In December 2022, I covered BAE Systems plc (OTCPK:BAESF), and also in January here, and since then the stock has performed quite well. In this report, I will be discussing why the stock has performed well and assess whether there is further fundamentally driven upside.

The Bull Case For BAE Systems Stock

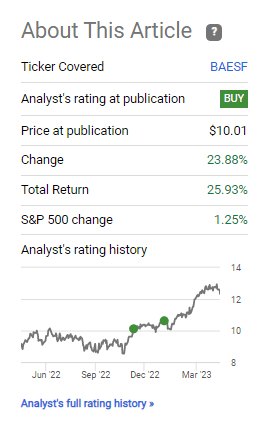

Seeking Alpha

Since I marked the stock a buy, BAE Systems has gained almost 24%, or 26% when considering the total return compared to a market that is more or less flat. If you follow my work, you will see these kind of double-digit gains quite often for the stocks I cover. Did I get lucky? Maybe, but if it happens so often then it might no longer be luck and portrays the strength of the industry and our ability to analyze the companies in the industry in a unique and data-driven way. We don’t rely on playing on the fear of investors, we present fact and analysis with very appreciable returns that many probably could only dream of.

So, what makes the bull case for BAE Systems? There are various drivers. The company has a strong backlog which it can turn into value and more recently the focus has widened to expanding the margins. Besides that, the company tends to guide conservatively on free cash flow and there is big potential to facilitate mid-term upward pressure on defense budgets. Combining the opportunities to increase volumes and coupled with better margins, that results in higher deployable cash flow which should boost the value of the stock.

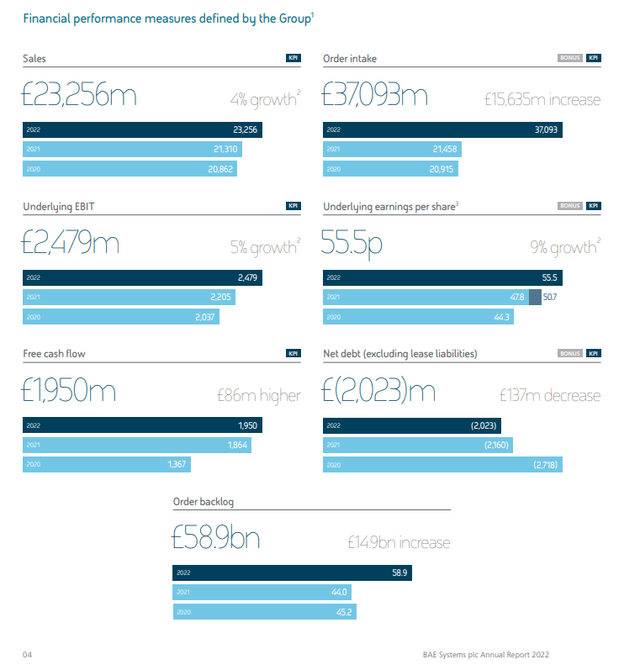

I also highlighted that BAE Systems tends to guide conservatively and I wasn’t wrong there. BAE Systems only reports twice per year, so the most recent update covered the full year earnings.

BAE Systems

We see that indeed the guidance of over £1 billion in free cash flow for 2022 was extremely conservative as the company achieved £1.95 billion in free cash flow almost double with record order intake of £37 billion and order backlog of £58.9 billion.

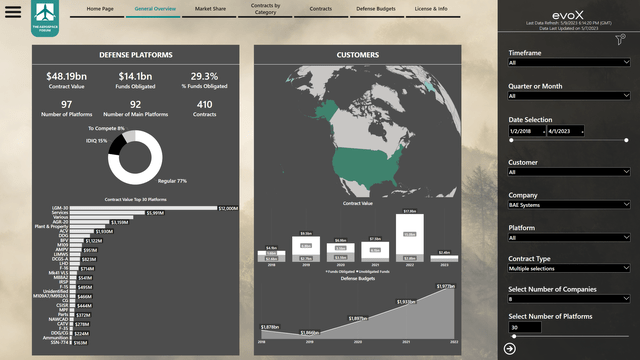

The Aerospace Forum

Also our evoX Defense Monitor, which includes defense contracts for over 100 companies, confirms that 2022 was a good year for BAE Systems in terms of winning defense contracts.

BAE Systems

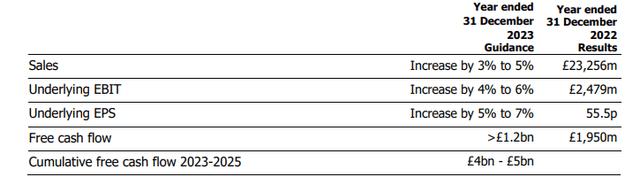

I marked BAE Systems as a steady growth company, and its 2023 guided shows that, with low to mid single-digit revenue growth but aided by margin expansion and share buybacks, that is going to result in EPS growth of up to 7%.

Is BAE Systems Stock A Buy?

|

Valuation BAE Systems |

|||

|

Market Capitalization [$ bn] |

$ 38.00 |

||

|

Preferred stock [$ bn] |

$ – |

||

|

Total debt [$ bn] |

$ 8.43 |

||

|

Cash and equivalents [$ bn] |

$ 3.78 |

||

|

Minority and non-controlling interests [$ bn] |

$ 0.22 |

||

|

Total Enterprise Value [$ bn] |

$ 42.87 |

||

|

EBITDA 2023 [$ bn] |

$ 4.05 |

||

|

EV/EBITDA |

10.6x |

||

|

Current price |

$ 12.53 |

||

|

Median |

Current |

Industry |

|

|

EV/EBITDA |

8.72 |

11.47 |

15.31 |

|

Price target |

$ 10.31 |

$ 13.56 |

$ 18.10 |

|

Upside |

-18% |

8% |

44% |

Filling in the numbers for BAE Systems we get to an enterprise value of $42.9 billion and with over $4 billion in EBITDA expected for 2023 that puts the EV/EBITDA multiple at 10.6x which is well above the median for the company but one can wonder how justified it is for a stock to trade close to its median when its metrics and end-market seem improvement. The current EV/EBITDA gives the stock 8% upside and expanding EV/EBITDA in line with the industry puts the upside at 44%.

I believe that there is still growth ahead. Perhaps not 44% but I do think this stock should trade at least 8% higher which could be further boosted by share buybacks with significant opportunities to see double digit share price appreciation if the market is willing to value the performance of BAE Systems and award it with expansion of the EV/EBITDA multiple.

Conclusion: BAE Stock Remains A Buy

I continue to rate BAE Systems plc stock a buy based on its 2023 outlook and the continued strength expected in the defense business. Performing an enterprise valuation suggests there is 8 to 45 percent upside for BAE Systems plc which could be further boosted by stock buybacks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here