All values are in CAD unless noted otherwise.

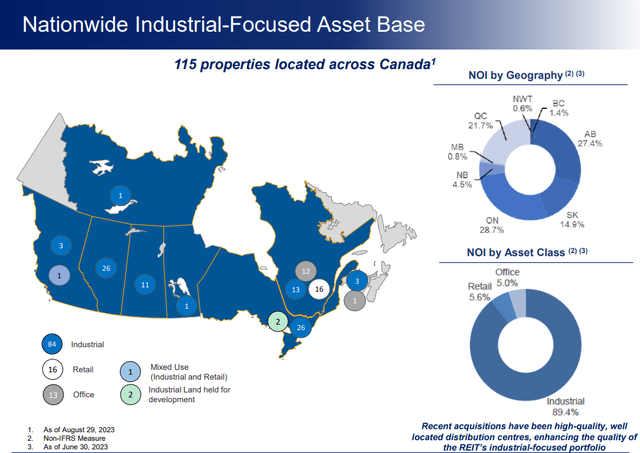

Nexus Industrial REIT (OTC:EFRTF, TSX:NXR.UN:CA) owns a 12 million square feet, 115 property portfolio, spread across various Canadian provinces. While Ontario, Alberta, Quebec and Saskatchewan house majority of them, the real estate investment trust, or REIT, does have a smattering presence in the Northwest Territories, British Columbia, Manitoba and New Brunswick.

September 2023 Presentation

Note: All amounts discussed are in Canadian Dollars.

As the name of this REIT and the above picture indicate, the portfolio is comprised primarily of industrial properties, with some retail and office exposure added to the mix, but that may not be for long. Nexus has a plan, and that is to be a “pure play industrial REIT.”

As the REIT grows, it will continue to upgrade the quality of its industrial portfolio with opportunities that meet its investment criteria, while also re-deploying capital from strategic dispositions of properties in its retail and office portfolio.

Source: 2022 Annual Report.

The Nexus acquisition game has been quite strong over the last few years. It had 72 properties in 2020, and now it stands at 115. Cognizant of the current macro environment, this REIT does plan to slow down until the change of the tide.

September 2023 Presentation

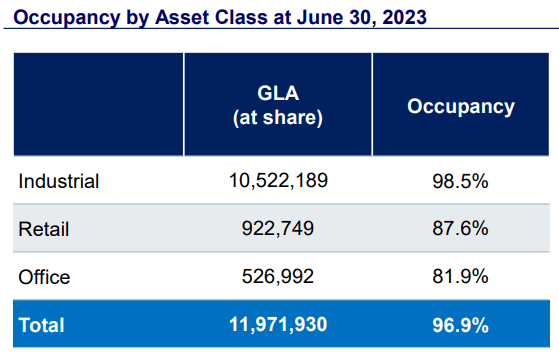

Collectively, the portfolio enjoyed a 96.9% occupancy at the end of Q2. That of course, is due to the overwhelming industrial presence in it. On a standalone basis and to no one’s surprise, the industrial portfolio occupancy far surpassed that of the retail and office portfolios.

September 2023 Presentation

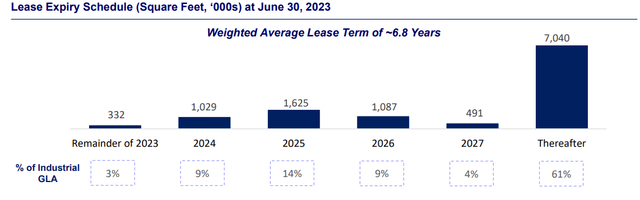

The weighted average lease term of the portfolio was close to 7 years at the end of Q2, with about 12% coming up for renewal in the next 18 months.

September 2023 Presentation

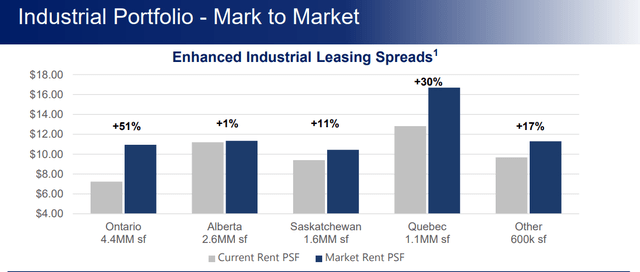

With the demand for industrial properties, these expirations provide a great opportunity for Nexus to lock in the current market rents.

September 2023 Presentation

The above chart prompts the question about what is going on with Alberta, and it was raised during the Q2 earnings call.

Brad Sturges

Okay. Just last question, just when I’m thinking through on the leasing side of things and just looking at your 2024 maturities, it’s obviously quite weighted Ontario, and then you’ve got a little bit in Alberta. What would you expect in terms of your leasing spreads when you look at those two markets? I think, we have a pretty good understanding of what Ontario looks like. Just more curious, I guess, on the Alberta side of things.

Robert Chiasson

Yes. So, I think Alberta will be — there’ll be a little bit of lift, but I think it’ll be relatively flat. We have a number of smaller pieces that are coming up, one of which being our Canada Cartage. They’re all in around 23,000 [ph] square feet for the most part, with the exception of Newly Weds Foods.

Kelly Hanczyk

Yes. We had two, so I think, yes, in fact, we had two, one is Canada Cartage, … So, we’re toying with the idea of either in the short-term, we’ll probably lease it out as truck parking and maybe have a slight drop, because that was a long-term lease that has been having year-over-year increases every year…

And the other one we had was Northern Mat & Bridge, which we’ve renewed. I think it begins next June. And so, we took a drop in rent. Well, I still think it’s a decent rent profile and is another one that has been growing by CPI for 10 years. That was signed early in the oil boom. So, that one affected us as well. I think the balance of the ones that we have are pretty much in and around market.

Source: Q2 Earnings Call Transcript

On the borrowings front, at June 30, Nexus had around $714 million of mortgages secured by 77 of its properties, close to 14% of which were coming up for renewal by the end of 2024.

Q2-2023 Financial Report

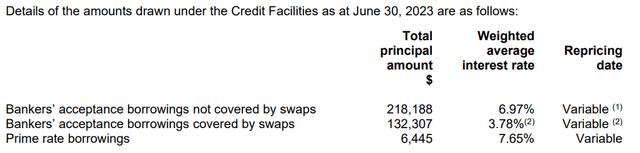

The weighted average term to maturity for the mortgages was 6.08 years. The weighted average interest rate on the mortgages was 3.28%, slightly up from 3.21% at the end of last year. In addition, the REIT had drawn $357 million from its credit facility, with the following interest costs associated with the borrowings.

Q2-2023 Financial Report

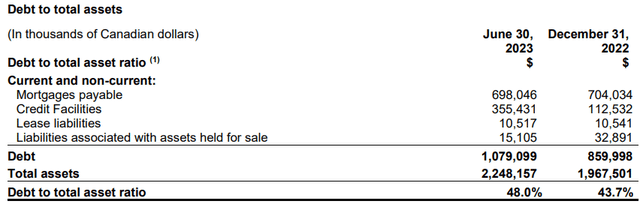

Nexus had around $7.9 million in cash at the end of Q2 and the ability to borrow an additional $88 million from its credit facilities. It drew $48 million from that, subsequent to the quarter end, for acquisition of an industrial property. The overall debt (mortgages and drawings on credit facilities) increased from $816 million at December 31 to over a billion at the end of Q2, and the REIT had plans to use this route more, as noted in the earnings call.

At June 30th, we had approximately $88.6 million undrawn on our credit facilities and we had a $569 million unencumbered asset pool. The Burlington property acquired in July was added to our unencumbered asset pool. The last acquisition we have to close in 2023 will be financed with a combination of Class B LP units and debt. We will also finance our committed development projects with debt.

Source: Q2 Earnings Call Transcript.

Between mortgages and upsizing the credit facilities, management indicated that it would use the latter option and see where the interest rates go, instead of locking in additional mortgages at the current high rates of 5.75% to 6%. As it stood at the end of Q2, the debt to assets had risen from 43.7% at the end of last year to 48%.

Q2-2023 MD&A

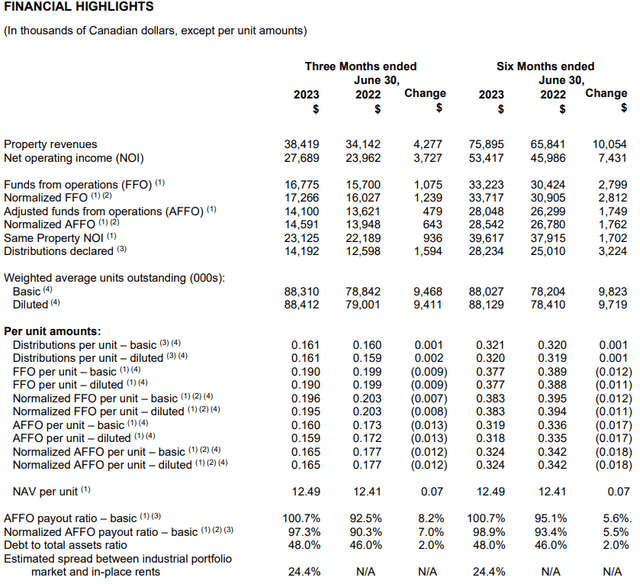

Nexus distributes 5.333 cents on a monthly basis and at the current price of $7.20, yields about 9%. In terms of yield, this REIT comes out smelling like roses in comparison to a couple of its peers. For example, Dream Industrial REIT (OTC:DREUF, DIR.UN:CA) yields 5.80% and Granite REIT (GRT.UN:CA) yields 4.56%.

Q2 2023 Results

The interest expense increased by over 40% year-over-year, but the accretive impact of net acquisitions, contractual rent increases and higher rates on new leases, as well as renewals, had the total funds from operations, or FFO, beating the prior year number by around 7%.

Q2-2023 MD&A

The pie had to be distributed over a higher number of units compared to the prior year, resulting in the FFO per unit underperforming Q2-2022. When all the adjustments were made, the end result was Nexus distributing close to 100% of its adjusted funds from operations in the first six months of this year.

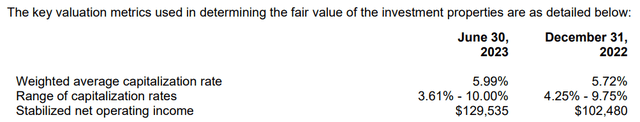

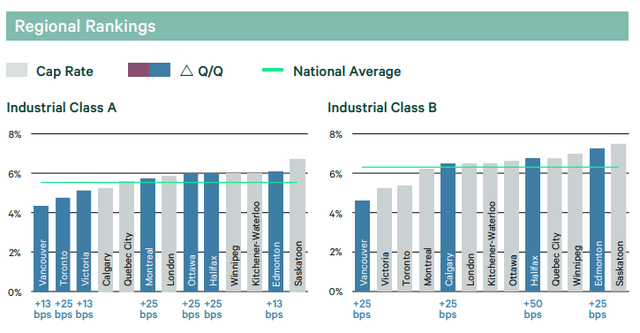

The REIT increased the capitalization rates of it properties compared to December 31, 2022.

Q2-2023 Financial Report

The increase is higher if we compare it to Q1-2023, where they had it at 5.62%. The 5.99% is reasonable considering the national numbers released by CBRE.

CBRE

Verdict

Nexus has done a lot of things right. The debt maturities are well spaced out, unlike the cavalier attitude we have seen from many Canadian REITs. The lease maturities are also manageable in a moderate recession. The company has borrowed primarily through property level debt, and that is our personal favorite way to do it. There is no existential risk with transferring the occasional failed project back to the bank alongside a write-off of the associated debt. Even the cap rates used are in-line with reality. Office exposure is extremely minor and does not change the equation here. Despite that, the REIT is trading at a substantial discount to its own NAV.

The implied cap rate works out close to 7.7% on the current price here, and we are hence finding this modestly attractive. One risk factor is that the REIT has bumped up credit facility use recently. But that we think is offset by the huge gap between market rents and portfolio rent. We are going to give this a tentative buy under $7.50 which works out to less than 10X FFO.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here