In my latest Federal Reserve Watch post, I argued that the Federal Reserve slightly changed positions in early April in response to the commercial bank failures it was having to deal with.

That change, as I showed in the post, changed a lot of statistical series around that time and I continue to find these changes coming up in more and more different places.

Today, I will discuss some changes that have been reflected recently in the bond markets.

In effect, starting in April there was a very definite change in the way that investors seemed to see things.

Since the end of March to the close of the market on Friday, the yield on both the 5-year U.S. Treasury note and the 10-year U.S. Treasury note have risen by about 100 basis points.

The yield on the 5-year Treasury note has risen from about 3.6 percent to about 4.5 percent.

The yield on the 10-year Treasury note has risen from about 3.5 percent to about 4.5 percent.

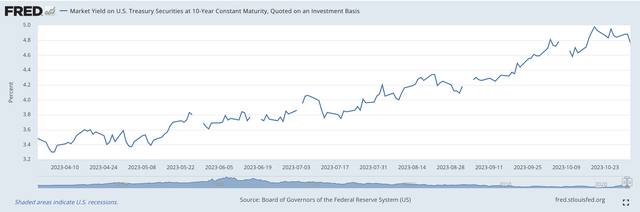

Here we see the movement in the yield on the 10-year U.S. Treasury note.

Yield on 10-year U.S. Treasury note (Federal Reserve)

You can see that the rise from late March is quite steady.

Next, we see the movement in the yield on the 5-year U.S. Treasury note.

Yield on 5-year U.S. Treasury note (Federal Reserve)

The rise in this yield roughly follows the path of the yield on the 10-year.

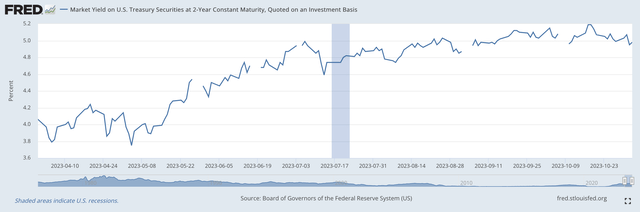

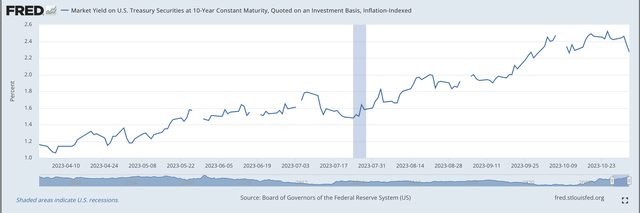

Now, what is interesting is that the yield on the Treasury Inflation Protected securities (TIPS), both the 5-year maturity and the 10-year maturity rose by roughly 100 basis points during this time period as well.

Yield on the 10-year U.S. Treasury Inflation Protected Securities (Federal Reserve)

The chart for the yield on the 5-year TIPs was roughly the same and I have chosen not to present it at this time.

So, what are we trying to say here?

Well, it seems as if during this time period, the yields on the 5-year U.S. Treasury notes and the yields on the 10-year U.S. Treasury notes rose…roughly…100 basis points.

During this same time period, the yields on the 5-year U.S. Treasury Inflation Protected notes and the yields on the 10-year U.S. Treasury Inflation Protected notes also rose by…roughly…100 basis points.

Remarkable.

Going a bit further, we attempt to estimate the inflationary expectations investors build into market yields by subtracting the yield on the TIPs security from the nominal yield on the note.

Thus, if the nominal yield on the current 10-year U.S. Treasury note is 4.5 percent and the yield on the 10-year U.S. Treasury Inflation Protected security is currently 2.1 percent, as they were at the market close on November 3, 2023, then the inflationary expectations built into the nominal yield is 2.4 percent.

When we compare this with the estimation for inflationary expectations built into the end-of-March number, we find that inflationary expectations are just about the same as the current number.

That is, over the past seven months, investors have roughly the same expectations for inflation now as they had at the end of March.

And, the inflationary expectations built into the yield on the 5-year U.S. Treasury note have not changed over the past seven months, at the end of March.

Thus, with all that has gone on in the U.S. economy and in the world, investors in the U.S. bond markets have not changed their outlook for inflation over the next 5-year period and over the next 10-year period.

That is, investors expect that the compound inflation rate in the U.S. economy over the next five- to ten-year period will be roughly around 2.3 percent.

Note this is above the target level of inflation that the Federal Reserve is shooting for…but it is not “way over” the target level of inflation that the Federal Reserve is shooting for.

U.S. Economic Growth

So what does this say about investors’ view of the future of economic growth?

Well, continuing the approach already begun, we come up with the conclusion that the investment community appears to believe that the U.S. economy will experience a compound rate of growth over the next five years…and over the next ten years…of about 2.2 percent.

Note that I am writing about the compound rate of growth over the next 5- to 10-years, and I am saying nothing about whether or not there will be one or more recessions over this time period.

What the markets seem to be telling us is that we can expect the economy will end the next ten years at a level that can be achieved by a 2.2 percent compound rate of growth every year.

Not too shabby.

Just as an example, the U.S. economy grew by 2.3 percent per year from the end of the Great Recession in 2009 to the beginning of the Covid-19 recession in March 2020.

So, investors in the bond market are saying that the next ten years of economic growth will not be too far different from the economic growth that was achieved in the 2010s.

And, with inflation staying down around 2.2 percent per year over this time period.

One further note, the compound rate of inflation in the 2010s was about the same level.

Most Interesting

The most interesting thing, however, that I get from these data is that over the past seven months, there has been a truly remarkable change in the outlook bond market investors have about the outlook for the economy.

At the end of March, right before the change in the behavior of the Federal Reserve, bond investors were expecting that the economy would grow at around a 1.2 percent to 1.3 percent rate of growth over the next five- to ten-years.

Attitudes changed in April and we now see that bond investors are expecting the economy to grow by about 100 basis points more over the next five- to ten-years.

This is quite a remarkable change!

The bond market is saying that the Fed will bring inflation roughly to a level not far above its target rate of inflation.

And, the bond market is saying that the economic growth to be achieved over the next decade will be around the level that was achieved in the 2010s.

Overall, not too bad.

But, what a shift in investor beliefs. Investors during the first part of the year were seeing a very, very dismal path for the U.S. economy.

Now, the path they see is not too bad…not too different from what was experienced in the 2010s.

Interesting…

Read the full article here