A Quick Take On SPS Commerce

SPS Commerce (NASDAQ:SPSC) reported its Q1 2023 financial results on April 26, 2023, beating expected revenue and EPS estimates.

The company provides supply chain management software and related services worldwide.

SPSC has produced continuous revenue growth, higher earnings and has a solid balance sheet and strong free cash flow.

My near-term outlook for SPSC is a Hold.

SPS Commerce Overview

Minneapolis, Minnesota-based SPS was founded in 1987 and provides cloud-based supply chain management solutions globally. From their platform, the company offers solutions to retailers, suppliers, grocers, distributors, and logistics firms to manage their omnichannel orders, optimize their sell-through performance, and automate new trading relationships.

SPS also provides fulfillment, analytics, and complimentary solutions such as assortment and community products. These solutions allow customers to enhance their visibility across their supply chains with greater analytics capabilities, better order management, and rapid fulfillment.

The firm is headed by Chief Executive Officer Archie Black, who has been with the firm since June 1998.

SPS Commerce acquires new customers through its partnerships with retailers, grocers, distributors, and logistics firms.

Additionally, the company relies on marketing and promotional campaigns to advertise its solutions, as well as direct sales activities to acquire new customers.

SPS Commerce’s Market & Competition

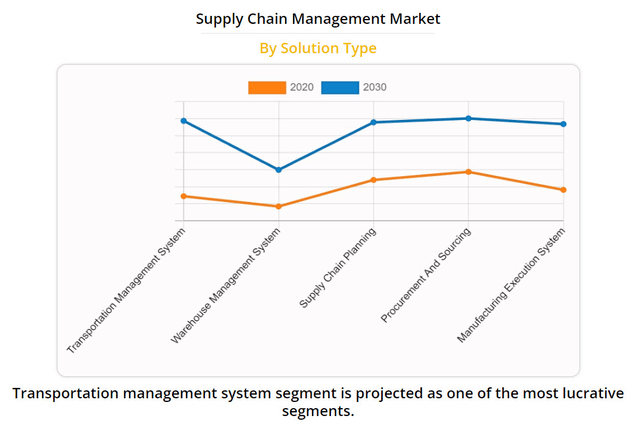

According to a 2021 market research report by Allied Market Research, the market for supply chain management software and services was an estimated $18.7 billion in 2020 and is forecast to reach $52.6 billion by 2030.

This represents a forecast CAGR of 10.7% from 2021 to 2030.

The main drivers for this expected growth are demand for increased supply chain visibility, especially after the disruptions caused by the COVID-19 pandemic and major geopolitical events such as the Russia-Ukraine war.

Also, the chart below shows the supply chain management market changes between 2020 and 2030 by solution type:

Supply Chain Management Market (Allied Market Research)

Major competitive or other industry participants include:

-

Epicor Software

-

Manhattan Associates (MANH)

-

HighJump

-

Info

-

IBM (IBM)

-

JDA Software Group

-

Kinaxis (OTCPK:KXSCF)

-

e2open

-

Oracle (ORCL)

-

SAP (SAP)

-

Descartes Systems Group (DSGX)

-

Others

SPSC’s Recent Financial Trends

-

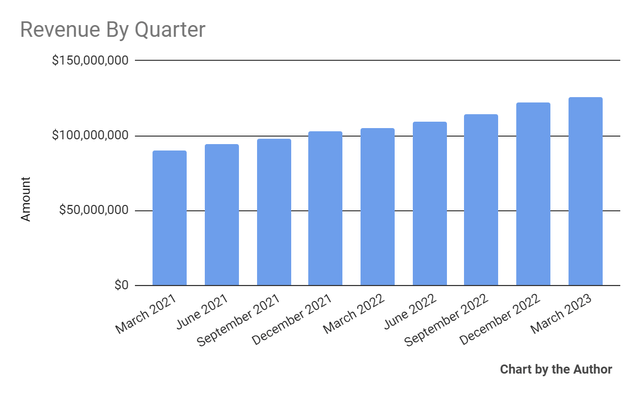

Total revenue by quarter has grown per the following chart:

Total Revenue (Seeking Alpha)

-

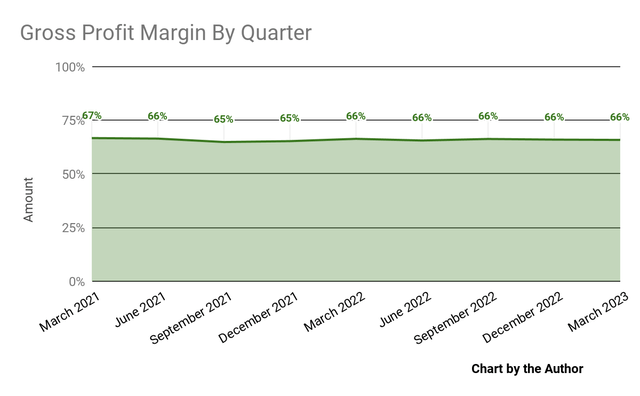

Gross profit margin by quarter has been stable for several quarters:

Gross Profit Margin (Seeking Alpha)

-

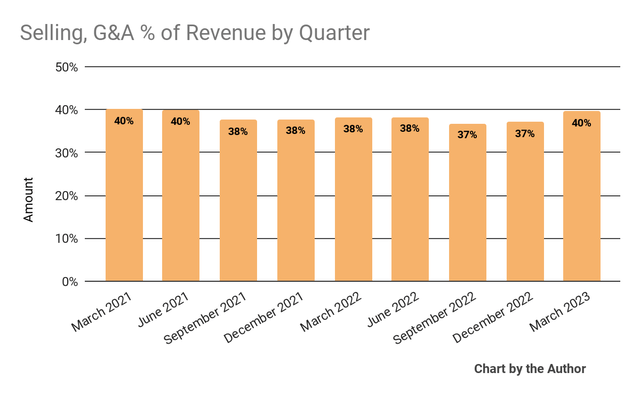

Selling, G&A expenses as a percentage of total revenue by quarter have increased in the most recent reporting period:

Selling, G&A % Of Revenue (Seeking Alpha)

-

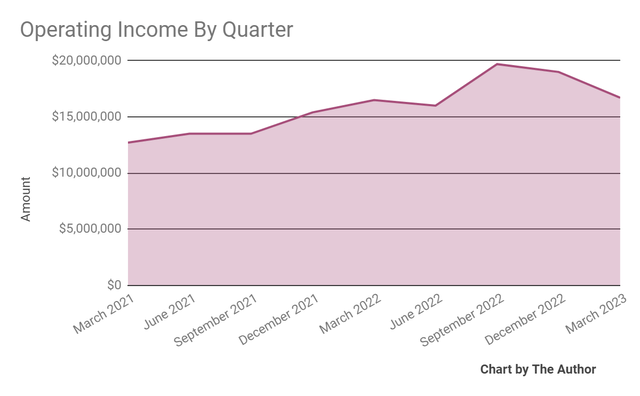

Operating income by quarter has been trending higher, although dropping in the past two quarters, as shown here:

Operating Income (Seeking Alpha)

-

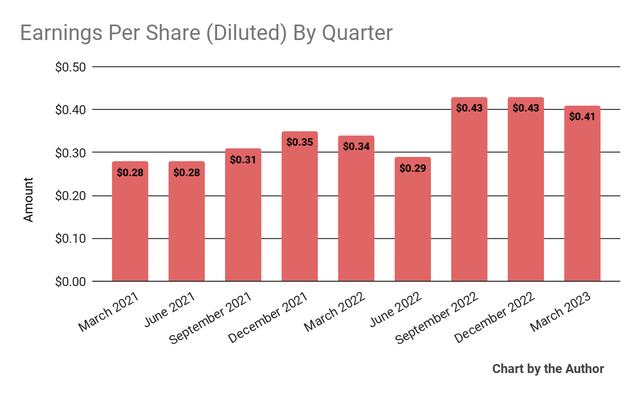

Earnings per share (Diluted) have been trending higher:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

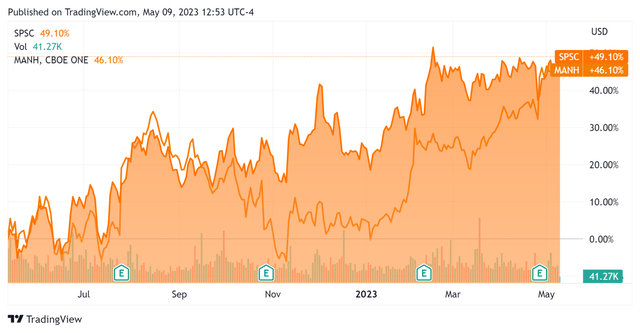

In the past 12 months, SPSC’s stock price has risen 49.1% vs. that of Manhattan Associates’ rise of 46.1%, as the chart indicates below:

52-Week Stock Price Comparison (Seeking Alpha)

For the balance sheet, the firm ended the quarter with $233.5 million in cash, equivalents and short-term investments and no debt.

Over the trailing twelve months, free cash flow was $96.5 million, of which capital expenditures accounted for $20.8 million. The company paid $36.2 million in stock-based compensation in the last four quarters, the highest TTM figure for the last eleven quarters.

Valuation And Other Metrics For SPSC

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

11.2 |

|

Enterprise Value / EBITDA |

51.9 |

|

Price / Sales |

11.5 |

|

Revenue Growth Rate |

17.8% |

|

Net Income Margin |

12.3% |

|

EBITDA % |

21.6% |

|

Market Capitalization |

$5,490,000,000 |

|

Enterprise Value |

$5,280,000,000 |

|

Operating Cash Flow |

$117,340,000 |

|

Earnings Per Share (Fully Diluted) |

$1.56 |

(Source – Seeking Alpha)

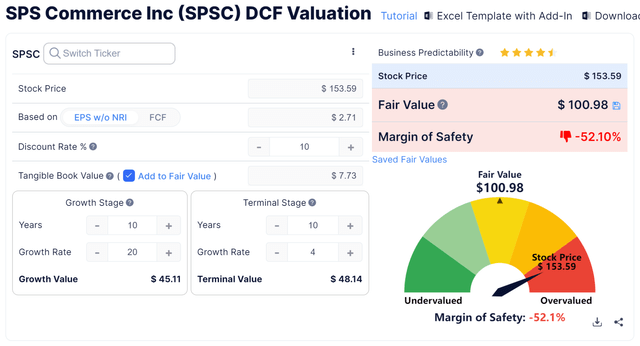

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and 2023 earnings:

Discounted Cash Flow Calculation – SPSC (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $100.98 versus the current price of $153.59, indicating they are potentially currently overvalued, with the given earnings, growth, and discount rate assumptions of the DCF.

As a reference, a relevant partial public comparable would be Manhattan Associates; shown below is a comparison of their primary valuation metrics, which appear to be largely similar:

|

Metric [TTM] |

Manhattan Associates |

SPS Commerce |

Variance |

|

Enterprise Value / Sales |

12.8 |

11.2 |

-12.5% |

|

Enterprise Value / EBITDA |

60.1 |

51.9 |

-13.7% |

|

Revenue Growth Rate |

18.0% |

17.8% |

-1.2% |

|

Net Income Margin |

17.0% |

12.3% |

-27.7% |

|

Operating Cash Flow |

$206,550,000 |

$117,340,000 |

-43.2% |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

SPSC’s most recent Rule of 40 calculation was 39.4% as of Q1 2023’s results, so the firm has performed well in this regard, per the table below:

|

Rule of 40 Performance |

Calculation |

|

Recent Rev. Growth % |

17.8% |

|

EBITDA % |

21.6% |

|

Total |

39.4% |

(Source – Seeking Alpha)

Commentary On SPS Commerce

In its last earnings call (Source – Seeking Alpha), covering Q1 2023’s results, management highlighted the firm’s network model, channel partner focus, suite of solution offerings and EDI (Electronic Data Interchange) expertise as important factors in its competitive positioning.

With so much disruption among retailers both during and following the COVID-19 pandemic, the company has seen strong demand for its fulfillment and analytics capabilities.

Total revenue for Q1 2023 rose year-over-year by 19.7% and gross profit margin dropped by about 0.5 percentage points.

Management did not disclose any company or customer retention rate metrics.

SG&A as a percentage of revenue grew by two percentage points year-over-year and operating income rose only 1.2% compared to Q1 2022’s results.

Looking ahead, leadership guided 2023 full-year revenue growth to be at 17% and adjusted EBITDA to be around 17.5%.

The company’s financial position is excellent, with ample liquidity, no debt and solid positive free cash flow.

Regarding valuation, SPSC is being valued at similar valuation multiples as that of competitor Manhattan Associates.

The primary risk to the company’s outlook is a slowing macroeconomic environment, lengthening sales cycles and reduced revenue growth trajectory as companies pull back on spending.

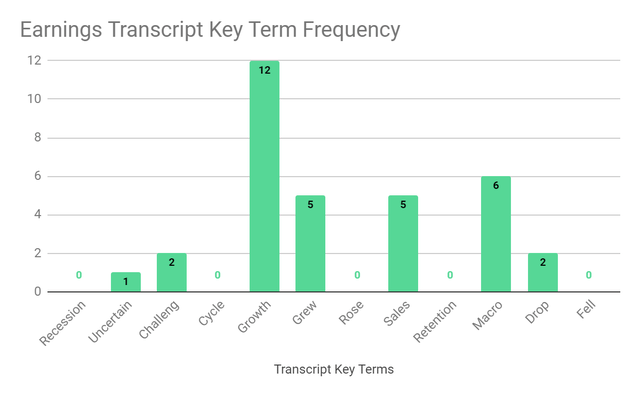

From management’s most recent earnings call, I prepared a chart showing the frequency of key terms mentioned (or not) in the call, as shown below:

Earnings Transcript Key Term Frequency (Seeking Alpha)

I’m most interested in the frequency of potentially negative terms, so management cited ‘Uncertain’ one time, ‘Challeng[es][ing]’ two times, and ‘Macro’ six times in various contexts.

In the past twelve months, the firm’s EV/EBITDA valuation multiple has risen approximately 12%, as the chart from Seeking Alpha shows below:

EV/EBITDA Multiple History (Seeking Alpha)

A question mark for the company is as supply chain disruptions continue to heal and macroeconomic conditions turn lower, how will demand for the firm’s solutions respond?

Still, SPSC has produced continuous revenue growth, higher earnings and has a solid balance sheet and strong free cash flow.

My near-term outlook for SPSC is a Hold.

Read the full article here