In case you didn’t know, we’re living in some very interesting times right now, with a lot of volatility and uncertainty, which is the reason I’ll be writing more and more on safe harbor stocks.

I know that you’ve heard me say this before, but it’s worth mentioning again: NOW IS NOT THE TIME TO BE TOO CUTE.

What do I mean by this?

Yield chasing is dangerous, and any dividend yield over 10% should be considered speculative, especially now. I’ve written numerous articles defending that claim:

Seeking Alpha

In that article I argued that investors should not look twice at buying Global Net Lease (GNL), City Office (CIO), or AGNC Investment Corp. (AGNC).

Seeking Alpha

In that article I remind readers to avoid investing in high yielding residential mortgage REITs. I explained.

“It’s well known that mortgage REITs use more leverage, and the investment risk is elevated, compared with equity REITs that grow dividends. To put it bluntly, mortgage REITs do not belong in a retirement portfolio.”

In this cycle my job is to steer you to safety and point you to some of the highest quality REITs that offer the best risk-adjusted total return prospects.

Trust me.

Dividend cuts are painful, and they can wipe out your retirement account.

I’ve seen this play out before and given the fact that I have over 30 years of experience as an investor (with $1 billion of deals under my belt) I speak from experience.

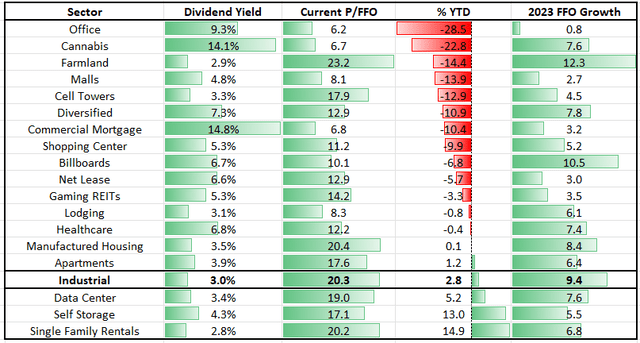

So today I’m going to provide you with an overview of two of my favorite Industrial REITs and they are core to my SWAN portfolio. If you don’t own them now, you should, and I can assure you that you’ll thank me later.

iREIT

Prologis (NYSE:PLD): 2.8% Dividend Yield

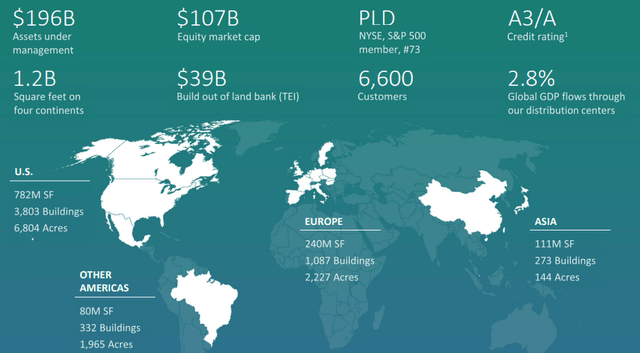

Prologis is the largest industrial real estate investment trust (“REIT”) with a current market capitalization of $115.3 billion. PLD is a behemoth in the industrial space with 5,489 buildings that cover 1.2 billion square feet in 19 countries and have a customer base totaling 6,600. In addition to their existing properties, PLD has $38.4 billion invested in land banks for future development and expansion.

In addition to leasing out industrial space, PLD generates income through its Prologis Essentials platform which provides services to their customers beyond the space they lease. Through the Essentials platform PLD is able to provide forklifts, generators, racking, overhead lighting, EV charging stations, and even furniture to assist their customers streamline and optimize their business.

PLD – IR

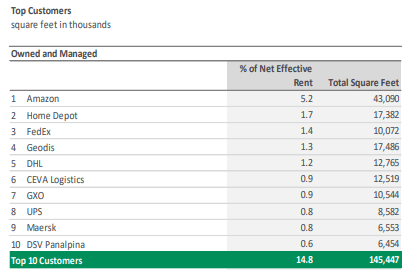

Prologis has a diversified tenant base and an occupancy rate of 98.0% as of the first quarter of 2023. Their top tenant (Amazon) contributes 5.2% of their net effective rent and their top 10 tenants contribute 14.8%. Their top tenants include names like Amazon, Home Depot, FedEx, DHL, and UPS to name a few.

PLD – IR

STAG Industrial (NYSE:STAG): 4.2% Dividend Yield

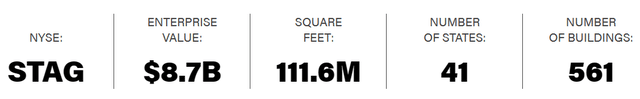

By comparison STAG is a much smaller industrial REIT with a market capitalization of $6.21 billion. Rather than having a global logistics network, STAG focuses on industrial properties within the United States.

STAG has a strategic focus on domestic properties across multiple markets. Instead of competing with institutional investors for industrial real estate in primary markets, STAG focuses on markets where their typical competitors are local investors that normally do not have the same access to capital.

STAG attempts to capitalize on fragmented, primarily non-institutional markets where they feel they have a competitive advantage. In total, STAG’s portfolio has 561 buildings that are located in 41 states and cover 111.6 million rentable square feet.

STAG – IR

STAG is well diversified by tenants with its top tenant (Amazon) only contributing 2.8% of their annualized base revenue (“ABR”) and their top 10 tenants only contributing 9.9%.

As of year-end 2022, STAG’s buildings were 98.5% leased with no tenant other than Amazon contributing more than 1% of their ABR and no single industry contributing more than 10.9%.

STAG – IR

While both PLD and STAG are industrial REITs they are polar opposites in many ways. PLD has properties all across the globe, while STAG focuses on domestic properties. PLD tends to buy large portfolios of properties in primary markets, for example their recent acquisition of Duke Realty, while STAG focuses on individual properties in fragmented markets.

Both PLD and STAG are high quality REITs and we have a buy recommendation on both, but I wanted to see how they stack up against each other to determine which one might present a better buying opportunity at this time.

Balance Sheet Strength / Debt Metrics

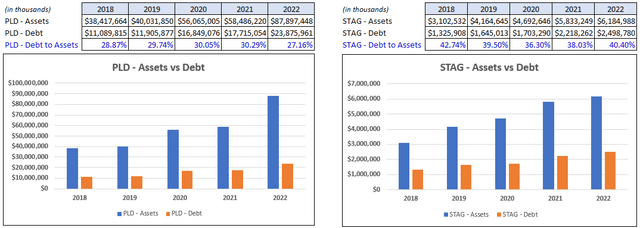

PLD is investment grade with a credit rating of A by S&P Global. They have excellent debt metrics with a debt to adjusted EBITDA of 4.3x and a fixed charge coverage ratio of 9.9x.

Their debt is approximately 92% fixed rate with a weighted average interest rate of 2.6% and a weighted average term to maturity of 9.7 years. As of year-end 2022, PLD had a debt to asset ratio of 27.16% and a long-term debt to capital ratio of 32.77%. Plus, as of the first quarter of 2023, PLD had $5.7 billion in total liquidity.

STAG is also investment grade rated and has a Baa3 credit rating from Moody’s (equivalent of BBB- by S&P). They have a net debt to adjusted EBITDA of 5.0x and a fixed charge coverage ratio of 5.6x.

Their debt is 90.5% fixed rate and has a weighted average interest rate of 3.39%. As of December 31, 2022, STAG had a debt to asset ratio of 40.40%, a long-term debt to capital ratio of 39.49%, and $757.8 million in total liquidity.

On this front I would give the advantage to PLD as they have a higher credit rating, a much stronger fixed charge coverage ratio, and a lower weighted average interest rate.

PLD / STAG (Form 10-K)

Profitability

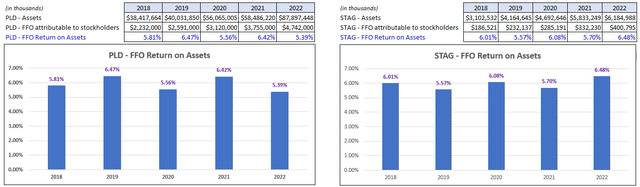

PLD and STAG are pretty comparable based on their FFO Return on Assets. Both have ranged approximately between 5.5% to 6.5% since 2018. Based on this metric it looks like the companies are evenly matched on how efficiently they use their assets to generate returns.

PLD/ STAG – Form 10-K (compiled by iREIT)

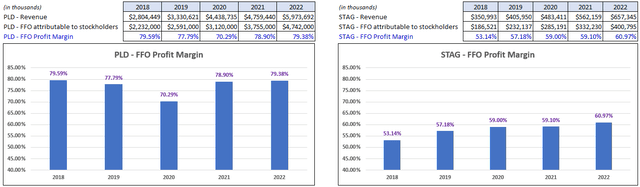

PLD has a clear edge when it comes to FFO profit margin. With the exception of 2020, PLD’s FFO profit margin has hovered around 78-79% whereas STAG FFO profit margin has been around 59%.

One encouraging sign is that STAG has improved this metric each year since 2018, but on the whole I would say that PLD has better profitability metrics when compared to STAG.

PLD/ STAG – Form 10-K (complied by iREIT)

AFFO Earnings Growth

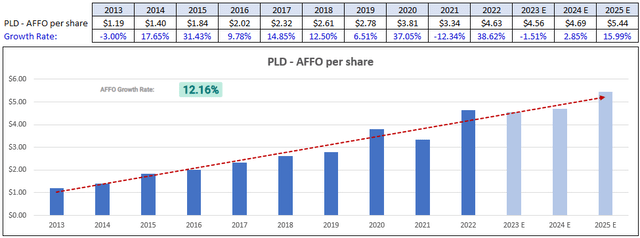

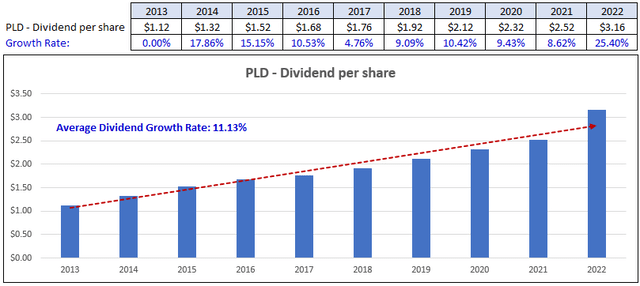

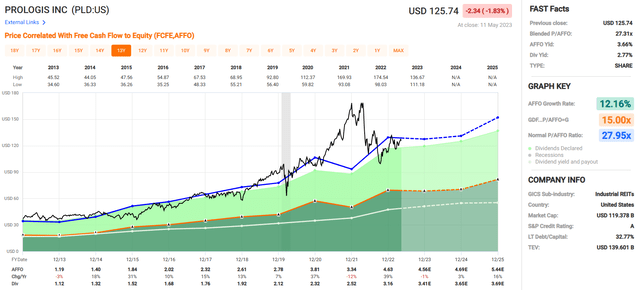

Prologis has delivered an average adjusted funds from operations (“AFFO”) growth rate of 12.16% since 2013. AFFO increased by 38.62% in 2022 but is expected to decline by -1.51% in 2023. Analysts expect AFFO growth of 2.85% and 15.99% in the years 2024 and 2025 respectively.

FAST Graphs (compiled by iREIT)

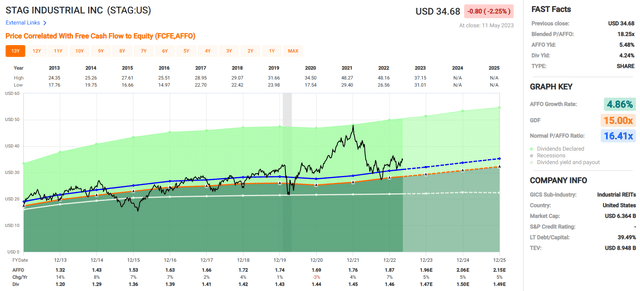

While STAG has positive AFFO growth, it is not growing nearly as fast as PLD. STAG has averaged an AFFO growth rate of 4.86% since 2013 and analysts expect that to continue with expected growth rates of 4.81%, 5.10% and 4.37% in the years 2023, 2024, and 2025 respectively. While growth rates of around 4% to 5% per year are solid, based on this metric Prologis is the clear winner.

FAST Graphs (compiled by iREIT)

Dividend Metrics

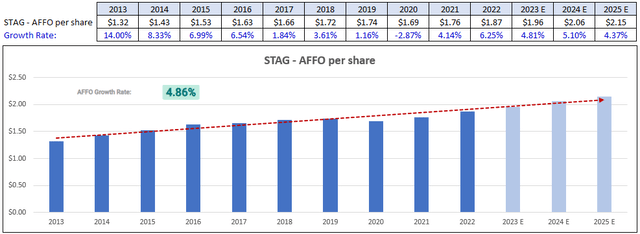

Prologis has increased their dividend on average by 11.13% each year since 2013. In 2022 PLD increased their dividend from $2.52 to $3.16 per share for a year-over-year growth rate of 25.40%.

FAST Graphs (compiled by iREIT)

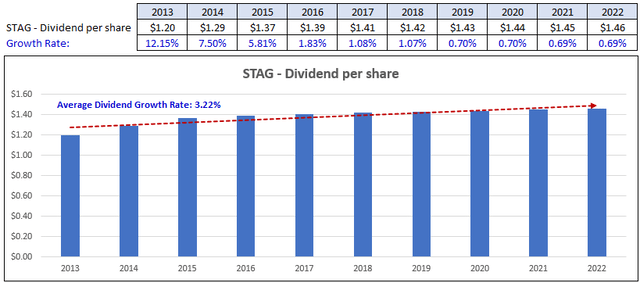

STAG has averaged a dividend growth rate of 3.22% since 2013. One thing to point out though is that STAG had fairly significant dividend growth in 2013, 2014, and 2015, but since that time the growth rate has slowed dramatically. Since 2019 their dividend growth has been under 1% and if you only look at the past 5 years their average dividend growth rate goes down to 0.77%.

FAST Graphs (compiled by iREIT)

Prologis clearly has superior dividend growth rates, however they pay a lower dividend yield than STAG. Prologis currently pays a 2.77% dividend yield, which is well under the 4.24% dividend yield that STAG pays.

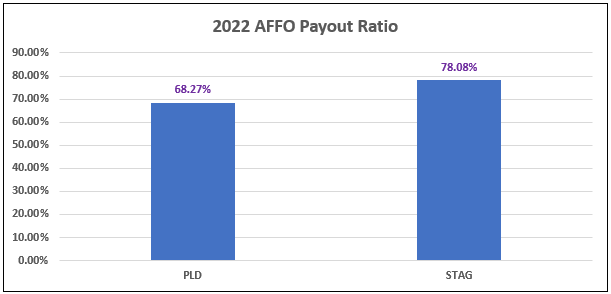

In terms of dividend safety, both PLD and STAG’s dividends are well covered with an AFFO payout ratio of 68.27% for PLD and 78.08% for STAG. PLD has a more conservative payout ratio but both REITs are within a comfortable range.

In terms of their dividend metrics I don’t see a clear winner here. Both PLD and STAG’s dividends are well covered, and both have increased their dividend each year over the past decade and did not have to cut it during the pandemic.

In this case it really just depends on the investor’s preference. If you’re looking for high yield and current income then STAG has the advantage. However if you are more of a dividend growth investor then PLD is clearly the better choice.

FAST Graphs (compiled by iREIT)

Valuation

Over the last decade the market has assigned a much higher multiple to PLD than STAG. PLD has had an average P/AFFO multiple of 27.95x since 2013 while STAG has had an average P/AFFO multiple of 16.41x over that same time period.

Prologis is a much larger company, with a stronger balance sheet and has delivered much higher growth rates so it makes sense that it deserves a premium multiple. At the same time though, you get more current cash flow for each dollar invested in STAG than you do from PLD. I think this again depends on the investor’s preference.

If you are more focused on quality, then you might be willing to pay a premium multiple with the expectation of continued high growth rates. If you are more value orientated then STAG might be the way to go.

Current Valuation

Currently Prologis is trading at a P/AFFO of 27.31x which is slightly below their average AFFO multiple of 27.95x. Prologis is an extremely high quality REIT that is trading at fair value when compared to their historic multiple. They have excellent debt metrics, growth rates, a solid yield, and a very well covered dividend. At iREIT, we rate Prologis stock a BUY.

FAST Graphs

STAG is currently trading at a P/AFFO multiple of 18.25x which is higher than their normal AFFO multiple of 16.41x, but well below the average multiple for an industrial REIT. STAG may only have modest growth rates, but it has a strong balance sheet with solid debt metrics and pays a high yield that is well covered. At iREIT, we rate STAG Industrial stock a BUY.

FAST Graphs

In Conclusion…

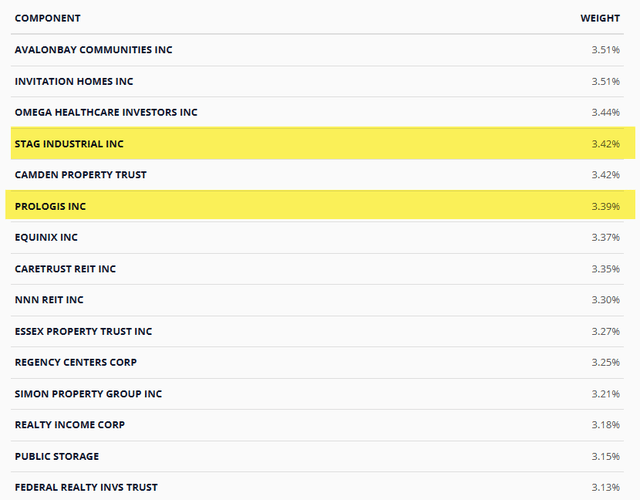

As seen below, STAG and PLD are both constituents in the iREIT-MarketVector™ Quality REIT Index (my new REIT ETF Index):

MarketVector

This Index screens for Quality and Value and I’m hoping to see the Index list later this summer (on the NYSE). Quality is an important part of the value proposition for the Index and having REITs like Prologis and STAG in the portfolio helps folks sleep well at night.

I hope you enjoyed this compare and contrast article and please let me know if you would like me to continue with these sector-focused comparisons (if you missed it, I wrote on VICI and GLPI last week).

As always, thank you for reading and commenting.

Happy SWAN Investing!

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Read the full article here