When economic boom times come to the real estate industry, speed can take priority over precision. Acquisition teams race against the clock, competing against scores of other suitors, making quickness as vitally important as correctly valuing a property. Similarly, a consistent flow of incoming residents during prosperous periods could leave some multifamily owners a bit less attentive to operations and maintenance details than they might be when renters are at a premium.

But thoroughness, precision and data reliance make a comeback in tougher times, such as the ones in which we find ourselves. In such periods, the continued viability of many real estate entities rests on access to unimpeachable data. That’s why some cutting-edge proptech firms have prospered during this otherwise lackluster economic chapter.

“The advances in applying data science and machine learning to real estate in the past few years have been significant, and the benefits they offer the industry are amplified in an uncertain economy,” said Christopher Yip, partner in real estate venture capital firm RET Ventures. “As interest rates climb and the consumer economy weakens, the ability for acquisitions and development teams to evaluate potential investments carefully is critical. Today’s real estate tech stack enables them to get income, migration and other demographic information in nearly real time. In addition, leveraging data and automation to more efficiently manage and operate existing assets is increasingly critical.

“Firms looking to maintain their competitive advantage will utilize the most compelling technologies to do so. And the providers of these technologies are poised to thrive in the near future.”

Among notable real estate technology breakthroughs is Markerr, a tool giving detailed insights about supply and demand catalysts within specific ZIP codes. For those eyeing property acquisitions, being able to gain up-to-date information on rents, salaries, employment, population, crime and a number of additional gauges can be a boon to decision making.

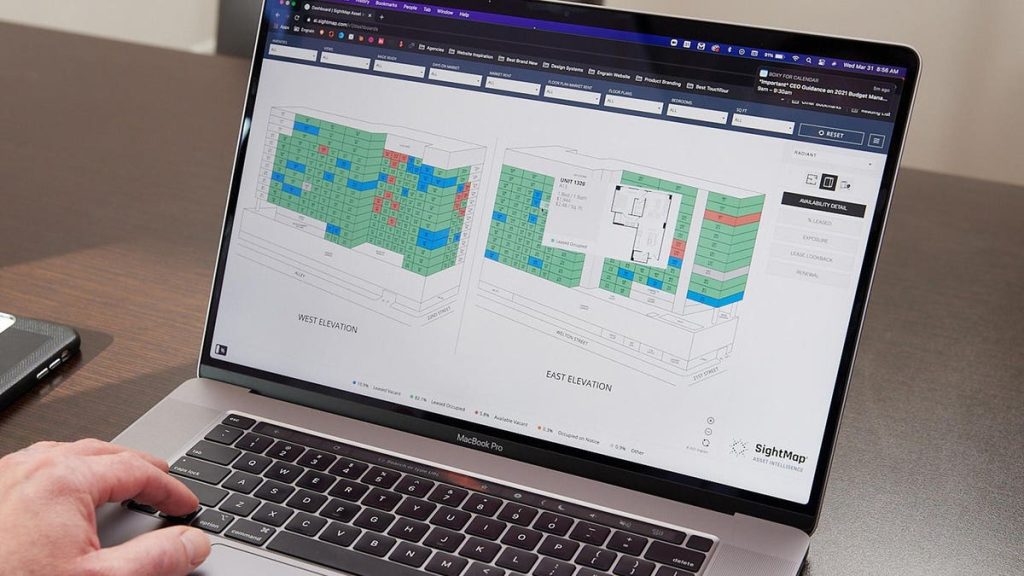

On the other hand, in economic downturns leasing and asset management professionals require improved means of analyzing the numbers they already possess. Asset intelligence software from Engrain empowers CRE professionals to move beyond spreadsheets and view critical property metrics overlaid on maps of their properties. Doing so enables them to drill down into vacancy, rental rates and other essential data within the context of the property’s physical layout. That enables them to pinpoint patterns and outliers that can help them finetune their pricing and leasing strategies as needed.

“For asset management teams, the ability to analyze key property metrics in the context of a property floorplan or stacking plan has proven extremely valuable, and a growing number of our clients have been utilizing that functionality,” says Engrain CEO Brent Steiner. “Data is important for the successful operations of any business, but when the economy turns, maximizing the insight gleaned from the data you already have becomes a true imperative.”

Elsewhere, a product made by PassiveLogic is winning recognition as one of the most fascinating advancements in building automation. The technology aggregates the thousands of sensors and equipment in a physical building into a physics-based “digital twin.” It then stages simulations that ascertain how varying building components will interact with one another, helping produce substantial energy savings. “Buildings are the largest driver of climate change and represent roughly a quarter of global GDP activity,” said Troy Harvey, CEO of PassiveLogic.

“Rapidly accelerating shifts in usage patterns and cultural dynamics demand an operational and technological revolution in this sector. PassiveLogic’s developments in generative AI and autonomous buildings technology are at the center point of how we address adaptive buildings, declining availability of trained labor, operational efficiency and growing climate requirements.”

Read the full article here