Opening

BCC, also known as Boise Cascade Company (NYSE:BCC), is a leading manufacturer and distributor of wood products and building materials in North America. With dozens of distribution centers and manufacturing facilities across the United States and Canada, BCC offers a wide range of products, including plywood, engineered wood products, lumber, and specialty wood products.

Founded in 2004, BCC’s business strategy focuses on providing its customers with high-quality products and services while maintaining a strong commitment to sustainability and environmental responsibility. BCC’s products are used in a variety of applications, including residential and commercial construction, remodeling, and DIY projects.

This article presents a comprehensive evaluation of the financial performance of BCC and its potential for future growth. Our analysis includes a thorough examination of the company’s revenue and profitability trends, free cash flow generation, and the strength of its balance sheet. Moreover, we will utilize a discounted cash flow analysis to estimate BCC’s intrinsic value, thereby offering valuable insights to investors seeking to evaluate the company as a potential investment opportunity in the current market.

Track Record

BCC has demonstrated steady revenue and free cash flow growth over the past decade and has maintained a solid return on equity (ROE). Let’s delve deeper into the company’s financial performance and explore its potential as an investment opportunity.

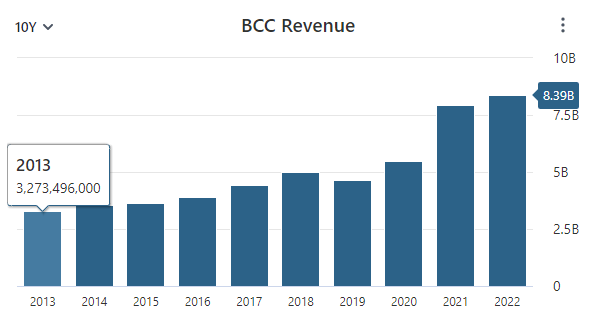

Revenue Growth: BCC has displayed impressive revenue growth over the past ten years, with only one year of revenue decline. In the past decade, BCC’s revenue increased from $3.27 billion to $8.39 billion last year, demonstrating the company’s ability to expand its operations and capture market share. Additionally, the company has grown its revenue in all but one year over the period.

Data Stock Analysis

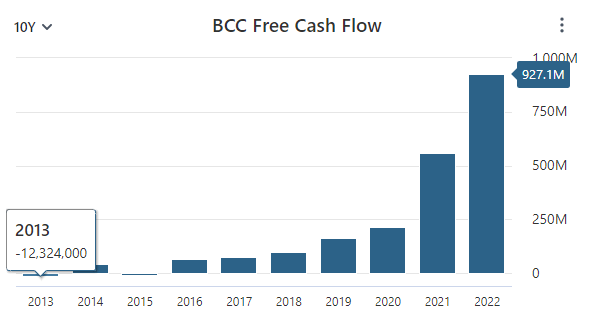

Free Cash Flow: Another crucial metric to consider is the company’s free cash flow, which measures the cash generated by the business that is available for investment, acquisitions, or shareholder payouts. Over the past ten years, BCC’s free cash flow has increased from a loss of $12.3 million to $927 million of free cash flow last year, indicating that the company generates significant cash flows from its operations.

Data by Stock Analysis

Return on Equity: ROE is a critical metric that investors use to assess a company’s performance. BCC has maintained an average ROE of 21.4% over the past ten years, which is remarkable given the company’s large size and established market position. A high ROE suggests that the company effectively uses its resources to generate profits for its shareholders.

Balance Sheet: BCC’s debt-to-equity ratio of 0.25 indicates that the company has a manageable amount of debt and that its balance sheet is in good condition. In addition, the company’s current ratio of 3.78, indicating that the company has a strong ability to meet its short-term obligations, such as paying bills and covering operational expenses.

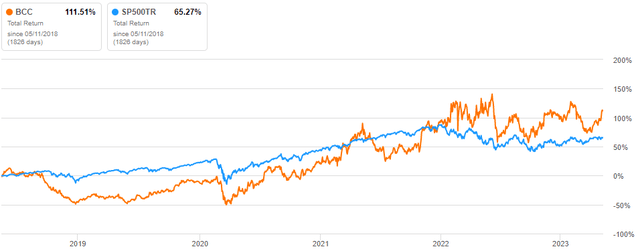

Total Return: BCC’s total return has surpassed the S&P 500’s total return over the past five years, delivering a total return of 111.5% compared to the S&P 500’s return of 65.2% over the same period. Long term shareholders of BCC have been rewarded, but the question on everyone’s minds is whether BCC can continue these stellar results.

Data by Seeking Alpha

Forecast

The outlook for BCC appears to be challenging in the coming years, as analysts are predicting a decline in revenue and earnings. The estimated revenue for 2023 is $6.46 billion, which represents a substantial decrease of -22.97% compared to the previous year. Although the company is expected to experience a slight recovery in revenue in 2024 and 2025, the year-over-year growth rate is still relatively low at 4.97% and -2.77%, respectively.

Similarly, BCC’s earnings are expected to decline significantly over the next three years, with EPS estimates of $8.31, $7.27, and $7.75 in 2023, 2024, and 2025, respectively. The year-over-year growth rate is projected to be negative in 2023 and 2024 but 2023 will be a particularly down year with earnings estimated to be down by more than 60%. A slight recovery is estimated in 2025 but overall, in the near-term BCC will come back down to earth after posting some of its best years in recent memory.

Moreover, the demand for BCC’s products is closely linked to the level of residential and light commercial construction, which is expected to slow down in 2023, according to industry forecasts. These forecasts project that the number of single- and multi-family housing starts in the U.S will range from 1.1 million to 1.3 million units, which is lower than the actual housing starts of 1.55 million in 2022 and 1.60 million in 2021 reported by the U.S. Census Bureau.

However, BCC does have a plan to boost its earnings and make them more consistent by selling a higher volume of engineered wood products (EWP) and enhancing the distribution channels. Their EWP is primarily based on creating veneer products. To achieve this goal, BCC is shifting more of its internally produced veneer away from plywood, a product line that is prone to drastic price fluctuations. Additionally, BCC purchased the Coastal Plywood Company last year, which possesses production facilities that can lead to additional growth opportunities for EWP.

While the outlook for BCC may appear challenging in the short term due to the predicted decline in revenue and earnings, the company has a plan in place to boost its earnings and make them more consistent. BCC’s shift towards engineered wood products and the acquisition of Coastal Plywood Company provides a potential avenue for growth opportunities.

Valuation

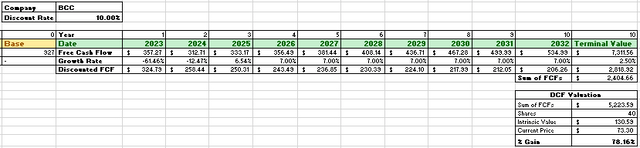

To assess BCC’s intrinsic value, we will use a discounted cash flow (DCF) analysis, which is a popular valuation method that estimates an investment’s intrinsic value by calculating the present value of its expected future cash flows.

To initiate the discounted cash flow (DCF) analysis, we will take BCC’s free cash flow from the previous year, which amounts to $927 million, as the foundation for our projections. Over the next three years, we will use growth rates of -61.4%, -12.47%, and 6.54%, respectively, based on the average analyst estimates of earnings for this period. However, beyond this timeframe, it becomes more challenging to accurately predict BCC’s free cash flows. As a result, we will use a growth rate of 7% over the following seven years, considering the company’s excellent track record of growth.

To determine the terminal value, we will use a more conservative perpetual growth rate of 2.5%. Additionally, we will employ a discount rate of 10%, which takes into account the long-term return rate of the S&P 500 with dividends reinvested. Based on these inputs, BCC’s intrinsic value can be calculated to be $130.59. This suggests that BCC may be substantially undervalued, indicating a potential 78.16% return for investors compared to the current market price.

Author’s Work

Final Word

In summary, Boise Cascade Company appears to be a strong investment opportunity for long-term investors. The company has consistently generated significant free cash flow, maintained a high return on equity, and has a manageable amount of debt on its balance sheet. Furthermore, BCC’s total return has surpassed the S&P 500’s total return over the past five years.

While the outlook for BCC may appear challenging in the short term due to the predicted decline in revenue and earnings, the company has a plan in place to boost its earnings and make them more consistent by shifting more towards engineered wood products.

Based on a discounted cash flow analysis, BCC’s intrinsic value is estimated to be $130.59, indicating a potential 78.16% return for investors compared to the current market price. Therefore, we recommend BCC as a buy for long-term investors looking for a potential undervalued investment opportunity.

Read the full article here