Investment thesis

Our current investment thesis is:

- IB is a leading broker, offering investors exactly what they are looking for at a superior level to its peers.

- Customer accounts are growing well, with commercial factors suggesting this should continue.

- Profitability is also good, with its relative underperformance offset by a low valuation.

- IB has shown the ability to achieve a 20x NTM P/E valuation while performing at an inferior level. Despite the NIM inferiority, we believe IB is capable of returning to this level.

Company description

Interactive Brokers Group, Inc. (NASDAQ:IBKR) is a global electronic broker that specializes in executing and processing trades in various financial instruments such as stocks, options, futures, forex, bonds, mutual funds, ETFs, metals, and cryptocurrencies.

It also provides custodial and servicing solutions for various entities such as hedge funds, mutual funds, registered investment advisors, proprietary trading groups, introducing brokers, and individual investors.

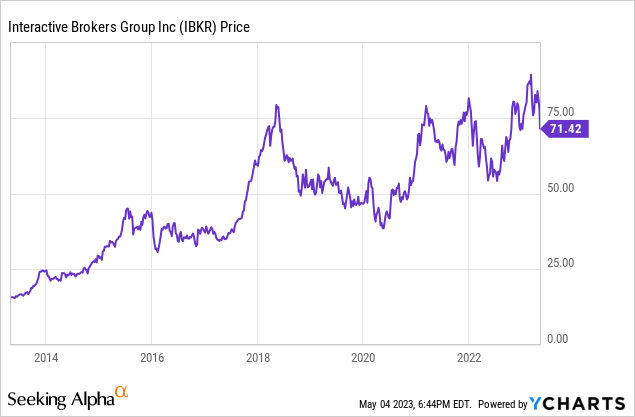

Share price

IB’s share price has traveled in one direction for the last decade, returning over 450% to shareholders. This has been driven by rapid growth and increasing bottom-line returns.

Financial analysis

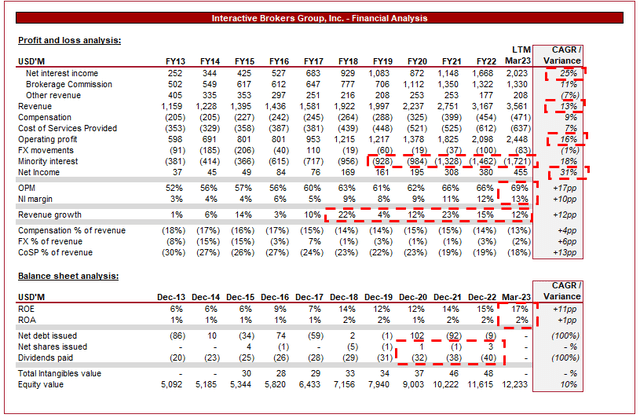

Interactive Broker Financials (Tikr Terminal)

Presented above is IB’s financial performance for the last decade.

Revenue

Revenue has grown at a CAGR of 13%, with incredible consistency and not a single year of decline. This is driven by two fundamental factors, those are account numbers and trading volume, which both go hand in hand. IB has seen its customer accounts grow from 189k in 2011 to 2.2m in Q1-23, a market-leading rise. Further, growth is not showing signs of slowing down, with customer accounts up 21% in the most recent quarter.

This is a reflection of IB’s attractiveness to investors. Our view is that investors care about 4 main things when considering a broker: pricing, market access, quality platform, and trust with execution.

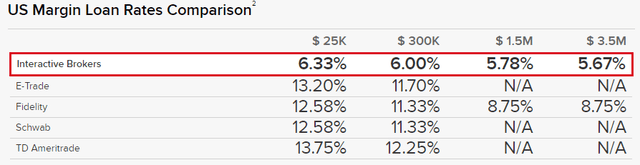

One of the reasons IB has been able to grow rapidly its pricing structure. IB is currently the cheapest for margin loans among the large US brokers. Not only is IB cheaper but it is substantially so, which encourages traders onto the platform. These are individuals who are trading in higher volume also, compounding the benefits for IB.

Margin rates (IB)

In conjunction with this, IB is paying the highest interest rate to investors for cash balances held. This encourages investors to hold cash on the platform, allowing IB to generate increasing returns. This is a specific target by Management, responding by holding short-dated assets. Again, IB is not just better than the market but substantially so.

Interest rate (IB)

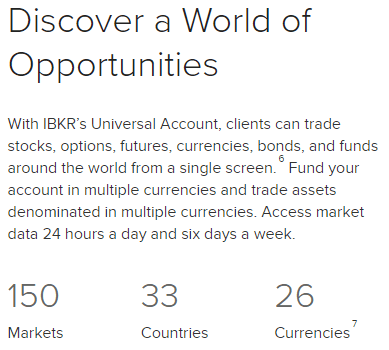

Additionally, the scope for trading different markets and asset classes is key. Many brokers focus on highly liquid and popular markets, such as US equities, but the value comes with extending beyond this to other asset classes, geographies, and currencies. With an extended remit, there is a lower number of brokers to compete with which increases IB’s legitimacy as a leading broker. As the following illustrates, IB offers a vast range markets which is far greater than most competitors.

Market coverage (IB)

Moreover, IB’s extended platform is fantastic. It is my broker of choice and from first-hand experience, my view is that the platform is easy to use and intuitive. Further, the additional services such as research, reports, notifications, and complex trading execution is an underrated companion which is extremely useful in various situations.

Trading platform (IB)

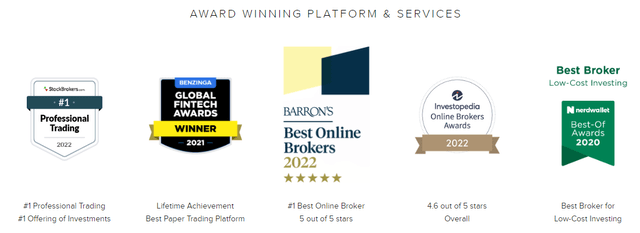

I am sure my opinion is highly regarded amongst readers but it is worth considering the wider view of the platform. IB has won numerous awards, as the following illustrates, as well as receiving good reviews.

Awards (IB)

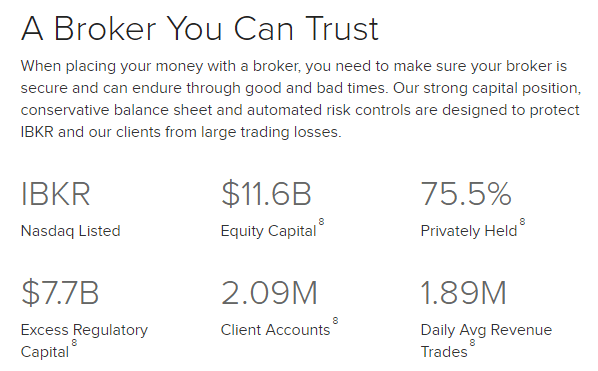

Finally comes trust. Trust is built through various avenues, one such being longevity. The company has been in operation since 1978, servicing clients and keeping churn to a minimum through quality services. Further, trust is maintained through financial strength. IB discloses the following to justify its financial strength, holding a substantial level of capital to respond to changing market conditions.

Trust (IB)

Finally, trust is developed through innovation to maintain a leading service. IB has developed its execution to ensure that it can achieve the best pricing for its customers. The most recent example is IBUSOPT, which IB believes will “help its retail and institutional clients achieve better price execution on their options trades”. IBUSOPT is a “new order destination for US equity and index options, is designed to offer clients the opportunity to interact with IBKR SmartRoutedTM order flow and have their orders filled in between the National Best Bid/Offer (NBBO)”.

Looking ahead, we believe market conditions will continue to attract new individuals to the investing world. The pandemic accelerated this in our view, as we saw the rise of pandemic-check investors. The near term may be tough, as investors take losses and are dissuaded by a declining market. This, however, has always shown itself to be short-lived, with investors returning once economic conditions improve.

The key threat in this regard is the rise of commission-free brokerages that are targeted at the younger audience, such as Robinhood (HOOD). IB has done relatively well to deter its current clients from switching, primarily through the quality of its service, but also by offering IBKR Lite, a commission-free alternative. We do not see this allowing IB to directly compete with the likes of Robinhood, however, as the platform is too “professional”. Many have criticized Robinhood for gamifying investing through the design of its app, attracting impressionable individuals through psychological signaling. Nevertheless, the value driver is paying clients and so our preference will always be less growth but premium pricing over higher growth and zero commission.

Additionally, IB is targeting financial advisors. It is doing so by introducing customized indexing, allowing for them to build stock portfolios modeled on other asset classes, such as ETFs, but adjusted for the individual investors’ unique needs. Further, other brokerages can also access IB’s backend infrastructure to route trades and conduct clearing activities, allowing IB to monetize another aspect of its operations.

Interactive Brokers has a strong presence in North America and Europe but has been expanding into new markets such as Asia. Given the trust it has built in the West, the company should have success translating this to additional geographies.

Overall, we are bullish on IB’s commercial profile. The business is providing investors with exactly what they need and it has a runway to further grow through expansion.

Economic considerations

Current economic conditions are defined by the heightened inflation rate we are currently experiencing. This has led to rates being raised as a means of combating the price spiral. With its impact on the cost of capital, it has led to weakening market conditions which are not good for IB, but the net impact is positive.

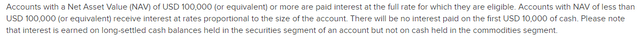

The reason is due to the ability to charge higher interest on margin loans while not proportionately paying out on deposits. This is because IB does not pay interest on the first $10k deposited. Further, Management only invests in short-term treasuries, allowing IB to benefit from the rising rates environment.

Interest-paying terms (IB)

With inflation remaining stubborn, especially in Europe, IB looks set to benefit from another financial year of heightened rates. Our current view is that rates will begin their decline at the end of 2023.

Margin

IB’s margins have improved handsomely over the last decade, with OPM increasing by 17ppts and NIM improving by 10ppts.

The largest driver of this is a change in revenue mix, with greater income generated from interest-bearing activities relative to other income. This is a far more profitable income stream. Net interest income now represents 56.8% of revenue, compared to 21.7% in FY13.

In the near term, margins will likely continue to rise as interest income rises further. Given the consistency of improvement, it is difficult to assess where rates can reach.

Q1-23 download

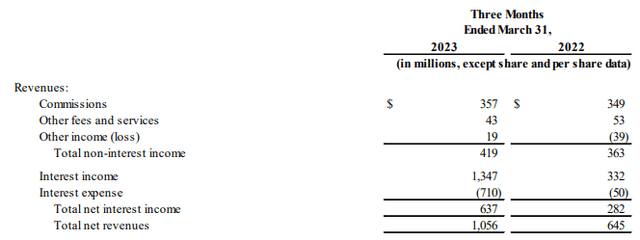

Q1 (1) (IB)

Although market conditions have slowed, brokerage revenue remains in excess of 2022 levels. The key driver of LTM performance, however, is interest income, which is more than double the Q1-22 level.

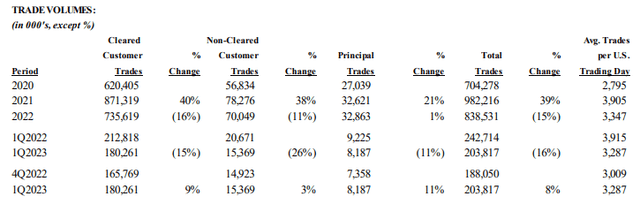

Q1 (2) (IB)

Trading volume remains below Q1-22 levels but has improved since Q4-22, potentially suggesting an improvement in market conditions following a weak 2022.

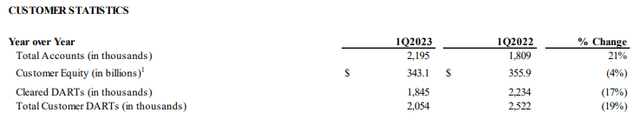

Q1 (3) (IB)

Finally, customer account growth continues to remain strong, with a 21% increase. Given the market conditions, a larger than normal number of individuals will close their accounts but this is still extremely positive.

Balance sheet

IB does not utilize debt to leverage its gains which means the risks to investors are lower, insulating against potential market shocks.

Distributions to shareholders have been minimal, with a steady dividend growing annually.

Outlook

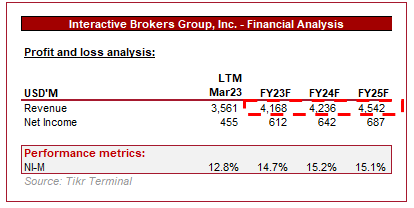

IB outlook (Tikr Terminal)

Presented above is Wall Street’s consensus view on the coming 3 years.

Revenue growth is expected to remain strong, although at a lower rate than what has been achieved prior. This looks to be a conservative view based on current market conditions. We believe IB can outperform this based on its commercial profile and market positioning.

Valuation

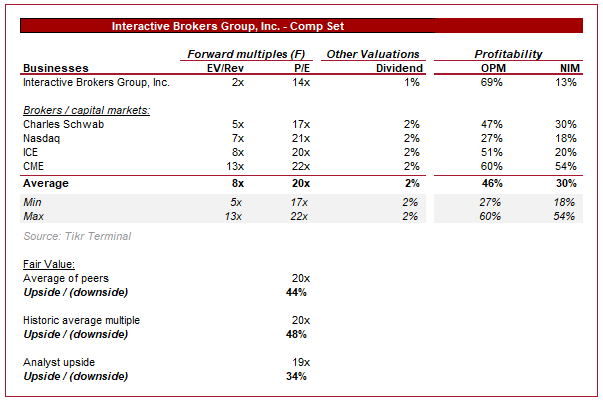

Valuation (Tikr Terminal)

Presented above is the current trading multiple for a cohort of financial services businesses.

IB is trading at a deep discount to these companies, likely due to the inferior bottom-line profitability, due to the minority interest mechanism. This said the key draw with IB is its superior growth, which Seeking Alpha rates an “A” relative to other FS companies. This partially offsets the current NIM inferiority. Nevertheless, profitability usually trumps growth unless the delta is substantial, suggesting a discount is warranted.

The question thus becomes, is a 44% discount appropriate? Based on prior trading, the answer is a clear no. IB’s average NTM P/E ratio across its historical trading period is 20x, which implies an upside of 48%. Given the improving margins, it could be argued that it means IB deserves a premium for this.

Analysts have taken the view that the net impact of the bull and bear case above is that a 19x multiple is fair, implying upside of 34%. This looks like a reasonable view given the historical ability to trade at the 20x level.

Key risks with our thesis

The risks to our current thesis are:

- Customer growth slowing the bump during the pandemic, impacting investor sentiment.

- Interest rates declining rapidly, resulting in a rerating of the stock based on the impact on earnings.

- A financial crisis triggered by current market conditions.

Final thoughts

IB is a fantastic business that represents an attractive long-term pick. Growth is strong and has shown resilience in changing market conditions, the product is very good, and consumers are increasingly investing. Margins are good and upward trending, with a strong balance sheet protecting against downside risk.

Investors concerned about relative margins are rewarded with valuation, as the current 14x forward P/E looks far too low for what investors are buying.

Read the full article here