Alteryx (NYSE:AYX) is another software stock I have been following for some time. I have also covered the stock twice and overall considered it an attractive growth investment opportunity due to its strong product, market leadership, and reputation in the Data Science & Analytics Automation/DA platform. The first coverage was in December 2019 when the stock was trading at over $110 per share, and the second coverage was in May 2020 when the share price had risen to over $128. In both instances, my bullish analysis and recommendations were proven right, as the stock would then soar to an all-time high of over $170 per share in July 2020.

However, since then, the share price has gradually declined due to the tightening IT spend environment caused by the ongoing economic downturn. Most recently upon its Q1 2023 earnings announcement last month, the stock was under selloff pressure most likely due to missing revenue estimates. Today, the stock is trading at around $36 per share, down ~28% from before the Q1 earnings call.

Having assessed Alteryx’s future growth prospect as of Q1 2023 myself, I continue to maintain my bullish position in the stock and initiate this third coverage with another buy rating. There are a few catalysts:

- The enterprise footprint remains intact. The churning customers in Q1 came from the lower-end segment of ARR spend. On the contrary, expansion sales motion on the higher-end/enterprise continues to be solid.

- Designer Cloud to drive significant new land opportunities post-downturn.

Furthermore, at $36 per share, the stock presents a bargain opportunity for investors willing to take a long-term view of the company’s prospects.

In this coverage, I will go over Alteryx’s brief background, product, business models, customers, recent financial highlights, catalyst, market landscape/competition, and risk, before jumping into estimating Alteryx’s fair target price.

Alteryx’s Brief Background – Product/Business Models/Customers

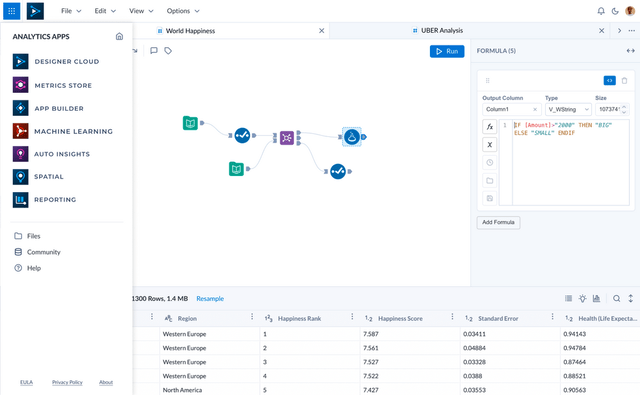

Alteryx is a software company that develops and markets DA platform for businesses. Its products allow organizations to access, prepare, and analyze data from various sources to produce insights and make data-driven decisions. The platform includes a suite of tools such as data blending, advanced analytics, and machine learning, which enable users to clean, transform, and analyze data without the need for complex coding or programming – also termed as no-code/low code functionalities.

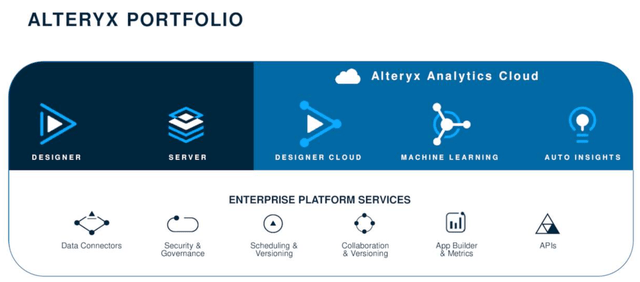

Its products, including Alteryx Designer, were initially offered as a desktop-only application. Since last year, though, Alteryx has begun offering its cloud-based DA platform, Alteryx Analytics Cloud.

AYX Q1 presentation

Upon the acquisition of cloud-based no-code data platform Trifacta last year, Alteryx then modified Trifacta’s platform and fit it into the Analytics Cloud as Alteryx Designer Cloud. The comprehensive list of its offering is as follows:

- Alteryx Designer: This product provides a drag-and-drop interface for data profiling, preparation, blending, and analytics. It allows users to create visual workflows or analytic processes, making it easier to analyze data and generate insights.

- Alteryx Server: This secure and scalable server-based product allows users to schedule, share, and run analytic processes and applications in a web-based environment. It provides a centralized location for storing and sharing workflows and results.

- Alteryx Connect: This collaborative data exploration platform helps users discover information assets and share recommendations across the enterprise. It allows users to search for and access data sets, see how data is connected, and collaborate with others on data projects.

- Alteryx Intelligence Suite: This suite of products includes automated modeling, optical character recognition, and natural language processing to gain insights and produce production models using artificial intelligence.

- Alteryx Analytics Cloud: This cloud-based platform includes three products:

-

Alteryx Designer Cloud: This cloud-native data profiling, preparation, and data pipelining product allows users to create visual workflows or analytic processes through the drag-and-drop interface.

-

Alteryx Machine Learning: This cloud-based solution provides automated machine learning or AutoML, allowing business analysts to quickly build, validate, iterate, and explore machine learning models with a fully guided user experience.

-

Alteryx Auto Insights: This cloud-native analytics solution uses artificial intelligence-driven data discovery to perform root cause analysis of business trends and automate insights for business users. It is built specifically for enterprises.

-

The company operates on a subscription-based business model, where customers pay for licenses to access its software platform on a recurring basis. The company generates revenue primarily through subscription fees and also offers professional services to assist customers with implementation and optimization of the platform.

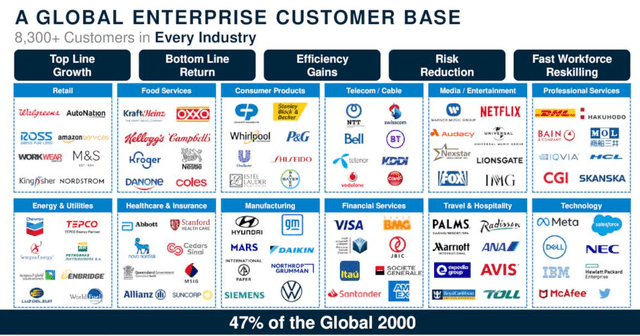

Though Alteryx is used by organizations of all sizes across all industries, its main focus and largest customer segment is the enterprise. Based on the information from its latest 10-K in December 2022, it has over 8,000 customers, including 930 of the Global 2000 companies such as Netflix (NFLX), Delta Air Lines (DAL), and Salesforce (CRM).

Q1 2023 Highlights

Here is a recap of Alteryx’s Q1 performance, along with relevant commentary:

- Q1 revenue of $199.09 million, a +26.1% YoY growth, but misses the estimate by $0.98 million – as mentioned by the management during the earnings call, the tough macro situation had put pressure on Alteryx’s enterprise sales motion by unexpectedly lengthening the deal cycle.

- Q1 ARR of $857 million, a 25% YoY growth – ARR growth had slowed down to 25% from a +30% level over a year ago.

- Q1 dollar-based net expansion rate/DBNER of 121% – One of the things Alteryx has done well over the years is maintaining expansion motion. DBNER has been consistent at ~120%.

- Issued $450 million aggregate principal amount of 8.75% senior notes due in 2028 in a private offering – in contrast to previous senior notes issued pre-COVID, this 2028 senior note carries a significantly higher interest rate.

- Q2 guidance: revenue is expected to be in the range of $180 million to $184 million, representing YoY growth of 0% – 2% – the Q2 revenue growth seems depressed, but it is merely an effect of Alteryx’s revenue recognition.

- Q2 ARR is expected to be in the range of $902 million to $906 million, representing YoY growth of 24% – 25%.

- FY 2023 guidance: revenue is expected to be in the range of $980 million to $990 million, representing YoY growth of 15% – 16%.

- FY 2023 ARR is expected to be in the range of $1.015 billion to $1.025 billion, representing YoY growth of 22% – 23%.

- FY 2023 Non-GAAP operating income is expected to be in the range of $80 million – $90 million.

- FY 2023 Non-GAAP EPS is expected to be in the range of $0.65 – $0.75 based on approximately 77.1 million non-GAAP weighted-average diluted shares outstanding.

Overall, the FY 2023 expectation of +15% revenue and +20% ARR growth suggests that Alteryx will do relatively well in spite of the ongoing macro downturn. Alteryx will also expect to deliver a positive Non-GAAP operating income for the year, which demonstrates a commitment to cost discipline.

Nonetheless, while the operating margin looks good on a Non-GAAP basis, Alteryx still has a long way to go in improving its GAAP operating margin. Alteryx has consistently been incurring significant Stock-Based Compensation/SBC expenses due to the uptrend in headcount addition, especially since the beginning of FY 2022. In Q1 2023, the Non-GAAP operating margin was -9% while the GAAP version of it was -44% – a massive difference. Alteryx is also looking to address this issue as it looks to narrow that gap in FY 2023. As we understood from the Q1 earnings call, Alteryx’s surge in hiring in 2022 will be followed by an 11% headcount reduction.

Catalyst

One of the things that make Alteryx interesting is its enterprise growth story. For many cloud software vendors with seat-based pricing, entering the enterprise segment is a key growth driver. An enterprise customer is generally a steady business with a relatively high purchasing power, which neutralizes the risk of it churning due to going out of business, a case seen often in SMB-focused software vendors. Aside from the ability to sell its product at a higher pricing point, the vendor would also sell significantly more seats with a better opportunity to upsell and cross sell.

AYX Q1 presentation

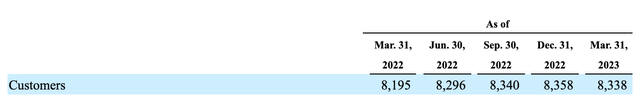

As of Q1 2023, we see how Alteryx’s enterprise penetration continues to be strong and growing. It has over 8,300 customers, which together make up 47% of Global 2000. As a comparison, Global 2000 penetration was 45% last year, indicating an improvement today. In the case of Alteryx, I think having this sort of enterprise footprint provides a safety net for the company. Overall, Alteryx’s enterprise customers appear to have been minimally affected by the IT spend rationalization trend.

AYX 10k – customers

Despite ending Q1 with 8,338 customers – fewer than the previous quarter – we have also learned that the customer churn in Q1 does not come from Alteryx’s enterprise segment (average ARR of ~$100k), but instead from the lower-end segment (average ARR of $15k). Moreover, Alteryx has been seeing higher expansion activities in the Global 2000/enterprise segment than in the overall customer base. Global 2000 DBNER was 131% in Q1, already higher than not only the last year’s figure but also the DBNER from the overall customer base of 121%.

AYX website – Cloud Platform

In addition to maintaining a strong enterprise penetration, I expect Alteryx to see growing adoption of its recently-launched Cloud Analytics Platform, which now has access to the Designer Cloud. Designer has been Alteryx’s most popular and primary product, yet Alteryx has often been criticized due to only making it available in the Windows-only desktop version. The acquisition of Trifacta last year has changed that. Upon integration of the Trifacta platform into Designer, Alteryx now offers a browser-based Designer called Designer Cloud powered by Trifacta.

Having launched the general access just in February this year with the economic downturn ongoing, I expect Alteryx to land new logos with Designer/Analytics Cloud Platform and unlock a lot of growth potential post-FY 2023 as the downturn subsides and IT spend picks up. So far, we have also seen promising early progress in Q1, as suggested by the management in the earnings call:

We are seeing strong early interest in our cloud offerings from both our customers and partner community. The number of customers leveraging our cloud solutions increased over 30% year-over-year in Q1. Our proven ability to quickly create value in high priority use cases with our flagship solutions has earned us the permission from many of our customers to explore incremental use cases and personas within the Alteryx Analytics Cloud platform. For example, we have a multibillion-dollar national commercial landscape customer that has leveraged Designer and Server for several years to unlock significant savings and eliminate single points of failure. In Q1, this customer expanded with additional Designer seats, plus added our cloud-native Auto Insights to provide AI-driven operational insights and visualization for leaders across hundreds of branch offices.

Market Landscape

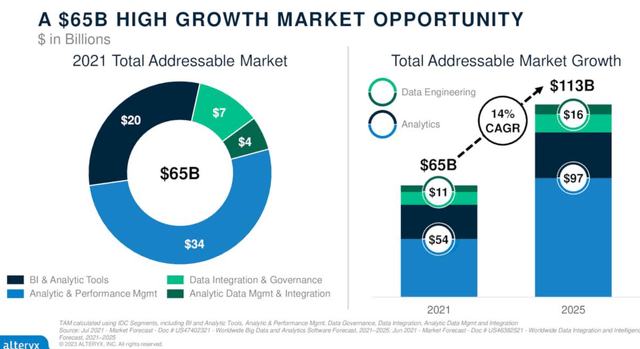

The market for data science and analytics automation solutions has been rapidly growing due to the increasing need for businesses to extract insights from their data. Alteryx estimates the total addressable market/TAM for this space to be $65 billion in 2021, and it is expected to grow at ~14% CAGR to reach $113 billion by 2025.

AYX’s Q1 presentation

In the TAM estimation, Alteryx pieced together a combination of four different adjacent software markets. All these software are addressing distinct, yet related problems in a broader data analytics value chain. The demand for these solutions is driven by the proliferation of big data and the need to make data-driven decisions. Companies are increasingly realizing the value of data analytics in improving their operations and gaining a competitive edge. The data analytics value chain broadly includes data discovery, preparation, and then insight production. Alteryx is known for its core capability in Data Engineering, an activity that mostly happens in the preparation stage.

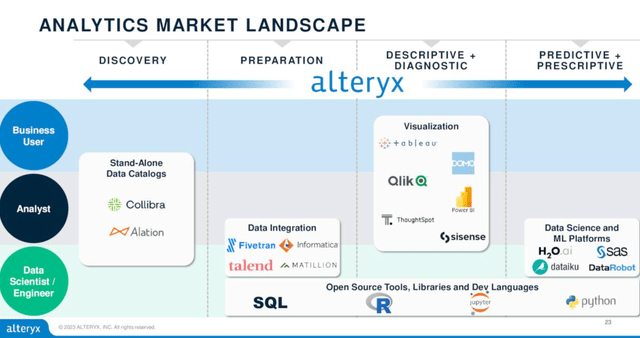

AYX’s Q1 presentation

In one of the presentation slides, Alteryx highlighted its capacity to cover the whole analytics value chain with its solution. While I am not quite sure how to interpret the idea in that slide, it does not seem to be a quite accurate self-assessment as of today. It is true that Alteryx has a visualization feature, however, it has minimal depth and it is not the reason why large customers purchase Alteryx. Today, Alteryx remains well-known for its strength in data preparation. Consequently, when corporates are out looking for a data visualization tool, they do not think of Alteryx. Instead, they think of BI tools.

As the data analytics market evolves in terms of size and demand, so do the solutions. In the process, some software vendors have established themselves as definite leaders in a specific sub-market of data analytics, making the space too competitive for ambitious new entrants. The leadership in the enterprise visualization sub-market has long been held by the BI & Analytics vendors Salesforce Tableau and Microsoft Power BI (MSFT).

Likewise, Alteryx has relatively few identifiable head-to-head competitors, though, given the fact that many BI vendors also offer basic data preparation functionalities, Alteryx points out Microsoft, Oracle (ORCL), Qlik, Tableau, Dataiku, and Databricks as possible competitors in its 10K.

One of the emerging trends in this market is the use of AI and ML to enhance data insights. AI and ML can help automate and streamline data processing, enabling businesses to extract insights faster and more accurately. Alteryx has also incorporated AI/ML technology in its cloud-based AutoML and Auto Insights offerings. BI vendors such as Tableau, Power BI, and Qlik have also started to provide AI/ML features to enhance insight productions.

Risk

Alteryx faces several risks that could impact its business. To begin with, the competitive threat from BI vendors expanding into data preparation space and analytics automation could threaten Alteryx’s market share. As discussed previously, some BI vendors already offer similar functionalities to some extent. Qlik, for instance, offers a data preparation solution and has also been actively expanding into other data analytics sub-market via strategic acquisition.

While Alteryx’s solution remains differentiated, the prolonged economic downturn can potentially alter near-term buying dynamics where the trend of IT spend rationalization in data analytics favor consolidation of tools into BI instead of DA like Alteryx. Alteryx’s expensive pricing can also exacerbate the situation further. As it stands, this would be one of the key areas I am keen to monitor in the next few quarters in 2023.

Alteryx is also still operating quite far away from its target model, though I expect the company to maintain more steady and improved operating margins starting in FY 2023. Considering the recent 11% headcount reduction, it appears that Alteryx had learned that it was a little too aggressive in FY 2022. As per our earlier discussion in the financial section of this coverage, that was the year when SBC had a noticeable increase. Eventually, too much SBC will be counterproductive to Alteryx’s goal of managing shareholders’ dilution.

Valuation/Pricing

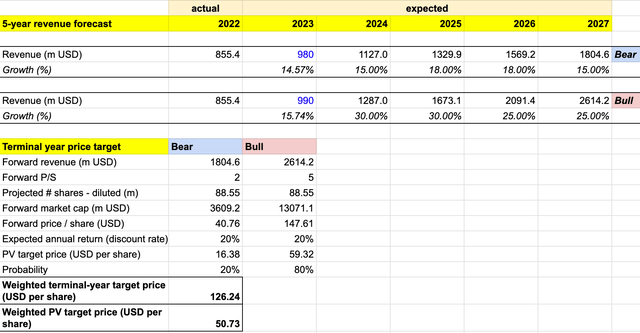

In estimating the price target for Alteryx, I consider the following probability-weighted bull vs bear scenario-based 5-year revenue forecast:

- Bull scenario (80% probability) – economic downturn to subside towards the end of FY 2023, and Alteryx’s revenue to see 30% revenue growth in the next two FYs, driven by the subscription of the Designer Cloud by new logos and Cloud Platform expansion, and then 25% in FY 2026 and FY 2027, with the company emphasizing bottom-line improvements to take it closer to its target model. I also expect a 30% share dilution in FY 2027, the same thing in the bear scenario.

- Bear scenario (20% probability) – economic downturn to prolong into FY 2024. Alteryx to see 15% revenue growth in FY 2024, the same outlook as in FY 2023, and then to see only modest adoption of Designer Cloud with a slight downtick in DBNER in the following years all the way into FY 2027 due to unexpected fundamental shift in buying dynamics. One or two competitors from the BI/visualization space also started expanding into Alteryx’s core DA domain.

In both scenarios, I normalized Alteryx’s annual revenue by removing the appearance of seasonality due to its ASC606 revenue recognition policy. As an example, Alteryx’s FY 2021 revenue growth was merely ~8% YoY while its FY 2022 revenue was ~59%. What happened here was a “push back” effect, where due to lower contract duration in FY 2021, there was less upfront revenue recognized in FY 2021. Nonetheless, ARR growth continued to grow steadily – Alteryx’s FY 2021 and FY 2022 ARR growth rates were 31% and 30% respectively. The normalized projected revenue in the model would track closely the ARR growth pattern.

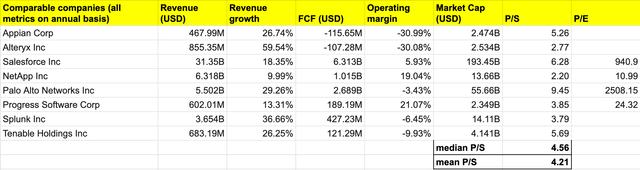

author’s own analysis – AYX comparable companies

Since Alteryx does not really have publicly-traded pure-play competitors I could identify, I estimated my bull-case forward P/S for Alteryx based on the median P/S of software stocks with similar characteristics in at least one or more parameters such as go-to-market, key customer segment, and revenue stream.

The stocks in this universe have multiple product lines, are enterprise-focused, and generate a considerable amount of professional services revenue making up their revenue mix as part of their go-to-market strategy – just like Alteryx. In particular, the latter seems to be the reason why many of these stocks do not have double-digit valuation multiples despite their decent profitability and growth.

Aside from Salesforce/Tableau, none of the companies in the comparable universe provide data analytics/BI solutions. The median P/S of this group is ~5x. Meanwhile, for the bear scenario, I applied a P/S of 2x, a slightly lower multiple than Alteryx’s current P/S of 2.7x.

author’s own analysis – AYX target price model

Consolidating all the information above into my model, I arrived at an FY 2027 weighted target price of +$126 per share in FY 2027. Discounting that target price with a 20% discount rate, I arrived at a Present Value/PV weighted target price of +$50 per share. The 20% discount rate represents the expected annual return, which is a fair expectation for a growth stock like Alteryx.

In summary, the $50 per share is the highest price point at which investors can purchase the stock to realize a projected 20% annual return to achieve the FY 2027 target price of $126. At ~$36 per share today, Alteryx then trades at a ~28% discount to my target price. This suggests that the stock is undervalued, creating an attractive buying opportunity today.

Conclusion

Alteryx has been under pressure due to missing revenue estimates in Q1 2023, leading to a 28% drop in share price. However, the enterprise growth story and the potential of the Designer Cloud product to drive significant new land opportunities post-downturn remain intact, which supports a bullish outlook.

Nevertheless, the competitive threat from BI vendors and the prolonged economic downturn are potential risks that investors should monitor closely. Alteryx is also still operating far from its target model, but steady and improved operating margins are expected to start in FY 2023.

I initiate my coverage with an overweight rating. The stock presents an attractive buying opportunity today, trading at a 28% discount to the target price based on my model.

Read the full article here