Intro

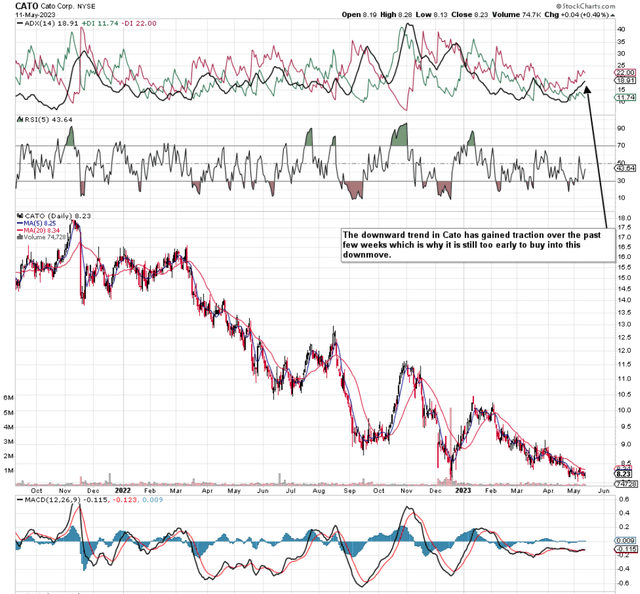

If we pull up a technical chart of The Cato Corporation (NYSE:CATO), we see that shares continue to make lower lows with the stock’s December’2022 lows now being currently tested. We were actually bullish on Cato back in late 2021 due to its strong underlying bullish trend at the time. Furthermore, we believed that strong cash-flow generation back then would eventually move the needle but we had one caveat which was the following. Given the number of fixed costs and inventory needed to run a successful apparel outfit, companies in this industry can be very volatile, to say the least. Being demand-led where significant overhangs of stock can remain on the books in quiet periods, we witnessed how sales and earnings of Cato literally fell off a cliff in the company’s fiscal year which ended in January 2021.

This is why we stated at the time (November 2021) that investors should let Cato’s technicals guide their investment decisions in this play. To this effect, the multi-year top was pretty much in when we penned that piece roughly 18 months ago. Shares since then unfortunately have continued to make lower lows and now find themselves roughly 45% or approximately $8 a share down and now trade just north of $8 a share.

Cato Technical Chart (Stockcharts.com)

Q4 Earnings

Now, with shares trading with ultra-low trailing valuation multiples (P/B of 0.7 & P/S of 0.21) and with the dividend having spiked to 8.2%+, the temptation here is to buy Cato at its current valuation and ride this present downturn out. Comparable sales actually grew in Cato’s recently reported fourth quarter although the CEO was quick to point out that supply chain headwinds as well as high inflation (resulting in customers having less disposable income) mean that same-store sales actually came in down for the full fiscal year.

Furthermore, the tone in the Q4 earnings report was one of caution as management seemed to be unclear on how to tackle fiscal 2023. Inflationary environments many times result in companies selling more on the front end but making less in profits due to higher costs. Gross margin for example collapsed by almost $67 million in fiscal 2022 which is a sizable number considering Cato’s present market cap of approximately $167 million. Therefore, despite the fact that Cato’s $128+ million of balance-sheet cash & ST investments can continue to fund share-buybacks and the dividend for some time to come, we would recommend investors not to buy into Cato at present for the following reason.

Dividend Sustainability

Although Cato’s 8% dividend yield may look compelling when one takes into account the company’s strong balance sheet, we must always remember that a stock’s dividend yield is a very good read on the inherent risk in the investment. The higher the yield, the higher the risk generally. In fact, the first major red flag is the gap between Cato’s yield (8.22%) and this sector in general (2.38%).

Furthermore, prior to the pandemic, Cato was paying out $1.32 per share in dividends per year whereas now, the annual payout comes in at $0.68 per share. Suffice it to say, the present sky-high 8.22% dividend yield has not come about as a result of sustained dividend increases but rather due to the decline of the share price in recent years.

From an affordability standpoint, Cato in fiscal 2020 did not report sufficient net earnings or free cash flow to cover the dividend. Irrespective of how management has been using cash reserves to fund the dividend (Which has been decreasing book value or net worth), the absence of a positive dividend pay-out ratio informs investors straight off the bat that the dividend may not be sustainable.

High Yielder V Dividend Grower

So here is the kicker and the risk concerning a long-term investment in Cato at this present moment in time. Given how inflation has increased in recent years, we believe it is FAR more important to judge Cato on its forward-looking dividend growth potential instead of the dividend yield being paid out today. Let me explain. Let’s say one invested $100k into Cato today where the average annual dividend yield remained at approximately 8% over the lifetime of the investment (No dividend growth recorded). This would mean that the initial investment capital of $100k would be recouped in full in approximately 12.5 years. Where Cato shares would be trading after 12.5 years and what inflation would look like are obviously unknowns at this stage.

Now let’s say $100k was also invested in a company that averaged a 4% dividend yield but also managed to grow the annual payout by 6% on average over the lifetime of the investment. Here this investment would be paid off in 16 years (3.5 years more) but the projection for capital appreciation in the share price of the stock would be far higher for the following reason. Proven dividend growth stocks usually report growing sales, earnings, and cash-flows which in turn make dividend growth possible. So in the end, very little capital appreciation in this stock would be needed to easily beat Cato’s 12.5-year payback period mentioned. Suffice it to say, don’t merely focus on what you can earn today through high yields but rather protect your hard-earned investment dollars by ensuring growth remains buoyant in your dividend investments.

Conclusion

To sum up, although Cato with its strong balance sheet, keen valuation, and 8%+ dividend yield may look tempting, the market continues to remain uninterested in this play. In fact, the message being sent is that it is still not the time to enter here. We look forward to continued coverage.

Read the full article here