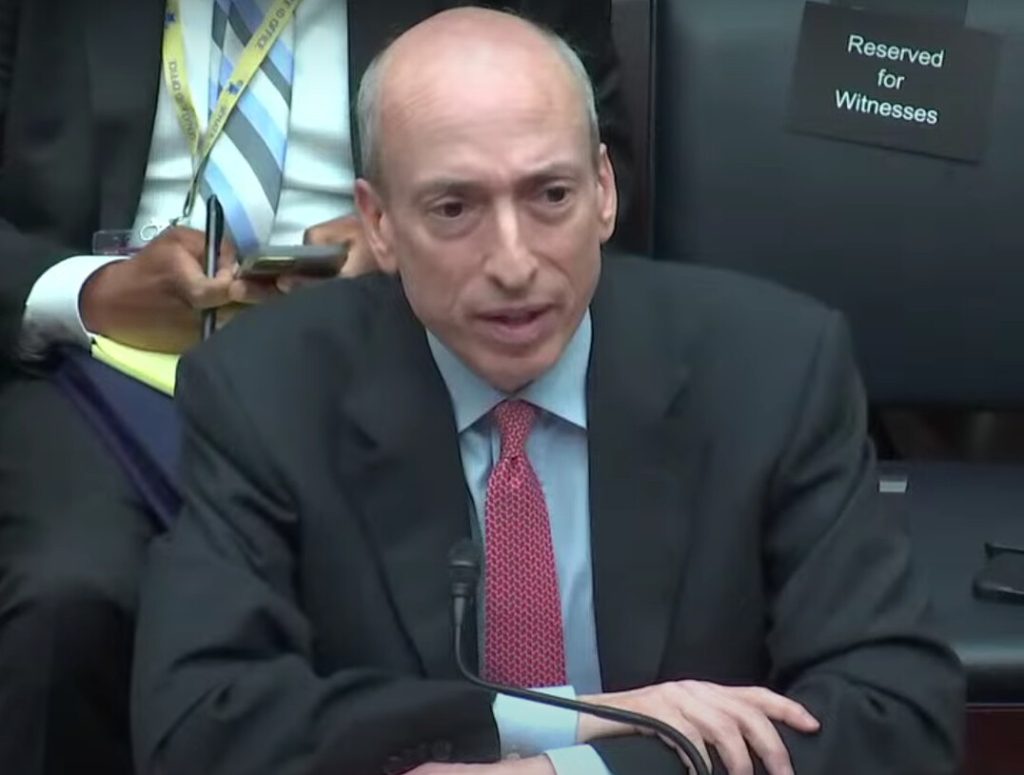

Securities and Exchange Commission (SEC) Chairman Gary Gensler remained tight-lipped as usual when asked about the state of spot Bitcoin ETF applications being handled by the agency on Wednesday.

In an interview with Bloomberg, Gensler declined to comment on the agency’s next steps after losing in court to Grayscale – owner of the world’s largest Bitcoin fund – in August.

At the time, judges unanimously found the SEC’s actions to be “arbitrary and capricious” in denying the Grayscale Bitcoin Trust (GBTC)’s conversion into a spot Bitcoin ETF following its application in 2021. Last week, the SEC remained silent as its time window to appeal the ruling ran out, meaning few options remain for the agency besides approving the product.

“I’m not going to pre-judge,” the Gensler told Bloomberg. “The staff is doing work on those multiple filings.”

Besides Grayscale, the SEC is juggling live Bitcoin ETF applications from 12 other asset managers including BlackRock, Fidelity, Ark, Franklin Templeton, and others.

Though the SEC has already delayed approvals for all relevant applications, it also provided a request for comment on whether the applications were designed to safeguard against manipulation and other risks.

SEC Communications

The agency is also in direct communication with applicants on what improvements they can make to their applications to address the regulator’s concerns and other risks. Gensler stated:

“Our Division of Trading and Markets of course looks at the filings, This is a time-tested process that goes back decades. The staff of the SEC, it’s called the Disclosure Review Team, but in that group, they respond and give feedback to potential issuers.”

Firms including Fidelity and BlackRock have since updated their original filings with new details likely addressing some of these questions. Some include disclosures about Bitcoin’s energy footprint, how Bitcoin is safely kept by the issuers’ respective custodians, and how shares of each fund will be redeemed for actual BTC.

Ark Invest also amended its joint ETF filing with 21Shares last week. Ark CEO Cathie Wood said on Monday that she thinks the SEC’s communicativeness on the matter represents a “change in behavior” on their part.

“I do think hopes are rising that a – or a number of – Bitcoin ETFs will be approved,” said Wood.

Galaxy Digital CEO Mike Novogratz predicted on Wednesday that a spot Bitcoin ETF will be approved by the end of 2023, in light of Grayscale’s court victory.

Read the full article here