Fulgent Genetics (NASDAQ:FLGT) is a technology company founded in 2011. Since then, it has continued to actively expand its business by increasing the number of oncology tests and the range of services offered, becoming one of the leaders in the field of clinical diagnostics in the United States.

On May 5, 2023, the company released its financial results for the first quarter of 2023, which showed that as the COVID-19 pandemic subsides and the corresponding drop in COVID-19 testing revenue, demand for comprehensive anatomic pathology services, molecular diagnostic, and genetic testing continues to show positive dynamics in recent months.

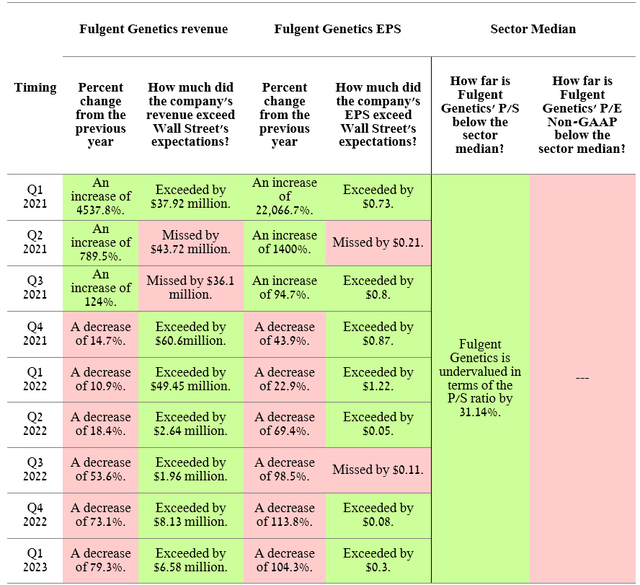

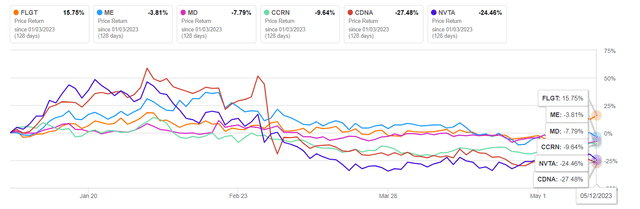

Author’s elaboration, based on Investing.com

As a result, Fulgent Genetics’ net income and revenue continue to surprise Wall Street analysts’ expectations, which is reflected in its share price growth in 2023, unlike major competitors like 23andMe (ME), CareDx (CDNA), and Invitae (NVTA).

Author’s elaboration, based on Seeking Alpha

We initiate our coverage of Fulgent Genetics with an “outperform” rating and a $42 target price for the next 12 months.

Fulgent Genetics’ Financial Position

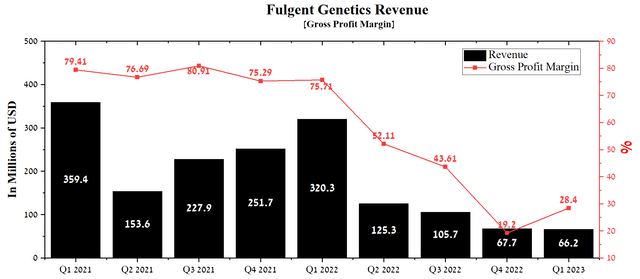

The business model built under Ming Hsieh’s leadership, which includes acquiring promising assets aimed at developing drugs against cancer and its diagnostics, will allow management to turn the genomic diagnostics business into a precision medicine company. Fulgent Genetics’ revenue for the first three months of 2023 was $66.2 million, down slightly from the previous quarter but showing a more significant decline from the prior year.

Author’s elaboration, based on Seeking Alpha

The main reason for the sharp decline in revenue is the reduction in cooperation with public schools and various public health agencies in the field of testing for COVID-19. Fulgent Genetics, along with such industry mastodons as Quest Diagnostics (DGX), Labcorp (LH), and OPKO’s BioReference Health (OPK), has been one of the key players in the fight against the pandemic from 2020 to 2022. The company shipped about 19.3 million COVID-19 tests, earning about $1.7 billion, which allowed for a more aggressive R&D and M&A policy.

From Q4 2022, the company’s gross margin began to show positive dynamics again, thanks to reduced reagents and supplies costs and an increase in Fulgent Genetics’ core revenue to $62.7 million in the first three months of 2023. We predict that by 2023 the company’s gross margin will reach 35.5%, and by 2024 this value will increase to 42.5%.

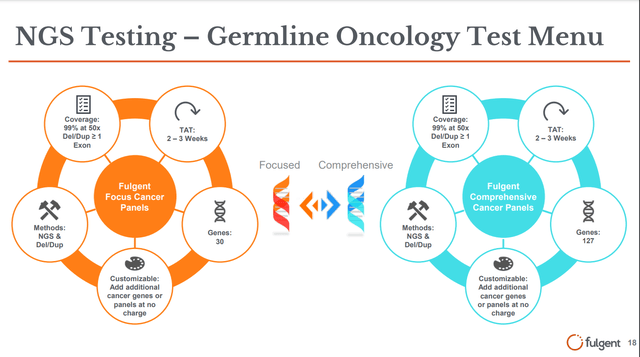

This result will be achieved due to the growth in demand for the company’s genetic tests in China and the acceleration of the integration of Inform Diagnostics, which was acquired in April 2022 and is one of the leading pathology laboratories. We believe that this acquisition has enabled Fulgent Genetics to strengthen its position in the rapidly growing market for pathological tests and expand its portfolio of next-generation sequencing (NGS) tests, which provide physicians and patients with many benefits. These advantages over traditional methods such as Sanger sequencing are more genomic information for physicians, faster data processing, and more accurate genome sequencing.

Fulgent Investor Presentation

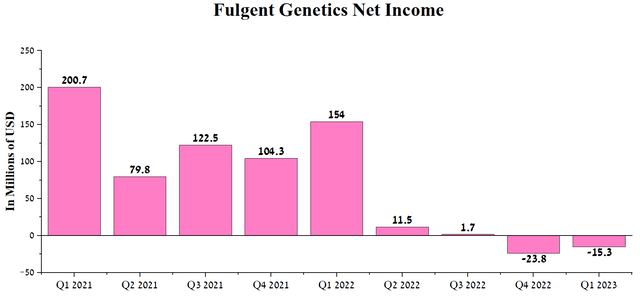

The company’s net loss continued to decline and stood at $15.3 million in Q1 2023, beating Wall Street analysts’ expectations.

Author’s elaboration, based on Seeking Alpha

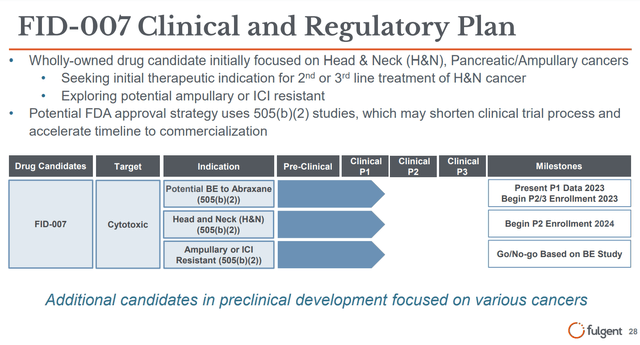

2023 will be another year of necessary transformation and high spending on developing the company’s pharmaceutical segment projects. As a result of the acquisition of Fulgent Pharma in 2022, the company acquired promising technologies for delivering small-molecule drugs with low solubility in aqueous solutions.

Thanks to the nanoencapsulation of experimental medicine, its solubility improves, ultimately positively affecting its absorption inside the patient’s body. The company is continuing its Phase 1 clinical trial evaluating the efficacy of FID-007, a nano-encapsulated paclitaxel, in treating various types of cancer. We estimate that the first results of this clinical study are expected in June 2023 and will be an essential milestone in developing the company’s business.

Fulgent Investor Presentation

Under our DCF model, we expect the company to have a net loss of $65 million in 2023. However, from the first half of 2025, the company will begin to show a profit, including due to geographic expansion and increased access to Beacon787, one of the most advanced carrier tests. We believe this product is a helpful tool for millions of women planning to become pregnant to make better decisions about family planning and reduce the risk of passing on genetic and chromosomal conditions to their children.

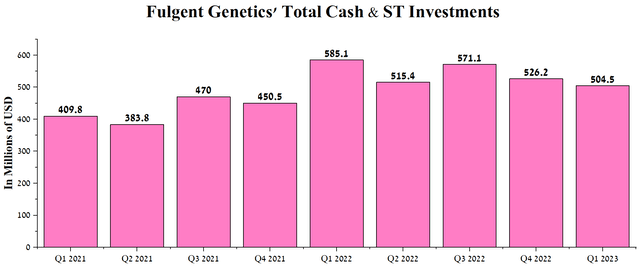

At the end of March 2023, total cash and short-term investments were $504.4 million, or about 48% of Fulgent Genetics’ current market capitalization.

Author’s elaboration, based on Seeking Alpha

Fulgent’s current cash flow is sufficient to maintain high R&D activity, and we see no need to take action to increase the company’s liquidity through a secondary public offering.

Conclusion

We initiate our coverage of Fulgent Genetics with an “outperform” rating and a $42 target price for the next 12 months. Fulgent Genetics is a technology company founded 12 years ago and, since then, has continued to actively expand its business by increasing the number of oncological and genetic tests and the range of services offered, becoming one of the leaders in the field of clinical diagnostics in the United States. In addition, the company is continuing its Phase 1 clinical trial evaluating the efficacy and safety profile of FID-007, a nano-encapsulated paclitaxel, in treating intractable cancers.

In the next three months, we expect the company’s share price to drop to $29 per share due to continued macroeconomic volatility in some European countries due to the war between Russia and Ukraine and an increased risk of default due to the US government debt ceiling being reached. If this price is reached, we plan to start purchasing Fulgent Genetics shares as a long-term investment.

Read the full article here