We had a good start to the year.

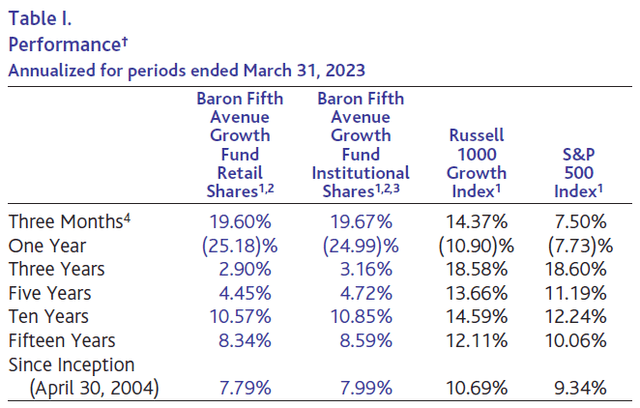

Baron Fifth Avenue Growth Fund® (MUTF:BFTHX, MUTF:BFTIX), (the Fund) gained 19.7% (Institutional Shares) during the first quarter, which compares to gains of 14.4% for the Russell 1000 Growth Index (R1KG) and 7.5% for the S&P 500 Index (SPX), the Fund’s benchmarks.

Performance listed in the table above is net of annual operating expenses. Annual expense ratio for the Retail and Institutional Shares as of September 30, 2022 was 1.03% and 0.76%, respectively, but the net annual expense ratio was 1.00% and 0.75% (net of the Adviser’s fee waivers), respectively. The performance data quoted represents past performance. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate; an investor’s shares, when redeemed, may be worth more or less than their original cost. The Adviser reimburses certain Fund expenses pursuant to a contract expiring on August 29, 2033, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. Current performance may be lower or higher than the performance data quoted. For performance information current to the most recent month end, visit www.BaronFunds.com or call 1-800-99BARON.

† The Fund’s 3-, 5-, and 10-year historical performance was impacted by gains from IPOs and there is no guarantee that these results can be repeated or that the Fund’s level of participation in IPOs will be the same in the future.

1 The Russell 1000® Growth Index measures the performance of large-sized U.S. companies that are classified as growth and the S&P 500 Index of 500 widely held large cap U.S. companies. All rights in the FTSE Russell Index (the “Index”) vest in the relevant LSE Group company which owns the Index. Russell® is a trademark of the relevant LSE Group company and is used by any other LSE Group company under license. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. The indexes and the Fund include reinvestment of dividends, net of withholding taxes, which positively impact the performance results. The indexes are unmanaged. Index performance is not Fund performance; one cannot invest directly into an index.

2 The performance data in the table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

3 Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares, which have a distribution fee. The Institutional Shares do not have a distribution fee. If the annual returns for the Institutional Shares prior to May 29, 2009 did not reflect this fee, the returns would be higher.

4 Not annualized.

The year began with many pundits’ expectations of doom and gloom in the midst of a historically aggressive Fed tightening cycle. “Earnings revisions will push stocks lower in the first quarter…;” “We project a U.S. recession is likely to start around the beginning of 2023 and last through mid-year;” and “A hard landing is coming… and it’s not priced in!” were some of the experts’ predictions we quoted in our last quarterly letter. Because 2022 was by far the worst year for equities (and most other financial assets) since the Great Financial Crisis (GFC) in 2008, we found it hard to tell how much of this doom and gloom was already being priced in. And while companies reported slowing business activity, leading them to lower guidance for 2023, the market seemed to have found its footing and recorded mid-to-high single-digit gains across most segments and most geographies in January. The Fund performed even better with a gain of 13.8%, driven by the significant bounce back in many of the worst-performing stocks in 2022. NVIDIA (NVDA) was up 33.8%, Shopify (SHOP) up 41.9%, and Tesla (TSLA) up 40.6% in January alone, giving investors a glimpse of how prospective returns tend to be negatively correlated to recent ones.

On February 2, the most watched technical indicator, the Golden Cross, provided the ultimate buy signal, and momentum investors piled on. Then came the January jobs report showing an increase of 517,000 jobs and a drop in the unemployment rate to 3.4%, a 53-year low! Since we are still in the good-news-is-bad-news world, the market went down, declining mid-single digits over the next five weeks. On March 9, we witnessed the collapse of Silicon Valley Bank (OTC:SIVBQ) (SVB), the 16th largest bank in the U.S., followed by the Swiss-government-induced takeover of Credit Suisse (CS) by UBS (UBS) for pennies on the dollar. Also on March 9, the 200-day moving average of the SPX, another widely used market indicator, broke down, sending a “sell-all” signal to the investing public. Forty-eight hours later, just when the situation started to look pretty bleak, the market turned around and went back up. The Fund gained 6.0% in the month of March and ended the quarter with a solid 19.7% gain. A long way to go to recoup our losses from last year, but a good start indeed.

From a performance attribution perspective, stock selection was responsible for 344bps of our 530bps of outperformance as compared to the R1KG Index. From a GICS sector perspective, we had an unusually consistent quarter, with outperformance in all sectors but one – Information Technology (IT). Our two best-performing sectors in the quarter were Consumer Discretionary and Communication Services, which together contributed 334bps to the Fund’s relative gains. Industrials and Health Care generated an additional 130bps, while the balance is attributed to not owning any of the worst-performing sectors during the quarter, such as Consumer Staples, Energy, Real Estate, Materials, and Utilities. From a sub-industry perspective, within Consumer Discretionary, our most significant contribution came from broadline retail, due mostly to gains from MercadoLibre (MELI) and Amazon (AMZN), which together contributed 157bps of alpha. Within Communication Services, we benefited from our holdings in advertising and interactive media & services, which were responsible for 101bps of outperformance, thanks to our investments in Trade Desk (TTD) and Meta (META), respectively. Within IT, our modest underperformance (Fund up 22.4% vs. 24.9% for the R1KG) was caused by our IT consulting & other services holdings Endava (DAVA) and EPAM (EPAM), but even that was partially offset by the Fund’s 5.6% overweight to the sector.

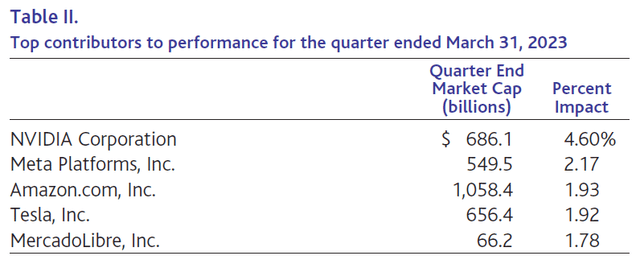

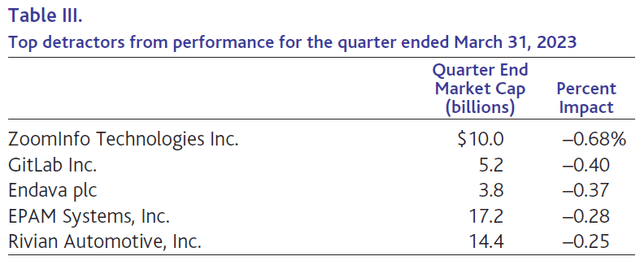

From a stock-specific perspective, we had an unusually large number of big winners in the first quarter, with 8 investments that contributed over 100bps each to our absolute returns and 15 that contributed over 45bps each. That’s more than half of the portfolio. The top five contributors – NVIDIA, Meta, Amazon, Tesla, and MercadoLibre – generated an impressive 1,241bps, while Shopify, ServiceNow (NOW), and ASML (ASML, OTCPK:ASMLF) added an additional 382bps to quarterly gains. On the other side of the ledger, we had 7 detractors, but just a single investment, ZoomInfo (ZI), that detracted more than 45bps from our results.

SVB, platforms, and digitization

On Wednesday March 8, SVB’s stock was trading at $267 per share, with a market cap of $16 billion. Two days later the price was $0. Despite being headquartered in Silicon Valley with start-ups and world-renowned venture capitalists (VCs) as its clientele, SVB was far from being a start-up. It was a 40-year-old regulated bank with over $200 billion in assets and approximately $175 billion in deposits, making it the 16th largest bank in the U.S. On March 8, after the market close, SVB announced plans to raise $2 billion of capital to “strengthen its financial position.” In that same investor letter, the company claimed to be “well-capitalized, with a high-quality, liquid balance sheet and peer-leading capital ratios” even before the capital raise.

What happened next caught most market participants by surprise and was truly unprecedented. A few large VCs became concerned over the health of SVB and asked each other a logical question: Why would SVB raise capital if they didn’t need it? With plenty of scar tissue left from the GFC, they decided it would be prudent to pull their money out of SVB. All of it. Then, they decided to advise all their start-up clients to do the same and naturally went to social media to share their action and their concerns with the rest of the world. Well…, in the physical world, when everyone tries to run through the same door, there is obviously no door large enough to fit them. It turns out that in the digital world, it is even worse. The ease of pulling large amounts of money out with a push of a button from a smartphone during any and all hours of the day, combined with the network effects of social media, created an old-fashioned run on the bank. Now, while there is nothing unprecedented about a run on a bank, there was no precedent for the speed of this run on this bank. On Thursday, March 9, SVB’s clients withdrew (or attempted to withdraw) $42 billion – or about $500,000 per second! For comparison, the biggest recorded bank run during the 2008 GFC had clients pulling $17 billion from Washington Mutual over the course of 10 days. After SVB went under in early March of 2023, Signature Bank (OTC:SBNY) followed within hours, and First Republic and Credit Suisse needed to be rescued within days.

In the digital economy, network effects are a double-edged sword. Things can go viral and “blow up” at a pace unseen and unimaginable before. ChatGPT acquired 1 million users in five days and 100 million users in less than two months. But the other side of this sword is that a couple of nervous VCs can make a 40-year-old multi-billion-dollar business disappear just as fast.

Although we have never owned legacy banks, we were not unscathed by this calamity, experiencing collateral damage now and possibly in the future. A number of our holdings may be negatively impacted as budgets in the financial services industry are likely to be constrained in the short term, which may, in turn, impact their near-term purchasing decisions and spending plans. For example, Endava, a provider of outsourced IT services and software development, saw its shares drop roughly 20% after SVB collapsed. Approximately half of its revenues come from customers in the financial services industry even though its exposure to banks is only 10% and its exposure to regional banks is less than 2%. Could banks push out projects because they now have other more pressing concerns? Yeah, they could. Would financial services companies stop digitizing, stop moving to the cloud, or decide not to adopt artificial intelligence (AI) because of this crisis? Highly unlikely in our view. And so, while the uncertainty over 2023 financial targets and results has clearly increased, the long-term future of Endava is unaffected and remains bright in our view.

Platforms and AI

In a recent blog post titled “The Age of AI Has Begun,”1 Bill Gates discussed how AI is the second revolutionary technology he has seen in his lifetime (with the first one being in 1980 when he was introduced to the graphical user interface of the PC, which became the basis for Microsoft Windows):

“The development of AI is as fundamental as the creation of the microprocessor, the personal computer, the Internet, and the mobile phone. It will change the way people work, learn, travel, get health care, and communicate with each other. Entire industries will reorient around it. Businesses will distinguish themselves by how well they use it.”

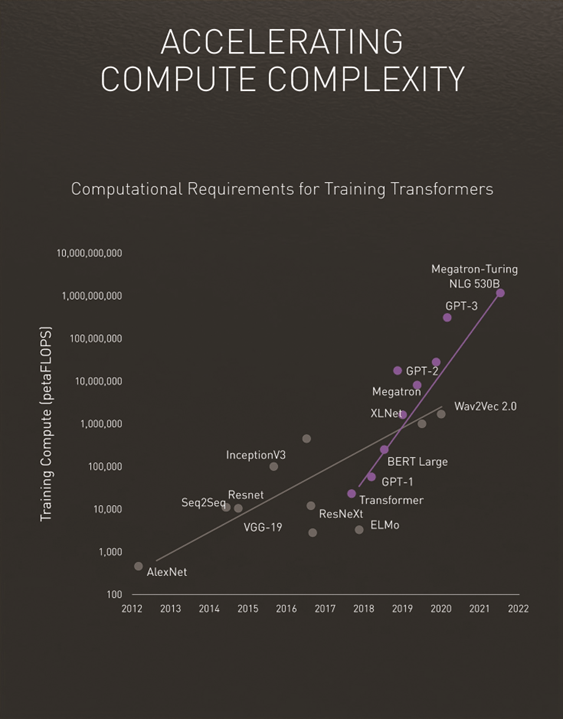

We have followed developments in AI for years. The pace of innovation has significantly accelerated since the introduction of the transformer model and self-attention in 20172 by AI researchers at Google (GOOG, GOOGL), whose work significantly improved how AI models learn about common relationships in languages, thus building an understanding of context. These models have become the basis of today’s large language models, such as OpenAI’s GPT-4 (the model behind ChatGPT), which we discussed in some detail in last quarter’s letter. While AI development, in general, has been progressing at a rapid pace (with model size up 8x in two years), transformer models are progressing even faster (275x in two years). The following chart from NVIDIA visually demonstrates this significant acceleration (the purple line shows transformer models):3

The potential implications of AI could be profound: increasing information-worker productivity from creative professionals to developers; improving decision-making at companies of all sizes, making them much more dynamic and data-driven; creating new consumer value propositions with more personalized experiences that are based on data and real-time feedback loops; and creating new markets we can’t even dream up today. AI has the potential to drive significant disruption across many industries and entire economies. Similar to how the internet in the late 1990s or the smartphone in the mid-2000s enhanced productivity, shaped new markets, and created trillion-dollar Big Ideas (e.g., Amazon, Apple, Google), we may be in the early stages of the next meaningful platform shift, surfacing new risks and opportunities for businesses. Our initial observations suggest the following:

- Disruptive change is becoming even more pervasive, increasing the importance of continuously underwriting the investment thesis, which is very different from buy and hold. More than ever, we are now in a world of buy, hold, CONSTANTLY VERIFY, and search for disconfirming evidence.

- Data IS the new oil. The value of proprietary data will increase; AI models will only be as good as the data that feeds them. As a result, the competitive advantages of companies with proprietary data, with the ability to leverage it, will continue to increase.

- Digitally transforming a company’s business is crucial and will remain management’s top priority. Companies unable to remove silos and build architectures and organizational structures that enable them to harness their data will be left behind.

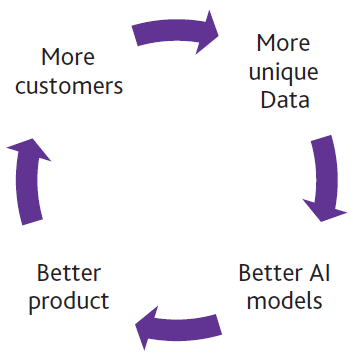

- Formation of a virtuous AI cycle in which the scale and uniqueness of a company’s data could create a virtuous cycle among data, product quality, and go-to-market strategies, leading to winner-take-most competitive dynamics. The first-mover advantage would also matter more, as it could help jump-start this cycle.

- Go-to-market and referenceability are increasing in importance because companies that are able to attract more users faster than their competitors are in a better position to reach escape velocity as long as they can harness and leverage the data generated to their advantage.

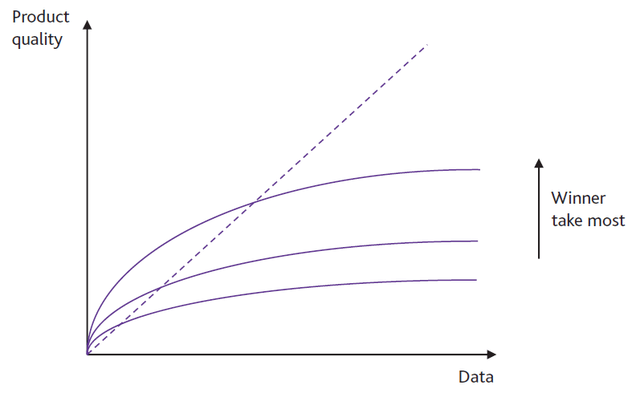

- Market shares of platform businesses are likely to reach even higher levels in the endgame. We believe this would be the case not only for vertical solution providers who already have high market shares (like Veeva (VEEV), with approximately 80% market share in life-sciences CRM) but also for horizontally focused companies. A key question for each company would be the extent to which its product can continuously improve with the scale and uniqueness of its data. If it asymptotes at a relatively low scale, the market is likely to be more competitive than if performance improvements would be sustainable for longer, as depicted in the following chart:

The n is more important than the g

As we have described in prior letters, getting the duration of growth right (the ‘n’) matters much more than getting the rate of growth correct (the ‘g’). Many companies have been able to grow very rapidly for a few years. Few are able to sustain high growth rates for long periods of time. Those that do become the Big Ideas we are hunting for. While the current macro slowdown and the banking crisis present/create clear headwinds to the g in the near term, we think it also sows the seeds for tailwinds to the n. On the one hand, we are hearing from many companies about lengthening sales cycles, optimizations of ongoing expenses, a requirement to get C-level approval for purchases, and just a general increase in the level of uncertainty. On the other hand, history and experience suggest that economic downturns drive market-share gains for industry leaders, which strengthens their competitive advantage even further. As AI becomes more pervasive, the leading platforms will likely increase their lead on data, shortening the time to escape velocity. We are already hearing from our companies (who are the leaders in their industries) about consolidation dynamics, as customers take advantage of this period of uncertainty to consolidate spending away from point solutions and onto the platforms.

We believe the coming commercialization of AI will serve as a tailwind for many of our companies. The increased importance of digitization should benefit digital-first businesses and those that enable digitization, like Endava or EPAM, who provide outsourced software development services, and Snowflake (SNOW), which helps companies remove data silos and become more data-driven. CrowdStrike (CRWD) is another good example of a company whose product directly benefits from data. The more data CrowdStrike acquires, the better it becomes at catching cybersecurity threats, which in turn helps the company win more customers, thus driving more data onto the platform, and the cycle continues.

While near-term uncertainty remains high, we have even greater conviction about the long-term prospects of our companies. We have no insight, or even a view, on whether the economy is headed for a recession, or a prediction on how the market, or the Fund, will perform in the second quarter or for the rest of 2023. Our pattern recognition continues to suggest, however, that this period of time will prove to be a good entry point for investors in the not-too-distant future.

NVIDIA Corporation is a fabless semiconductor mega-cap company and a global leader in gaming cards and accelerated computing hardware and software. Despite subdued demand for gaming cards due to an ongoing PC slowdown and inventory correction, shares of NVIDIA rose 90.2% during the first quarter as a result of material developments in generative AI as evidenced by the release of ChatGPT and GPT-4. These technologies hold the promise of enabling significant productivity gains across domains from content creation, coding, and even biologic discovery. During its annual GTC conference in March, NVIDIA announced new products that expand its addressable market, such as the L4 chip, which opens the opportunity for video processing, representing 80% of internet traffic. We continue to believe NVIDIA’s end-to-end AI platform and leading market share in gaming, data centers, and autonomous machines, along with the size of these markets, will enable the company to benefit from durable growth for years to come and therefore remain shareholders.

Shares of Meta Platforms, Inc., the world’s largest social network, were up 75.6% this quarter due to decisive cost discipline actions taken by the company (including layoffs of more than 20% of its staff and a reduction in its data center and office footprint), improving adoption of new advertising products, the company’s work in generative AI, and the broader rally in technology stocks. On the top line, Meta continues growing its user base with daily average users up 5% year-over-year in the last quarter. Engagement remains healthy with impressions up 23% year-over-year, and newer advertising formats (like Instagram Reels) are reportedly picking up steam as well with 40% of advertisers now using Reels. Longer term, we believe Meta will utilize its leadership in mobile advertising, massive user base, innovative culture, and technological scale to sustain durable growth for years to come, with further monetization opportunities ahead in newer areas such as WhatsApp.

Amazon.com, Inc. is the world’s largest retailer and cloud services provider. Shares were up 23.0% in the quarter, driven by solid financial results. Revenues were up 12% year-over-year and AWS (Amazon Web Services) revenues were up 20% year-over-year to a run rate of over $85 billion, even though the company guided to deceleration as a result of the weaker macro environment, which is driving customer budget optimizations. Shares also benefited from the continued cost discipline, including steps to meaningfully improve core North American retail profitability to pre-pandemic levels. While near-term uncertainty remains, Amazon’s growth runway in e-commerce remains long, which is still less than 15% penetrated in the U.S. (with a longer runway internationally). Amazon also remains the clear leader in the vast and growing cloud infrastructure market, with large opportunities in platform offerings and application software, including enabling AI workloads. Additional areas such as advertising (where Amazon still holds less than 5% market share), logistics, and health care further solidify the company’s growth durability.

Tesla, Inc. designs, manufactures, and sells EVs, related software and components, and solar and energy storage products. After being our top detractor in the fourth quarter when its price fell 53.6%, the stock reversed course and was up 68.5% in the first quarter of 2023. The about-face was driven by a rapid shift in investor sentiment, as investors now expect Tesla to continue growing rapidly while maintaining industry-leading margins despite the potential recession, supply-chain challenges, increased competition in China, and price adjustments. In addition, after devoting considerable time to reorganizing Twitter post-acquisition, CEO Elon Musk has re-established his commitment to Tesla, while a management presentation during its analyst day provided visibility into the broad quality of talented professionals leading Tesla. We expect Tesla to continue leading the electrification of the automotive and energy storage markets through its vertical integration, scale, and cost leadership. As long-term shareholders, we have witnessed Tesla increase deliveries from practically zero to over 1.3 million units while proving it can reduce costs and rapidly expand its product line and manufacturing footprint. We also expect Tesla’s next platform to have a significant impact on the company’s results. We remain confident in Tesla’s fundamentals and management team and believe that, with still less than 2% market share, the company remains well positioned to enjoy a long runway of growth as the market shifts to EVs.

The stock of MercadoLibre, Inc., the dominant e-commerce platform in Latin America, rose 55.8% during the first quarter. The company reported a significant fourth quarter earnings beat, driven by strong performance on essentially all key drivers of operating margins across both the commerce and fintech segments, including higher fulfillment penetration, stronger adoption of advertising solutions, lower loan loss provisions on the credit business, and operating leverage driven by economies of scale. Net revenues grew 57% year-on-year in constant currency, total payment volume was up 80%, and operating margins reached 11.6%. On its earnings call, the company suggested these drivers will continue to generate sequential margin expansion in the coming quarters and years. We believe retrenchment by some top e-commerce competitors could lead to a possible acceleration of MercadoLibre’s market share growth, especially in Brazil. We believe MercadoLibre will be the dominant player in a Latin American e-commerce industry that remains early in its growth lifecycle, driven by the relative low e-commerce penetration in the region. We remain shareholders.

ZoomInfo Technologies Inc. provides go-to-market business intelligence software. Despite reporting 47% year-over-year revenue growth (41% organic), 41% adjusted operating income margins, and 42% free-cash-flow margins for 2022, shares declined 17.9% during the first quarter after the company guided for a slowdown in revenue growth driven by increasing macroeconomic uncertainty, elongating sales cycles, slower upselling to existing customers, and a slowdown in seat expansion. While near-term uncertainty has increased, we believe ZoomInfo’s competitive positioning remains strong while the opportunity ahead is significant. We retain conviction and believe that ZoomInfo will benefit from long-duration growth, as it has only about 35,000 customers out of a 700,000 business-to-business opportunity. New products in talent and marketing add optionality.

GitLab Inc. (GTLB) is a provider of a DevOps platform that addresses all stages of the software application life cycle. Despite reporting decent quarterly results with revenue growth of 58% year-over-year and operating losses below expectations with non-GAAP operating margins of –11% compared to expectations of –22%, the company issued below-consensus 2023 revenue growth guidance, calling for a meaningful slowdown to 25% revenue growth. Technology industry layoffs and tighter IT/developer budgets resulted in lower net revenue retention rates in GitLab’s Premium Tier, as some existing customers cut back on paid licenses to account for reduced hiring, while others anticipated a lower rate of developer headcount growth in 2023. Management is assuming the trend will continue through the remainder of 2023. Despite the heightened macro-driven near-term uncertainty, we remain shareholders. We believe the company remains well-positioned competitively in a duopoly market with a long runway for growth, underpinned by the increasing demand for integrated DevOps platforms that help customers build applications more efficiently. GitLab is also implementing a 25% to 50% price increase on its Premium Tier that should benefit growth into 2024 and 2025, while also helping the company achieve profitability sooner than it initially projected.

Endava plc provides consulting and outsourced software development services for business customers. Shares declined 12.2% during the first quarter as a result of growing investor concerns over the potential near-term demand implications resulting from the banking crisis, given that 50% or more of Endava’s revenue comes from financial services firms. In addition, shares were impacted by the company reducing its financial guidance for the fiscal year 2023 to reflect slower bookings as macroeconomic uncertainty weighed on client decision-making in December. Nevertheless, the company reported solid quarterly results, with 30% revenue growth and 26% EPS growth. Management noted that bookings have improved in the first couple of months of 2023, and it expects annualized revenue growth to return to greater than 20% fairly quickly. While near-term uncertainty has increased, we remain investors because we believe Endava will continue gaining share in a large global market for IT services for years to come.

EPAM Systems, Inc. provides outsourced software development to business customers. Shares declined 8.8% during the quarter after the company provided 2023 financial guidance that was below Street expectations. After growing revenue by 28% and EPS by 20% in 2022, management expects slower growth this year due to near-term client caution around IT spending in an uncertain macroeconomic environment. However, management anticipates only a temporary slowdown as visibility on new projects supports accelerating revenue growth back to 20% by early 2024. We continue to own the stock due to EPAM’s long runway for growth, underpinned by the growing demand for digitization and management’s strong execution in meeting that demand over the years.

Shares of Rivian Automotive, Inc. (RIVN), a U.S.-based EV manufacturer, fell 16.5% during the quarter. Despite seven-fold growth in its monthly production rate between late 2021 and late 2022, production guidance for 2023 missed analyst forecasts as a result of continued supply-chain constraints, even though they have begun to be alleviated. In addition, production costs are still materially higher than the company’s long-term goal due to the underutilization of Rivian’s manufacturing facility, which is contributing to cash burn and growing investor concerns during an uncertain macro environment. Finally, despite having close to $12 billion in cash at the end of 2022, the current pace of cash outflows suggests the company will need to either continue adjusting its capital allocation plans or raise more capital. We are closely monitoring Rivian’s advancement in key areas and awaiting additional information on its R2 platform, which addresses a larger portion of the market. Similar to Tesla in its early days, we believe a successful ramp-up in production will drive economies of scale and improved unit economics through fixed cost leverage and increasing purchasing power as well as broader efficiency gains as the company moves along its learning curve. We remain shareholders and believe that the company’s unique product (which continues getting positive reviews), a vertically integrated technology approach, and promising commercial partnerships will drive long-duration growth as the economy remains early in its shift to EVs.

Portfolio Structure

The Fund is constructed on a bottom-up basis with the quality of ideas and level of conviction playing the most significant role in determining the size of each investment. Sector weights tend to be an outcome of the portfolio construction process and are not meant to indicate a positive or a negative view.

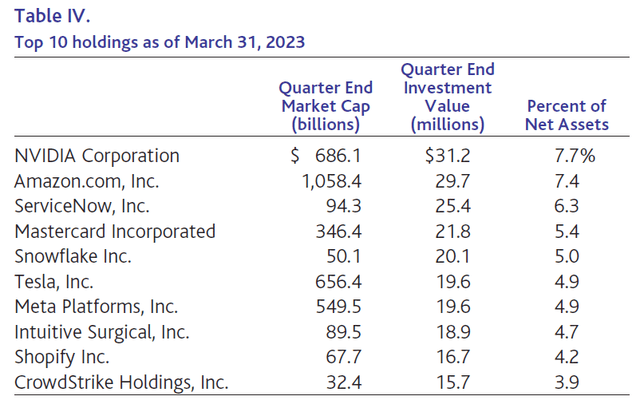

As of March 31, 2023, the top 10 holdings represented 54.2% of the Fund, and the top 20 represented 84.4%. The total number of investments in the portfolio was 29 at the end of the first quarter, unchanged from the end of 2022.

IT, Consumer Discretionary, Health Care, Financials, and Communication Services made up 96.8% of net assets. The remaining 3.2% was made up of GM Cruise and SpaceX, our two private investments classified as Industrials, and cash.

Recent Activity

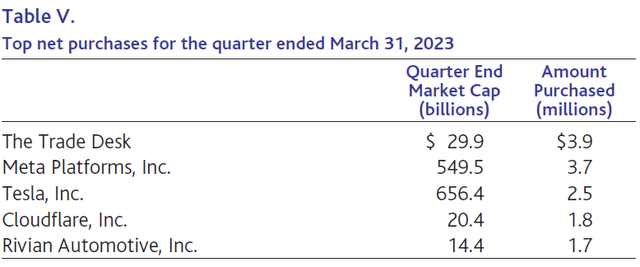

During the first quarter, we added to eight existing positions, including continuing to build several of our newer positions, such as the connected TV (CTV) leader, Trade Desk, the EV manufacturers Tesla and Rivian, the networking and infrastructure platform Cloudflare (NET), and the assisted driving and autonomous driving solution provider Mobileye (MBLY). At the same time, we also added to various longer-term holdings such as the leading social network, Meta (which was one of our largest purchases during the last quarter as well), and the leading robotic surgery system and consumable provider, Intuitive Surgical (ISRG). We also reduced six existing holdings mostly to generate funds to increase investment in which we saw a more attractive risk-reward profile.

Our top two purchases in this quarter were similar to our largest additions during the last quarter, The Trade Desk and Meta Platforms, Inc., since we believe the risk-reward remains very attractive for both companies.

Trade Desk is the leading internet advertising demand-side platform, enabling programmatic (automated) buying of digital advertising. The company is benefiting from the growth in CTV, while also expanding its market share as advertisers find its neutral positioning in the market attractive; the company only operates on one side of the market (the buy side) as opposed to Google which also purchases ads for its own assets (such as YouTube). Thus, Google operates under a structural potential conflict of interests: on the one hand, its advertising customers are interested in paying as little as possible for the ads they purchase, but on the other hand, its publishing assets such as YouTube, are interested in getting as much as possible for the ads they sell. Trade Desk’s management continues showing excellent performance under an uncertain macro backdrop. In its last quarterly results, the company reported 24% year-over-year revenue growth with 50% adjusted EBITDA margins, while also providing outlook that was slightly above expectations. This revenue growth rate is quite impressive when considered against the negative growth rates reported by most other digital advertisers, including -2% for Google search and -4% for Meta. We believe the company would be a key beneficiary as advertising dollars increasingly shift from linear TV to CTV. We have therefore increased our holding.

During the quarter, we also added to our Meta position. While the business is experiencing a near-term slowdown due to the increased macro uncertainty, which has impacted advertising budgets, the company’s long-term prospects remain favorable in our view, especially with an increased focus on profitability, with CEO Mark Zuckerberg calling 2023 “the year of efficiency.” As part of these efforts, Meta has flattened their organizational structure, “removing layers of middle management,” which should not only cut costs, but also improve the velocity of decision-making and innovation. Also important, the company continues growing its user base along with user engagement, including on Reels, while also attracting more advertisers to the new format. At the same time, management continues progressing on their AI-based targeting and measurement solution, which could increasingly offset the lost signal from Apple’s ATT (App Tracking Transparency) changes from two years ago. While the stock is no longer as undervalued as it was when we added to it during the fourth quarter, we believe the risk-reward is still favorable for long-term investors.

We also added to our Tesla, Inc. position during the quarter after visiting the company’s manufacturing facility in Texas and spending time with a range of executives, which has further increased our conviction in the company’s long-duration growth, underpinned by its innovative culture, decentralized and multi-disciplinary decision making, and scale benefits. While the near term remains uncertain as we expect the company to continue making trade-offs among pricing, market share (production volume), and profitability, we have a lot of conviction in Tesla’s ability to maintain its leadership positioning in the market as it transitions to EVs. Its structural cost advantage over competitors would become more evident, in our view, during tougher macroeconomic times, when prices are adjusted lower. Additionally, we believe Tesla is competitively advantaged in its development of autonomous driving, namely, due to its proprietary data advantage (has more real-world miles than other manufacturers, which is key to training AI models). Although we think it presents a significant opportunity, we currently treat it as optionality.

We also added to Cloudflare, Inc. during the quarter, the leading cloud-based networking and software infrastructure provider. Despite facing a macro-driven elongation of deal cycles, the company reported solid quarterly results with 42% year-over-year revenue growth, while also guiding to 37% growth for 2023. The company’s speed of innovation enables it to continuously grow its opportunity set as it adds more products to its platform, solving additional problems for customers from network services to zero-trust. Its scale-based competitive advantages enable it to be the low-cost provider in the industry, while also having significant volumes of data to power its AI models and improve its product over time. Once it gets customers on board, Cloudflare is then able to cross-sell them additional networking and security solutions at high marginal profitability, as they are served on the same underlying infrastructure and thus the company doesn’t need to spend once more on customer acquisition. This creates a virtuous cycle that should enable Cloudflare to become an important part of the infrastructure layer of organizations over time, in our view.

Lastly, we added to our Rivian Automotive, Inc. position, an EV manufacturer, after significantly reducing our holdings last year to harvest tax losses, as the stock’s correction created a compelling entry point, in our view, for long-term shareholders.

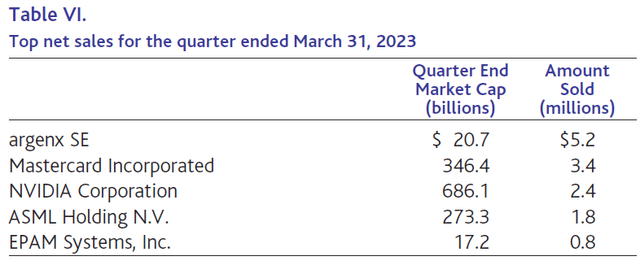

We reduced the size of our position in argenx SE (ARGX, OTC:ARGNF), a leading autoimmune biotechnology company, to better balance the risk from the upcoming CIDP (Chronic Inflammatory Demyelinating Polyneuropathy, a rare autoimmune neurological disorder) trial readout with the company’s long-term prospects and other opportunities we see across the portfolio. While we also slightly rebalanced our NVIDIA Corporation position as the stock rose significantly during the first quarter, we remain excited about the company’s prospects to be a key beneficiary of the growth in AI. It is now our largest position in the Fund. We also slightly reduced our Mastercard Incorporated (MA), ASML Holding N.V., and EPAM Systems, Inc. positions to fund redemptions as well as to reallocate to ideas in which we saw a more positively skewed risk-reward profile for the next several years.

Outlook

First Quarter 2020 – For the first time in 100 years, we are reintroduced to a global pandemic.

First Quarter 2021 – The reopening trade leads to significant outperformance for “value” sectors (e.g., energy, legacy banks, and airlines) for the first time in over a decade.

First Quarter 2022 – Russia invades Ukraine and further exacerbates COVID-19-driven supply-chain challenges, pushing up inflation and compressing the pace of the Fed’s tightening cycle.

First Quarter 2023 – SVB, the 16th largest bank in the U.S., collapses after a run on the bank, the largest bank crash since 2008. The 167-year-old financial institution, Credit Suisse, is sold for $3.2 billion to UBS in a takeover brokered by the Swiss National Bank.

Care to offer the outlook for the first quarter of 2024? We sure do not.

Skeptical investors often ask, if we have no confidence in forecasting the next three months or the next year, how can we have confidence in forecasting 5 or 10 years into the future? While this skepticism is understandable, we believe it is misplaced. Short-term stock price fluctuations (and company fundamentals) are disproportionately affected by the macro and by factors outside a company’s control. We believe most of these factors are impossible to predict accurately with any consistency. However, it turns out that a business’s uniqueness, the sustainability of its competitive advantages, and its management’s ability to prudently allocate capital and to earn high rates of return on the company’s investments can be analyzed and therefore forecasted far more accurately over longer periods of time. Sure, qualitative things like a company’s culture, the strength of its management team, and even the disruptive change analysis are all subjective; assessing them requires both experience and a healthy margin of safety, but at the end of the day, there are only a handful of variables that go into the intrinsic value equation:

- How big is the opportunity?

- What market share can the company reasonably expect to get?

- How economically profitable would this business over time and at maturity?

- What is the cost of capital?

- And what is the terminal growth rate?

These are the variables that long-term owners of a business care about and spend their time researching. Over the last three months, we believe these variables have been moving in the right direction for most of our portfolio companies. Interestingly, although the Fed’s rhetoric remains hawkish with “more inflation fighting left to be done,” the 10-Year U.S. Treasury yield has fallen from around 3.9% at year-end 2022 to around 3.4% as we write this letter. Similarly, real rates, as measured by the yield on 10-Year U.S. TIPS have dropped from around 1.6% to around 1.1% over the same period. Just sayin’….

Every day we live and invest in an uncertain world. Well-known conditions and widely anticipated events, such as Federal Reserve rate changes, ongoing trade disputes, government shutdowns, and the unpredictable behavior of important politicians the world over, are shrugged off by the financial markets one day and seem to drive them up or down the next. We often find it difficult to know why market participants do what they do over the short term. The constant challenges we face are real and serious, with clearly uncertain outcomes. History would suggest that most will prove passing or manageable. The business of capital allocation (or investing) is the business of taking risk, managing uncertainty, and taking advantage of the long-term opportunities that those risks and uncertainties create.

We are optimistic about the long-term prospects of the companies in which we are invested and continue to search for new ideas and investment opportunities while remaining patient and investing only when we believe target companies are trading at attractive prices relative to their intrinsic values.

Sincerely,

Alex Umansky

Portfolio Manager

Investors should consider the investment objectives, risks, and charges and expenses of the investment carefully before investing. The prospectus and summary prospectus contain this and other information about the Funds. You may obtain them from the Funds’ distributor, Baron Capital, Inc., by calling 1-800-99BARON or visiting www.BaronFunds.com. Please read them carefully before investing.

Risks: The Fund invests primarily in large-cap equity securities which are subject to price fluctuations in the stock market. Even though the Fund is diversified, it may establish significant positions where the Adviser has the greatest conviction. This could increase volatility of the Fund’s returns. The Fund may not achieve its objectives. Portfolio holdings are subject to change. Current and future portfolio holdings are subject to risk. There is no guarantee that these objectives will be met.

The discussions of the companies herein are not intended as advice to any person regarding the advisability of investing in any particular security. The views expressed in this report reflect those of the respective portfolio managers only through the end of the period stated in this report. The portfolio manager’s views are not intended as recommendations or investment advice to any person reading this report and are subject to change at any time based on market and other conditions and Baron has no obligation to update them.

This report does not constitute an offer to sell or a solicitation of any offer to buy securities of Baron Fifth Avenue Growth Fund by anyone in any jurisdiction where it would be unlawful under the laws of that jurisdiction to make such offer or solicitation.

BAMCO, Inc. is an investment adviser registered with the U.S. Securities and Exchange Commission (SEC). Baron Capital, Inc. is a broker-dealer registered with the SEC and member of the Financial Industry Regulatory Authority, Inc. (FINRA).

Footnotes

1 GatesNotes.com, March 21, 2023

2 Vaswani, A., N. Shazeer, N. Parmar, J. Uszkoreit, L. Jones, A. Gomez, L. Kaiser, and I. Polosukhin, “Attention Is All You Need,” arxiv.org, December 6, 2017.

3 NVIDIA Investor Day 2022 presentation materials.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here