Vista Outdoor Inc. (NYSE:VSTO) is in the process of splitting itself into two publicly traded companies. By doing so, management hopes the market will place a higher valuation (in terms of a multiple of adjusted EBITDA) on Vista Outdoor’s non-ammunition businesses than it is currently (while more or less maintaining the same valuation on a multiple of adjusted EBITDA basis for its ammunition business), as the separation could encourage the market re-rate the value of Vista Outdoor’s equity. There could be significant capital appreciation upside here as the spinoff gets closer to being finalized, though it may not be until after the separation has been completed that the market will re-rate the equity of the two new companies.

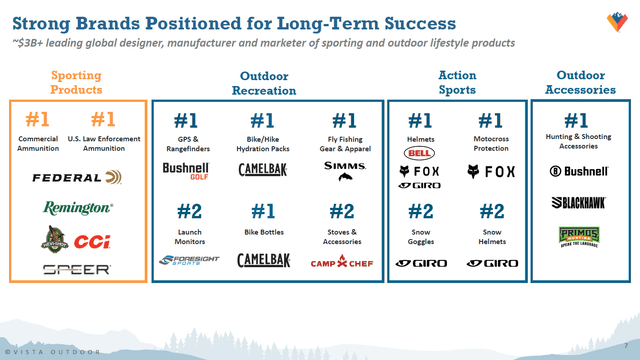

The company’s ‘Sporting Products’ business reporting segment is primarily focused on manufacturing and selling ammunition under brands such as Federal and Remington. Its ‘Outdoor Products’ business reporting segment is primarily focused on designing and selling a wide variety of products under numerous brands including GPS and rangefinder systems under the Bushnell Golf brand, hunting and shooting accessories under the Bushnell and Blackhawk brands, stoves and related accessories under the Camp Chef brand, helmets for motorcycling and winter sports under the Bell, Fox, and Giro brands, hydration packs under the CamelBak brand, and much more.

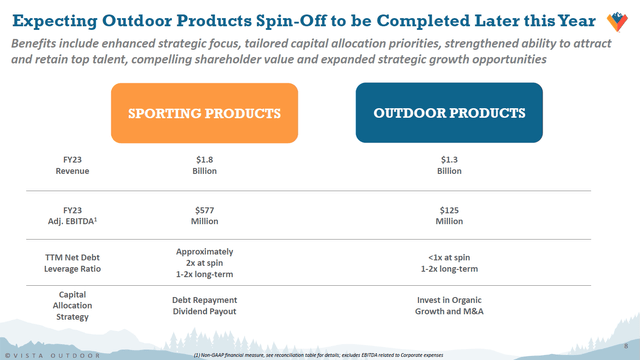

By splitting its Sporting Products unit from its Outdoor Products unit, Vista Outdoor aims to improve the operational focus and capital allocation options of both units. The goal is to spinoff the company’s Outdoor Products unit to investors in a tax-free manner by the end of calendar year 2023. Once the spinoff has been completed, there will be two standalone publicly traded companies with one focused on manufacturing and selling ammunition and the other focused on designing and selling outdoor products.

Vista Outdoor is splitting its business into two standalone publicly traded companies. (Vista Outdoor – Fourth Quarter FY2023 Earnings IR Presentation)

Valuation Boost

One of the most important reasons behind the planned split is that it could potentially boost the valuation investors are willing to place on the company’s Outdoor Products unit as a standalone entity. Put another way, Vista Outdoor’s management team does not think the market is properly evaluating the company’s future financial performance for qualitative reasons that I will go over in just a moment. During Vista Outdoor’s latest earnings call held in May 2023, management noted that:

Our company currently trades about 5 times enterprise value to fiscal year 2024 EBITDA, in line with ammunition and sporting company peers. While pure-play Outdoor Products focused peers tend to trade at double digit enterprise value to EBITDA, we believe this value is not being reflected in our current trading price. And after the spin, we expect that our Outdoor Products segment should move towards trading at similar multiples to its outdoor peers.

Given the rise of ESG investing and similar investment strategies that could potentially screen out companies with ammunition operations, management’s reasoning behind the split makes sense, in my view. The upside that improved operational focus could yield is likely also material. It’s possible that as standalone units these operations would be more desirable from an M&A perspective, meaning a potential buyer would be more likely to acquire assets that operate in the same realm as compared to a company with somewhat disparate operations, though Vista Outdoor has not shown any interest in selling itself at this time.

Vista Outdoor’s Sporting Products segment is its main earnings and cash flow generator. (Vista Outdoor – Fourth Quarter FY2023 Earnings IR Presentation)

Financial Performance

In fiscal 2023 (period ended March 31, 2023), Vista Outdoor generated $3.1 billion in GAAP net sales, up 1% year-over-year due to modest revenue growth at both its Sporting Products (sales rose by 1% to reach $1.8 billion) and Outdoor Products (sales rose by 1% to reach $1.3 billion) segments. The company’s GAAP gross margin fell by over 295 basis points from fiscal 2022 to fiscal 2023 to reach 33.5% as commodity pricing increases, rising freight and product expenses, and decreased volumes took their toll on Vista Outdoor’s profitability levels.

A combination of declining gross margins, meaningful operating expense growth (R&D and SG&A expenses were up a combined 19% year-over-year), and a $0.4 billion impairment charge saw Vista Outdoor’s GAAP operating income come in at $0.1 billion in fiscal 2023 versus $0.6 billion in fiscal 2022. The company reported -$0.17 (negative $0.17) in GAAP diluted EPS in fiscal 2023 as net interest expenses and corporate income tax expenses pushed the firm’s bottom-line into the red.

I define free cash flow as net operating cash flow less capital expenditures. This is the money that companies can use to pay dividends, buyback their stock, and bolster their balance sheet strength in an organic manner. Vista Outdoor generated ~$0.45 billion in free cash flow in fiscal 2023 and did not repurchase a meaningful amount of its stock. Historically, the company has been a solid free cash flow generator (Vista Outdoor was also comfortably free cash flow positive in fiscal 2022). The firm does not pay a common dividend at this time, though it could if it wanted to.

Guidance

Looking ahead, Vista Outdoor expects its financial performance on a consolidated basis will face sizable headwinds. The company is guiding for $2.85-$2.95 billion in revenues in fiscal 2024, down 6% year-over-year at the midpoint. Sales at its Sporting Products segment are expected to come in at $1.475-$1.575 billion this fiscal year (down 13% year-over-year at the midpoint of guidance) and sales at its Outdoor Products segment are expected to come in at $1.375-$1.475 billion in fiscal 2024 (up 6% year-over-year at the midpoint of guidance).

What makes its sales forecast sting (a bit) is that the forecasted non-GAAP adjusted EBITDA margin of its Sporting Products unit for fiscal 2024 is 26.75%-27.75% versus 12%-13% at its Outdoor Products unit.

It’s worth noting that Vista Outdoor expects to see a major improvement in the profitability of its Outdoor Products segment in fiscal 2024, which posted an adjusted EBITDA margin of 9.5% in fiscal 2023. Growing economies of scale via organic sales growth is partially why management is optimistic on Vista Outdoor’s performance here. However, profitability at the company’s Sporting Goods segment is expected to fall in fiscal 2024 after posting an adjusted EBITDA of 32.8% in fiscal 2023 (the expected decline in its economies of scale in fiscal 2024 is a difficult headwind to circumvent).

The company’s Sporting Goods segment is Vista Outdoor’s major earnings and cash flow generator. Its operations here are supported by four domestic ammunition manufacturing facilities.

Vista Outdoor expects to generate $4.50-$5.00 in EPS and $290-$340 million in free cash flow (as per the company’s definition) this fiscal year. The firm’s consolidated growth trajectory is contending with some hurdles though its underlying business remains comfortably profitable. Capital expenditures are guided to be 1.5% of Vista Outdoor’s sales in fiscal 2024, equivalent to ~$44 million at the midpoint of its sales guidance, which if realized would be up moderately from the $39 million it spent in fiscal 2023. The company is guiding for $65-$75 million in interest expenses in fiscal 2023, up from $59 million net interest expenses in fiscal 2023.

At the end of March 2023, Vista Outdoor had $0.1 billion in cash and cash equivalents on hand versus $0.1 billion in short-term debt and $1.0 billion in long-term debt. Once the spinoff is complete, the Sporting Products segment is expected to retain the bulk of Vista Outdoor’s total debt load and management expects to use the standalone firm’s free cash flows to steadily reduce leverage at the new unit. At its Outdoor Products’ segment, this standalone operation post-spinoff is expected to take only a modest portion of Vista Outdoor’s total debt load and may utilize capital markets to fund growth endeavors by investing in the business (organic growth) and pursuing M&A deals (inorganic growth).

Concluding Thoughts

Vista Outdoor is making the right call by separating its ammunition-focused business from its outdoor products-focused businesses. There is a very good chance that the market will re-rate the value of its Outdoor Products segment once the spinoff is complete as funds with ESG investing criteria that were previously screening out ammunition-related names will be able to invest in the new publicly traded company.

Shares of VSTO have fallen considerably since the final quarter of 2021, in part due to a moderation of its ammunition sales in the US, though the pending separation should represent a major catalyst for its stock. Vista Outdoor is an intriguing capital appreciation opportunity.

Read the full article here