A key lesson to keep in mind when investing is that most stocks will give you second chances. In fact, Warren Buffett recently noted during Berkshire Hathaway’s (BRK.A)(BRK.B) annual meeting that value investing opportunities are abound because people will do dumb things.

This notion is exacerbated in today’s market, considering the ease by which investors can borrow to invest, making volatility ever more pronounced compared to the years when Buffett was just starting out.

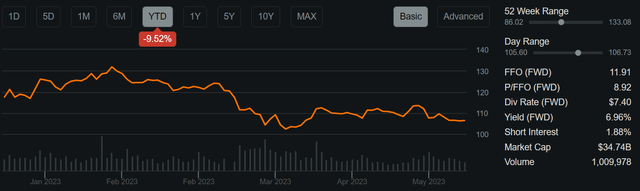

This brings me to Simon Property Group (NYSE:SPG), which I last covered here in February, highlighting how it topped analyst expectations. As shown below, the stock is again trading in deep value territory and sits well under its 52-week high of $133.

In this article, I discuss recent developments and why the stock is now a bargain for income and value investors.

SPG Stock (Seeking Alpha)

Why SPG?

Simon Property has been no stranger to ups and downs over the past 3+ years as many have prognosticated its demise along with the rest of the retail sector. It’s proven, however, that survival of the fittest is alive and well, and that retailers will always seek to position their wares and services in front of consumers in a premium physical, “boots on the ground”, format.

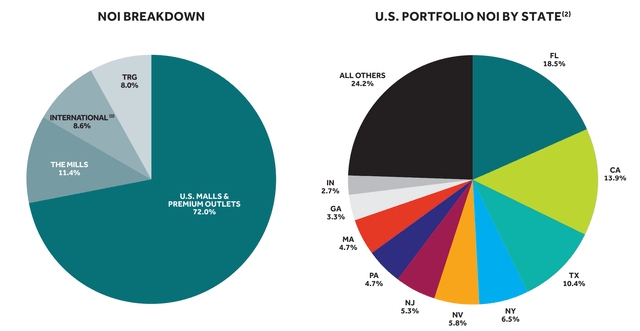

This is reflected by Simon Property’s high quality asset base that’s comprised primarily of Class A malls, Premium Outlets, and International properties. Moreover, SPG derives 8% of is NOI from the Taubman Retail Group, of which it acquired a majority interest in 2020. TRG’s asset base includes 26 properties, including prime assets such as the Beverly Center in Los Angeles, and The Gardens Mall in Palm Beach, Florida.

Investor Presentation

Meanwhile, SPG appears to be doing just fine amidst economic volatility as U.S. domestic property NOI grew by 4% YoY during the first quarter. This was driven in part by base minimum rent rising by 3% to $55.84 per square foot over the prior year period. Retailers are also finding success at SPG’s locations, as sales per square foot rose by 3.3% YoY and occupancy rose by 110 basis points YoY to 94.4%.

SPG also recently opened the Paris-Giverny, in which it owns a 74% interest, in late April of this year. This center expands SPG’s international footprint and includes 228K square feet of luxury and premium brands, offering shoppers in the western region of Paris with fine open-air retail and leisure experiences.

This center, along with others in Europe, may be set to benefit from “revenge travel” from China, as lockdown and travel restrictions have eased. If anything, retailers there could see a bump in revenue in the same manner as the U.S. when revenge travel took hold in 2021 and 2022.

Additionally, SPG has restarted construction on its upscale outlet center in Tulsa, Oklahoma and has several densification projects under construction across North America, Europe, and Asia. This includes the addition of mixed-use style properties with 2,000 residential units and hotel rooms.

Looking ahead, SPG should continue to see strong demand, as it signed over 1,200 leases during Q1, with over 25% of leasing activity being new deal volume. It currently has 1,500 leasing deals in its pipeline and expects to be complete with 75% of its 2023 expirations by the end of the second quarter currently in progress. For the full year, management expects FFO per share to be $11.87 at the midpoint, representing a $0.05 increase over last year.

Importantly, SPG is only a handful of REITs to carry an A- credit rating from S&P, giving it the ability to lock in interest rates at relatively lower levels. Moreover, it has a staggering $9.3 billion of liquidity, and recently completed a $1.3 billion senior notes offering with a 5.67% coupon rate over a long 20 year term.

Notably for dividend investors, SPG recently raised its dividend again this month by $0.05 to $1.85 per share, and this represents a 9% increase over the prior year period. This equates to a safe 62% FFO payout ratio, based on the midpoint of management’s 2023 guidance.

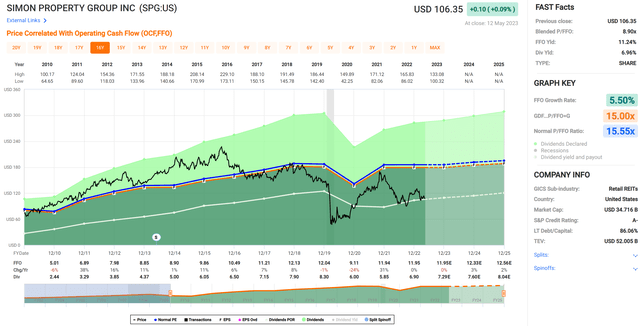

Lastly, SPG appears to be dirt cheap at the current price of $106.35 with a forward P/FFO of just 8.9x, sitting well under its normal P/FFO of 15.6 since the Great Recession. While analysts project just 3.4% FFO per share growth next year, I believe investors are more than compensated with a 7% yield and the low valuation. Analysts have a consensus Buy rating with an average price target of $131.75, implying a potential 24% upside based on capital appreciation alone.

FASTGraphs

Investor Takeaway

Simon Property Group has proven to be a quality play in the retail space, with solid and growing operating metrics and strong tenant demand. It maintains its A-credit rating from S&P and continues to raise its dividend, which remains well-covered.

It also continues to pursue development opportunities across the U.S. and Internationally with mixed use residential projects, and its properties in Europe could benefit from a pick-up in travel coming out of Asia. Now may be an opportune time to layer into the stock with it again sitting in deep bargain territory and a 7% yield to boot.

Read the full article here