Chart Industries (NYSE:GTLS) now has the Howden acquisition “under its belt”. So now management has to make good on all its promises. There is a lot of leverage here. But Mr. Market is very concerned about unforeseen things that are beyond the control of management that could unfavorably impact a now highly leveraged company. This management decided to forgo the decision to issue more preferred stock (which might have reassured the market) when closing. That meant more debt than expected in the eyes of the market. However, the market should have been aware of that as the financing news announced progressive results of financing in place.

Now, management has to produce. The big thing in the favor of the combined company (debt, preferred stock, and all) is the fact that both companies have long-lead times with big backlogs that have largely locked the current year into place. About all that can happen now is the addition of smaller orders for probably the fourth quarter or movement of some shipments into the first quarter of the next fiscal year. That is an unusual amount of surety for an industrial company.

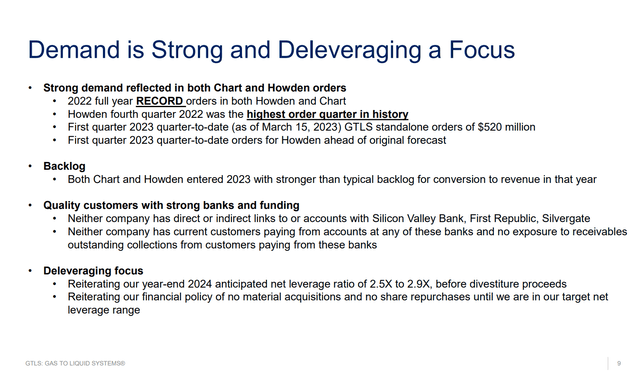

Chart Industries Current Business Status Summary (Chart Industries Bank Of America Industrials Conference March 21, 2023)

In line with the company management’s outlook is the note about record orders and a backlog. Traditionally the backlog has been extremely firm as these projects usually proceed even during times like 2020 when many things shut down. There is also a fair amount of government involvement in many of these projects (like hydrogen and water for example) that also serves to steady the business.

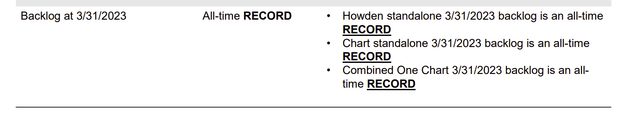

Chart Industries Backlog Update (Chart Industries Investor Update April 2023)

Management reiterated in the update and later on with the earnings presentation that both companies were on their way to a record year. This is an important point because the first few months of deleveraging are usually the ones that need to go as schedule. As leverage declines, there is more room for unforced errors or unplanned events.

Mr. Market has always worried about like what a good recession like 2008 or even 2020 would do to the business. But in the 40 years or so I have followed this company, about the only thing that happened was orders slowed somewhat during the crisis and then immediately bounced back. Large projects are hard to stop (and this company is a small operator in a large project business). Therefore, business tends to keep going to matter the current atmosphere.

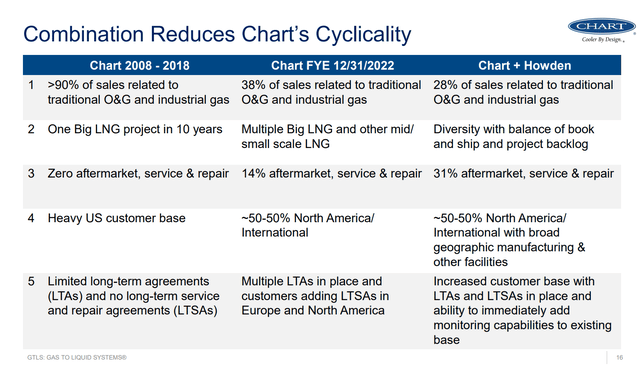

Chart Industries Summary Of Business Strategic Evolution (Chart Industries Bank Of America Industrials Conference March 21, 2023)

From that little company I found 40 years ago to the present company today has seen some major strategic initiatives. Probably none has been more important than decreasing the importance of the cyclical natural gas business. There were times when the cyclical nature of oil and gas took orders to zero or close enough. Now, as shown above, there will be ongoing business even when oil and gas heads down.

My own personal belief is that the oil and gas business will have some effect on earnings because of the influence of the business during cyclical tops. But other businesses will offset that like the aftermarket business which tends to be countercyclical.

In the meantime, the oil and gas business is clearly roaring ahead as an industry recovery proceeds. When this is combined with a presence in the fast-growing marijuana and hydrogen markets, the result is a very robust and likely fast-growing future.

Some other markets like water are also fast growing, but do not attract nearly the attention that certain other markets attract.

So, the benefits of this acquisition appear to be the ability to be a one-stop shop for a lot of customers. This means the combined company should be able to grow sales faster than the two companies could separately. That can be highly subjective and really hard to measure. But generally, the market is happy as long as fast growth continues.

What All This Means

The market wants to see results. The first result will be of course the shipment of the respective backlogs without a loss of quality control. Management typically minimizes acquisition risks by keeping prior management in place. Most of the benefits come by combining sales efforts and sharing sales leads in the corporation. Logistically, that is going to make a large combination like this one a whole lot less risky.

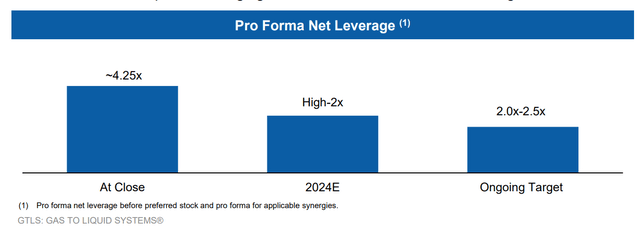

Chart Industries Projected Debt Ratio Guidance From Original Merger Announcement (Chart Industries Acquisition Of Howden November 9, 2022)

Two things will likely hold the stock price back. The first is the debt ratio shown above after the acquisition. This one is from the November 2022 announcement. But I do not believe that it has changed all that much since then. I suspect we get a solid one with the first quarter report as a “starting point”.

The second one is the conversion of the preferred stock. There also was some convertible debt that I need to check on in the first quarter. All of this needs to be cleaned up to make the financials a lot easier for the market to understand.

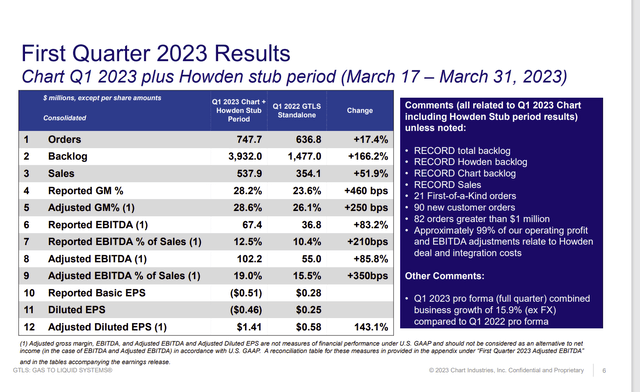

Chart Industries First Quarter Results Summary (Chart Industries First Quarter 2023, Earnings Conference Call Slides April 2023)

Management reported a blockbuster first quarter before acquisition and other one-time expenses. That $1.41 adjusted earnings was easily the highest first quarter earnings I had seen in quite some time (maybe ever). The stock responded positively to the earnings and the backlog announcements by management. But it will take more than one quarter of darn good earnings.

As long as that debt ratio is high, the stock may make limited progress without some evidence of rapid improvement in earnings. Typically, this stock has traded based upon backlog activity, probably because the market looks forward. That may be restricted somewhat given the debt load shown above.

The Future

The future could be very rocky. Typically, in the past, Mr. Market has had severe doubts about the backlog during any time of panic or crisis like the current. Given that the market did not exactly like the merger announcement, probably due to the leverage, there is ample risk of more downward movement.

However, despite the market concerns, this business has proven remarkably business cycle resilient in the past. Therefore, even though there are several examples of this stock going down with the market (and more sometimes), it nearly always led the market back. This is a very volatile stock.

As long as management meets the deleveraging goal, this stock should outperform the market given the business presence in some very hot markets that Mr. Market likes quite a bit. But the key is that deleveraging goal.

The other thing is that this management traditionally added to the product line through acquisitions. Those acquisitions will stop until decent leverage is restored. That is extremely unusual for this company. The effects of that have yet to be determined. However, it is possible that the product line ages, and the company loses its competitive edge somewhat. Joint ventures may solve that problem. But it is definitely uncharted territory.

For me, this is a strong speculative buy due to all the risks discussed, and I could lose quite a bit of principal if things head South. Therefore, I will probably keep the position at about 2% at the most of my portfolio. This is one of the most volatile stocks that I own. Anyone who cannot stand a 50% swing “because it is Tuesday” really needs to look elsewhere.

Read the full article here