This story was originally published on May 9 for subscribers of Reading The Markets, a Seeking Alpha Investing Group.

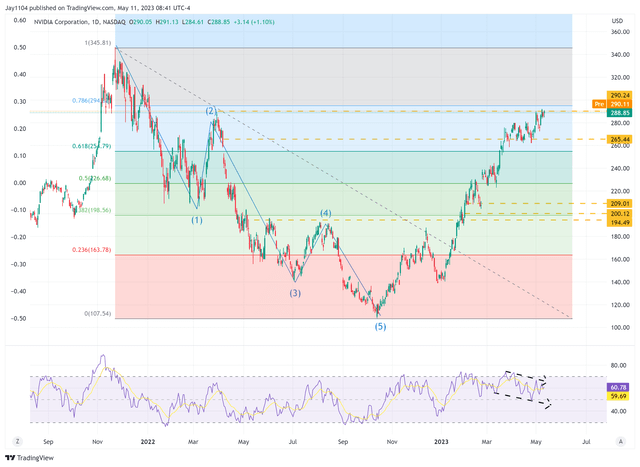

Nvidia’s (NASDAQ:NVDA) recent surge has seen the stock retrace almost 78.6% of its decline from its November 2021 highs, resulting in a 160% increase since October. However, an options trader has bet that the rally is due to end and a significant pullback is coming.

The company has benefited from the recent rise in cryptocurrencies such as Bitcoin and the promise of a future dominated by artificial intelligence. This has led to a surge in Nvidia’s valuation, reaching levels close to historical highs, comparable only to the peak of the COVID-19 bubble.

TradingView

Nvidia Stock’s Valuation and Price Do Not Justify The Fundamentals

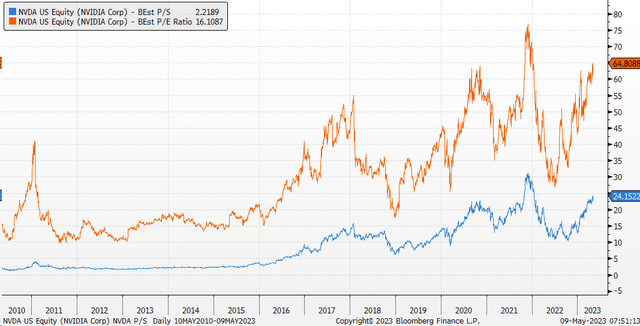

Currently, the stock is trading at 64.8 times its fiscal 2024 earnings estimates and 24.1 times its sales estimates, both near the upper limits of their trading range. This suggests that investors are seeking significant earnings and sales growth in the future.

Bloomberg

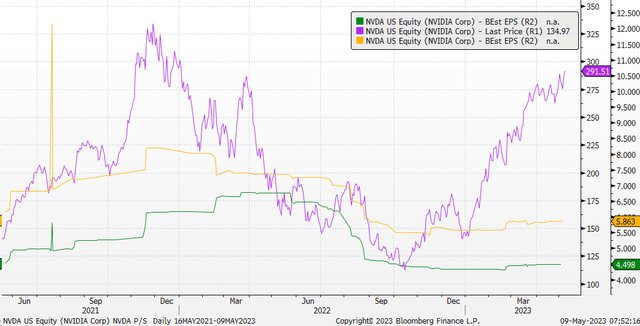

Now, at least at this point, analysts do not seem as optimistic about the future despite the significant stock gains and have done little to lift the company’s earnings estimates for fiscal 2024 and 2025. Earnings estimates have dropped significantly from their peaks. While the stock has rallied sharply, earnings estimates have not, a clear sign that analysts do not see the same opportunities for the business as investors.

Bloomberg

Nvidia is scheduled to release its earnings on May 24. Analysts predict that its adjusted earnings per share for the first fiscal quarter will decrease by 32.7% year-over-year to $0.91, with revenue dropping 21.5% to $6.5 billion.

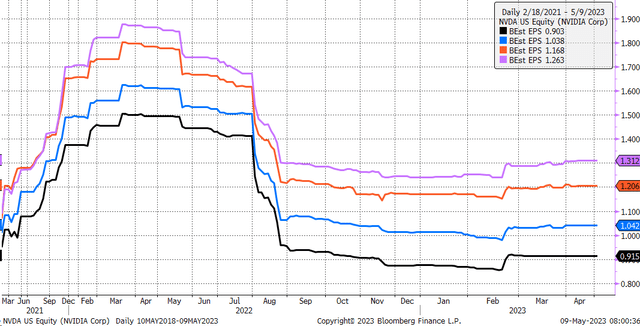

However, the guidance provided by the company will be more crucial as Nvidia will be facing an easy comparison with its weak second quarter of 2022. Therefore, analysts anticipate a 104.25% increase in second-quarter 2023 earnings to $1.04 per share, with revenue growing by only 6% to $7.1 billion. Nevertheless, these earnings expectations are still significantly lower than analysts initially estimated many quarters ago.

Bloomberg

Given that the surge in Nvidia’s stock price thus far has been primarily driven by multiple expansion and optimism for a promising future, there is little margin for error when the company reports its results. This is because the prospects of strong growth from these benefits in the next one to two years seem unlikely.

A Massive Wager

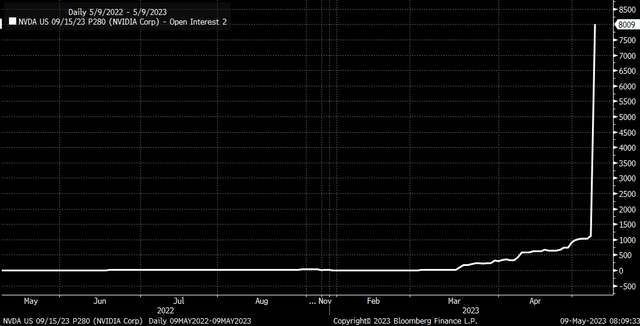

An options trader is betting that the market returns to its sense on Nvidia over the next few months. On May 9, there was a notable increase in open interest for Nvidia’s September 15 $280 puts, with around 6,900 contracts bought on the ask for approximately $26.50 to $26.60 per contract. This implies that the trader would require the stock to drop to roughly $253.50 to earn a profit if holding the put contracts until expiration, a decline of approximately 13.0%. This is a substantial bet, with the trader paying a roughly $18 million premium.

Bloomberg

Bearish Divergence

According to the technical chart, Nvidia’s shares are facing resistance at $292, which was the high in March 2022. Moreover, a bearish divergence is visible on the RSI, with a sequence of lower highs and lower lows compared to the stock price, which has made a higher high. The critical support level for Nvidia has been at around $265. If this level is breached, it could lead to a significant decline for Nvidia, possibly down to about $209, where a gap exists from mid-February.

However, if the stock pushes above $292, it could rise to around $312 in the near term.

TradingView

Nvidia’s stock has become significantly overvalued once again. Despite the company’s improving earnings and indications of growth, they are still far from the levels they were once expected to achieve. This raises concerns about why the stock is trading at its current levels.

For Nvidia’s shares to continue rising, the company must deliver better-than-expected results and provide significant upside surprises in its guidance. Otherwise, it may be difficult for the stock to maintain its current levels or continue its upward trend.

Read the full article here