosures (FTSE Russell)

No one knows how long this cautious mood is likely to persist, but the newfound investor interest in defensive stocks seems a reasonable response to the extreme uncertainty currently looming over the outlook for the global economy and future monetary policy.

© 2023 London Stock Exchange Group plc and its applicable group undertakings (the “LSE Group”). The LSE Group includes (1) FTSE International Limited (“FTSE”), (2) Frank Russell Company (“Russell”), (3) FTSE Global Debt Capital Markets Inc. and FTSE Global Debt Capital Markets Limited (together, “FTSE Canada”), (4) FTSE Fixed Income Europe Limited (“FTSE FI Europe”), (5) FTSE Fixed Income LLC (“FTSE FI”), (6) The Yield Book Inc (“YB”) and (7) Beyond Ratings S.A.S. (“BR”). All rights reserved.

FTSE Russell® is a trading name of FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, YB, and BR. “FTSE®”, “Russell®”, “FTSE Russell®”, “FTSE4Good®”, “ICB®”, “The Yield Book®”, “Beyond Ratings®” and all other trademarks and service marks used herein (whether registered or unregistered) are trademarks and/or service marks owned or licensed by the applicable member of the LSE Group or their respective licensors and are owned, or used under licence, by FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, YB or BR. FTSE International Limited is authorised and regulated by the Financial Conduct Authority as a benchmark administrator.

All information is provided for information purposes only. All information and data contained in this publication is obtained by the LSE Group, from sources believed by it to be accurate and reliable. Because of the possibility of human and mechanical error as well as other factors, however, such information and data is provided “as is” without warranty of any kind. No member of the LSE Group nor their respective directors, officers, employees, partners or licensors make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to the accuracy, timeliness, completeness, merchantability of any information or of results to be obtained from the use of FTSE Russell products, including but not limited to indexes, data and analytics, or the fitness or suitability of the FTSE Russell products for any particular purpose to which they might be put. Any representation of historical data accessible through FTSE Russell products is provided for information purposes only and is not a reliable indicator of future performance.

No responsibility or liability can be accepted by any member of the LSE Group nor their respective directors, officers, employees, partners, or licensors for (A) any loss or damage in whole or in part caused by, resulting from, or relating to any error (negligent or otherwise) or other circumstance involved in procuring, collecting, compiling, interpreting, analysing, editing, transcribing, transmitting, communicating or delivering any such information or data or from use of this document or links to this document or (B) any direct, indirect, special, consequential or incidental damages whatsoever, even if any member of the LSE Group is advised in advance of the possibility of such damages, resulting from the use of, or inability to use, such information.

No member of the LSE Group nor their respective directors, officers, employees, partners, or licensors provide investment advice and nothing in this document should be taken as constituting financial or investment advice. No member of the LSE Group nor their respective directors, officers, employees, partners, or licensors make any representation regarding the advisability of investing in any asset or whether such investment creates any legal or compliance risks for the investor. A decision to invest in any such asset should not be made in reliance on any information herein. Indexes cannot be invested in directly. Inclusion of an asset in an index is not a recommendation to buy, sell or hold that asset nor confirmation that any particular investor may lawfully buy, sell or hold the asset or an index containing the asset. The general information contained in this publication should not be acted upon without obtaining specific legal, tax, and investment advice from a licensed professional.

Past performance is no guarantee of future results. Charts and graphs are provided for illustrative purposes only. Index returns shown may not represent the results of the actual trading of investable assets. Certain returns shown may reflect back-tested performance. All performance presented prior to the index inception date is back-tested performance. Back-tested performance is not actual performance but is hypothetical. The back-test calculations are based on the same methodology that was in effect when the index was officially launched. However, back-tested data may reflect the application of the index methodology with the benefit of hindsight, and the historic calculations of an index may change from month to month based on revisions to the underlying economic data used in the calculation of the index.

This document may contain forward-looking assessments. These are based upon a number of assumptions concerning future conditions that ultimately may prove to be inaccurate. Such forward-looking assessments are subject to risks and uncertainties and may be affected by various factors that may cause actual results to differ materially. No member of the LSE Group nor their licensors assume any duty to and do not undertake to update forward-looking assessments.

No part of this information may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of the applicable member of the LSE Group. Use and distribution of the LSE Group data requires a licence from FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, YB, BR, and/or their respective licensors.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here