Investment Thesis

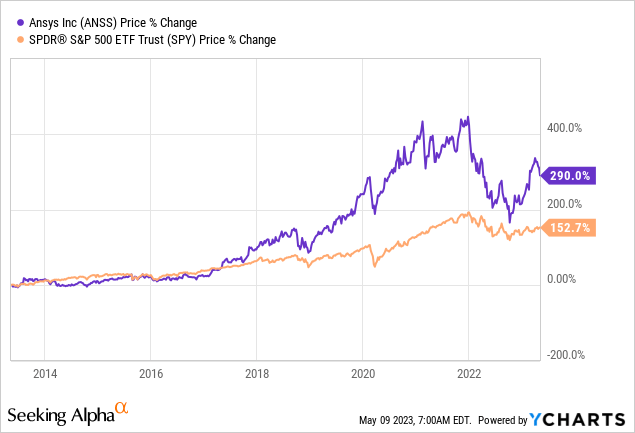

ANSYS (NASDAQ:ANSS) has been a solid compounder in the past decade, with shares up nearly 300%, vastly outpacing the S&P 500 Index (SPY) which was only up 150%. The company operates in the fast-growing simulation software market, which presents strong growth opportunities as use cases continue to increase. Its latest earnings also breezed past expectations with strong top and bottom-line growth. However, the current valuation looks quite elevated after the massive rally in the past few months, with multiples meaningfully above peers. I believe the company is now fully valued and has limited upside potential.

Why ANSYS?

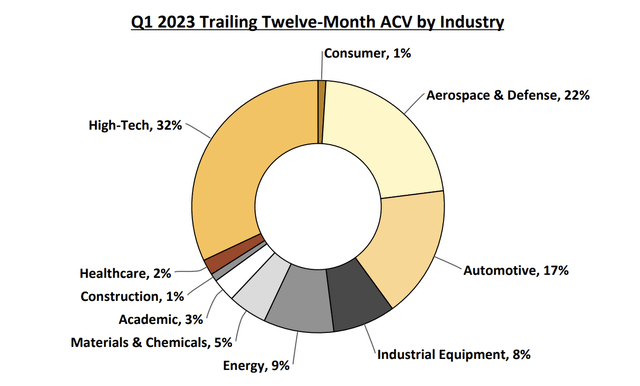

ANSYS is a US-based company that provides simulation software solutions to customers around the globe. It helps companies run real-time simulations to test the applicability and efficiency of their product, which then allows them to make required adjustments based on the performance shown. The company has a heavy presence in industries such as high-tech, aerospace & defense, automotive, and industrial equipment. Its customers include notable blue-chip companies such as Raytheon Technologies (RTX), Ford (F), and Ferrari (RACE).

Simulation software is a highly attractive industry as it plays a critical role in innovative technologies. It allows companies to see the performance of their product without having to physically test it, which is especially important for high-risk products. For instance, it is very hard to test the performance of military weapons and autonomous vehicles in real life due to safety and cost concerns. This also reduces the need for physical prototypes, which helps companies to cut down costs and improve their operational efficiency.

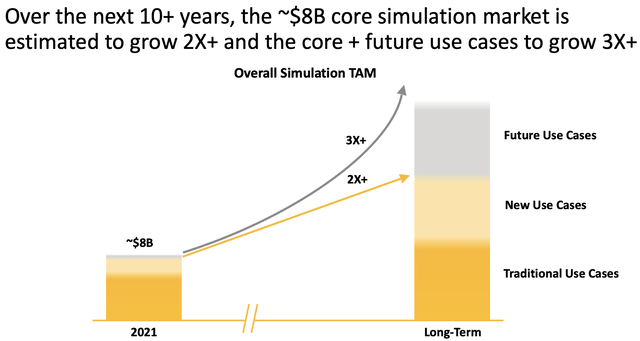

As the popularity of cloud technology, electrical/autonomous vehicles, and IoT (internet of things) continues to grow, the demand and use cases for simulation software should also increase. According to Grand View Research, its market size is forecasted to grow from $21 billion in 2023 to $51.1 billion in 2030, representing a solid CAGR (compounded annual growth rate) of 13.6%. Given the recent rise of AI (artificial intelligence), market growth may further accelerate as more innovative technology and use cases emerge.

The simulation software industry also has a high entry barrier due to the complex nature of its solutions, which creates a strong moat for ANSYS. In order to maintain its leading position, the company has been consistently investing approximately 20% of its annual revenue in R&D (research and development). It currently has the broadest product portfolio that serves different customer needs and I believe it is best positioned to benefit from the ongoing market expansion.

ANSYS

Q1 Earnings

ANSYS announced its first-quarter earnings last week and the results are very strong, especially when considering the current macro backdrop. The company reported revenue of $509.4 million, up 20% YoY (year over year) compared to $425.1 million. Software license revenue grew 39.3% from $157.4 million to $219.2 million, accounting for 43% of total revenue. Maintenance and service revenue grew 8.5% from $267.6 million to $290.3 million, accounting for 57% of total revenue. ACV (average contract value) was $399.4 million, up 16% compared to $344.1 million. The growth is driven by the upbeat demand for different simulation solutions across multiple industries, most notably tech and automotive. The pipeline was also solid as the company ended the quarter with deferred revenue and a backlog of $1.36 billion, up 13% YoY.

The bottom line was also excellent as the company benefited from better economies of scale and operating leverage. The gross profit margin increased 190 basis points from 84.8% to 86.7%, mainly due to the decline in costs for maintenance and services. This resulted in the gross profit up 22.6% YoY from $360.3 million to $441.8 million. Spending also remained disciplined, as operating expenses as a percentage of revenue dropped 400 basis points from 65.7% to 61.7%. The improved scale and leverage resulted in the net income increasing by 42% YoY from $71 million to $100.6 million. The net income margin expanded 310 basis points from 16.7% to 19.8%. The diluted EPS was $1.15 compared to $0.81, up 42%.

The guidance for FY23 is relatively soft compared to this quarter’s results. The company expects revenue to be $2.24 billion to $2.32 billion, which translates to revenue growth of 8.5% to 12.4%. The non-GAAP diluted EPS is expected to be $8.39 to $8.91, representing a growth of 8.3% at the midpoint.

ANSYS

Valuation

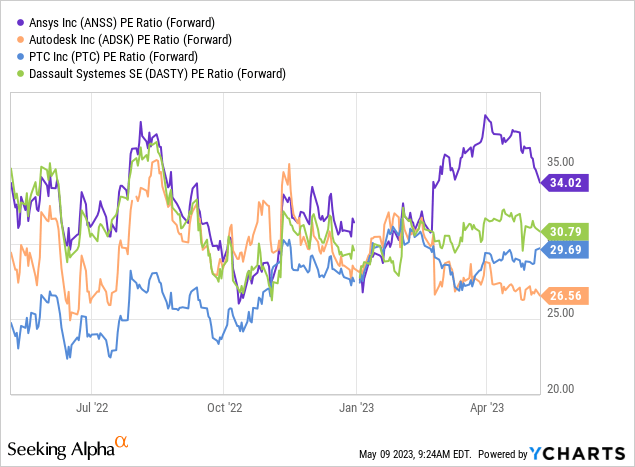

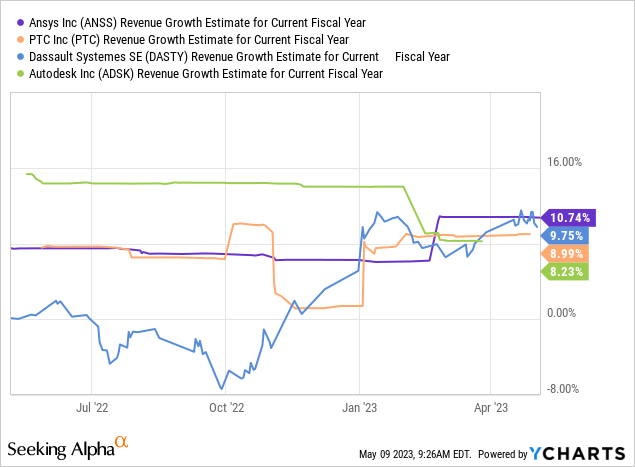

After the huge 50% rally since October, ANSYS’ valuation is looking quite expensive once again. The company is currently trading at an fwd PE ratio of 34x, which is pretty elevated compared to other simulation software companies such as Autodesk (ADSK), PTC (PTC), and Dassault Systemes (OTCPK:DASTY), as shown in the first chart below. The peer group has an average fwd PE ratio of 29x, which represents a solid discount of 14.7%. The valuation gap seems hard to justify as the company’s estimated growth rate for FY23 is basically in line with peers, as shown in the second chart below. ANSYS’s multiple is also currently near the high end of its historical range, only below the euphoric COVID phase from 2020 to 2021. Given this backdrop, I do not see much opportunity for multiples expansion in the near term unless the market sentiment improves substantially.

Investors Takeaway

ANSYS is a great company but I believe investors should wait for a better entry point. The company operates in an attractive industry that should see durable market growth as new technologies and use cases continues to emerge. Its business is also highly resilient as it provides critical solutions to companies. Despite facing a slowing economy, the latest earnings still demonstrated strong growth amid upbeat demand. However, the company’s valuation is the biggest issue here, as it is looking pretty expensive after the recent rally. I believe the elevated valuation will likely limit its upside potential therefore I rate the company as a hold for now.

Read the full article here