DuPont de Nemours (NYSE:DD) reported weak Q3 2023 results that missed analyst estimates. DD shares dropped sharply on the news falling ~7%.

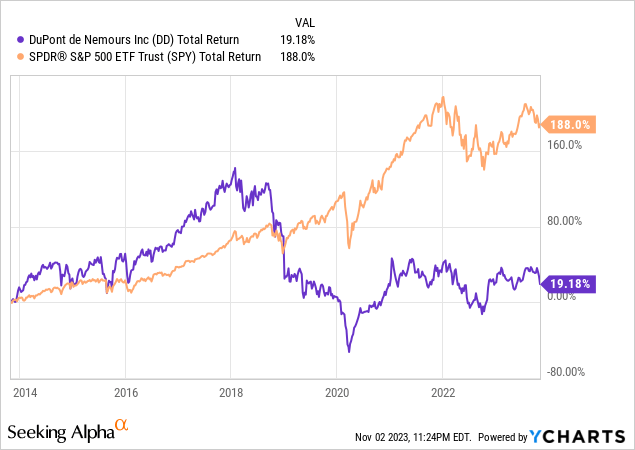

Following the post earnings drop, DD shares have now delivered a total YTD return of -1% compared to a return of 11.8% delivered by the S&P 500.

DD has also underperformed the S&P 500 over the past 10 years delivering a total return of just 19% compared to 188% for the index.

I believe DD is poised to continue delivering below market returns going forward.

Q3 2023 Results

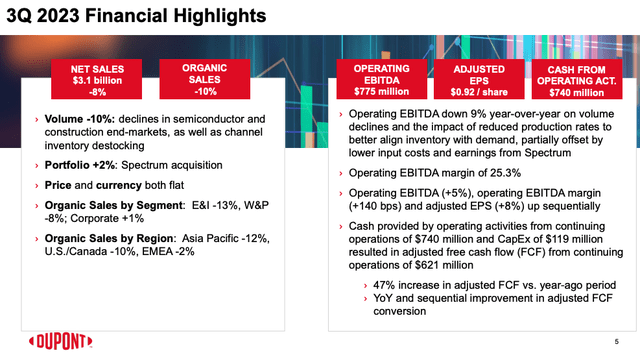

DD reported EPS of $0.70 per share, down 13% from the same period a year ago. On an adjusted basis, DD reported EPS of $0.92 per share which topped analyst estimates of $0.84. Revenue came in at $3.06 billion, which represents a year-over-year drop of 8%. The revenue result was a significant miss as Wall Street analysts had been expecting sales of $3.15 billion.

The revenue miss is more important to the investing community than the Adj. EPS beat as revenue tends to be difficult for companies to manage while metrics such as Adj. EPS can more easily be managed such that the company reports strong results.

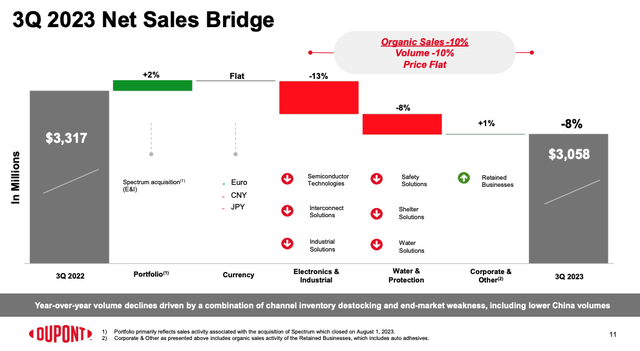

The 8% drop in sales on a year-over-year business included a 10% organic drop in sales offset by a favorable portfolio impact of 2% due to the August 1 acquisition of Spectrum.

The organic sales decline of 10% was driven by weakness from semiconductor and construction end-markets as well as some impact due to channel inventory destocking.

In terms of geographic results, Asia Pacific experienced a 12% organic sales decline while organic sales in the U.S. & Canada and EMEA dropped by 10% and 2% respectively.

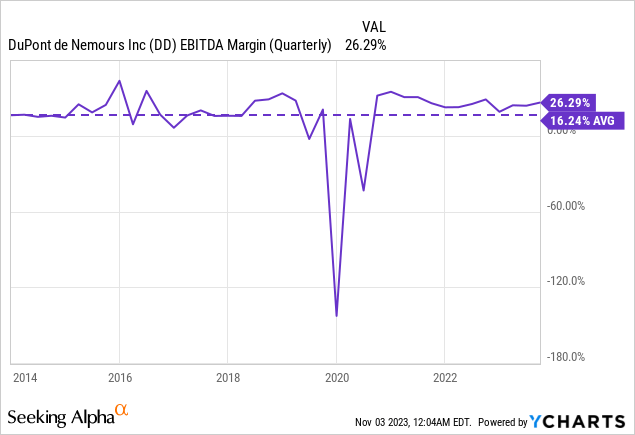

Operating EBITDA for the quarter came in at $775 million compared to $856 million a year ago. Operating EBITDA margin dropped to 25.3% from 25.8% during the same period a year ago. However, Operating EBITDA margin did improve 140 bps compared to Q2 2023.

DD Investor Presentation DD Investor Presentation

FY 2023 Guidance Cut

DD lowered its sales guidance for FY 2023 to ~$12.17 billion down from a prior range of $12.45 – $12.55 billion. The company also cut its Operating EBITDA forecast to ~$2.975 billion from a prior range of $2.975-$3.025 billion. EPS guidance was narrowed to ~$3.45 from a prior range of $3.40-$3.50 previously.

DD Investor Presentation

Highly Competitive and Highly Cyclical Industry

DD provides technology-based materials and solutions. The company is subject to a high degree of competition from high quality companies. In the Electronic & Industrials business, DD competes with 3M (MMM), Element Solutions (ESI), Henkel, Merck KGaA, MKS Instruments, Parker-Hannifin (PH), and others. In the Water & Protection business, DD competes with 3M, Honeywell (HON), Owens Corning (OC), Kingspan, LG Chem, and others.

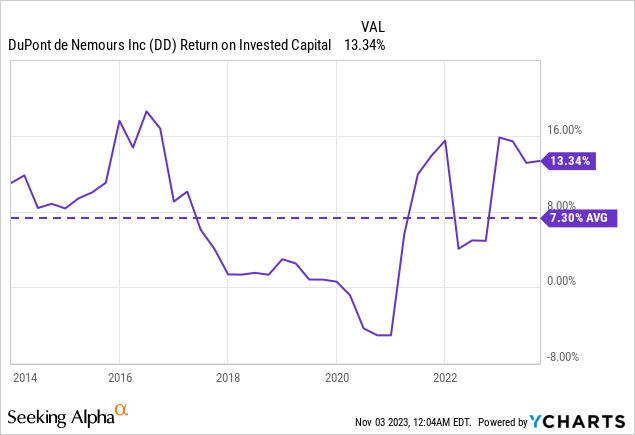

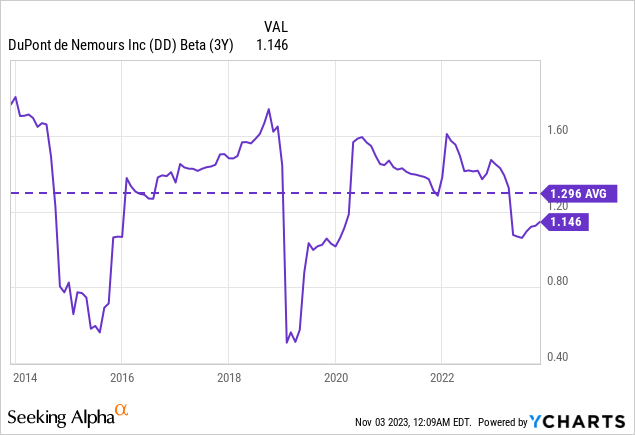

DD experiences a high degree of cyclicality as its end units are highly driven by global economic strength. Further evidence for DD’s cyclicality can be seen in the fact that the stock has exhibited a relatively high average beta of 1.29x over the past 10 years.

Corporate Transformation Has Been A Distraction

As shown by the flow chart below, DD has undergone a major transformation over the past year which started with a merger with Dow Chemical in 2017. Following this landmark merger, DD went on to divest a number of businesses mostly notably the commodity chemical business. In 2019, DD completed the spin-off of Dow Inc (DOW) a new company focused on the commodity chemicals business.

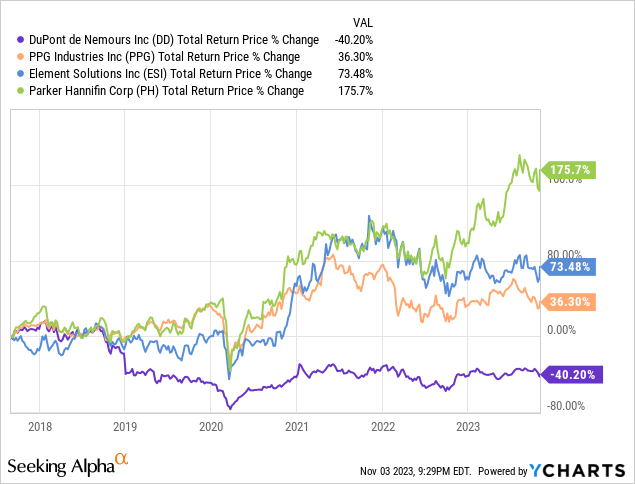

Since the merger with Dow Chemical closed in August 2017, DD shares have significantly underperformed its peers in similarly cyclical businesses. I believe the complexity OF this merger and ensuing business combinations and divestitures was a major distraction for the company.

DD Investor Presentation

Valuation

DD has received a valuation grade of D from Seeking Alpha quant scores. I agree with this characterization.

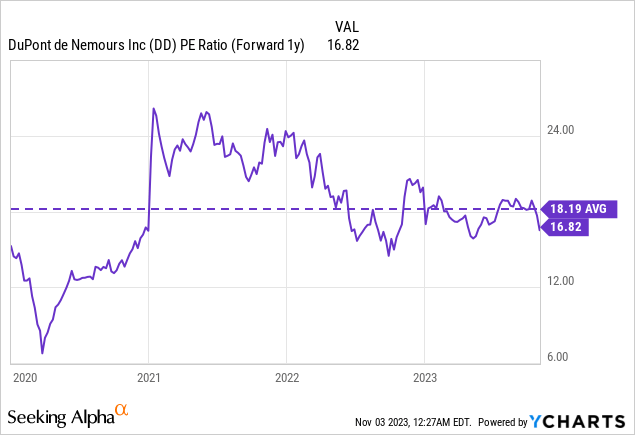

DD trades at ~16.5x consensus 2024 earnings. Comparably, the S&P 500 is trading at ~17x 2024 consensus earnings. While DD has undergone significant corporate changes over the years due to mergers and spinoffs, the company has not been able to achieve a high degree of EPS growth historically. Moreover, as shown by the chart below earnings have been highly volatile.

Given the high volatility of DD earnings and low growth potential, I believe the stock should be selling at a substantial discount to the S&P 500. Thus, I believe the stock is currently overvalued.

DD is currently trading broadly in line with comps including other industrial materials companies such as PPG (PPG), International Flavors & Fragrances (IFF), Element Solutions (ESI), and Parker-Hannifin (PH). DD trades at a significant premium to 3M but 3M is trading at a low valuation due to ongoing litigation challenges.

DD also appears to be unattractive relative to its own historical valuation range as the stock is trading close to the average forward P/E ratio and forward EV/ EBITDA ratio it has traded at over the past few years.

Seeking Alpha

Seeking Alpha

Risks To My View

The primary risk to my view is that the economy experiences a significant upside surprise which leads to stronger results for DD. Given the highly cyclical nature of DD’s business any economic strength has potential to lead to significantly higher earnings in any given year.

While a positive economic surprise is certainly possible I view this as unlikely in the current environment. Moreover, I believe that DD should trade at a lower valuation relative to the S&P than is currently the case. For this reason, even if the economy strengthens and DD reports better earnings I believe the stock may not trade up much due to the fact that it is currently overvalued.

Another potential risk to my view is that DD may achieve more cost savings than the company current projects. Currently, the company is targeting $150 million of cost reductions in 2024 and plans to start taking actions in mid-December. If the company is able to deliver more than $150 million in cost cuts then margin improvement may drive better than expected 2024 earnings.

Another potential risk to my view is that DD is able to drive better than expected future growth due to new product development. The company spends ~4% per year on R&D and thus material product breakthroughs have potential to drive better than expected growth. As shown by the chart below, DD has been recognized for its leading R&D efforts. However, I view any R&D gains as more of a long-term driver as opposed to short-term driver of performance. In order for me to believe in the R&D story, and DD’s ability to create highly differentiated products, I would want to see that pull through in above market revenue growth rates and pricing power in the quarters ahead.

DD Investor Presentation

Conclusion

DD reported Q3 2023 results which disappointed investors due to a significant sales drop suggesting the economy may be slowing. Investors sent DD shares sharply lower following the news.

DD is a highly cyclical company operating in a very competitive business which has made it difficult for the company to generate strong shareholder returns over the past few years.

Despite the recent pullback, DD shares continue to trade at a valuation which is inline with the S&P 500. Given the highly cyclical nature of DD’s business and relatively low growth potential I believe the stock should trade at a moderate discount to the S&P 500.

I am initiating DD with a sell rating and would consider upgrading the stock if the valuation improves on a relative basis to the S&P 500.

Read the full article here