The following segment was excerpted from this fund letter.

Lifecore Biomedical (NASDAQ:LFCR)

Lifecore, until recently known as Landec Inc., was formerly a non-sensical combination of a pre-made salad business, a processed avocado business, other food-related assets, and a high-quality CDMO that specializes in fill-finish work for highly viscous liquids (think of a liquid so dense that if you slapped a bucket of this liquid, there would not be a splash). This business combination never made sense, and over the last ~2 years the food-related assets have been divested, leaving the CDMO as a pure play. This is in line with my original thesis. However, my original thesis also imagined that the proceeds from the sale of the food assets would go a long way toward repairing an over-leveraged balance sheet. Unfortunately, due to a combination of unforeseen circumstances, the asset sales fell short of my assumed proceeds, leaving the company as a pure-play CDMO with a balance sheet problem.

We have been involved in the biologic CDMO space for more than 5 years through our ownership of Avid Bioservices (CDMO). That investment has been a home run for us as strong secular tailwinds, high normalized margins, low normalized capex, high switching costs, and a business that is fairly predictable over longer periods of time have fueled our gains. However, it has been a wild ride, with many bumps in the road as despite being fairly predictable over longer periods of time, quarter-to-quarter CDMO businesses can be very lumpy as customers adjust their orders based on their own inventory levels.

A balance sheet problem and the potential for quarterly “air pockets” in revenue tied to normal customer behavior is not a good combination, and LFCR fell victim to this combination in mid-March, leading to a painful mark-to-market loss of -66% in one day. Essentially, the company is in technical default of its loan covenants, which means that its bank lenders have the ability to call the loans at any time, which would tip the company into bankruptcy. The headlines here are obviously not good.

However, despite the fact that shares have since rallied more than 120%, I think the opportunity here is highly skewed, and I increased our position size substantially.

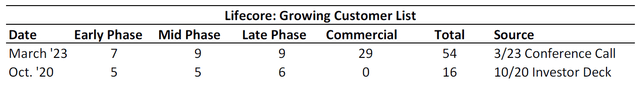

First, this is a balance sheet problem, not a business problem. As evidenced by a growing customer list, Lifecore has been executing very well and is still the beneficiary of massive tailwinds.

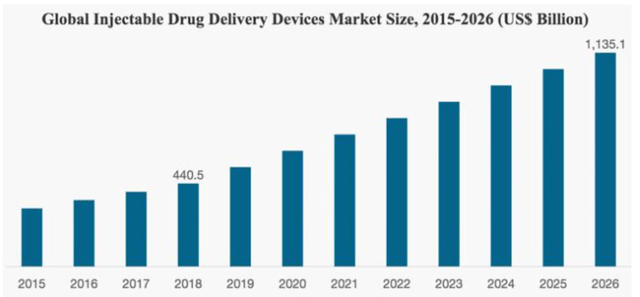

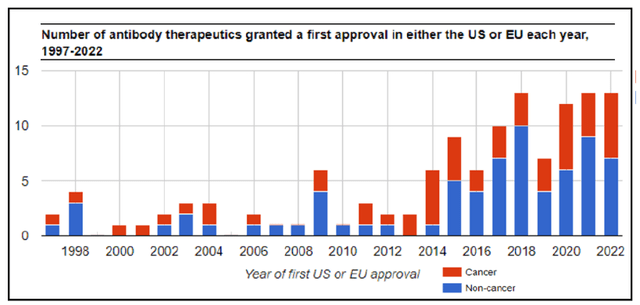

As a snapshot of those tailwinds, consider that 43% of U.S. pharmaceutical sales are biologici (aka large molecule), while 90% of global pharmaceutical sales are small moleculeii. Biologics are almost always injectable, and the prefilled syringe market is growing faster than the injectables market.iii In fact, at a recent conference, West Pharmaceutical Services Inc. (WST), a supplier to CDMOs, noted that their fastest growing sector is prefilled syringes, and that demand is growing faster than they anticipated.iv v

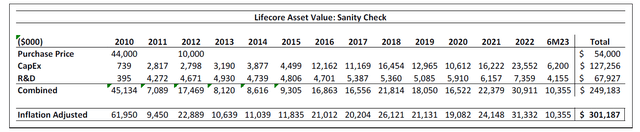

Second, while the balance sheet problem should not be taken lightly and must be dealt with, I do not think the equity value is at risk of a disaster scenario. My conversations with knowledgeable industry sources have suggested that replacement cost of Lifecore’s assets would be around $400M, and would take 4-5 years, which is attractive vs. the Company’s current enterprise value of approximately $250M. To sanity check this estimate of $400M replacement cost, we can examine Lifecore’s history with these assets. Landec first purchased the business in 2010 for $44M, with a $10M earnout. In the years since that time, the company has spent nearly $130M in capital expenditures, and $70M in R&D.

This implies an inflation-adjusted value for the asset of $300M. However, this approach is deeply flawed, and thus very conservative. For starters, it assumes that the company has not earned any return on the money they have spent over the last 12-13 years. Second, this approach essentially gives no value to the company’s customer list since the 2013 earn-out. These assumptions are provably false as the number of projects that the company is engaged with has more than tripled since that time, while revenue is up ~4x.

Third, there is reason to believe that the initial purchase price for the asset was too low. While there is nothing novel about injectable drugs, and the earliest biologic drugs have been regulated by Congress since the 1902 Biologic Control Act, within a few years after the 2012 sale there was an explosion in biologic drugs, to the point that today 55% of all drugs in development are biologic.vi As a result, multiples in the space have moved drastically higher. The point here is not to be overly precise. Rather, the point is to suggest that a $300M estimate of the asset value should be overly punitive and that $400M passes the smell test.

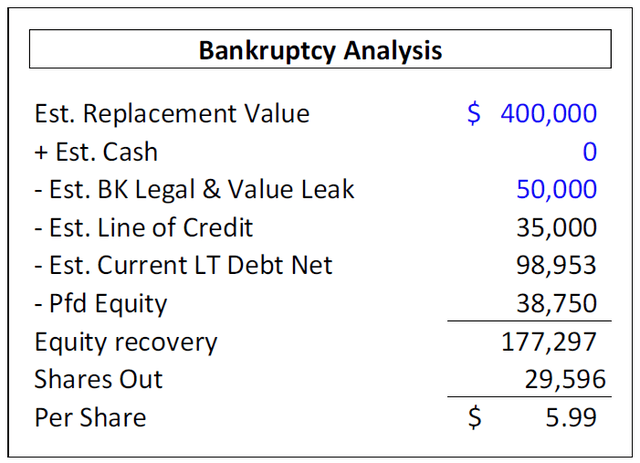

From this base, we can consider what a bankruptcy process might mean for Lifecore Equity. Even when giving no credit for existing cash and/or recent debt payments a rudimentary bankruptcy analysis suggests that equity owners today would survive intact, and with a nice profit. Of course, given that this business is accelerating, not declining, a valuation based on future cash flows would be more appropriate than replacement cost. The point is just to suggest that even in a bankruptcy scenario, equity owners have little to fear other than mark-to-market risk.

From that point, the analysis becomes a game theory exercise. By definition, a bankruptcy process that results in equity recovery means that the lenders will be made whole. The lenders thus have two choices.

1) Force Lifecore into bankruptcy proceedings, spend a year in court, force a sale or liquidation, and then be made whole on their loan.

Or

2) Grant Lifecore forbearance on their loans, extract a pound of flesh for the privilege, allow the previously announced sale process to move forward, and then be made whole on the loan in 3 to 6 months.

In both cases, the lenders are made whole, but in one case, the lenders receive an additional return on an accelerated timeline. As such, the choice seems obvious – especially because Lifecore has already announced that they are pursuing strategic alternatives (a euphemism for selling the company). The fact that the lenders have not already forced the company into bankruptcy adds weight to the idea that bankruptcy is not on the horizon, and instead, some sort of negotiated settlement will be reached.

The company’s negotiating position is likely made stronger by the demand for their assets. For years, I have heard from industry sources that Lifecore would have many potential buyers in a sale, but the mishmash of food assets owned by Landec made a transaction a non-starter. With the food assets now separate, I suspect the phone has been ringing off the hook as potential buyers seek to scoop up this scarce asset. At this point, any indications of interest would be non-binding, but they would allow the company to make it clear to their lenders that they will recoup their loan.

Also aiding the company’s position are the clear positive trends in their business, including announcing a major acceleration from an existing customer (widely known to be Alcon) concurrent to the news that they were currently stumbling. This customer committed to paying $10M upfront, as well as agreeing to reimburse the company for $15M in future capital expenditures. Details on the size of this future business are limited, but management has implied that the delta from this existing customer would be equivalent to the most important piece of business in company history. Examining disclosure around historic customer concentration suggests that this could mean more than $30M in revenue (vs. initial 2023 guidance of $124M), and assuming a normalized margin, perhaps $10M in incremental EBITDA annually.

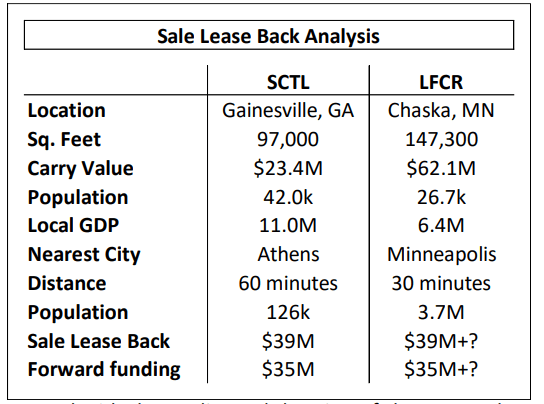

Lastly, Lifecore has a monetizable asset in the form of their owned real estate, and thus the potential to enter into a sale lease back transaction as part of repairing their balance sheet. This is the route that small molecule CDMO Societal CDMO (SCTL) followed just a few months ago, in December of 2022.vii Through a sale leaseback transaction of their 97,000 square foot manufacturing facility, SCTL was able to generate $39M in cash, as well as secure $35M in future capital expenditure commitments. While the old adage “all real estate is local” should not be entirely disregarded, a sale leaseback buyer would be purely financial, and thus more concerned with the quality and duration of the tenant than anything else. This suggests that Lifecore could extract quite a bit of cash from a sale leaseback transaction, although doing so may make the company less attractive to a potential acquiror.

Despite these strengths, the range of possibilities in a forbearance negotiation is wide. In the best – but unlikely – case, the lenders will amend the terms of the loan for a $3M fee, as they recently did during the preferred equity raise process. It is hard to know what the worst case would be, but I think it is conservative to think that the lenders may demand as much as 20% of the company in the form of penny warrants, and insist that the company be sold in the near term. While 20% dilution is not insignificant, it would also align the interests of the lenders with the interests of the equity, which in theory would allow the company to run a more thorough sale process. After all, a more thorough process should lead to a higher sale price, which would benefit all parties.

However, it is also possible – or perhaps likely – that dilution to equity would ratchet down based on the outcome of a sale process. I say likely because in the above scenario, while I estimate the share count would move past 42 million shares inclusive of lender warrants, convertible A shares, and PIK shares, I still believe the company could be worth more than $8 per share at a 15x multiple of this years initial EBITDA guidance. At this price, the value of the lender’s penny warrants would approach $55M, which is an enormous sum in relation to the ~$100M loan that is at stake. I also believe that 15x would be a low multiple, reflecting a company that is not selling from a position of strength, and I also believe this year’s initial guidance is well below what should be considered “normal” in light of recently announced new business.

The point of all of the above is really just that the lenders have no reason to push the company into bankruptcy, and from today’s price, even with fairly harsh assumptions I believe there is a path to significant upside. There are also reasons to believe that the outcome of a sale process could be much better.

For starters, there are many historic transactions that demonstrate that high-quality CDMOs demand premium multiples, with high teens and low 20s multiples of EBITDA, and mid to high single digits multiples of revenue not being uncommon. Only a few weeks ago, it was reported that Baxter’s (BAX) fill-finish CDMO may sell for 6.2x revenue, and perhaps 18-19x EBITDA.viii To be fair, this is a larger business with a more diversified client base so perhaps it deserves a premium to LFCR’s assets. But at the same time, one could argue that LFCR deserves a premium due to their more specialized capabilities, captive source of pharmaceutical-grade hyaluronic acid (a preferred excipient), potential to cross-sell to Alcon, and pre-ordered equipment that would otherwise require a 3- to 4-year wait.

It is also worth noting that Lifecore has hired Morgan Stanley (MS) to advise them during the strategic review. Morgan Stanley recently advised private CDMO Alcami Corporation during their sale process, which saw them purchased by private equity investors GHO Capital and The Vistria Group.ix While I don’t think the phrase “roll up” is necessarily appropriate to describe Alcami’s strategy, they recently acquired sterile fill-finish assets through the acquisition of TriPharm services, recently acquired a biostorage and pharma services business, and have invested over $140M in capex to expand their own fill-finish capabilities.x

While terms have not been disclosed, industry whispers are that Alcami sold for more than 20x EBITDA. A multiple of 20x is at the high end of the M&A comp range (but not the top), which suggests that perhaps this was a competitive process. Surely Morgan Stanley has maintained their list of all of the parties that were interested in Alcami who helped push the multiple up, and perhaps one of them would like a second bite at the fill-finish apple.

Or perhaps GHO Capital / Vistria / Alcami would be interested in expanding their footprint. This doesn’t seem like a stretch for a number of reasons. For starters, GHO and Vistria have commented that they view Alcami as a platform from which to build, and they expect to pursue geographic expansion via M&A. But more interesting than that is the fact that until about 18 months ago Alcami’s CEO, Patrick Walsh, was on Landec’s board, and was also Chairman of the “Lifecore Innovation Committee.”xi Clearly, he is familiar with LFCR’s assets and capabilities, and he seems to have a mandate to grow Alcami’s business. Presumably whatever operational difficulties would come with an integration would be made easier by a CEO who was formerly intimately involved with Lifecore’s business.

Given this recent transaction, it is impossible to rule out the possibility that Lifecore too could be worth 20x EBITDA in a sale. While of course buyers will not want to give credit to forward numbers, not all forward numbers are created equally. In the case of Lifecore and Alcon, where Alcon is advancing $10M and committing to reimbursing $15M in future capex, it seems as if credit should be given for this future business. The odds that Alcon would commit $25M and then walk away are essentially zero. Given this dynamic, “normal” EBITDA for Lifecore might be almost $42M, which does not give Lifecore any credit for statements they have made that their existing pipeline and customer base should be enough for them to double their business within a few years. In any case, on an EBITDA base of $42M, assuming a $10M forbearance charge, no penny warrants, and a conversion of preferred A shares (inclusive of PIK) Lifecore could be worth approximately $20 per share, or more than 5x higher than where shares presently trade.

The huge discrepancy between public market price and the potential private price could lead to several different event paths. One path could be as simple as the company announcing they have received forbearance, which could lead to shares doubling, which then raises the public market anchor price.

Another path could see Lifecore’s board refusing to accept a bid that is too anchored to the low public price, and instead choosing to pursue a rights offering in order to simply repay their lenders. This scenario could see the share count more than double to ~65M shares (inclusive of rights, Pfd A dilution shares, PIK shares, etc.), and push out a sale process by 2-3 years. However, even with this massive dilution, I believe the future revenue and earnings power of the Company is such that waiting for the ramp is a strong alternative to accepting a lowball bid today.

In summary, I clearly made mistakes in my initial analysis of Landec’s ability to repair their balance sheet. However, even inclusive of potential dilution, there is a case that I was not wrong in my assessment of the company’s value. Re-underwriting shares today to reflect likely event paths suggests that Lifecore is a case of a stock with little downside even through bankruptcy (although the mark to market would be painful) and a very real chance to make 5x our money in a short period of time. Importantly, we could fall well short of my belief that this asset could be worth 20x forward EBITDA, and still be well rewarded for our trouble.

Footnotesihttps://www.ahip.org/news/press-releases/new-research-big-pharma-companies-earn-big-revenues-throughpatent-gaming |

|

Disclaimer: This document, which is being provided on a confidential basis, shall not constitute an offer to sell or the solicitation of any offer to buy which may only be made at the time a qualified offeree receives a confidential private offering memorandum (“CPOM”) / confidential explanatory memorandum (“CEM”), which contains important information (including investment objective, policies, risk factors, fees, tax implications, and relevant qualifications), and only in those jurisdictions where permitted by law. In the case of any inconsistency between the descriptions or terms in this document and the CPOM/CEM, the CPOM/CEM shall control. These securities shall not be offered or sold in any jurisdiction in which such offer, solicitation, or sale would be unlawful until the requirements of the laws of such jurisdiction have been satisfied. This document is not intended for public use or distribution. While all the information prepared in this document is believed to be accurate, Laughing Water Capital, LP, Laughing Water Capital II LP, and LW Capital Management, LLC make no express warranty as to the completeness or accuracy, nor can they accept responsibility for errors appearing in the document. An investment in the fund/partnership is speculative and involves a high degree of risk. Opportunities for withdrawal/redemption and transferability of interests are restricted, so investors may not have access to capital when it is needed. There is no secondary market for the interests and none is expected to develop. The portfolio is under the sole trading authority of the general partner/investment manager. A portion of the trades executed may take place on non-U.S. exchanges. Leverage may be employed in the portfolio, which can make investment performance volatile. The portfolio is concentrated, which leads to increased volatility. An investor should not make an investment unless it is prepared to lose all or a substantial portion of its investment. The fees and expenses charged in connection with this investment may be higher than the fees and expenses of other investment alternatives and may offset profits. There is no guarantee that the investment objective will be achieved. Moreover, the past performance of the investment team should not be construed as an indicator of future performance. Any projections, market outlooks, or estimates in this document are forward-looking statements and are based upon certain assumptions. Other events which were not taken into account may occur and may significantly affect the returns or performance of the fund/partnership. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events which will occur. The enclosed material is confidential and not to be reproduced or redistributed in whole or in part without the prior written consent of LW Capital Management, LLC. The information in this material is only current as of the date indicated and may be superseded by subsequent market events or for other reasons. Statements concerning financial market trends are based on current market conditions, which will fluctuate. Any statements of opinion constitute only current opinions of Laughing Water Capital LP and Laughing Water Capital II LP, which are subject to change and which Laughing Water Capital LP and Laughing Water Capital II LP do not undertake to update. Due to, among other things, the volatile nature of the markets, an investment in the fund/partnership may only be suitable for certain investors. Parties should independently investigate any investment strategy or manager and should consult with qualified investment, legal, and tax professionals before making any investment. The fund/partnership is not registered under the investment company act of 1940, as amended, in reliance on an exemption thereunder. Interests in the fund/partnership have not been registered under the securities act of 1933, as amended, or the securities laws of any state and are being offered and sold in reliance on exemptions from the registration requirements of said act and laws. The S&P 500 and Russell 2000 are indices of US equities. They are included for informational purposes only and may not be representative of the type of investments made by the fund. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here