Introduction

Cellnex Telecom (OTCPK:CLNXF) (OTCPK:CLLNY) is one of the largest cell phone tower operators in the world, and the largest in Europe. The past few years, the company has taken excellent advantage of the availability of low-cost debt to gradually expand its empire but as interest rates are increasing, it is time to pay the piper. Cellnex realizes this and is now only completing the already agreed ‘build to suit’ tower sites and isn’t spending a whole lot of cash on expansion anymore. Fortunately almost 80% of its total amount of outstanding debt has a fixed rate and while this provides good visibility, the debt will eventually have to be refinanced and interest expenses will increase.

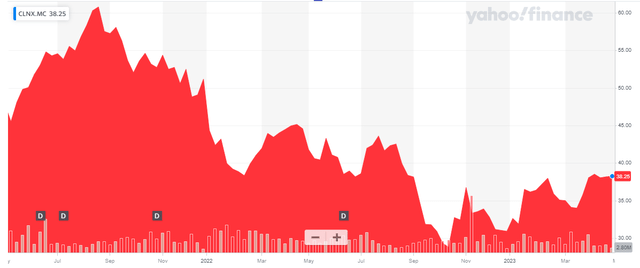

Yahoo Finance

Cellnex Telecom is a Spanish company and its primary listing (ticker symbol CLNX) on the Madrid Stock Exchange for sure is the most liquid listing. The average daily volume is 1.4M shares and the current market capitalization is 27B EUR based on the current share count of 705M (706.5M outstanding minus the shares in treasury).

The cash flows remain strong, but the expansion capex still required plenty of cash

I provided a more in-depth analysis of Cellnex in January and I’d recommend you to have a look at that article to get a better understanding of the company’s background and targets for 2025. In this article I will mainly zoom in on the Q1 performance to see if Cellnex remains on track for a solid result this year.

Unfortunately Cellnex only publishes detailed financial statements after the first semester but the Q1 trading update contains all the information and elements we need.

During the first quarter, Cellnex reported a total revenue of 985M EUR and it recorded a total adjusted EBITDA of 730M EUR for an EBITDA margin of almost 75%. As of the end of the quarter, Cellnex operated almost 112,000 operational sites of which about 25,000 were in France, 15,600 are located in Poland followed by the United Kingdom (12,500) and Spain (10,500) as most important countries for Cellnex.

The most important metric to value Cellnex Telecom is the ‘ recurring leveraged free cash flow’. Although Cellnex is not a REIT but a normal corporation, and the RLFCF comes pretty close to the definition of what would be the AFFO of a REIT: it includes the interest expenses as well as the sustaining capex and lease payments, but it excludes growth capex.

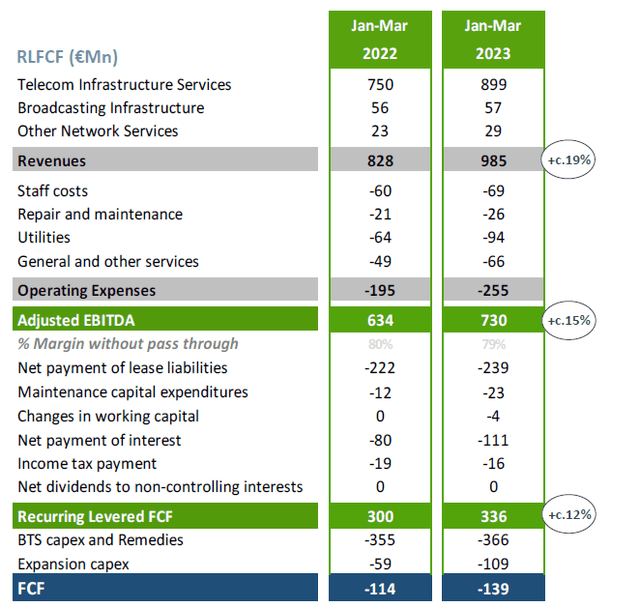

Cellnex Investor Relations

The image above explains how the RLFCF is calculated. The starting point is the 985M EUR revenue and after deducting the 255M EUR in operating expenses, the adjusted EBITDA was 730M EUR. From that result, we still need to deduct the lease payments (239M EUR), the interest payments and taxes as well as the 23M EUR in sustaining capex. This results in a RLFCF of 336M EUR.

There are however two important issues I’d like to raise here. First of all, we should also add back the 4M EUR in working capital investments to the equation. Additionally, the majority of the interest payments occurs in the first quarter of this year. On the Q1 2023 conference call, the Cellnex management confirmed the full-year interest expenses will come in at 320-340M EUR. If I would use the higher end of that guidance, the average quarterly interest payments would come in at 85M EUR per quarter, which is about 26M EUR lower than what has been paid in the first quarter of this year. This means that on a normalized basis and adjusting the result for changes in the working capital and the timing of interest payments, the underlying RLFCF was approximately 366M EUR or 0.52 EUR per share.

Of course the main element to keep an eye on is the evolution of the gross debt, net debt and interest expenses. The current average cost of debt is less than 2% and we should operate under the assumption the average cost of debt will gradually double over the next decade as existing debt matures and will have to be refinanced at higher rates.

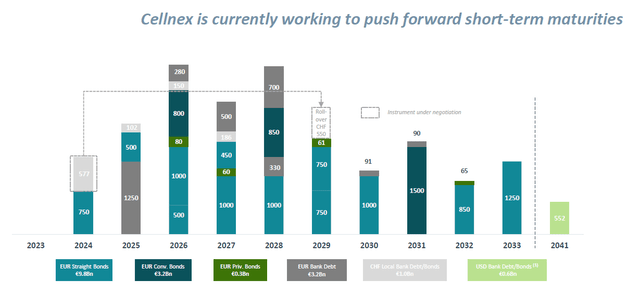

Cellnex Investor Relations

Between now and the end of 2026, the company will have to refinance in excess of 5.3B EUR in gross debt and an increase of the average cost of debt by 250 basis points across the board will increase the total interest expenses by 130M EUR and the after-tax impact will be approximately 100M EUR. I don’t anticipate Cellnex to reduce its gross and net debt level by 2025-2026 as the company is still spending its net free cash flow on certain pre-agreed expansion projects.

Investment thesis

Needless to say, the higher cost of debt will have an impact on the bottom line and the Recurring Leveraged Free Cash Flow Result per share. But thanks to the staggered maturity dates of the existing debt, the interest expenses will only increase gradually and there is a good chance the impact may be offset by higher revenues as 65% of the lease agreements have annual rent hikes based on the Consumer Price Index (although there usually is a 2-3% cap). Increasing the revenue by 2.5% in the 2024-2026 era would add about 75M EUR in annual revenue to the top line. And of course, the additional towers that are currently under construction will start to contribute to the top and bottom line as well.

I currently have no position in Cellnex but I have written a few out of the money put options. Most of those options have expired without me being assigned to buy the shares but I continue to write put options with strike prices below 35 EUR. I would like to pick up stock in the low-30 EUR range. At 32.5 EUR, this would be a multiple of 15.5 based on the anticipated AFFO of 2.1 per share in 2023 (and I am well aware that higher interest rates mean the company will likely not show earnings/AFFO/RLFCF growth over the next few years as the anticipated revenue increases will have to be used to compensate for higher interest expenses.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here