The U.S. government could default on its debt within a matter of weeks, jeopardizing payments to millions of Americans and businesses.

Treasury Secretary Janet Yellen warned last week that the country could run out of money as early as June 1 if legislators do not raise or suspend the nation’s borrowing limit.

“This would be a huge hit to the economy and really an economic catastrophe,” Yellen told CNBC on Monday. “If Congress doesn’t raise the debt ceiling, the president will have to make some decisions about what to do with the resources we do have, and there are a variety of different options, but there are no good options. Every option is a bad option.”

But what is the debt ceiling, which is often used as a political football – and how could it affect individual Americans if Congress fails to raise the cap?

BANKING CRISIS THREATENS TO IGNITE CREDIT CRUNCH OF US HOUSEHOLDS: WHAT TO KNOW

The debt ceiling, which is currently around $31.4 trillion, is the legal limit on the total amount of debt that the federal government can borrow on behalf of the public, including Social Security and Medicare benefits, military salaries and tax refunds.

If Congress is unable to increase the debt limit, the Treasury would enter uncharted territory, incapable of paying bills – including payments to Social Security beneficiaries, government employees or service members – since it would have no cash on hand. The Treasury Department would be unable to issue any more bills or bonds and would instead have to rely on tax revenue and emergency accounts to pay the bill.

In a worst-case scenario, the U.S. would be so cash-strapped that it would have to delay its payment of interest or principal on the nation’s debt.

The government bumped up against that limit in January, prompting the Treasury Department to initiate a series of actions that are known as “extraordinary” measures intended to stave off a default.

“A technical default would also have severe consequences for millions of people. Social Security recipients, veterans, U.S. military employees, government employees, defense contractors, among others would likely go unpaid,” said John Lynch, chief investment officer for Comerica Wealth Management. “The downstream effects of job losses and freezing of the credit markets would be a multiple-quarter negative hit to GDP, making a deeper recession all but certain.”

The dire warnings come amid a lengthy standoff over the debt limit. Republicans, who control the House, have promised to raise the borrowing limit only in exchange for deep spending cuts. In turn, President Biden and his fellow Democrats, who control the Senate, have refused to negotiate and insisted on a “clean” debt ceiling bill that does not include any cuts.

INFLATION JUMPED 0.4% IN APRIL AS PRICES REMAIN STUBBORNLY HIGH

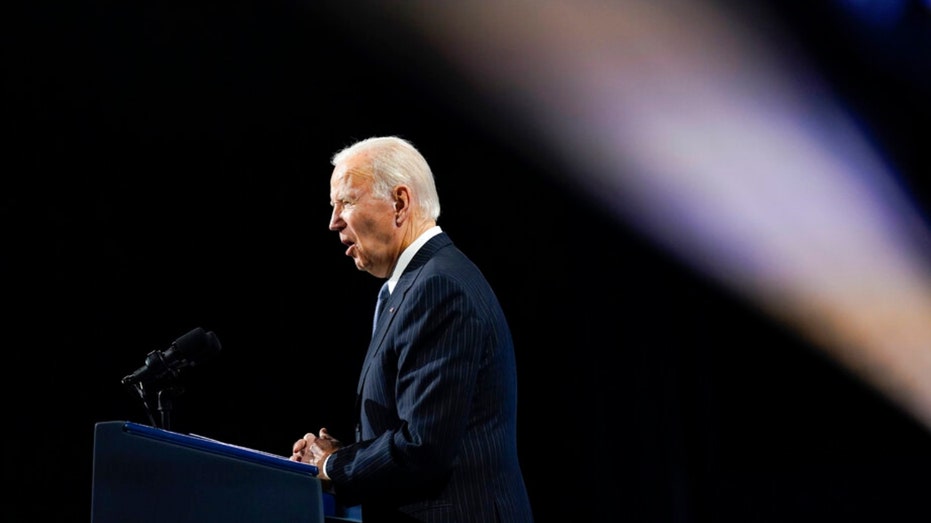

Biden hosted House Speaker Kevin McCarthy, R-Calif., and other congressional leaders at the White House Tuesday to discuss the nation’s spending and debt, but the meeting concluded with no consensus reached.

“I made clear during our meeting that default is not an option,” Biden said after the meeting. “I repeated that time and again. America is not a deadbeat nation. We pay our bills, and avoiding default is a basic duty of the United States Congress.”

McCarthy likewise said the two sides were at an impasse.

“I didn’t see any new movement,” he said.

A meeting between Biden, McCarthy and the other congressional leaders scheduled for Friday was postponed until early next week.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

If the U.S. failed to raise or suspend the debt limit, it would eventually have to temporarily default on some of its obligations, which could have serious negative economic implications. Interest rates would likely spike, and demand for Treasurys would drop; even the threat of default can cause borrowing costs to increase, according to the Committee for a Responsible Federal Budget.

While the U.S. has never defaulted on its debt before, it came close in 2011, when House Republicans refused to pass a debt-ceiling increase, prompting rating agency Standard and Poor’s to downgrade the U.S. debt rating one notch.

Read the full article here