Main Thesis & Background

The purpose of this article is to evaluate the Vanguard Energy ETF (NYSEARCA:VDE) as an investment option at its current market price. This is a passively managed sector fund with an objective to “track the performance of a benchmark index that measures the investment return of stocks in the energy sector.”

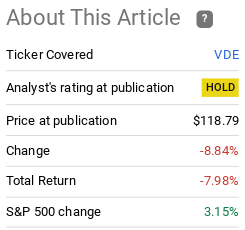

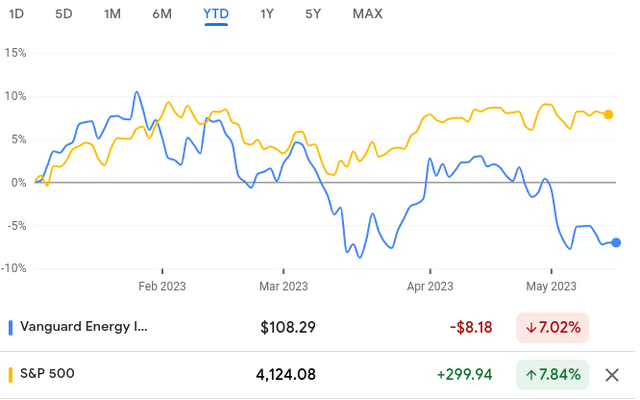

This fund is my largest sector holding and is one of the most popular ways to play the sector. It is one of three Energy ETFs I own, but I took a cautious view of it back in March. I saw the gains from 2022 that extended moderately in to the new year as a sign to take some chips off the table. In hindsight, I was right:

Fund Performance (Seeking Alpha)

Given this sharp decline and marked under-performance, it was time to take another look at the sector. While some major headline risks remain, I think the risk-reward proposition is much more favorable now. As a result, I view the recent weakness as a buying opportunity and will explain the reasons behind my rating upgrade below.

Oil Sell-Off Will Not Last

A fundamental reason to why I like the idea of getting in on Energy ETFs now is because oil prices have moderated. This has impacted both equity share prices and fuel costs for consumers. While this may sound counter-intuitive, buying in on weakness is often where the value rises. Once prices rebound – it is often too late to really capture strong gains. Therefore, when I see the crude market get punished along with Energy shares, I almost always buy with a long-term mindset.

Given the pullback in prices even after OPEC+’s surprise production cut announcement, I believe that is indeed what we are seeing now:

Crude Prices (Yahoo Finance)

What this is showing is that after an initial rebound in prices resulting from this announcement, prices have gone right back down to where they were before. This is mainly due to recession fears – both in the U.S. and elsewhere around the world. This is making bullish signals very temporary when they occur because the overriding sentiment is negative in the market. When economic growth slows, the expected demand for oil drops. The price then follows.

The point I am making is that this seems a bit too simplistic given all that is going on. Yes, recession fears should impact prices. I am not suggesting otherwise. But it appears that sentiment has been getting baked in with regularity. This suggests to me there is more upside than downside at the moment – and that is precisely when we want to move in to a sector.

In addition, there are always other factors that can sway prices beyond just OPEC+ output/cut announcements. This includes political upheaval in oil producing regions, inconsistent energy policy (i.e. the U.S. currently), and natural disasters. One case of concern for the time being are Canada’s wildfires. While so far less destructive than years past, the current situation is threatening oil sands crude which is fundamental to Canadian crude output. Over the last few months this has helped to strengthen prices for Canadian heavy oil:

Canadian-Originated Crude Prices (Bloomberg)

My overall takeaway from all this is there are supporting factors out there for crude at the moment. Recession and demand fears are weighing on prices. No doubt about it. But there are other macro-events like OPEC+ decisions and wildfires that are supportive of higher prices. This dynamic convinces me that being bullish on weakness is still a good move – which is why I see VDE’s drop as a buying opportunity more broadly.

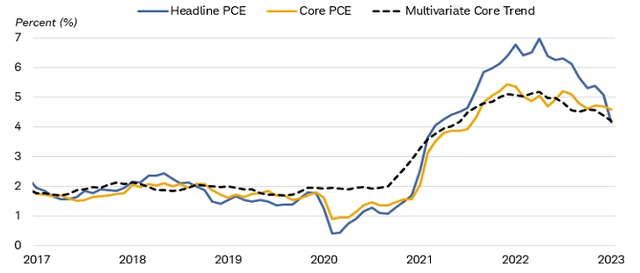

Inflation Is A Mixed Bag

My next topic is a macro-one that is relevant for the entire economy but also has important implications for Energy. This is inflation, which has begun to finally show signs of cooling. While inflation metrics remain elevated on a historical level, the drop is clear to all who look at it:

Inflation Measures (US) (Charles Schwab)

This is another area that has a push-pull dynamic. So readers need to carefully consider their own outlook and perspective before deciding if this means buying Energy right now will indeed pay-off. For example, declining inflation is being driven by two key factors. One, rising interest rates which is impacting the second, lower demand.

These factors are not really “good” for Energy. If rates get too high they become restrictive. This is consistent with fears over a recession. As consumer and business demand for goods and services falls, a recession becomes more likely, and so too will the possibility for a drop in oil demand (and more energy inputs). This can be a net negative for VDE and the potential for a recession is very real. If we look at an area like loan demand it is easy to see where the concern is coming from:

Loan Demand (as measured by the senior loan officer survey) (Federal Reserve)

The importance of this is hard to overstate and it illustrates that the risks facing the sector are significant. My thesis stems from the fact that I see more upside if we avoid a severe recession than downside if a recession does occur soon. But I could easily be wrong if demand continues on this trajectory and becomes too depressed for investor’s outlooks. So I urge selective buying at this juncture.

But there is opportunity too. The fact is that as inflation cools that offers the Fed (and other central banks) an opportunity to pause or reverse their rate hike agendas. If the Fed does see this meaningful drop in PCE and CPI metrics as warranting a pause, that is supportive of economic growth for the next few quarters at least. This would be bullish for cyclical areas and VDE by extension. It is this opportunistic outlook that outweighs some of the risks facing the sector.

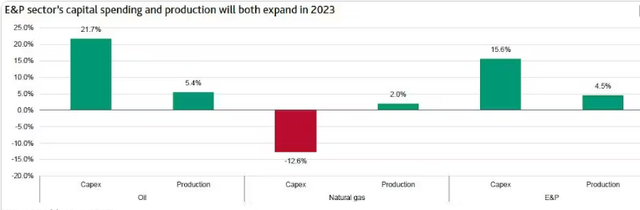

Energy Firms Staying Disciplined

Another reason for going long the underlying companies in VDE is their fiscal discipline in the face of a more challenging environment. While spending is set to rise in 2023 across the board on exploration and production, the gains are modest compared to other years. This limit on how much more natural gas and oil that will hit the market will be supportive of prices now and for the longer term:

Exploration and Production Spending Increase (Energy Sector) (Moody’s)

While this may not be great news for consumers, I see it as a positive for investors. This will limit the risk of a “glut” in energy inputs like what we saw in 2020. By limiting new production during a period of economic uncertainty these companies are ensuring that the world won’t be too over-supplied if demand falters. By contrast, if growth surprises to the upside, we will see an under-supplied market and that will give a nice boost to VDE.

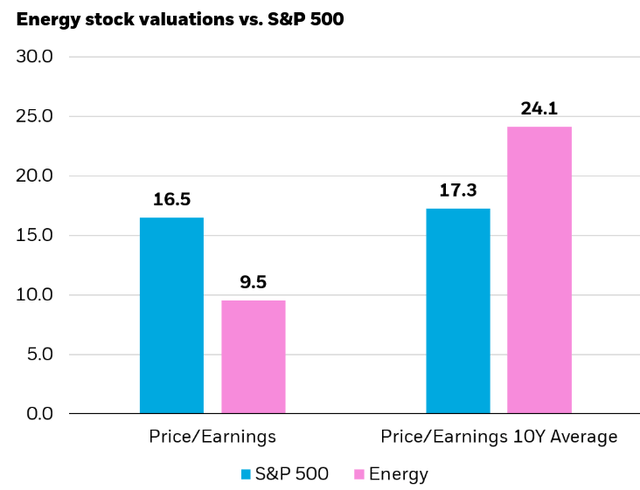

Energy Shares Entered The Year Cheaply Priced

My last point looks at Energy as a relative hedge and value play. This stems from the fact that even after 2022’s outperformance, Energy shares (on average) were trading at steep discounts to the broader market. This is unusual on a longer term timeline but is distinctive in the size of the gap:

Relative Valuations (January 2023) (BlackRock)

Yet, even with this disparity, the S&P 500 has widely out-performed Energy on a year-to-date basis. This means the current gap in P/E ratios has widened much further (all other things being equal):

YTD Performance (Google Finance)

What I see here is value. Part of this stems from my broader optimism on Energy in particular, but also that I am getting much more cautious on the S&P 500. I need to find someplace to put new money – in addition to cash, bonds, and non-US assets – so Energy seems as good a spot as any. The S&P 500 is starting to look like it is ignoring risks while Energy is overly baking them in. This mismatch makes me a contrarian bull on funds like VDE.

Bottom-line

VDE has had an up and down year. For those who have “stayed the course”, the net result has been negative. But for those with a tactical, proactive approach, it is very likely they are sitting with some gains – compounding on last year’s strong returns. But being tactical means knowing when to sell and also when to buy and I see now as a buy opportunity.

The sector is supporting higher crude prices by spending less on investment and exploration, OPEC+ continues to embark on production cuts, and Chinese economic growth is helping to boost demand to counterbalance recession fears in the West. With Energy sharply under-performing the S&P 500 in 2023 so far, this looks like a good value and/or contrarian play. Therefore, I am upgrading my rating on VDE to buy, and I encourage readers to give the idea some thought going forward.

Read the full article here